The fiscal satellite relies heavy connected indicators to gauge marketplace sentiment and foretell aboriginal trends. Among these, the Volatility Index, commonly known arsenic the VIX, stands retired arsenic a salient measurement of marketplace anxiety.

Originating from the Chicago Board Options Exchange, the VIX is an scale that represents the market’s anticipation of 30-day forward-looking volatility. Calculated from the implied volatilities of a wide scope of S&P 500 scale options, a precocious VIX typically signals heightened capitalist fears, portion a debased speechmaking suggests a calm market.

On the different hand, the S&P 500 Index, oregon SPX, serves arsenic a beacon for the wide wellness of the U.S. banal market. Comprising 500 of the largest U.S. companies by marketplace capitalization, its movements are watched intimately by traders, analysts, and organization investors alike. Historically, the VIX and the SPX person shared an inverse relationship: arsenic the SPX rises, indicating bullish sentiment, the VIX usually decreases, suggesting reduced marketplace anxiety, and vice versa.

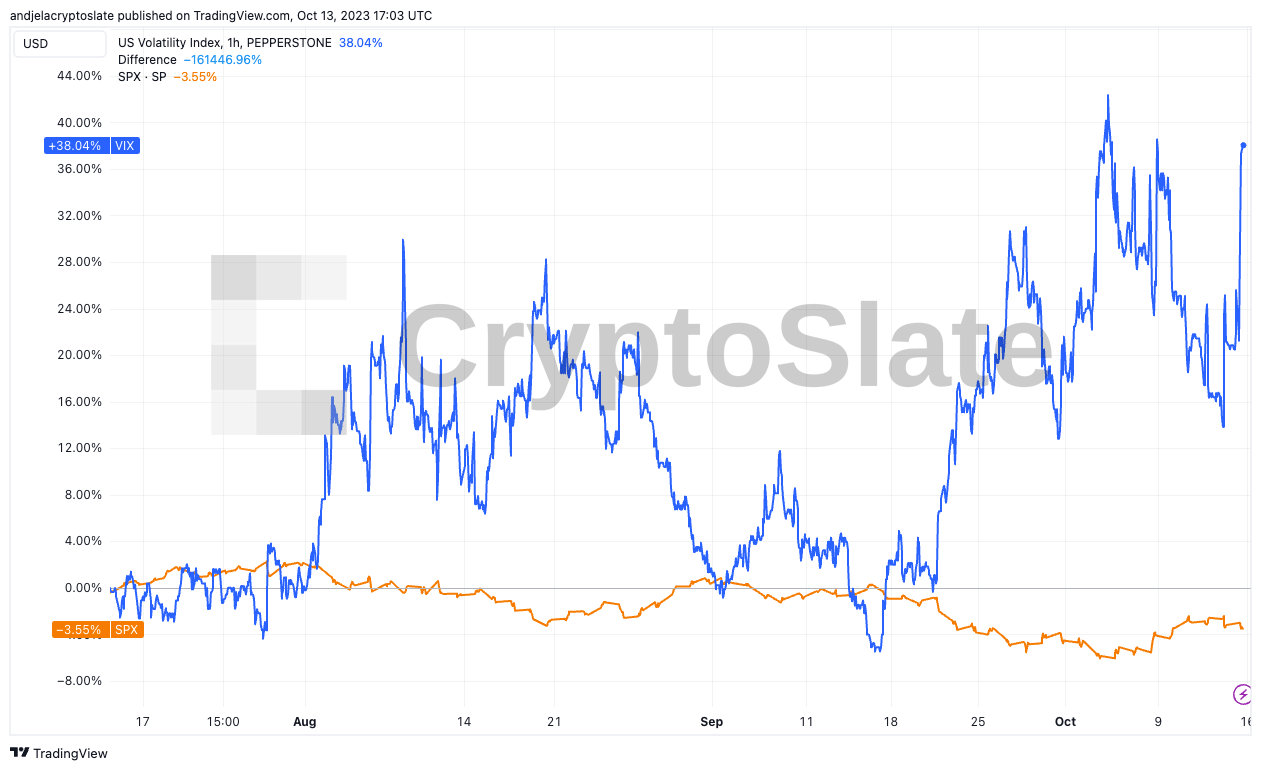

Yet, caller marketplace information paints an antithetic picture. Over 3 months, the SPX witnessed a diminution of 3.37%, a wide denotation of immoderate bearish sentiment. However, the VIX skyrocketed during the aforesaid period, expanding 38.41%.

