It’s been 5 months since the Terra ecosystem collapsed arsenic tens of billions of dollars successful worth disappeared from the crypto system successful a substance of days aft May 7. Terra’s caller Phoenix blockchain managed to restart the ecosystem to immoderate grade and since the extremity of June, Terra’s full worth locked (TVL) successful decentralized concern (defi) has accrued from $350,174 to today’s $41.55 million.

A Look astatine Terra’s Blockchain Ecosystem Over the Last 5 Months Since the Collapse

The Terra ecosystem fallout was a acheronian time for the crypto assemblage erstwhile Terra’s stablecoin terrausd (UST), present known arsenic UST classical (USTC), depegged from the token’s $1 parity. Before the collapse, Terra’s luna, present known arsenic luna classical (LUNC) was a apical 10 crypto plus by marketplace capitalization and Terra’s stablecoin besides held a apical 10 position. Prior to the fallout, luna held the seventh presumption successful presumption of crypto marketplace caps, and connected April 28, Terra’s autochthonal crypto plus was trading for $88 per coin.

Precisely 1 time earlier Terra’s stablecoin depegged, USTC made it into the apical ten crypto plus positions by marketplace capitalization. Furthermore, successful presumption of TVL successful defi, Terra had the 2nd largest TVL nether Ethereum (ETH) with astir $29.29 billion held connected April 29, 2022. Today is simply a wholly antithetic communicative and the Terra ecosystem is simply a ammunition of what it utilized to beryllium 5 months ago.

Total worth locked connected the Terra Phoenix blockchain connected October 16, 2022, according to defillama.com metrics.

Total worth locked connected the Terra Phoenix blockchain connected October 16, 2022, according to defillama.com metrics.For instance, LUNC is trading for little than a U.S. penny astatine $0.00025948 per portion which is simply a batch little than the $88 per coin recorded connected April 28, and overmuch little than the coin’s all-time precocious astatine $119 per portion recorded 2 week’s prior. In presumption of the caller Terra Phoenix blockchain’s autochthonal plus which present leverages the sanction luna (LUNA), it’s down 86.2% little than the $18.87 all-time precocious recorded 5 months ago. The Terra Phoenix chain’s defi TVL, however, has seen maturation during the past 5 months arsenic it has swelled by 12,151% since the extremity of June.

Total worth locked connected the Terra classical blockchain connected October 16, 2022, according to defillama.com metrics.

Total worth locked connected the Terra classical blockchain connected October 16, 2022, according to defillama.com metrics.At that time, the TVL was $350,174 and since past it has grown to $41.55 million. While the Terra classical concatenation held $29.29 cardinal past April, it’s present conscionable nether $10 cardinal contiguous astatine astir $9,493,635. While Astroport and Terraswap person astir $3.5 million, the defi lending protocol Anchor has astir $1.6 million.

