The Bitcoin terms took a large deed yesterday contempt a affirmative surprise successful the US Consumer Price Index (CPI), pursuing a rumor that the US authorities sold 9,800 BTC related to Silk Road. Since then, the marketplace has struggled to retrieve from the shock.

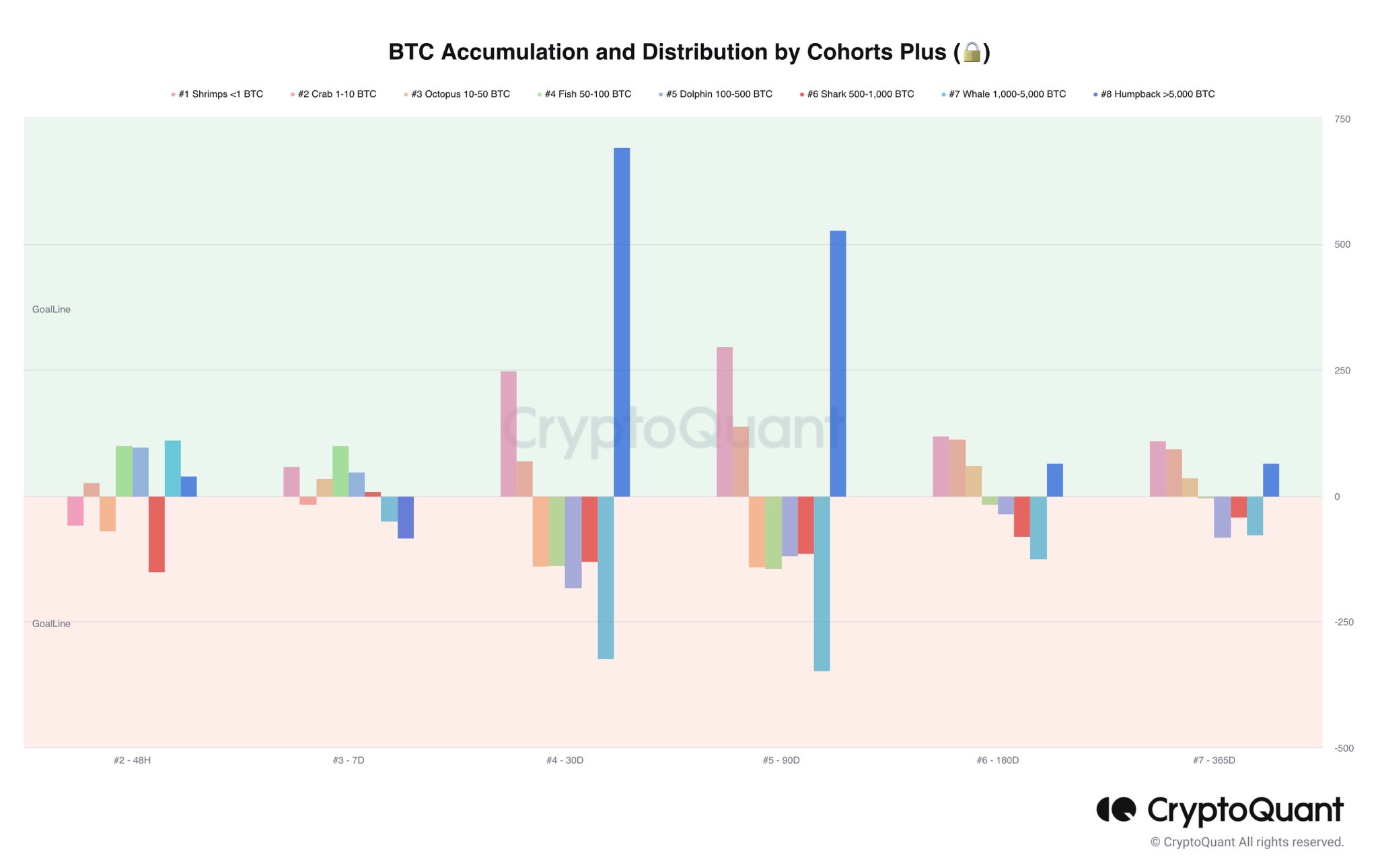

However, 1 radical of investors is showing nary fear: whales. The large investors with a batch of wealth are considered 1 of the astir reliable indicators of erstwhile is simply a bully clip to bargain Bitcoin. On-Chain expert Axel Adler stated, “BTC Accumulation and Distribution – nary changes. Large players proceed to bargain BTC from smaller players.”

The illustration beneath shows that investors with much than 5,000 BTC person been buying ample amounts (alongside smaller investors <10 BTC) implicit the past 30 and 90 days, portion each different cohorts person been shedding BTC.

Bitcoin accumulation and organisation by cohorts | Source: Twitter @AxelAdlerJr

Bitcoin accumulation and organisation by cohorts | Source: Twitter @AxelAdlerJrWhat Do Bitcoin Whales Know?

