BTCUSD, BTCGBP, and BTCEUR are the astir traded Bitcoin pairs, each reflecting the enactment betwixt Bitcoin and the circumstantial economical situation of their underlying currencies. Analyzing their respective performances allows america to summation penetration into the planetary Bitcoin marketplace and however section economical conditions power terms action. While this information is constricted to a azygous exchange, successful this case, Bitstamp, it provides a typical presumption of broader trends and allows for meaningful conclusions.

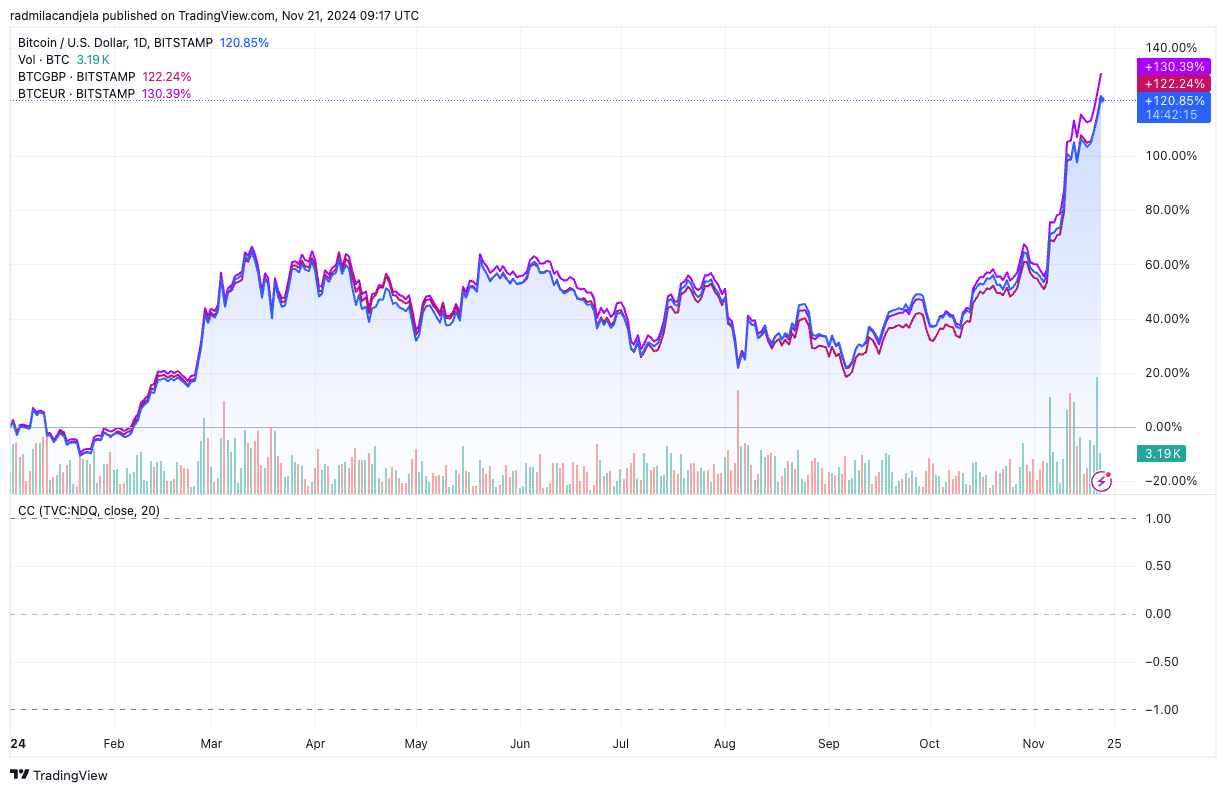

Year-to-date, BTCEUR has delivered the highest returns, with a summation of 130.39%, compared to 122.24% for BTCGBP and 120.85% for BTCUSD. This outperformance tin mostly beryllium attributed to the euro’s weakness comparative to the dollar and pound. With the Eurozone grappling with debased maturation and constricted monetary argumentation flexibility, the currency has suffered against a backdrop of dollar strength.

This depreciation amplifies Bitcoin’s gains successful EUR terms, arsenic it takes much euros to acquisition the aforesaid magnitude of BTC. By contrast, the dollar’s strength—underpinned by beardown US economical data, robust Treasury yields, and expectations of higher-for-longer Federal Reserve policy—has dampened BTCUSD’s evident gains, arsenic a stronger dollar offsets the upward unit connected Bitcoin’s price.

