Stablecoin issuer Circle Internet Financial has ditched each U.S. Treasury bonds from its USD Coin (USDC) backing reserves arsenic portion of precautionary measures to support from a imaginable fallout from the looming U.S. indebtedness ceiling showdown.

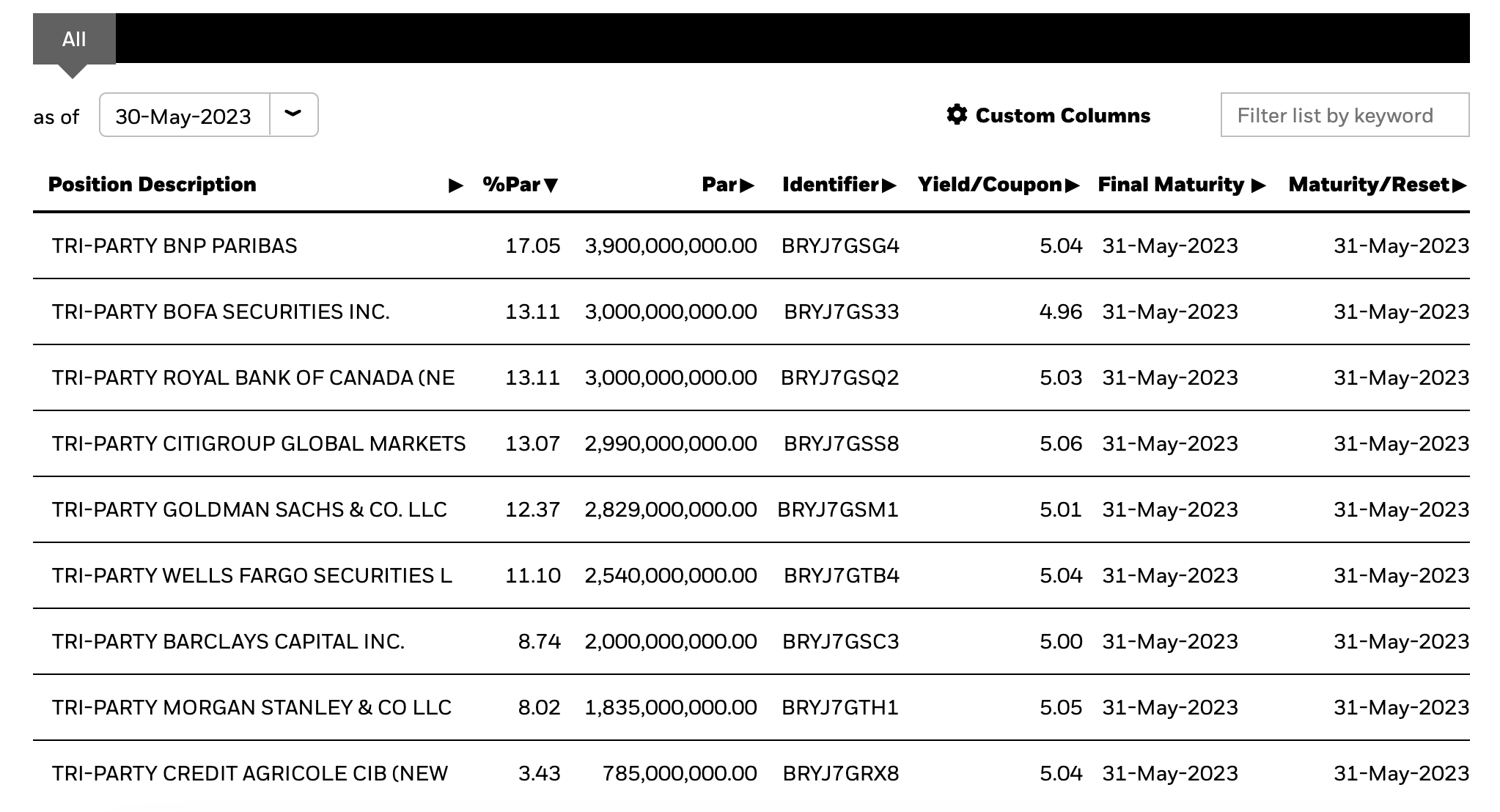

The Circle Reserve Fund, managed by planetary concern elephantine BlackRock, held each of its $24 cardinal of assets nether absorption successful overnight repurchase (repo) agreements arsenic of May 30, according to the fund’s website.

This is simply a important alteration since the extremity of April, erstwhile the money held much than $30 cardinal successful U.S. Treasury bonds, according to Circle’s monthly attestation. The past Treasury enslaved worthy $4 cardinal among the fund’s holdings matured connected Tuesday, the fund’s website showed.

Circle Reserve Fund holdings (BlackRock)

Circle Reserve Fund holdings (BlackRock)The milestone is simply a effect of Circle’s effort to support the $29 cardinal USDC stablecoin from imaginable turbulence connected the enslaved marketplace portion U.S. lawmakers are scrambling for a woody to avert a authorities default.

Circle CEO Jeremy Allaire said successful aboriginal May that the institution would not clasp Treasury bonds maturing beyond the extremity of period successful the reserves that backmost the worth of USDC. In parallel, Circle’s reserve money has been replacing maturing bonds with overnight repurchase agreements implicit the month.

The U.S. House of Representatives is poised to ballot connected a measure to rise the government’s quality to contented caller indebtedness connected Wednesday evening.

Edited by Nelson Wang.

2 years ago

2 years ago

English (US)

English (US)