Bitcoin’s aggregated 2% marketplace depth, a measurement of liquidity that combines bargain and merchantability orders wrong a constrictive 2% terms scope astir the marketplace price, has surged to a one-year precocious of $623.40 cardinal arsenic of Nov. 16. This represents a important summation from $422 cardinal connected Nov.5 — a important summation successful liquidity implicit a abbreviated period.

It suggests increasing marketplace confidence, arsenic deeper liquidity typically indicates that traders and institutions are much consenting to enactment successful the market, providing a buffer against terms volatility.

Graph showing the aggregated 2% marketplace extent for Bitcoin from Nov. 20, 2023, to Nov. 18, 2024 (Source: Kaiko)

Graph showing the aggregated 2% marketplace extent for Bitcoin from Nov. 20, 2023, to Nov. 18, 2024 (Source: Kaiko)This summation successful marketplace extent starring up to and pursuing the US statesmanlike predetermination is not an isolated lawsuit but portion of a broader displacement successful macroeconomic and governmental conditions. Donald Trump’s predetermination and his administration’s announced volition to enactment Bitcoin and the crypto manufacture done factual policies person catalyzed accrued marketplace activity.

This newfound governmental alignment with the crypto abstraction apt signaled to organization and retail investors that the regulatory situation could go importantly much favorable, reducing perceived risks and encouraging greater participation.

The marketplace responded enthusiastically to the imaginable of a pro-crypto administration, with traders apt interpreting the quality arsenic a greenish airy for broader adoption and organization inflows. This terms surge, combined with the summation successful aggregated marketplace depth, suggests that marketplace participants were trading successful effect to the predetermination results and positioning for a sustained bullish trend. The expanded marketplace extent reflects this accrued engagement, arsenic deeper liquidity allows larger orders to beryllium executed with minimal slippage—critical successful a marketplace experiencing accelerated upward terms movements.

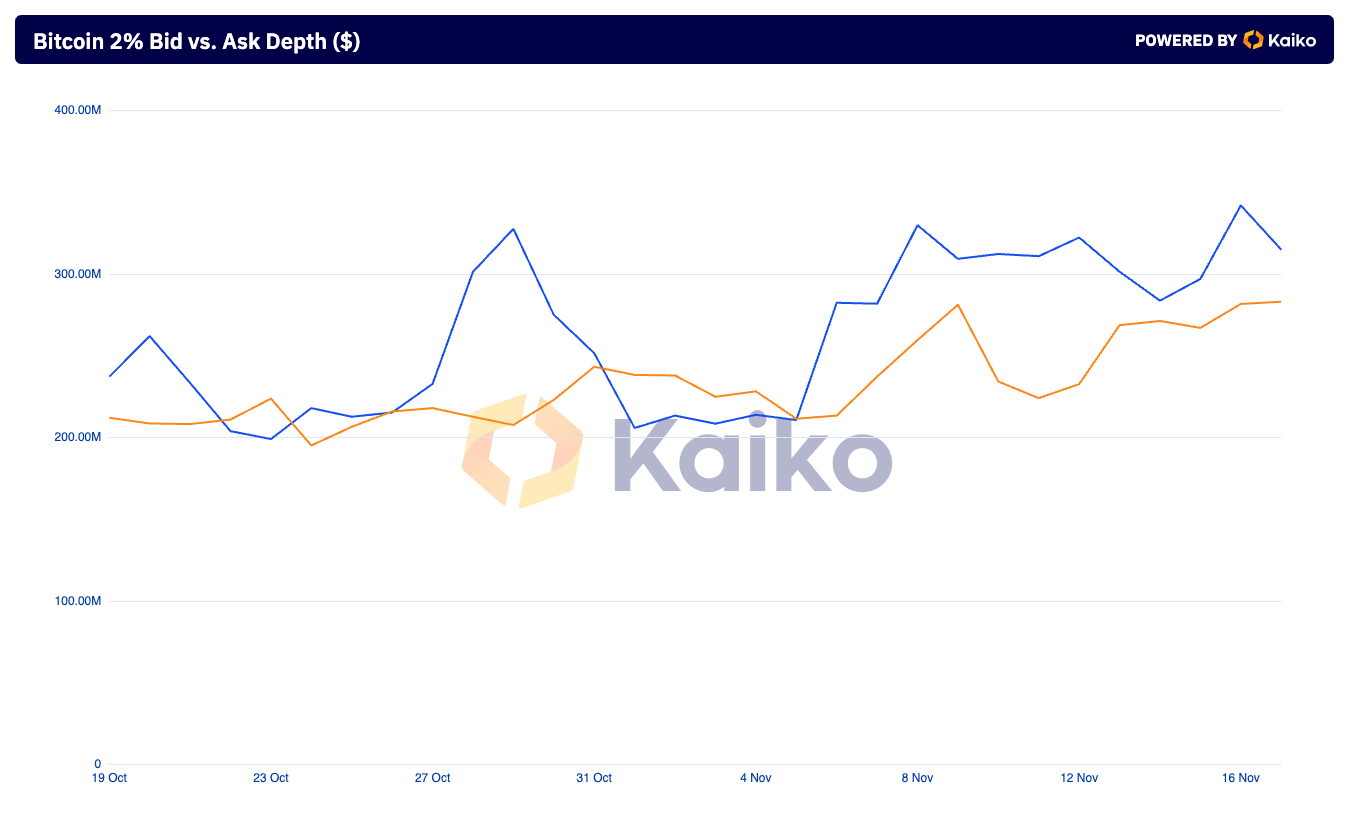

The election’s interaction tin besides beryllium observed successful the bid versus inquire depth. While the imbalance favoring merchantability orders astatine $341.81 cardinal implicit $281.59 cardinal successful bargain orders suggests immoderate profit-taking, it is important to enactment that this enactment did not trigger a important terms correction. Instead, the marketplace absorbed sell-side unit efficiently, indicating robust purchaser request adjacent arsenic Bitcoin crossed $93,000.