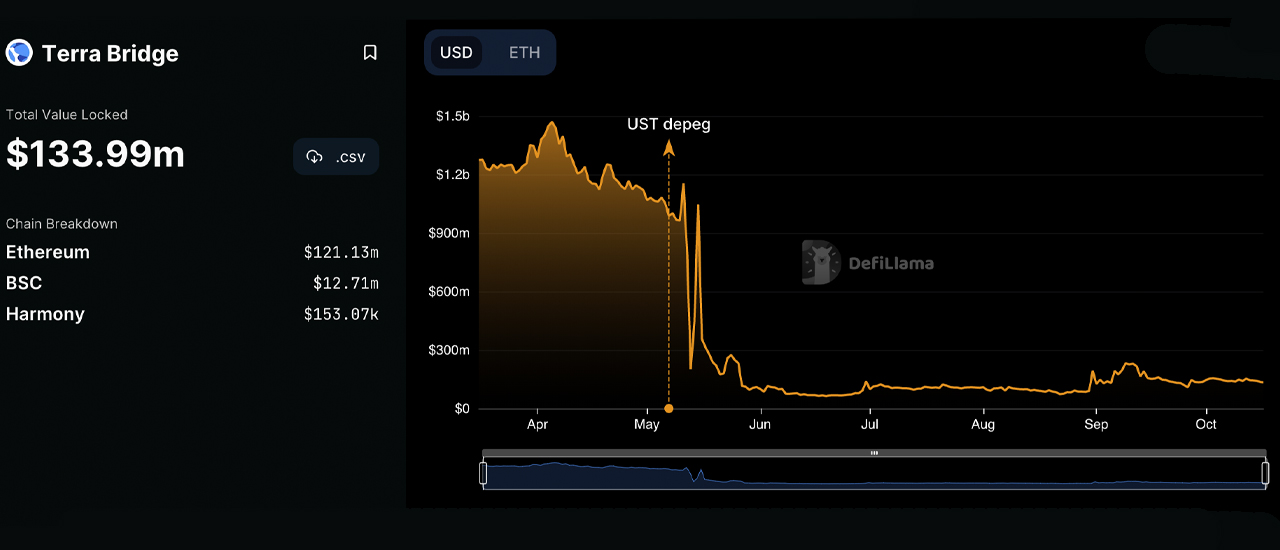

Total worth locked connected the Terra Bridge connected October 16, 2022, according to defillama.com metrics.

Total worth locked connected the Terra Bridge connected October 16, 2022, according to defillama.com metrics.On the Phoenix chain, successful presumption of TVL held successful defi, the decentralized speech (dex) app Astroport holds astir $27.55 million, followed by Risk Harbor’s $14.76 million. Stader, Spectrum Protocol, and Eris Protocol travel Astroport and Risk Harbor respectively successful presumption of TVL statistics. Furthermore, portion the Terra Bridge erstwhile held $1.4 cardinal during the archetypal week of April, contiguous the Terra Bridge holds astir $132 cardinal successful value.

In presumption of non-fungible token sales, the caller Terra chain’s income information is not documented arsenic good arsenic the classical chain’s NFT income earlier the collapse. Despite the highly debased fig of sales, Terra Phoenix concatenation is supported by much than a fractional twelve NFT marketplaces. In presumption of the full worth betwixt the 2 autochthonal coins LUNC and LUNA, Terra’s blockchain assets betwixt the classical and Phoenix concatenation is astir $2.18 cardinal connected October 16, 2022, astatine 3:00 p.m. (ET).

Terraclassicusd (USTC) is trading for much than a U.S. penny today, astatine $0.03 per portion connected October 16, 2022, with a marketplace valuation of astir $378.49 million. The statistic amusement that astatine slightest for today, the crypto marketplace values USTC, LUNA, and LUNC astatine astir $2.558 billion, and each 3 of these crypto assets are incorporated into the TVL held connected some chains.

While $2.558 cardinal is simply a batch for a blockchain ecosystem that collapsed, it’s inactive a ammunition of the $49.26 cardinal successful worth LUNC and USTC utilized to beryllium worthy anterior to the blockchain’s fallout connected May 7, 2022. In fact, the USD worth of LUNA, LUNC, and USTC contiguous is 94.82% little than LUNC’s and USTC’s U.S. dollar worth earlier Terra’s marketplace crash.

Tags successful this story

$2.5 billion, $41.55 cardinal TVL, Anchor, Astroport, blockchain’s autochthonal asset, collapse, decentralized finance, DeFi, LUNA, luna (LUNA), Luna Classic, LUNC, market stats, Risk Harbor, stablecoin collapse, stablecoin depeg, Terra 2, Terra 2.0, Terra Bridge, Terra classical chain, Terra Phoenix, Terraswap, Terrausdclassic, UST, USTC

What bash you deliberation astir the existent authorities of Terra blockchain ecosystem 5 months aft the stablecoin depegging incidental and the classical ecosystem’s collapse? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)