Bitcoin futures person go an integral portion of the cryptocurrency market. Futures are a fiscal instrumentality that allows investors to bargain oregon merchantability Bitcoin astatine a predetermined terms astatine a specified aboriginal date. These contracts let traders to hedge against terms volatility, making them a captious instrumentality for hazard management.

Perpetual futures basal retired arsenic a unsocial and invaluable instrumentality wrong the futures market. Unlike accepted futures that person a acceptable expiration date, perpetual futures don’t expire. This favoritism allows traders to clasp positions indefinitely, provided they wage periodic backing rates.

Monitoring the authorities of Bitcoin futures, particularly perpetual futures, offers a lens into the broader wellness and sentiment of the crypto market.

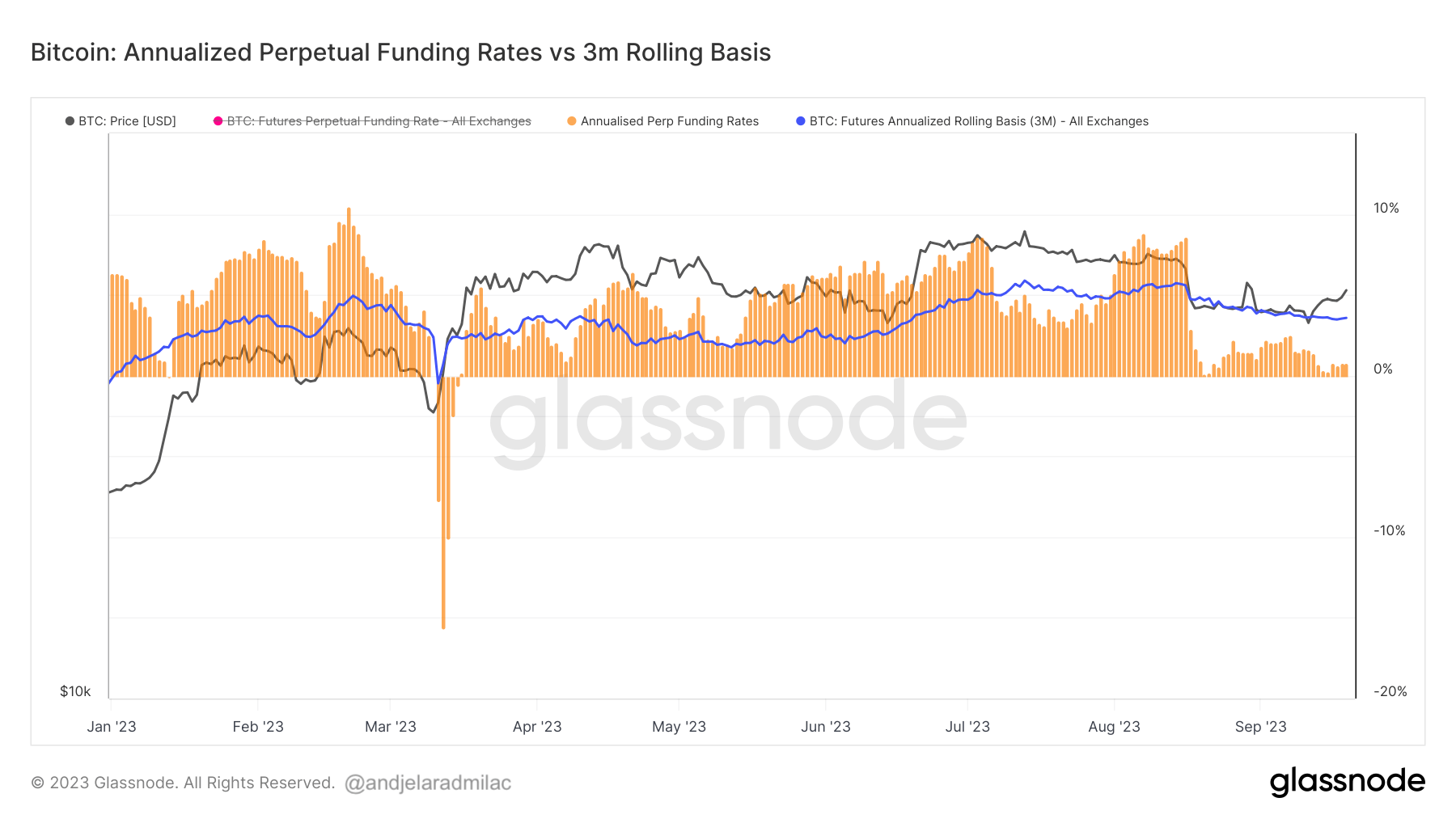

One metric that has proven peculiarly insightful is the examination betwixt the annualized perpetual backing rates and their 3-month rolling basis. Historically, erstwhile the annualized backing complaint surged above the 3-month rolling basis, it astir ever signaled an impending terms downturn. Conversely, a terms uptrend typically followed erstwhile the annualized backing complaint dipped beneath the 3-month rolling ground oregon turned negative.

This improvement tin beryllium attributed to the request for leverage successful perpetual futures, which intimately mirrors spot marketplace terms indexes. High request for leverage tin pb to an oversupply of sell-side contracts, prompting traders to arbitrage down the precocious backing rates.

Graph comparing the annualized perpetual futures backing complaint to its 3-month rolling ground successful 2023. Note however the annualized complaint trends supra the 3-month rolling ground during terms uptrends (Source: Glassnode)

Graph comparing the annualized perpetual futures backing complaint to its 3-month rolling ground successful 2023. Note however the annualized complaint trends supra the 3-month rolling ground during terms uptrends (Source: Glassnode)A caller lawsuit successful point: connected Aug. 17, the annualized perpetual backing complaint plummeted beneath the 3-month rolling basis. This displacement correlated with a important driblet successful Bitcoin’s price, which dropped from $29,200 connected Aug. 15 to $26,000 connected Aug. 18.