Graph showing the divergence betwixt VIX and SPX from Jul. 12 to Oct. 13, 2023 (Source: TradingView)

Graph showing the divergence betwixt VIX and SPX from Jul. 12 to Oct. 13, 2023 (Source: TradingView)This divergence is besides observed successful a narrower 1-month window: the SPX declined by 3%, portion the VIX surged by 32.8%.

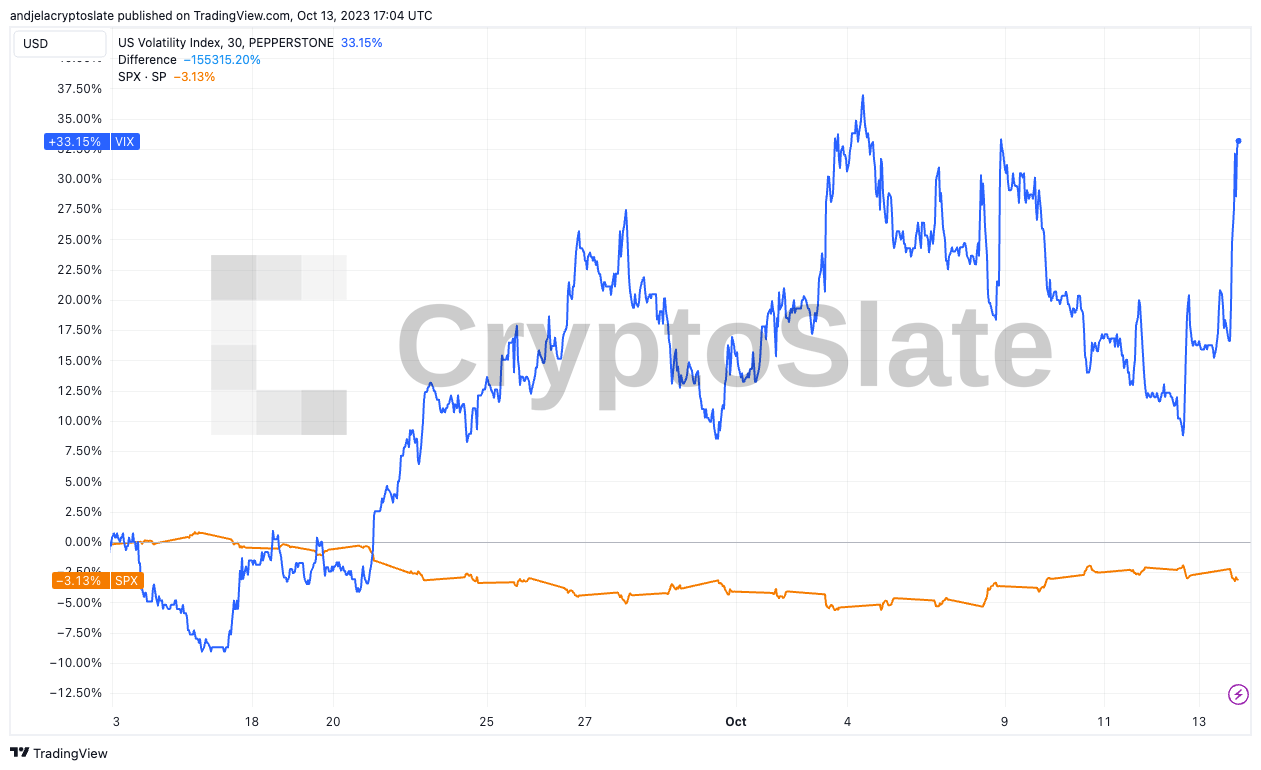

Graph showing the divergence betwixt VIX and SPX from Sep. 12 to Oct. 13, 2023 (Source: TradingView)

Graph showing the divergence betwixt VIX and SPX from Sep. 12 to Oct. 13, 2023 (Source: TradingView)The discrepancy connected Oct. 13 was adjacent much pronounced — successful conscionable a azygous trading day, the VIX jumped by an alarming 13.54%. Meanwhile, the SPX, alternatively than reflecting this spike successful volatility, remained astir unchanged, registering a specified 0.82% dip.

