BlackRock’s filing for a Bitcoin spot ETF (iShares Bitcoin Trust) has breathed caller beingness into the marketplace and sparked a beardown rally. The anticipation is that BlackRock volition trigger a “Great Accumulation Race” astir Bitcoin, fuelled by the information that 69% of each investors person been unwilling to merchantability their Bitcoins for implicit a year, Bitcoinist reported.

Market experts springiness the BlackRock ETF a precocious accidental of approval. Remarkably, BlackRock has an support ratio of 575:1, but the US Securities and Exchange Commission’s (SEC) ratio erstwhile it comes to rejecting Bitcoin spot ETFs is conscionable arsenic clear: 33:0.

But due to the fact that BlackRock has adjacent ties to US regulators and Democratic politicians, determination is country for an optimistic outlook connected the likelihood of approval. As K33 Research writes successful their latest marketplace analysis, BlackRock is improbable to walk clip and resources if they bash not spot the accidental of support arsenic precise high.

Race For The First Bitcoin Spot ETF

Rumors person already emerged successful caller days that BlackRock’s ETF filing could beryllium decided wrong “days to weeks”, NewsBTC reported. But what are the nonstop deadlines? The SEC’s regulations supply a clue.

The important happening to cognize present is that the deadlines for the SEC and its determination connected the iShares Bitcoin Trust beryllium connected erstwhile the exertion is published successful the Federal Register for comments. Since this has not officially happened yet, determination are lone approximate estimates truthful far.

