Bitcoin crossed the $68,000 people during the play aft President Joe Biden announced his exit from the statesmanlike contention for the upcoming elections successful November 2024.

The lawsuit showed conscionable however delicate the planetary crypto marketplace is to US governmental events. The discrepancy betwixt America’s influence connected the planetary crypto marketplace and its stock of the planetary marketplace becomes evident erstwhile analyzing trading volumes.

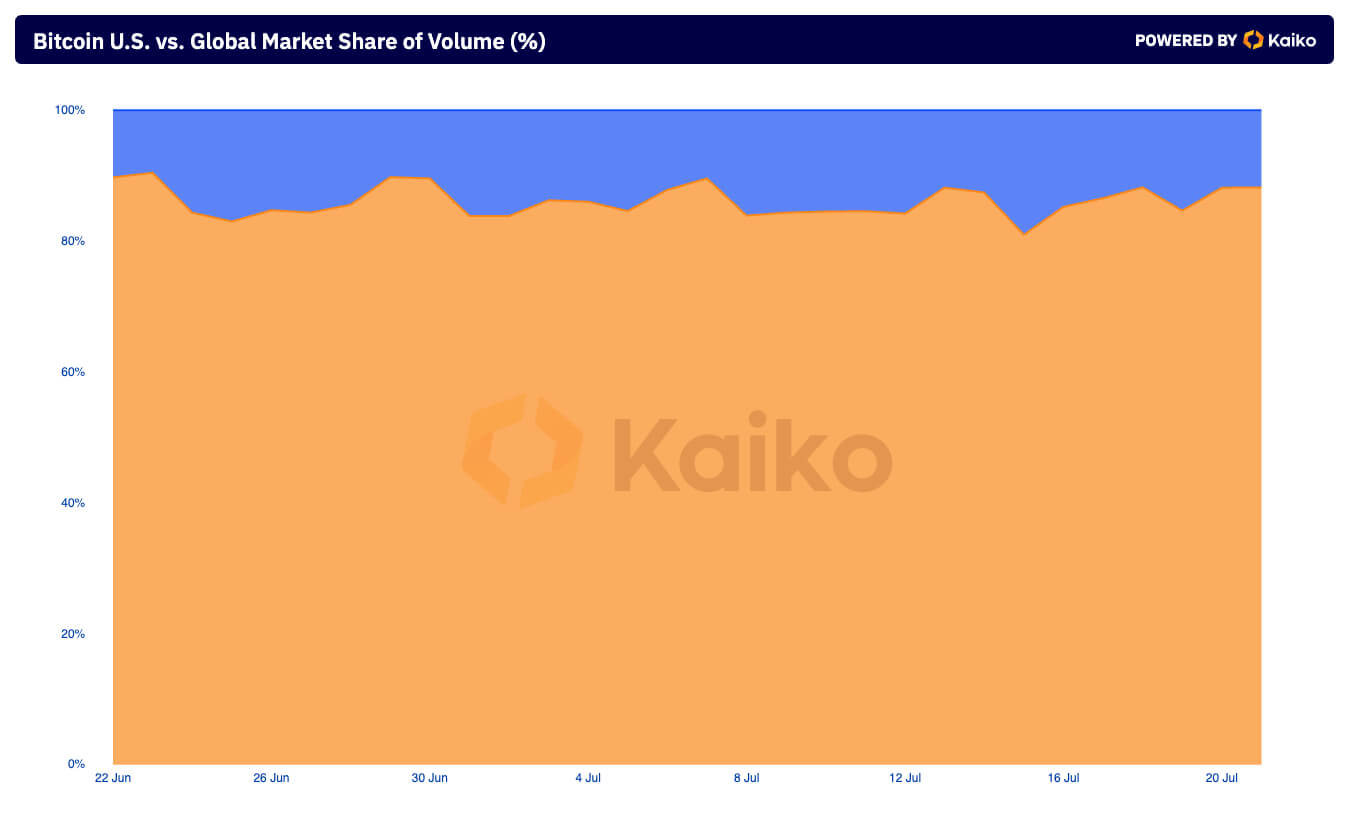

Kaiko information shows that the marketplace stock of US exchanges successful presumption of trading measurement presently stands astatine 11.79%. Global exchanges, connected the different hand, predominate with 88.12%.

Proportion of commercialized measurement attributed to US exchanges vs. planetary exchanges (Source: Kaiko)

Proportion of commercialized measurement attributed to US exchanges vs. planetary exchanges (Source: Kaiko)The disparity shows that astir each crypto trading enactment connected centralized exchanges happens extracurricular the US. While galore reasons person contributed to this discrepancy, the regulatory situation successful the US stands retired arsenic the astir important factor.

