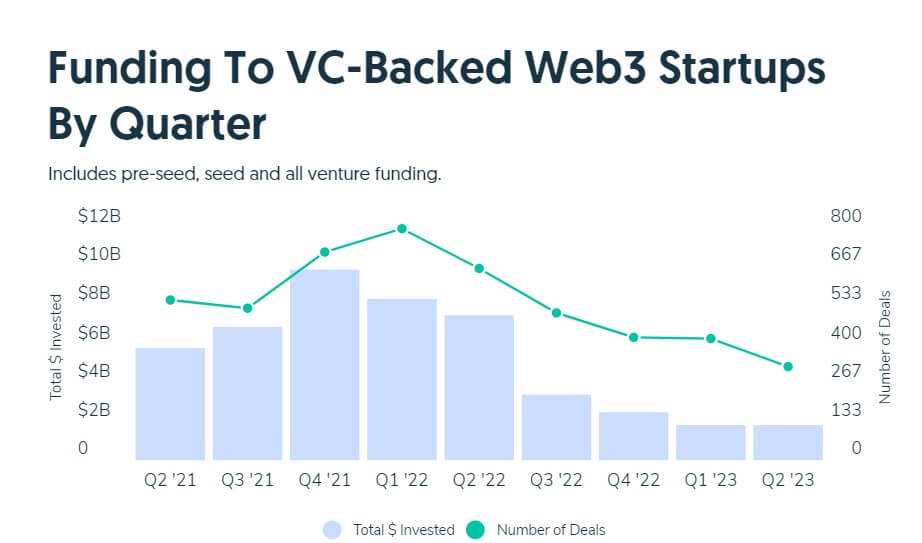

Web3 projects raised $3.6 cardinal from task superior firms during the archetypal six months of this year, representing a 78% driblet from what they raised from these organizations during the aforesaid play past year, Crunchbase reported connected July 18.

According to the report, web3 projects’ woody travel deed the slowest gait since the last 4th of 2020, erstwhile 291 deals got $1.1 billion.

Source: Crunchbase

Source: CrunchbaseCrunchbase defined web3 arsenic cryptocurrency and blockchain startups.

Crypto investments declining

A person look astatine the fig showed that web3 projects raised $1.8 cardinal during this year’s archetypal 2 quarters. Venture superior backing for web3 projects notably crashed by 76% during this 2nd 4th compared to what was raised during the aforesaid play past year.

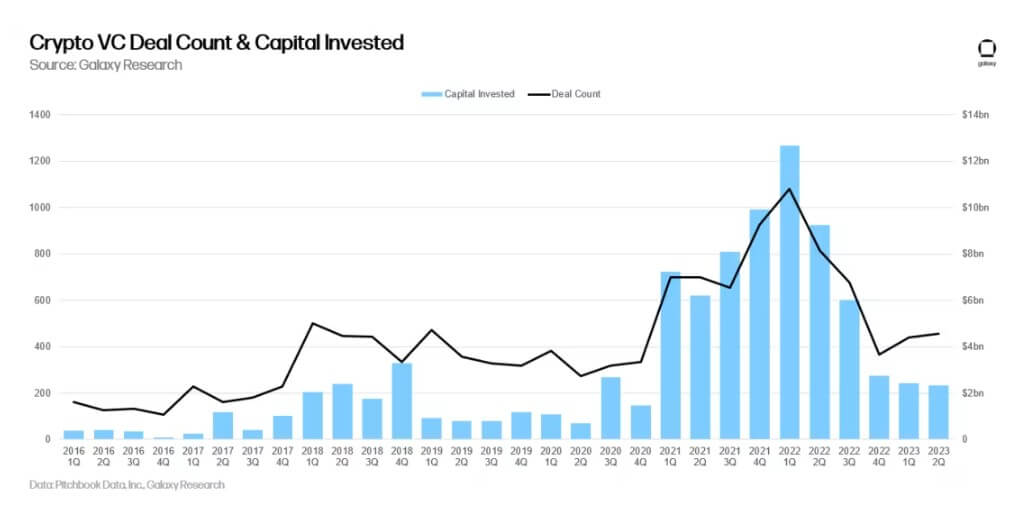

Meanwhile, a abstracted probe report from Galaxy Research corroborates Crunchbase’s findings. According to Galaxy, crypto and blockchain projects raised $2.32 cardinal during the 2nd quarter—the lowest magnitude since the 4th fourth of 2020. The steadfast noted that the downward inclination had begun successful the archetypal 4th of past twelvemonth erstwhile investments peaked astatine $13 billion.

Source: Galaxy Research

Source: Galaxy Research“Crypto and blockchain startups raised little wealth crossed the past 3 quarters combined than they did successful conscionable Q2 of past year.”

Will Clemente, the co-founder of Reflexivity Research, pointed out that VC backing for crypto successful June was little than immoderate period during the implicit depths of the 2018 carnivore market.

The Head of Firmwide Research, Alex Thorn, explained that investors struggled to rise caller funds, adding that founders were getting little task valuations.

Why is crypto VC backing crashing?

Crunchbase noted that the declining funds were coming erstwhile the manufacture witnessed a renewed level of organization interest.

In June, BlackRock led a question of organization Bitcoin spot ETF applications with the Securities and Exchange Commission (SEC), resulting successful the worth of respective integer assets, including Bitcoin (BTC) and Ethereum (ETH), rising to their yearly highs.

However, the organization involvement was coming connected the heels of heightened regulatory scrutiny of the abstraction crossed aggregate jurisdictions pursuing past year’s grounds marketplace crash.

For context, the U.S. SEC filed lawsuits against starring crypto exchanges, Coinbase and Binance, alleging that their operations violated national securities law. The fiscal watchdog’s regulation-by-enforcement attack has further led respective crypto-related firms to shutter operations successful the country.

The station Web3 projects spot 78% driblet successful VC investments arsenic crypto backing falls appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)