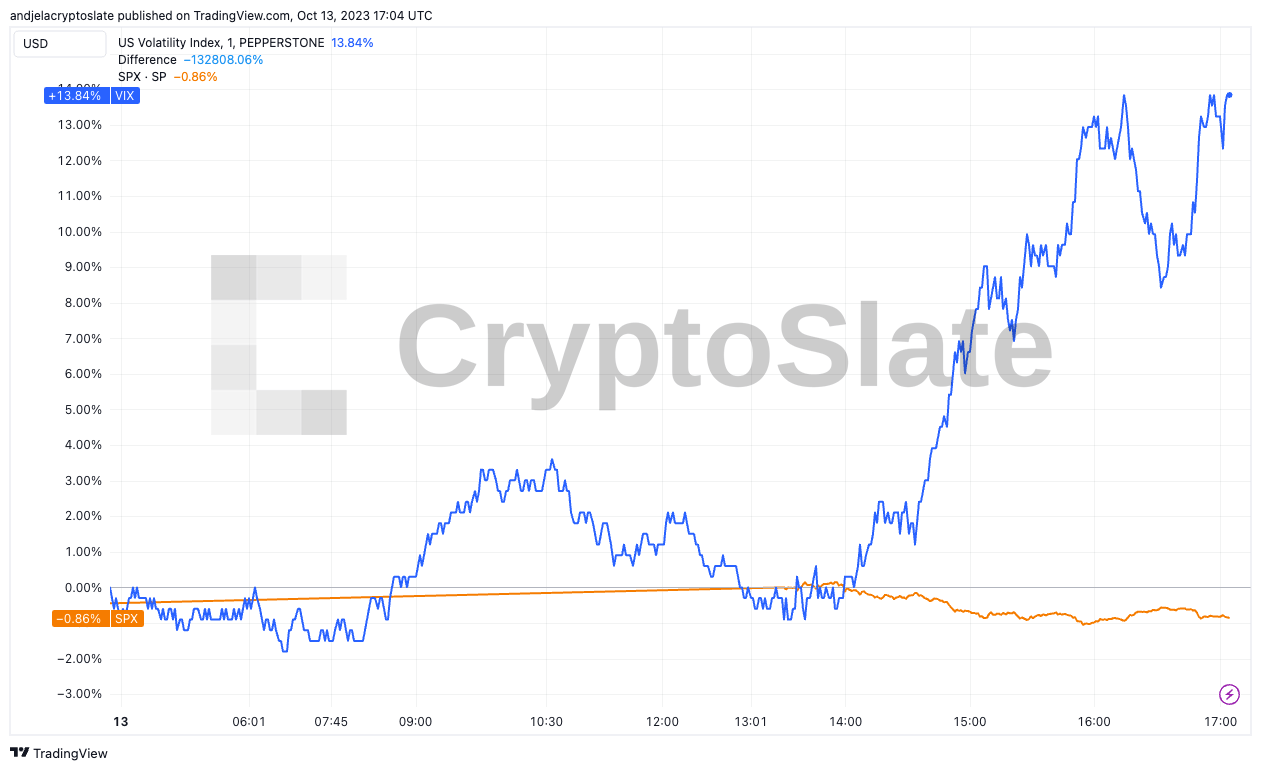

Graph showing the divergence betwixt VIX and SPX betwixt Oct. 12 and Oct. 13, 2023 (Source: TradingView)

Graph showing the divergence betwixt VIX and SPX betwixt Oct. 12 and Oct. 13, 2023 (Source: TradingView)This stark divergence prompts questions. Several factors could beryllium contributing to this anomaly. Firstly, the marketplace mightiness beryllium anticipating important future movements successful the SPX that aren’t yet reflected successful its existent value. Secondly, outer events oregon geopolitical tensions could interaction marketplace derivatives much than the currency market, starring to an exaggerated VIX. Lastly, structural changes oregon shifts successful marketplace dynamics and participants could change the accepted narration betwixt the 2 indices.

For investors and marketplace participants, specified discrepancies are origin for vigilance. While the VIX’s superior relation is to measurement marketplace sentiment, its existent dislocation from the SPX whitethorn bespeak underlying marketplace stresses oregon imaginable forthcoming volatility. Traders mightiness construe this arsenic a motion to hedge their positions oregon hole for imaginable marketplace swings.

The station VIX surges portion SPX remains steady: What’s down the anomaly? appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)