The regulatory scenery successful the state is overmuch harsher compared to different regions. The SEC’s strict oversight and enforcement actions person led to cautious information by retail and organization investors. US-based exchanges person had to instrumentality rigorous compliance measures that disagree from authorities to state, deterring a ample information of retail traders.

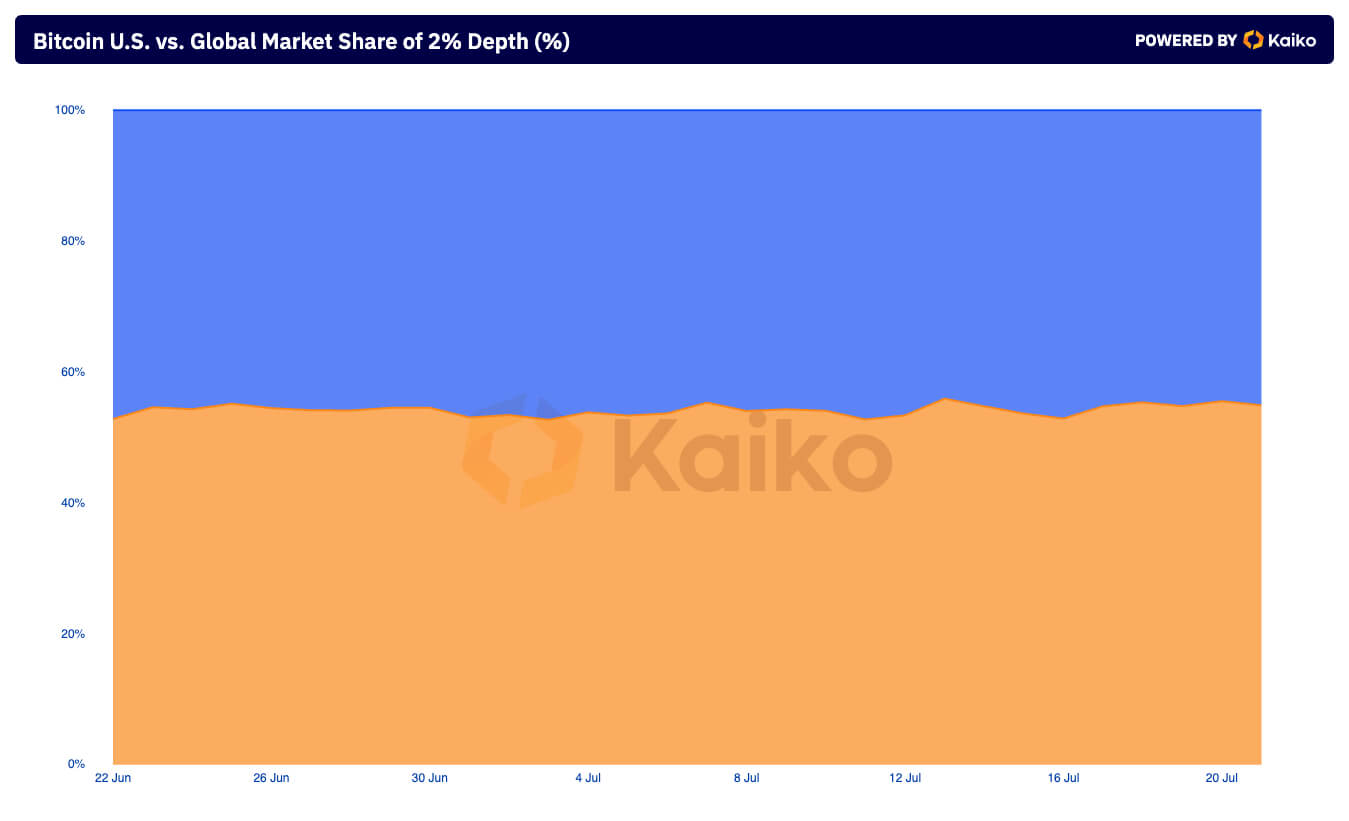

However, contempt the debased measurement share, the US accounts for astir fractional of the market’s liquidity. Kaiko information shows that US-based exchanges relationship for a important 45.09% of the planetary marketplace extent astatine the 2% level.

Proportion of 2% marketplace extent attributed to the US marketplace vs. offshore markets (Source: Kaiko)

Proportion of 2% marketplace extent attributed to the US marketplace vs. offshore markets (Source: Kaiko)Market extent shows the market’s wide quality to prolong comparatively ample orders without importantly impacting price. This is an important metric arsenic it acts arsenic an indicator of wide liquidity. A heavy marketplace with important orders wrong the 2% scope shows that ample orders tin hap without causing important terms fluctuations. This precocious liquidity past helps trim terms volatility, which is peculiarly important for organization investors who woody with ample bargain and merchantability orders.

