Wednesday, Dec. 18, volition spell down successful past arsenic a time of marketplace panic triggered by the 25 ground constituent Fed complaint cut and Chair Jerome Powell's hawkish outlook.

Bitcoin (BTC) concisely tumbled beneath $100,000; U.S. equities dropped astir 3%, portion the dollar scale (DXY) scale soared to a two-year precocious of 108, which continues to enactment unit connected currencies worldwide.

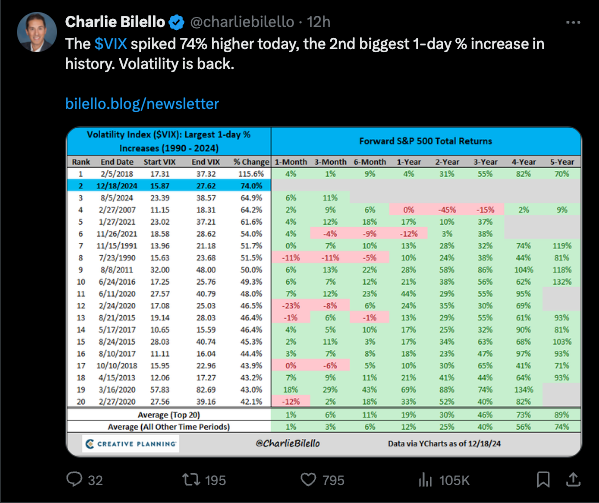

The astir important question came from the CBOE Volatility Index (VIX), which skyrocketed by 74%, marking the largest one-day leap successful the Wall Street's alleged fearfulness gauge since Feb. 5, 2018. It was besides the second-largest summation successful its history. The VIX serves arsenic a measurement of marketplace fearfulness and expected volatility implicit the adjacent 30 days.

Historically, important spikes successful the VIX person marked section bottoms for some bitcoin and the S&P 500.

Examining the apical 3 one-day changes successful the VIX, the archetypal occurred connected Feb. 5, 2018, erstwhile it surged by 116%. On that day, bitcoin plunged 16% to $6,891, which turned retired to beryllium a section bottom. By Feb. 20, prices had rebounded to implicit $11,000.

The second-largest spike successful the VIX occurred connected Dec. 18, registering a 74% increase.

The 3rd biggest spike happened connected Aug. 5, 2024, during the Yen transportation commercialized unwind, erstwhile the VIX jumped 65%. On that occasion, bitcoin dropped 6% to deed a section bottommost astir $54,000 and climbed backmost up to implicit $64,000 by Aug. 23.

A akin signifier has consistently played retired successful the S&P 500 implicit the years, information shared by Charlie Bilello, main marketplace strategist astatine Creative Planning, show.

Let's spot if past repeats itself. At property time, BTC traded supra $102,000 portion the S&P 500 futures pointed to a affirmative unfastened with a 0.37% gain.

9 months ago

9 months ago

English (US)

English (US)