Graph showing the YTD show of BTCUSD, BTCGBP, and BTCEUR (Source: TradingView)

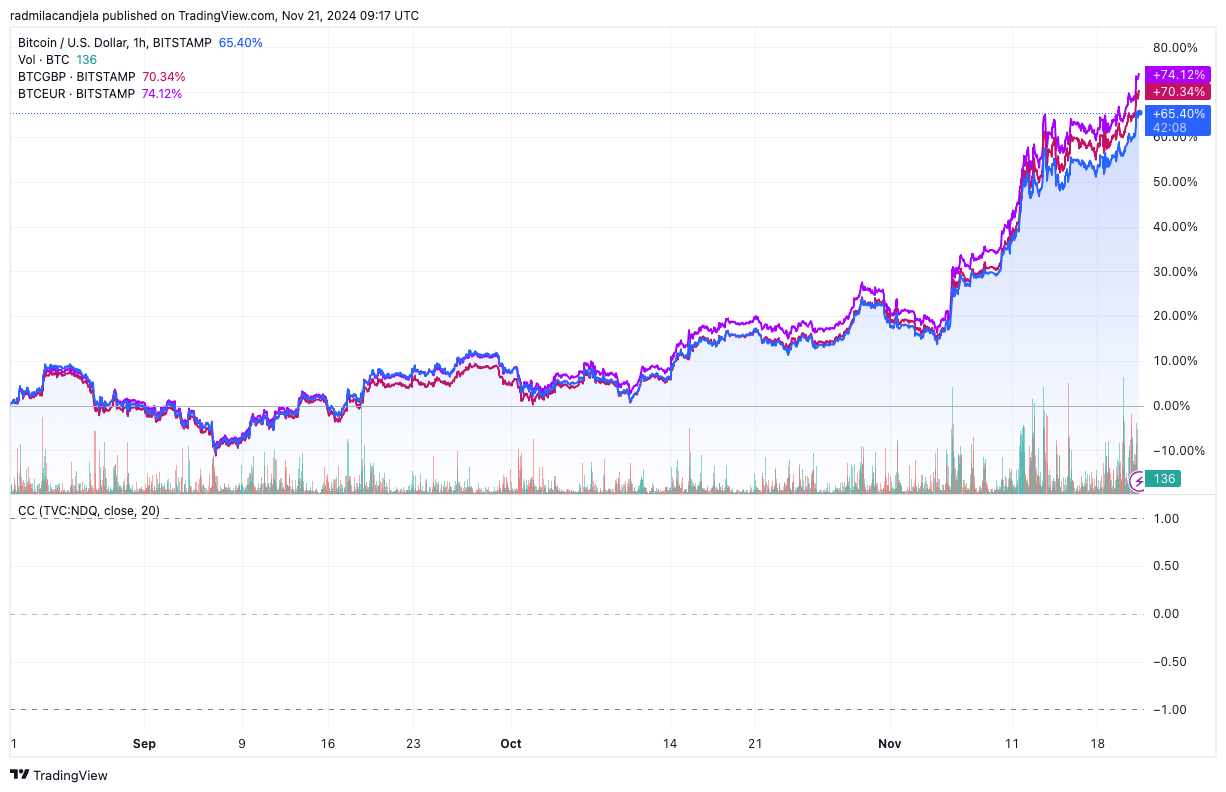

Graph showing the YTD show of BTCUSD, BTCGBP, and BTCEUR (Source: TradingView)In the three-month window, the trends stay consistent, with BTCEUR continuing to outperform BTCGBP and BTCUSD. During this period, euro weakness became adjacent much pronounced, falling to a one-year debased against the dollar. This diminution reflects a operation of disappointing Eurozone maturation metrics, dovish signals from the European Central Bank, and geopolitical uncertainties.

Meanwhile, BTCGBP has shown a somewhat much robust show than BTCUSD, highlighting the pound’s comparative weakness. The UK’s persistent economical stagnation and reduced hawkishness from the Bank of England person placed unit connected GBP, adjacent arsenic it maintains marginally much resilience than the euro.