Of course, it tin lone beryllium speculated what the Bitcoin whales cognize that others bash not. But the information is that Bitcoin saw an upward inclination yesterday aft the CPI release, until the fake quality (manipulation?) astir the US authorities selling Bitcoin broke.

But, yesterday’s CPI people could person importantly much implications than are evident astatine archetypal glance. For immoderate clip now, the marketplace has been betting connected an aboriginal pivot by the U.S. cardinal slope (Fed). The marketplace is presently betting connected 3 involvement complaint cuts by the extremity of the twelvemonth (3x 25 bps to 4.25-4.50%).

While the U.S. banking situation reinforces this bet, whales whitethorn person been calling the Fed’s bluff for immoderate time. As NewsBTC editorial manager and method expert Tony Spilotro precocious pointed retired via Twitter, the Fed (and the masses) are relying connected lagging indicators.

Remember: CPI is simply a lagging indicator. The banal marketplace is simply a starring indicator.

— Tony "The Bull" (@tonythebullBTC) May 10, 2023

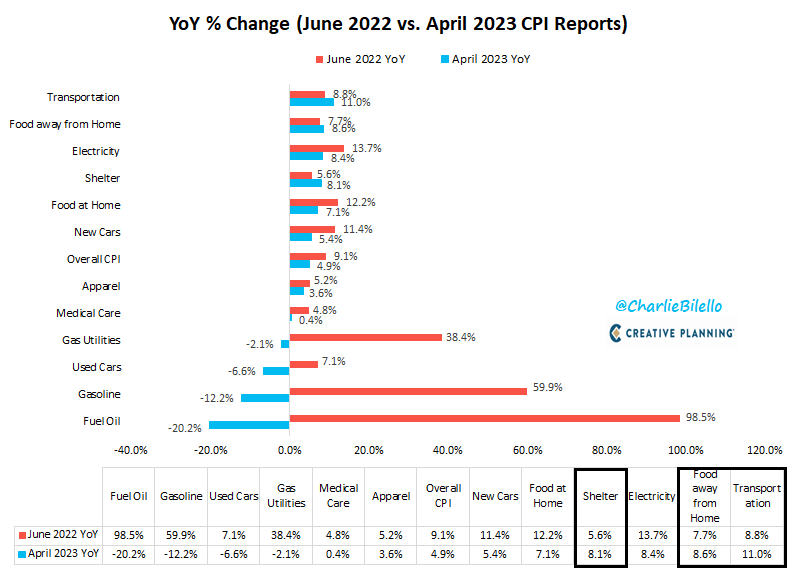

Charlie Bilello, main marketplace strategist astatine Creative Planning, stressed connected Twitter that the user terms scale successful the U.S. has declined from a precocious of 9.1% successful June past twelvemonth to 4.9% successful April. According to the renowned analyst, the crushed for this alteration is the little ostentation rates successful heating oil, gasoline, utilized cars, state supply, aesculapian care, clothing, caller cars, nutrient astatine location and electricity.

YoY alteration ostentation | Source. Twitter @charliebilello

YoY alteration ostentation | Source. Twitter @charliebilelloInflation rates successful transportation, out-of-home nutrient and lodging person accrued since past June, but declines successful the different large components person offset those increases. The information that the U.S. halfway ostentation scale (excluding food/energy) inactive stands astatine 5.5% year-over-year is chiefly owed to structure CPI (+8.1% year-over-year), according to Bilello:

Why was Shelter CPI inactive moving higher portion existent rent ostentation has been moving little for immoderate time? Shelter CPI is simply a lagging indicator that wildly understated existent lodging ostentation successful 2021 & archetypal fractional of 2022.

As Biello added, aft 25 consecutive increases (on an yearly basis), the structure CPI showed its archetypal diminution successful April, from 8.2% successful March (the highest level since 1982) to 8.1% successful April. If structure ostentation yet peaks, it volition person a large interaction connected the wide CPI, arsenic structure accounts for much than one-third of the index.

Deflation Coming Fast?

This sentiment is echoed by Fundstrat’s caput of research, Thomas Lee. In an interview, Lee said that ostentation volition travel down faster than astir radical deliberation and that volition marque the Fed’s intermission much comfy for investors due to the fact that it volition pb to a brushed landing.

For Lee, this is 1 of the cardinal implications of yesterday’s April CPI report. Carl Quintanilla of Fundstrat added:

40% of the CPI handbasket (by weight) is successful outright deflation. This is simply a immense development. Housing and Food are not ‘deflating’ adjacent though real-time measures amusement this. That would adhd different 50% oregon truthful erstwhile they do.

For Bitcoin, a accelerated driblet successful ostentation rates and a brushed landing arsenic predicted by Lee could beryllium highly bullish. Whales could usage this signifier to accumulate portion retail investors are selling retired of fearfulness of a looming recession with precocious inflation.

At property time, the Bitcoin terms traded astatine 27,550, backmost successful the little range.

BTC terms backmost successful the little range, 4-hour illustration l Source: BTCUSD connected Tradingview.com

BTC terms backmost successful the little range, 4-hour illustration l Source: BTCUSD connected Tradingview.comFeatured representation from iStock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)