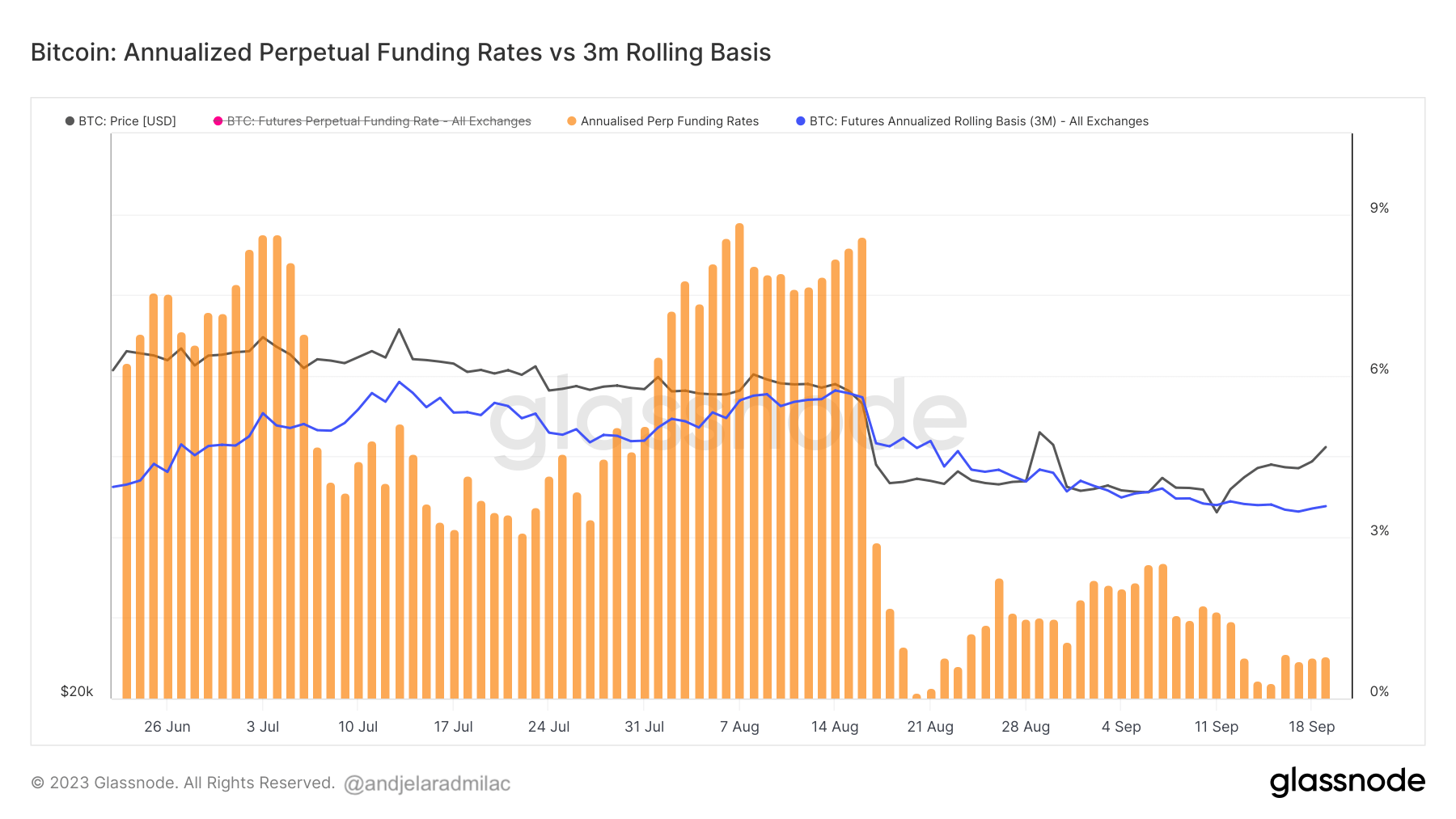

As of Sep. 19, the annualized perpetual backing remains beneath the 3-month rolling basis, registering astatine 0.782%, portion the 3-month rolling ground stands astatine 3.574%. This suggests that the marketplace is presently de-risking, often observed aft a downside terms enactment oregon during bearish trends.

Graph comparing the annualized perpetual futures backing complaint to its 3-month rolling ground from June 22 to Sep. 20, 2023 (Source: Glassnode)

