There is simply a crushed centralized exchanges person dominated contempt being antithetical to crypto’s halfway tenets.

The pursuing sentiment editorial was written by Bitcoin.com CEO Dennis Jarvis.

The gross mismanagement and outright fraud successful 2022 by galore opaque centralized exchanges are driving radical backmost to the halfway tenets of crypto, specified arsenic decentralization, self-custody, transparency, and censorship resistance. People are people turning to DeFi (decentralized finance). Unfortunately, overmuch of DeFi is not yet acceptable to enactment arsenic a suitable substitute.

In this article, I volition speech astir 2 of the astir important challenges: however to marque DeFi much accessible to caller users and however to amended its show erstwhile compared to centralized services.

The Onboarding Problem and Its Solution

The occupation with getting caller users to follow DeFi is partially owed to idiosyncratic acquisition (UX). Bitcoin.com’s Head of Product Experience Alex Knight did an fantabulous occupation outlining the problems and solutions of the UX challenges successful web3 applications. To summarize: the self-custodial web3 exemplary mostly leads to developers creating a idiosyncratic acquisition that’s fundamentally antithetic from the 1 radical are utilized to successful the custodial web2 exemplary — and that creates immense friction.

Solving the UX occupation is simply a operation of clever design, education, and incentives.

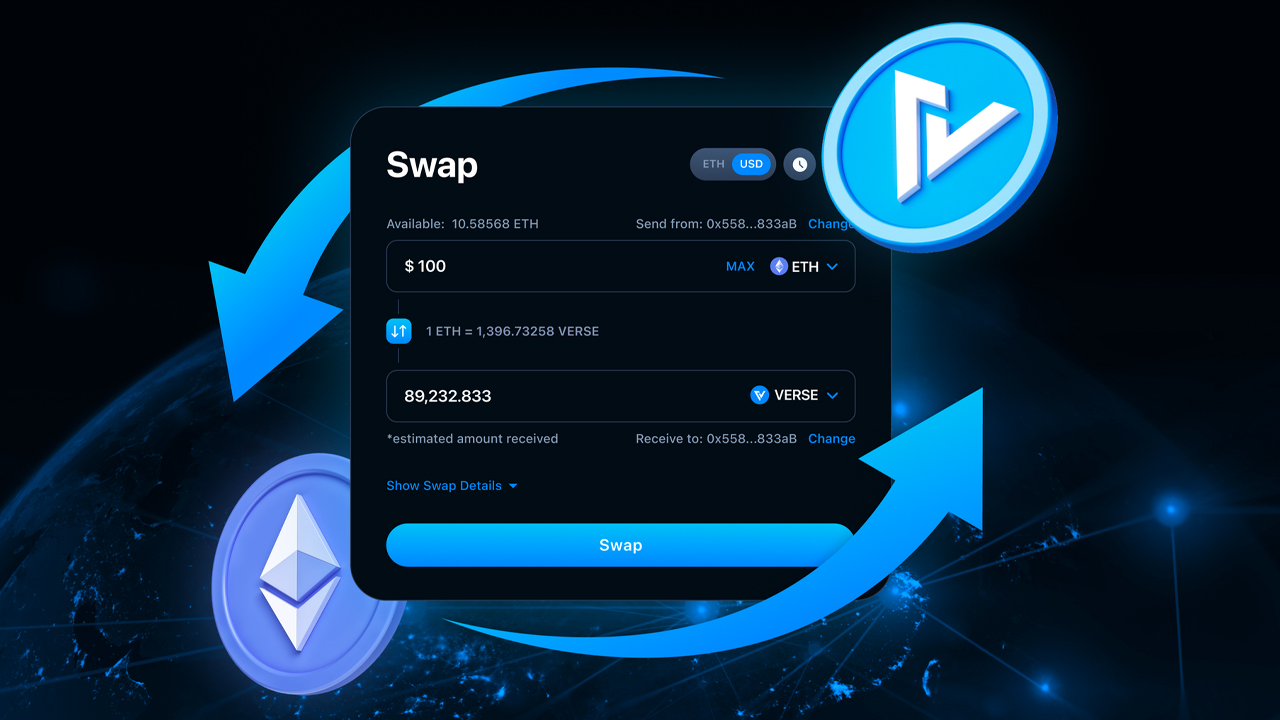

On the plan front, the situation is to make products that are arsenic acquainted and easy-to-use arsenic the champion web2 analogs. At Bitcoin.com our self-custodial multichain wallet app has long-provided an intuitive experience, but lone for elemental actions similar buying, selling, sending, and receiving crypto. As we integrate much analyzable DeFi features, including our ain decentralized speech Verse DEX, close into the app, it is captious that the idiosyncratic acquisition stay arsenic indistinguishable from web2 arsenic imaginable portion utilizing web3 rails exclusively.

