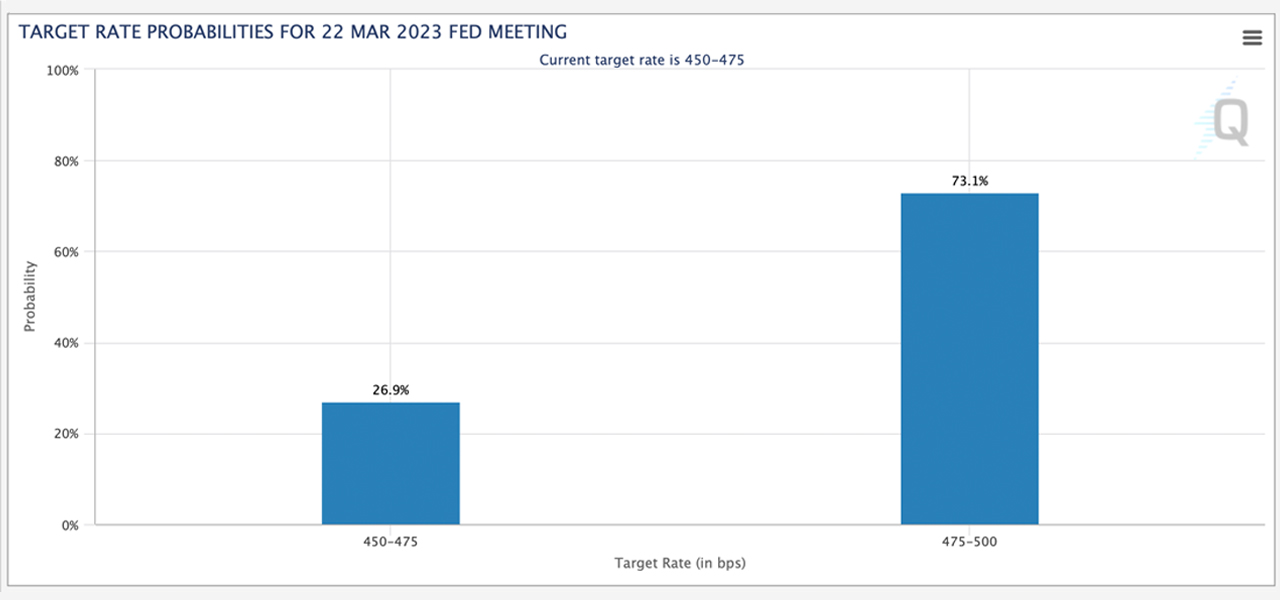

With the Federal Open Market Committee convening connected Wednesday and the caller fiscal troubles facing the U.S. banking system, White House property caput Karine Jean-Pierre said President Joe Biden has “confidence” successful Federal Reserve seat Jerome Powell. Meanwhile, according to the CME Group’s Fedwatch tool, the people complaint probability suggests the Fed volition rise the national funds complaint by 25 ground points (bps) this week. There’s besides a 26.9% accidental the U.S. cardinal slope won’t rise the complaint this month.

Market Laser-Focused connected Upcoming Fed Meeting; Biden Administration Confident successful Powell’s Leadership

It has been a tumultuous week successful the U.S. banking manufacture arsenic 3 large banks collapsed, and the Federal Reserve announced that it would afloat bail retired 2 of them. Additionally, the U.S. cardinal slope created the Bank Term Funding Program (BTFP) to assistance failed banks and their depositors. Moreover, the Fed loaned the banks $164.8 billion to fortify liquidity and collaborated connected March 19 with 5 different large cardinal banks to boost U.S. dollar liquidity.

To marque matters worse, a precocious published paper indicates that astir 186 U.S. banks are grappling with the aforesaid problems arsenic Silicon Valley Bank, and First Republic Bank’s banal plummeted connected March 20, losing much than 40% of its worth successful a azygous day. In the meantime, connected March 22, the Federal Open Market Committee (FOMC) and Fed seat Jerome Powell volition find the destiny of the national funds rate.

Prior to the banking manufacture fallout, the U.S. cardinal slope had been raising the benchmark complaint rapidly each period since this clip past year, pursuing the important monetary expansion successful effect to the Covid-19 pandemic, which saw the instauration keeping rates suppressed astatine zero. When ostentation began to soar, Fed members, including seat Powell, referred to it arsenic “transitory” and predicted it wouldn’t last.

However, the Fed’s swift monetary tightening successful effect to ostentation has caused significant issues with long-duration Treasury notes. During the White House press briefing connected Monday, property caput Karine Jean-Pierre was asked astir president Biden’s sentiment of the Fed chair’s enactment and whether Powell mightiness beryllium replaced arsenic the Fed’s head. “No, not astatine all. The president has assurance successful Jerome Powell,” Jean-Pierre stated.

Eight days prior, connected March 13, president Biden had reassured Americans that the U.S. banking strategy was secure. “Americans tin remainder assured that our banking strategy is safe,” helium said. “Your deposits are secure. Let maine besides guarantee you that we volition not halt here. We volition bash immoderate is necessary,” the U.S. president added.

Additionally, marketplace strategists and economists are funny astir the Fed’s plans for Wednesday, with immoderate speculating that the cardinal slope volition beryllium dovish. For example, past week, Goldman Sachs main economist Jan Hatzius revised the bank’s U.S. national funds complaint forecast and stated that helium does not expect a hike connected Wednesday.

Other marketplace analysts expect that the Fed volition rise the complaint by 25 ground points (bps) this week. At the clip of writing, the CME Group Fedwatch instrumentality indicates a 73.1% chance that the 25bps complaint summation volition occur. The Fedwatch instrumentality besides indicates that 26.9% of analysts foretell nary complaint hike this month.

Tags successful this story

Bailout, Bank Term Funding Program, Benchmark Rate, Central Banks, deposits, Dovish, economists, Federal Funds Rate, Federal Open Market Committee, Federal Reserve seat Jerome Powell, Financial Troubles, Goldman Sachs, inflation, Jan Hatzius, leadership, Liquidity, market analysts, market strategists, monetary expansion, Monetary Tightening, pandemic, President Biden, press briefing, rate forecast, rate increase, secure, target complaint probability, transitory, treasury notes, U.S. banking system, White house

What bash you deliberation the Fed’s determination volition beryllium this coming Wednesday? Share your thoughts astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)