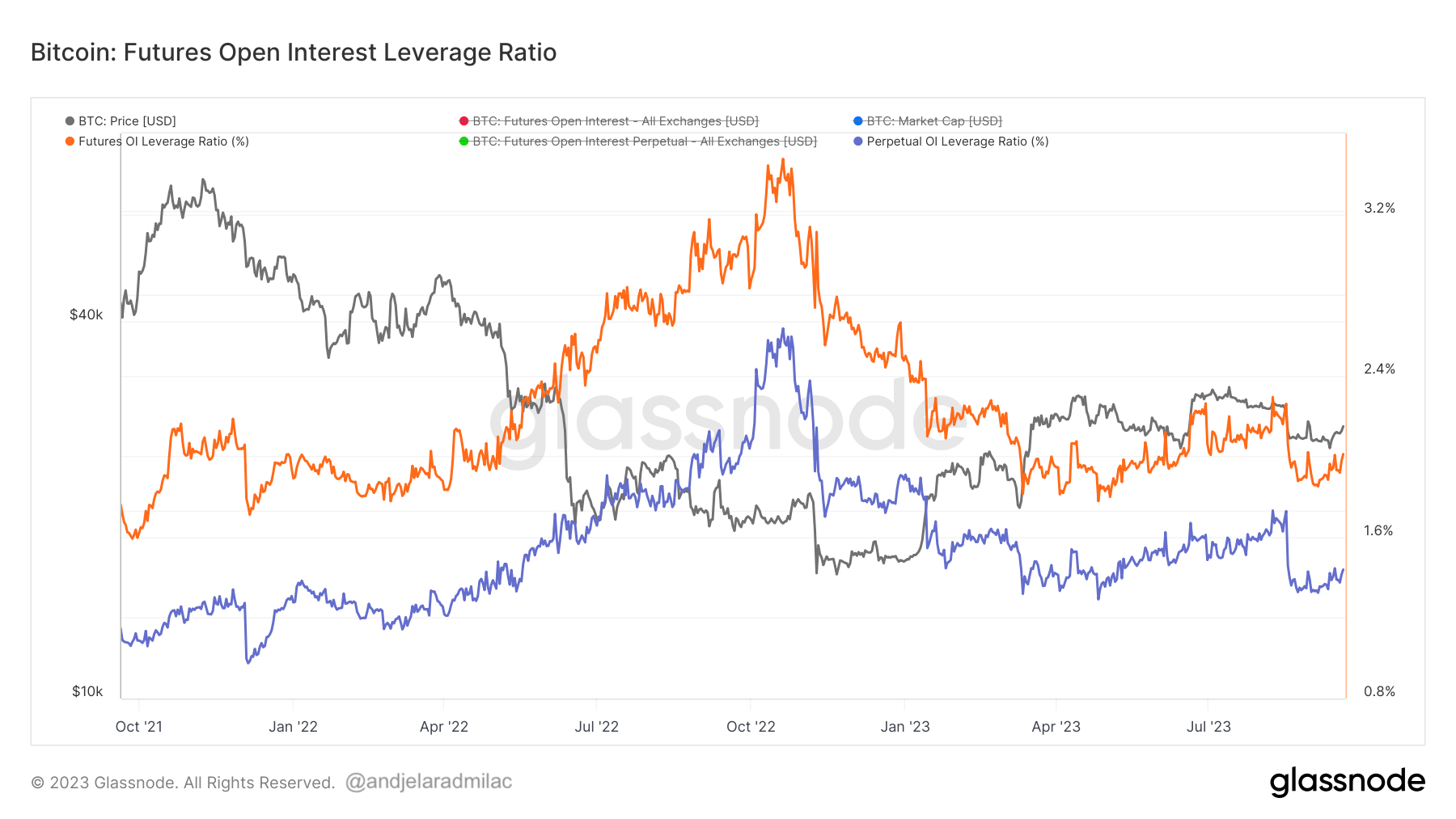

Graph comparing the annualized perpetual futures backing complaint to its 3-month rolling ground from June 22 to Sep. 20, 2023 (Source: Glassnode)Another metric worthy noting is the futures unfastened involvement leverage ratio. This ratio, calculated by dividing the marketplace unfastened declaration worth by the asset’s marketplace cap, shows the grade of leverage successful the marketplace comparative to its size.

High values bespeak a sizeable unfastened involvement compared to the marketplace size, raising the hazard of short/long squeezes oregon liquidation events. Conversely, debased values suggest a much unchangeable marketplace situation with reduced hazard of forced buying oregon selling.

Graph showing the unfastened involvement leverage ratio for perpetual futures (blue) and futures (orange) from Sep. 20, 2021, to Sep. 20, 2023 (Source: Glassnode)

Graph showing the unfastened involvement leverage ratio for perpetual futures (blue) and futures (orange) from Sep. 20, 2021, to Sep. 20, 2023 (Source: Glassnode)On Aug. 17, a crisp diminution successful this ratio was observed, showing a sizeable deleveraging lawsuit successful the market. By Sep. 19, the futures unfastened involvement leverage ratio was 2%, with the perpetual unfastened involvement leverage ratio astatine 1.439%. These figures marked an summation from 1.9% and 1.3% since Sep.18, correlating with Bitcoin’s terms surge past $27,000.