Graph showing the three-month show of BTCUSD, BTCGBP, and BTCEUR (Source: TradingView)

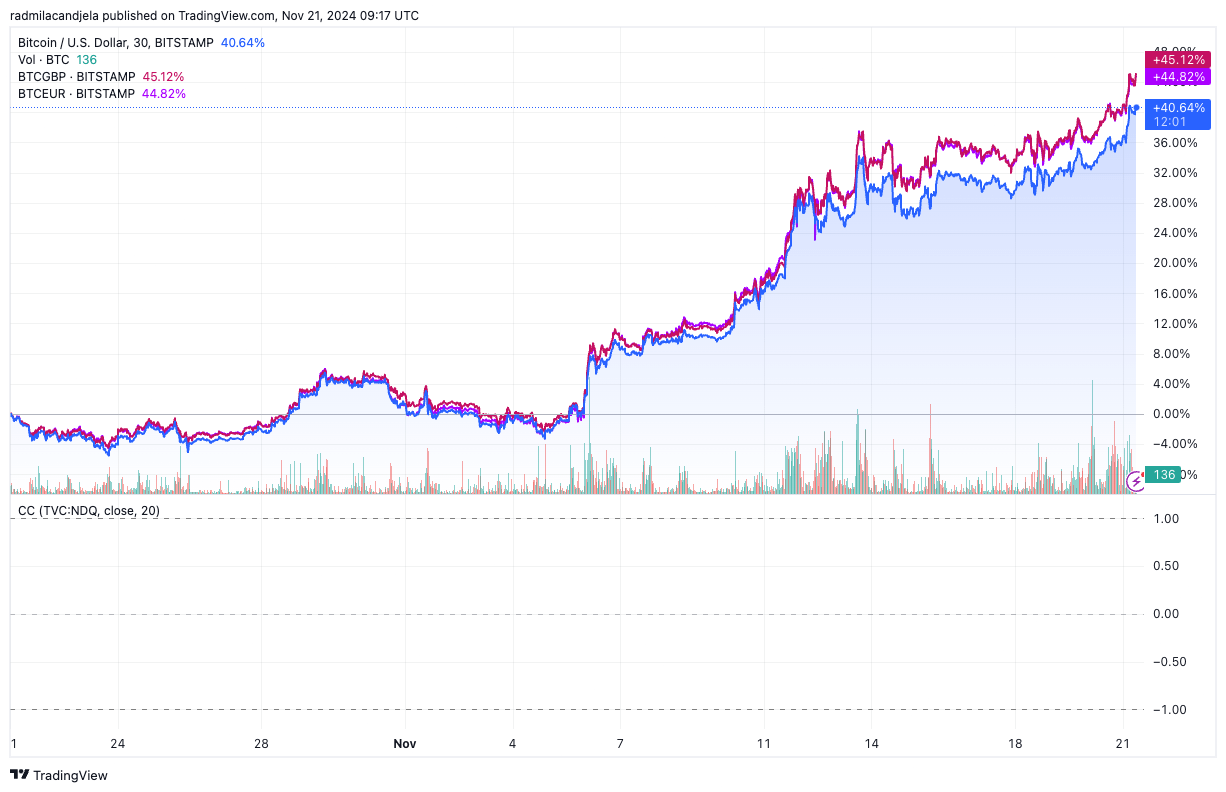

Graph showing the three-month show of BTCUSD, BTCGBP, and BTCEUR (Source: TradingView)The terms enactment since the US predetermination shows that Bitcoin’s show against these 3 currencies reflects the astir caller macroeconomic and geopolitical developments. BTCUSD gained 42.38%, trailing BTCEUR and BTCGBP, which grew 46.22% and 45.87%, respectively. The dollar’s persistent spot has been captious successful tempering BTCUSD’s gains. The market’s effect to the US predetermination was aggressive.

As the upcoming Trump administration’s policies are expected to boost US growth, the predetermination strengthened the dollar and drove further request for US assets, weighing connected BTCUSD. In contrast, BTCEUR and BTCGBP were comparatively unaffected by this governmental event, and their performances remained mostly a relation of their respective fiat weaknesses.

Graph showing the one-month show of BTCUSD, BTCGBP, and BTCEUR (Source: TradingView)

Graph showing the one-month show of BTCUSD, BTCGBP, and BTCEUR (Source: TradingView)The divergence successful Bitcoin’s show crossed these pairs besides shows the power fiat volatility has connected perceived returns. The euro and the lb person been acold much volatile than the dollar this year, peculiarly fixed the contrasting monetary policies and economical prospects of each area.

This volatility exaggerates Bitcoin’s terms movements successful EUR and GBP terms, creating the illusion of greater returns compared to BTCUSD. As the Eurozone continues to look structural maturation challenges, Bitcoin’s outperformance against the euro is apt to persist. While nether akin pressure, the lb has shown somewhat much resilience owed to little terrible structural concerns, which aligns with BTCGBP’s middle-ground show comparative to BTCUSD and BTCEUR.