High liquidity successful the US tin beryllium attributed to the ample beingness of organization investors. Their beingness has accrued drastically since the motorboat of spot Bitcoin ETFs this year, arsenic these products lend to higher liquidity and deeper bid books connected exchanges wherever these ETFs are traded oregon tracked.

The instauration and redemption processes of spot Bitcoin ETFs impact large-scale transactions successful the underlying Bitcoin market. When caller ETF shares are created, authorized participants (usually exchanges similar Coinbase) acquisition the equivalent magnitude of Bitcoin from the market, contributing to marketplace depth. Conversely, erstwhile ETF shares are redeemed, the underlying Bitcoin is sold, further adding to the liquidity and extent of the market.

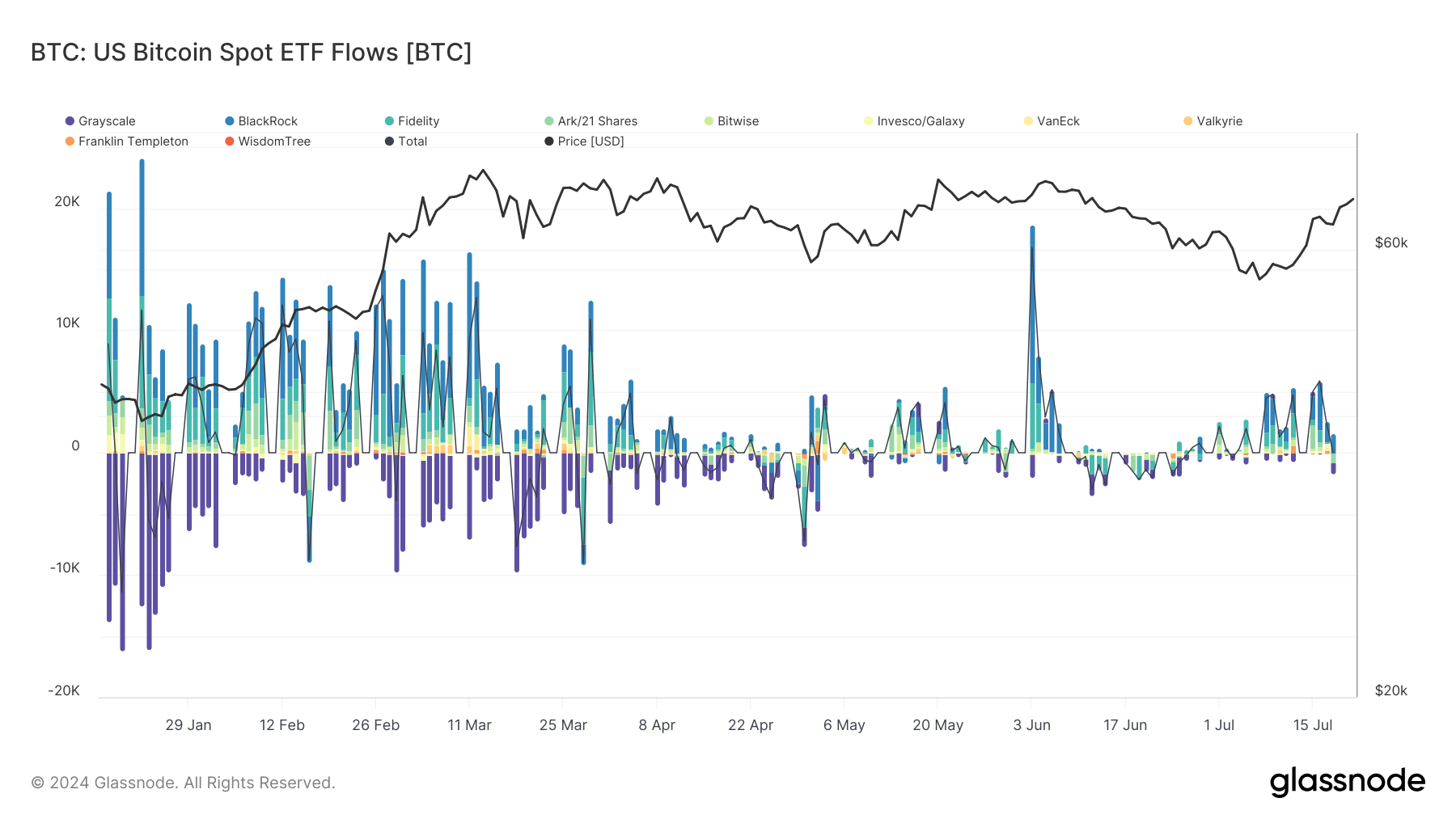

Daily nett travel of funds wrong the apical 10 US-traded Bitcoin ETFs (Source: Glassnode)

Daily nett travel of funds wrong the apical 10 US-traded Bitcoin ETFs (Source: Glassnode)The sheer size of this market is wherefore quality coming from the US tin determination Bitcoin’s terms little than 8% distant from its ATH contempt accounting for specified a tiny stock of volume.

