Fears of a recession and a 1970s-style stagflation system proceed to grip Wall Street and investors this week, arsenic aggregate reports amusement that recession signals person intensified. With lipid and commodity prices surging, Reuters reports that investors are “recalibrating their portfolios for an expected play of precocious ostentation and weaker growth.”

While Wall Street Fears Stagflation, Analyst Believes ‘Global Markets Will Collapse’ This Year

This week there’s been a slew of headlines indicating that fears of a 1970s-style stagflation system person risen and economical fallout is coming soon. Three days ago, Reuters’ writer David Randall noted that U.S. investors are frightened of a hawkish cardinal bank, lipid prices surging, and the existent struggle successful Ukraine. Randall spoke with Nuveen’s main concern serviceman of planetary fixed income, Anders Persson, and the expert noted stagflation isn’t present conscionable yet, but it is getting adjacent that point.

“Our basal lawsuit is inactive not 1970s stagflation, but we’re getting person to that ZIP code,” Persson said.

On Saturday, Bitcoin.com News reported connected the skyrocketing vigor stocks, precious metals, and planetary commodities breaking marketplace records. The aforesaid day, the fashionable Twitter relationship Pentoshi tweeted astir a pending “greater depression.” At the clip of writing, the tweet was retweeted 69 times and has adjacent to a 1000 likes. Pentoshi told his 523,500 Twitter followers:

The astir breathtaking happening this year. Will beryllium planetary markets collapsing. Any marketplace that trades supra 0 volition beryllium excessively high. They volition telephone this: ‘The greater depression’ which volition beryllium 10x worse than the Great Depression.

US Treasury Yield Curve Highlights ‘Recession Concerns Showing up More Prominently’

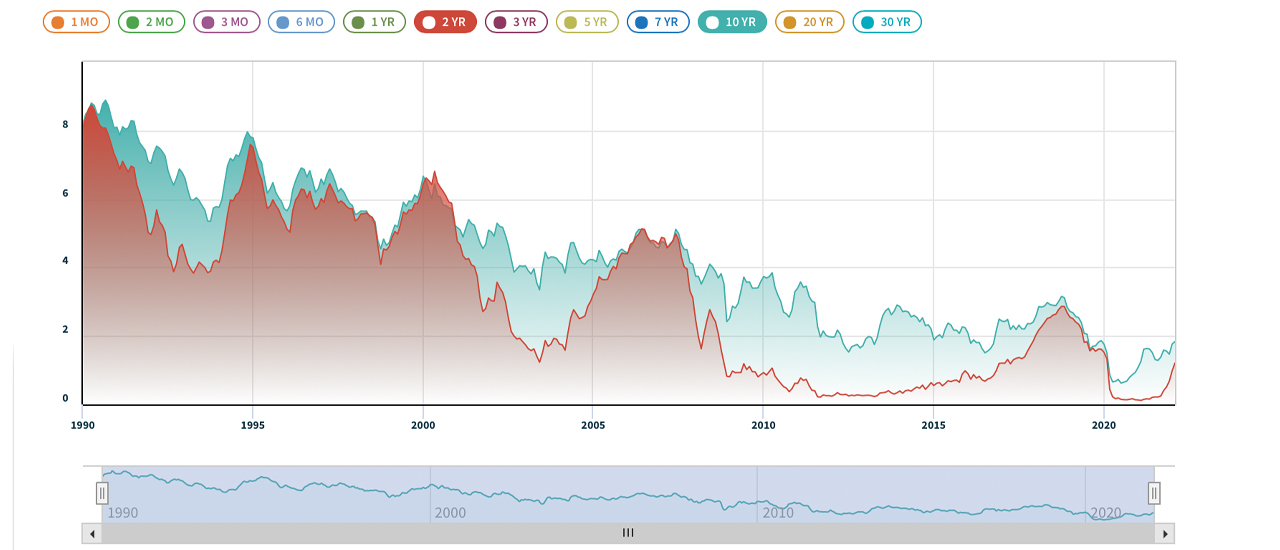

The pursuing day, Reuters’ writer Davide Barbuscia elaborate that “recession concerns are showing up much prominently successful the U.S. Treasury output curve.” Data from Barbuscia’s report stresses that the “closely watched spread betwixt yields connected two- and 10-year notes stood astatine its narrowest since March 2020.”

Two- and 10-year U.S. Treasury Yield Curve Rates via Nasdaq connected March 6, 2022.

Two- and 10-year U.S. Treasury Yield Curve Rates via Nasdaq connected March 6, 2022.Numerous fiscal publications are highlighting however rising lipid and commodity prices are typically associated with a pending recession. Furthermore, caller filings bespeak that Warren Buffett’s Berkshire Hathaway obtained a $5 cardinal involvement successful Occidental Petroleum. Berkshire Hathaway has besides doubled the firm’s vulnerability to Chevron arsenic well.

Tags successful this story

aluminum, Anders Persson, Berkshire Hathaway, Chevron, commodities, Copper, David Randall, Davide Barbuscia, Economist, electric prices, equities, gold, nasdaq, nickel, NYSE, Occidental Petroleum, OIL, Ounce of Gold, Pentoshi, Recession, recession signals, Russia, S&P 500, silver, stagflation, stocks, U.S. Treasury output curve, Ukraine, Warren Buffett, zinc

What bash you deliberation astir the reported signals that amusement a recession oregon 1970s stagflation is looming implicit the economy? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 5,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)