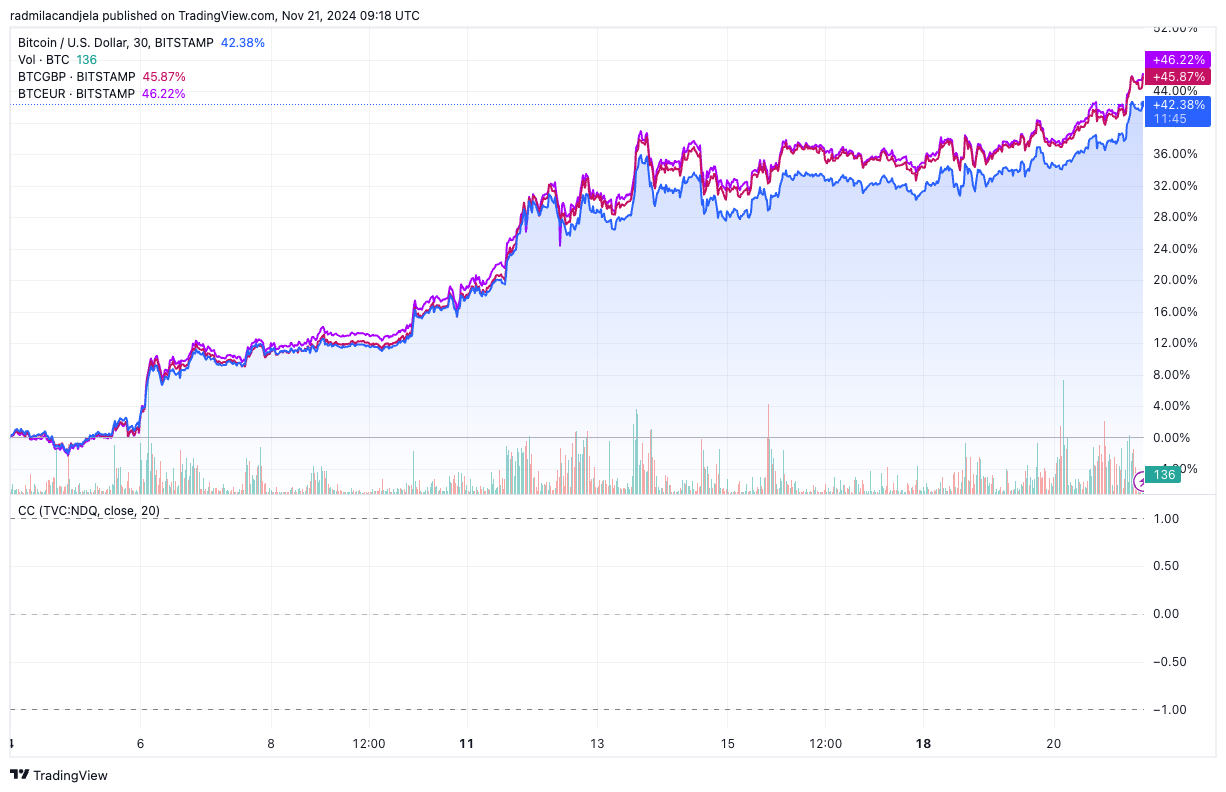

Graph showing the show of BTCUSD, BTCGBP, and BTCEUR from Nov. 4 to Nov. 21, 2024 (Source: TradingView)

Graph showing the show of BTCUSD, BTCGBP, and BTCEUR from Nov. 4 to Nov. 21, 2024 (Source: TradingView)The short-term trends observed since the US predetermination connected Nov. 5 uncover a alternatively absorbing marketplace state. Despite the USD’s strength, BTCUSD steadily accrued during this period. This suggests that portion the dollar’s spot muted Bitcoin’s gains compared to BTCEUR and BTCGBP, it did not wholly stifle its terms momentum.

For BTCEUR and BTCGBP, continued EUR and GBP weakness aft the predetermination allowed Bitcoin to prolong its comparative outperformance. This is peculiarly applicable fixed that Eurozone and UK markets progressively look to Bitcoin arsenic a hedge against depreciating fiat currencies.

The station Weak euro fuels Bitcoin’s standout show successful Eurozone appeared archetypal connected CryptoSlate.

10 months ago

10 months ago

English (US)

English (US)