Yet adjacent if web3 manages to scope parity with web2 successful presumption of ease-of-use, determination is inactive the situation of convincing radical to marque the switch. This is wherever acquisition and incentives travel in. Education volition bash 2 things: rebuild assurance successful crypto, and hole users to marque the move. Incentives volition supply the propulsion that’s often needed to effort thing new.

Luckily, the cryptocurrency abstraction is ideally suited to supply the cleanable operation of acquisition and incentives. I’ve written astir the powerfulness of loyalty tokens successful crypto, and the value of getting them right, and we’ve thought agelong and hard astir however to integrate them successful the Bitcoin.com ecosystem.

Now that we’ve launched our ain ecosystem token VERSE, we’re capable to commencement experimenting with ways to usage monetary incentives to safely usher radical into decentralized finance, wherever they tin payment from its advantages implicit CeFi (centralized finance). One mode we’re readying connected doing that is to reward newcomers with VERSE tokens for taking actions similar securely backing up their wallet.

This is supported by our recently launched CEX Education Program that volition reward radical affected by centralized crypto institution insolvencies portion encouraging the adoption of decentralized concern and self-custody.

The Execution Problem

Even if you lick the occupation of onboarding caller users, DeFi successful its existent iteration fails successful responsiveness and marketplace size. If either of these is lacking, radical volition not come, oregon wantonness soon after.

DeFi responsiveness has seized up nether what would beryllium considered airy postulation successful web2. On-chain capableness has not been capable to grip highest 2021 DeFi usage. Even with the proliferation of alt-L1’s and the beginnings of unrecorded L2’s, on-chain artifact abstraction was easy swamped.

DEX marketplace size encapsulates DeFi’s capableness problem. I’ll fto crypto Twitter assistance maine retired here:

*Tweet from @HighStakesCap*

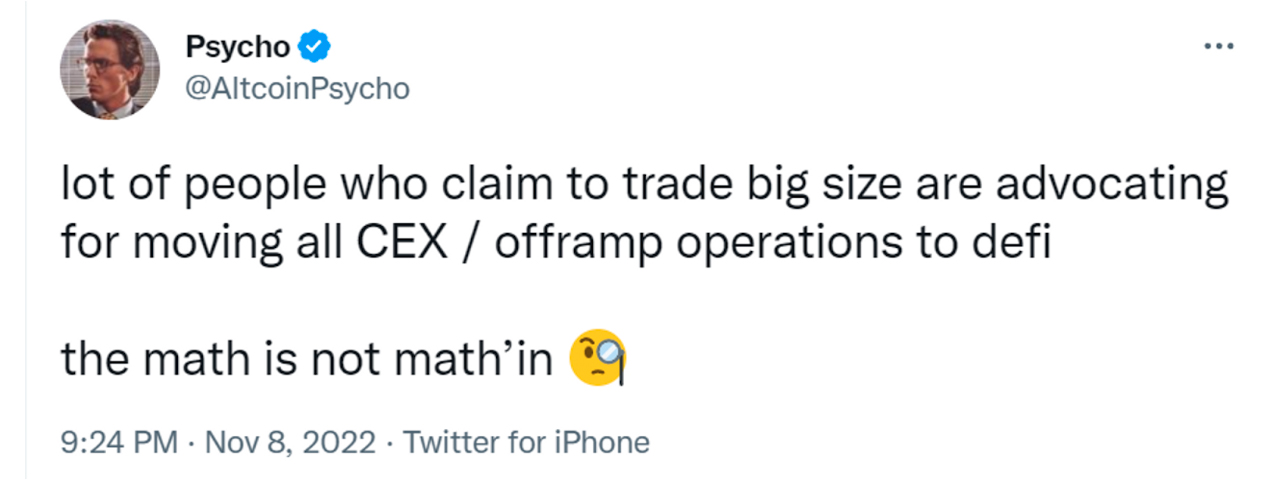

*Tweet from @HighStakesCap* *Tweet from @AltcoinPsycho*

*Tweet from @AltcoinPsycho* *Tweet from @ByzGeneral*

*Tweet from @ByzGeneral*Note that these comments were posted conscionable earlier FTX imploded. It’s imaginable that the tweets’ authors’ views person changed since then. Still, their criticisms ringing true: Current DeFi products simply cannot regenerate CEXs successful presumption of liquidity, volume, and bid matching.