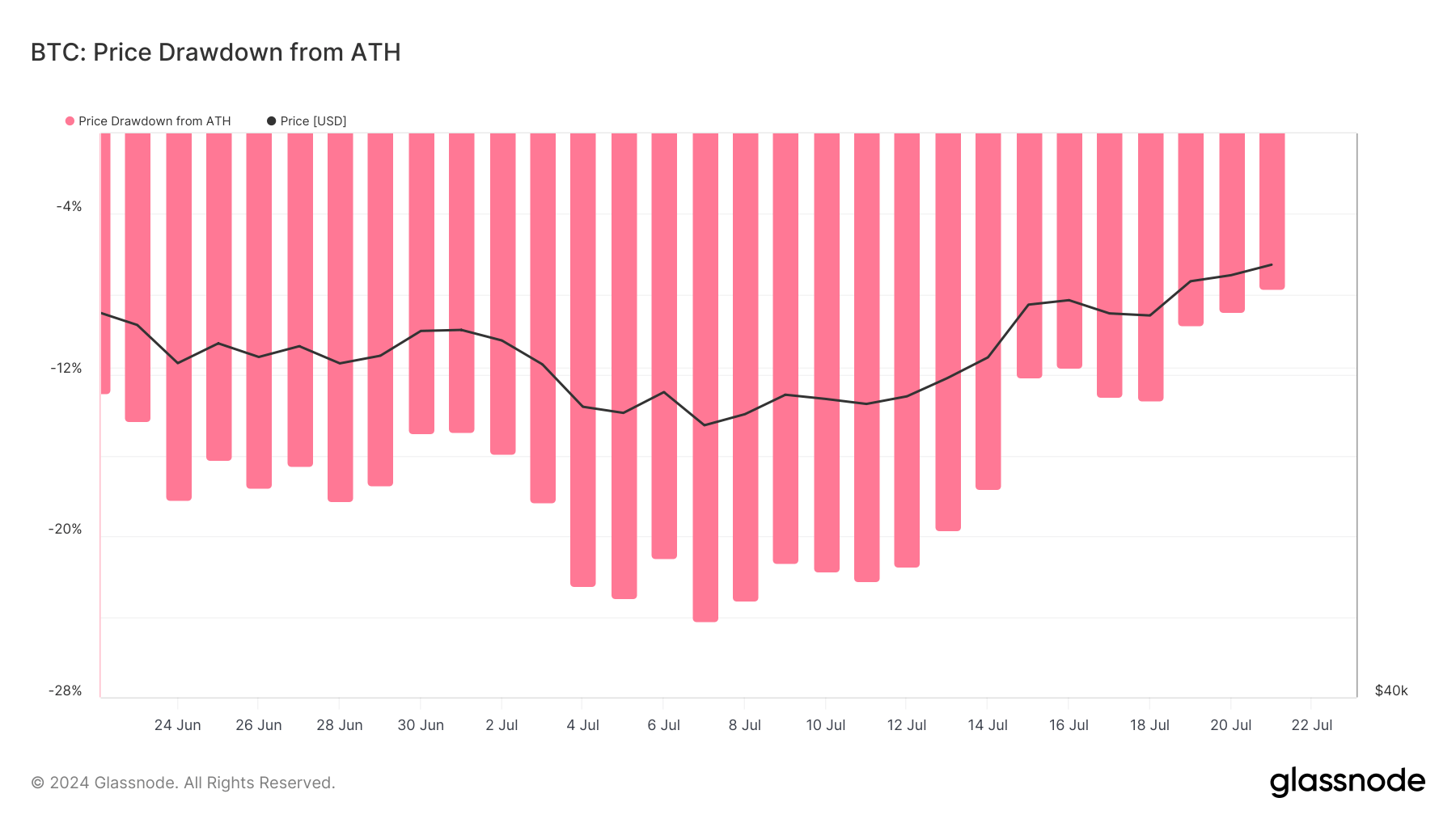

Percent drawdown of Bitcoin’s terms from the erstwhile all-time precocious (Source: Glassnode)

Percent drawdown of Bitcoin’s terms from the erstwhile all-time precocious (Source: Glassnode)The station US moves planetary markets due to the fact that of liquidity, not volume appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)