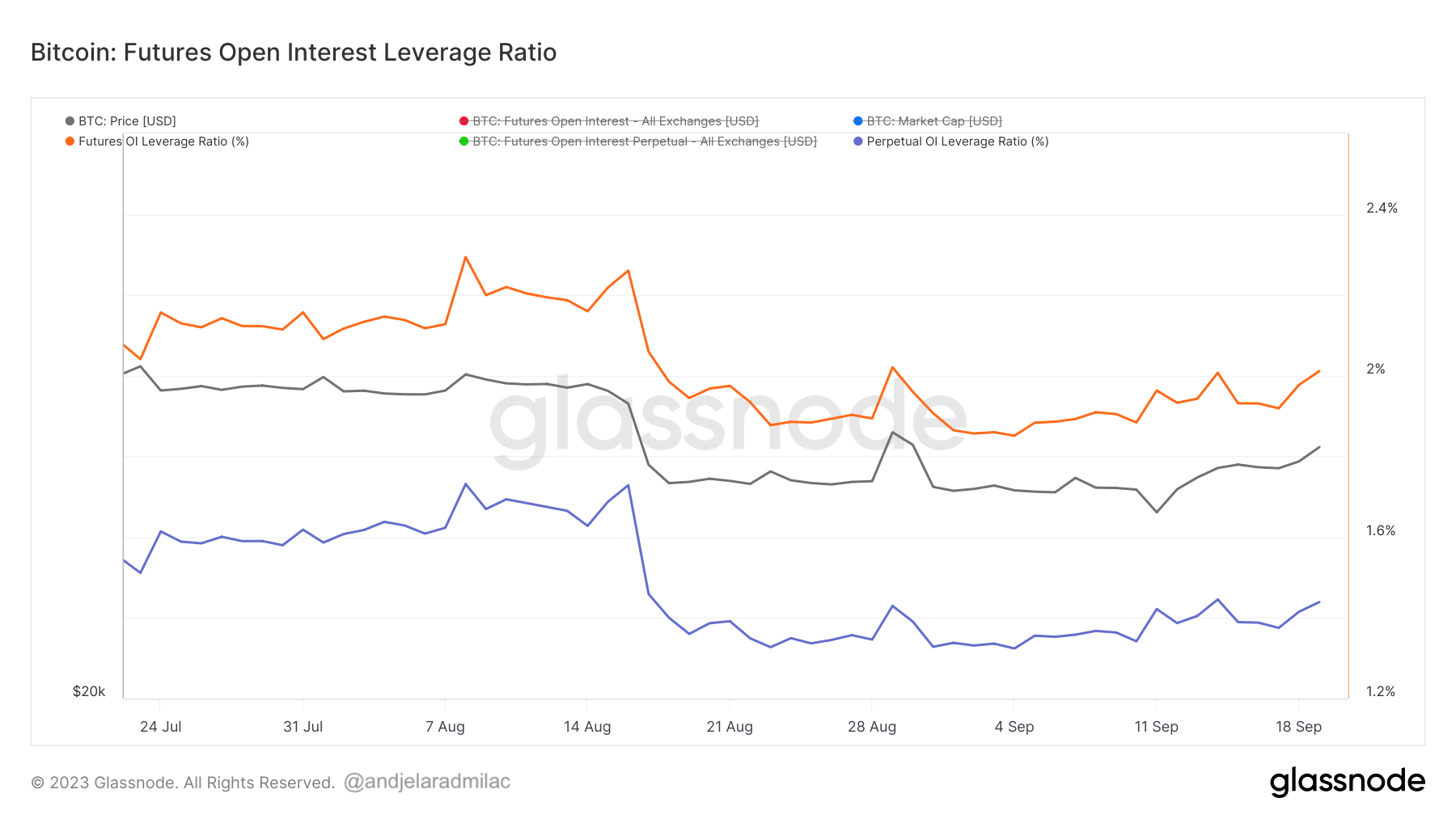

Graph showing the unfastened involvement leverage ratio for perpetual futures (blue) and futures (orange) from July 23 to Sep. 20, 2023 (Source: Glassnode)

Graph showing the unfastened involvement leverage ratio for perpetual futures (blue) and futures (orange) from July 23 to Sep. 20, 2023 (Source: Glassnode)As indicated by the annualized backing complaint and its 3-month rolling basis, the existent de-risking situation tin amusement caution among traders, perchance successful anticipation of further terms fluctuations oregon outer marketplace events. The caller summation successful the futures unfastened involvement leverage ratio hints astatine renewed assurance among traders, particularly aft a crisp diminution successful the ratio arsenic observed connected Aug. 17.

However, a rising leverage ratio tin beryllium a double-edged sword. While it mightiness bespeak beardown marketplace participation, it tin besides rise the measurement of imaginable short/long squeezes and summation the likelihood of liquidation cascades.

These metrics overgarment a representation of a marketplace that is treading carefully. Traders equilibrium their optimism with precaution, bracing for the volatility they expect to deed the market.

The station What perpetual futures archer america astir the existent Bitcoin market appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)