It’s a occupation for the crypto manufacture erstwhile galore of the biggest traders, marketplace makers, and proponents of crypto cannot execute trades oregon enactment successful size connected decentralized platforms. They’re forced to stitchery connected risky centralized exchanges, which creates a self-reinforcing rhythm of dependence connected CEXs.

In the past, CEXs seemed similar an agreed upon stop-gap until crypto exertion was astatine a spot wherever it was susceptible to instrumentality over. As crypto garnered much attention, I consciousness similar the manufacture arsenic a full became complacent, distracted by the magnitude of wealth pouring in. The feeling was thing like, “Those things volition beryllium solved successful time.”

Solution to the Execution Problem

I judge that the basal crypto technological tools are each here, oregon astir so. An illustration of a DEX that tin vie connected an acceptable level with a CEX, is the furniture 2-based dYdX exchange. Leveraging zero-knowledge impervious systems, dYdX tin execute transactions cheaply and rapidly capable to comparison with the responsiveness of CEXs. Currently, “the existing dYdX merchandise processes astir 10 trades per 2nd and 1,000 bid places/cancellations per second, with the extremity to standard up orders of magnitude higher.”

Now the lone happening it lacks is comparable liquidity. Since bully liquidity begets amended liquidity, a constructive archetypal measurement is that dYdX uses an bid publication and matching engine, a overmuch much businesslike and profitable mode to marque markets. Using an bid publication should pull marketplace makers to supply the liquidity capable to marque DEXs comparable to CEXs.

Additionally, liquidity volition travel present that it’s evident (again!) that you can’t spot these centralized intermediaries. Big players successful crypto request to marque a concerted effort to determination retired of CEXs into DeFi protocols. Bitcoin.com, for one, is arrogant to beryllium offering extended DeFi solutions. The Bitcoin.com Wallet, with implicit 35 cardinal self-custodial wallets created to date, continues to beryllium an important onboarding tool, mounting up newcomers to easy and securely interact with decentralized finance.

The Future Is DeFi

Don’t beryllium disillusioned by the shortcomings I person identified here. The information of the substance is that each of DeFi’s shortcomings are trivial successful examination to its strengths. DeFi enables self-custody of your assets but with the inferior we’ve travel to trust connected from centralized fiscal institutions; for example, swapping betwixt assets, earning output connected your assets, oregon utilizing your assets to instrumentality retired loans. Until now, these fiscal activities person ever required trusted intermediaries. The solutions to DeFi’s problems are attainable, which is successful stark opposition to the entrenched problems successful accepted finance. Ultimately the reply to accepted finance’s problems is DeFi.

Tags successful this story

Assets, attainable, Bitcoin.com, Centralized Exchanges, CEX, CEXs, Crypto, crypto technology, decentralized finance, decentralized platforms, DeFi, Defi education, DeFi products, Defi protocols, DeFi solutions, DEX, earning yield, Liquidity, loans, Market Makers, matching engine, onboarding, op-ed, Opinion Editorial, Order Book, order matching, scaling up, self custodial wallets, Self-custody, Swapping, Traditional Finance, trusted intermediaries, Verse, volume

What are your thoughts connected the imaginable for decentralized concern to regenerate centralized finance? Share your thoughts successful the comments conception below.

Guest Author

This is an Op-ed article. The opinions expressed successful this nonfiction are the author's own. Bitcoin.com does not endorse nor enactment views, opinions oregon conclusions drawn successful this post. Bitcoin.com is not liable for oregon liable for immoderate content, accuracy oregon prime wrong the Op-ed article. Readers should bash their ain owed diligence earlier taking immoderate actions related to the content. Bitcoin.com is not responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate accusation successful this Op-ed article.

To lend to our Op-ed conception nonstop a proposition to op-ed (at) bitcoin.com.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)