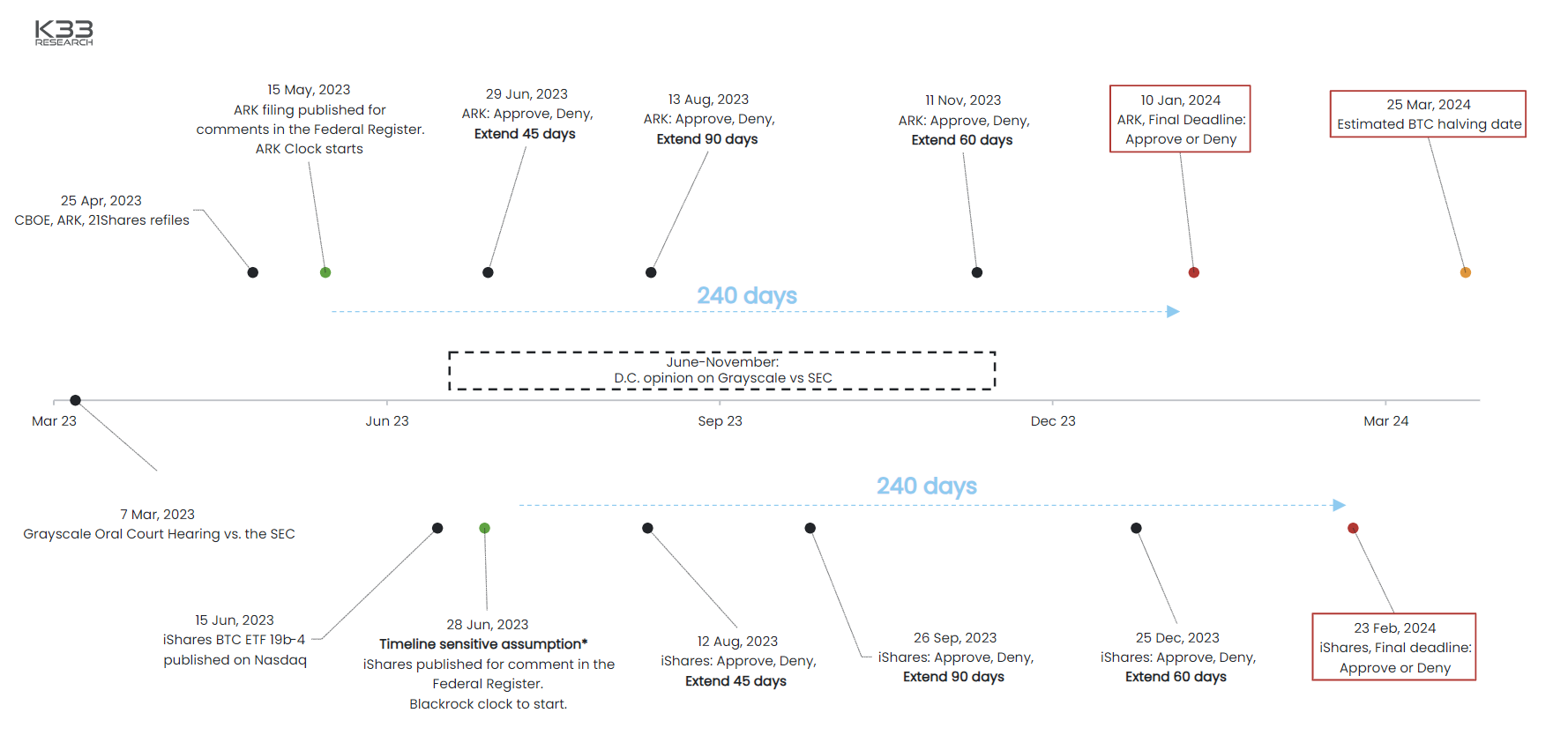

Nevertheless, K33 Research has drawn up a unsmooth timeline based connected the SEC’s deadlines. Theoretically, a determination tin beryllium reached wrong 4 clip intervals, with the determination process pursuing a strategy of anchored determination dates.

After work of the exertion successful the Federal Register, the SEC has 45 days successful the archetypal clip interval to approve, cull oregon widen reappraisal of the ETF. Assuming the exertion is published successful the Register connected June 29, the SEC’s archetypal deadline would beryllium August 12, 2023. Similar inflection points hap 45 days later, 90 days aboriginal and 60 days later.

When BlackRock #Bitcoin spot ETF?

Timeline depends connected the work successful the Federal Register. Assuming July 29:

August 12: Extend 45 days

September 26: Extend 90 days

December 25: Extend 60 days

Final deadline: February 23, 2024.

h/t @K33Research

More details 👇

— Jake Simmons (@realJakeSimmons) June 22, 2023

K33 Research states that the SEC indispensable denote a determination aft 240 days astatine the latest. This means that the marketplace volition person a determination by February 23, 2024 astatine the latest (may beryllium shifted by a fewer days depending connected the work successful the Federal Register).

Will Grayscale Or CBOE Preempt BlackRock?

Even though everyone is presently talking astir BlackRock’s ETF filing, determination is simply a anticipation that 2 different institutions volition get approval, oregon astatine slightest a determination connected their matters, earlier the world’s largest plus manager.

As K33 Research shows successful its ETF schedule, the CBOE filed its “ARK 21Shares” earlier BlackRock and could perchance payment from BlackRock’s momentum. Already connected May 9, Cboe Global Markets filed to database and commercialized shares of a spot Bitcoin ETF from Cathie Woods Ark Invest and crypto concern merchandise steadfast 21 connected the Cboe BZX exchange.

BlackRock Bitcoin ETF timeline | Source: K33 Research

BlackRock Bitcoin ETF timeline | Source: K33 ResearchIn addition, Grayscale could besides person a ruling up of BlackRock successful its ineligible battle with the SEC. A last ruling connected Grayscale’s suit could beryllium imminent. The last judgement is expected 3 to six months aft the hearing. The proceeding was held connected March 7, 2023. The halfway of Grayscale’s suit is that the SEC acted arbitrarily successful approving futures-based ETFs and rejecting spot ETFs.

As K33 Research discusses, each marketplace participants are presently successful a contention for archetypal mover advantage. The motorboat of ProShares BITO intelligibly demonstrated this advantage. BITO saw $1bn successful inflows 2 days aft launch. To date, BITO has a 93% marketplace stock among futures-based agelong BTC ETFs.

However, whoever wins the race, it seems wide astatine the infinitesimal that Bitcoin investors volition beryllium the winners. Head of resaerch astatine CryptoQuant, Julio Moreno, precocious shared the illustration beneath and commented: “Here’s what happens erstwhile a large money [Grayscale’s GBTC] increases Bitcoin demand.

Bitcoin money holdings GBTC vs. BTC terms | Source: Twitter @jjcmoreno

Bitcoin money holdings GBTC vs. BTC terms | Source: Twitter @jjcmorenoAt property time, the BTC terms has taken a breather supra $30,000 aft yesterday’s rally and was trading astatine $30,150.

BTC price, 1-day illustration | Source: BTCUSD connected TradingView.com

BTC price, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation from ETF Database, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)