Graph showing the values of bargain and merchantability orders wrong a 2% terms scope of Bitcoin’s marketplace terms from Oct. 19 to Nov. 18, 2024 (Source: Kaiko)

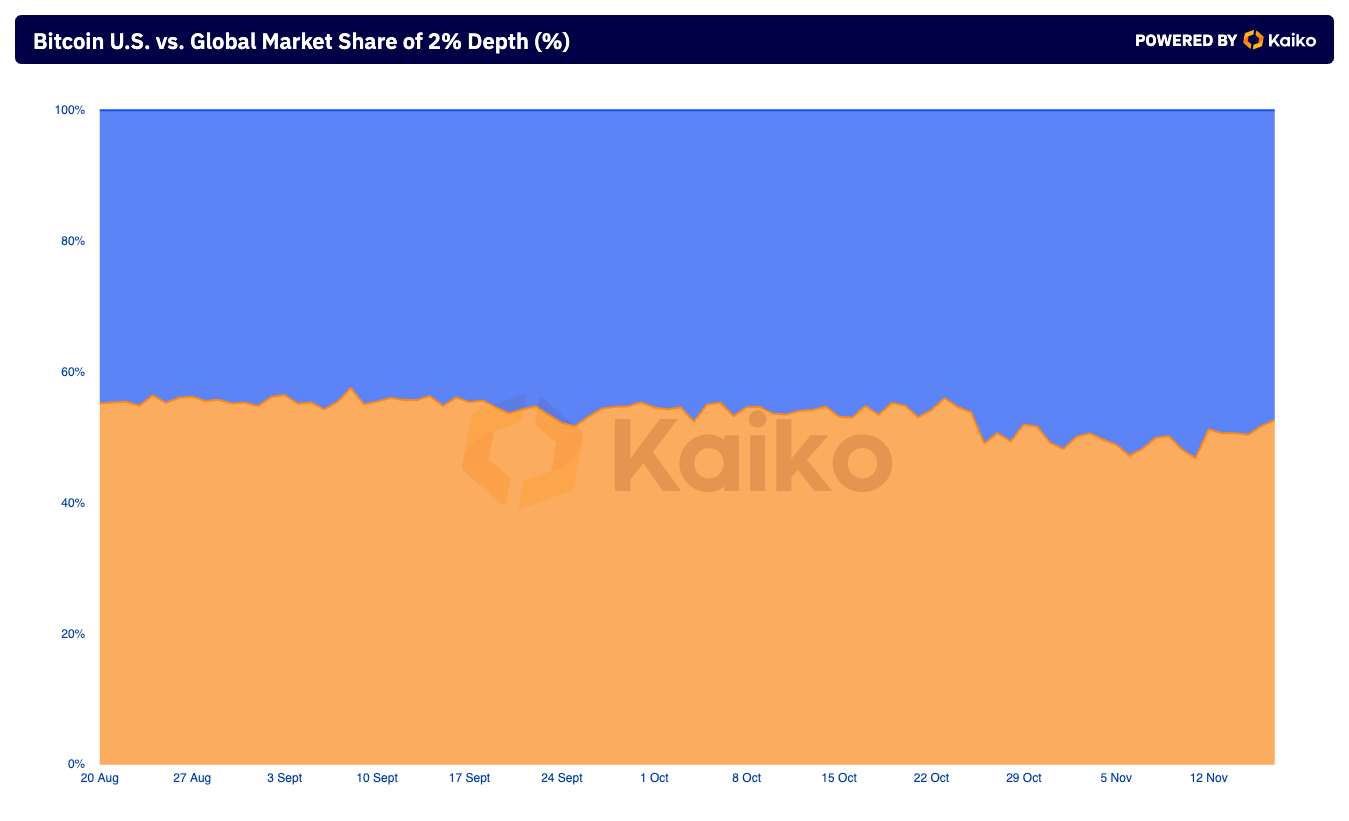

Graph showing the values of bargain and merchantability orders wrong a 2% terms scope of Bitcoin’s marketplace terms from Oct. 19 to Nov. 18, 2024 (Source: Kaiko)The US market’s historically ascendant stock of planetary marketplace extent appears to person played a important relation successful driving this liquidity surge. Although US marketplace stock dipped somewhat post-election, the broader inclination passim 2024—where the US accounted for implicit 50% of planetary depth—suggests that American institutions and traders person been pivotal successful shaping marketplace activity.

Graph showing the proportionality of marketplace extent attributed to the US marketplace compared to offshore markets from Aug. 20 to Nov. 18, 2024 (Source: Kaiko)

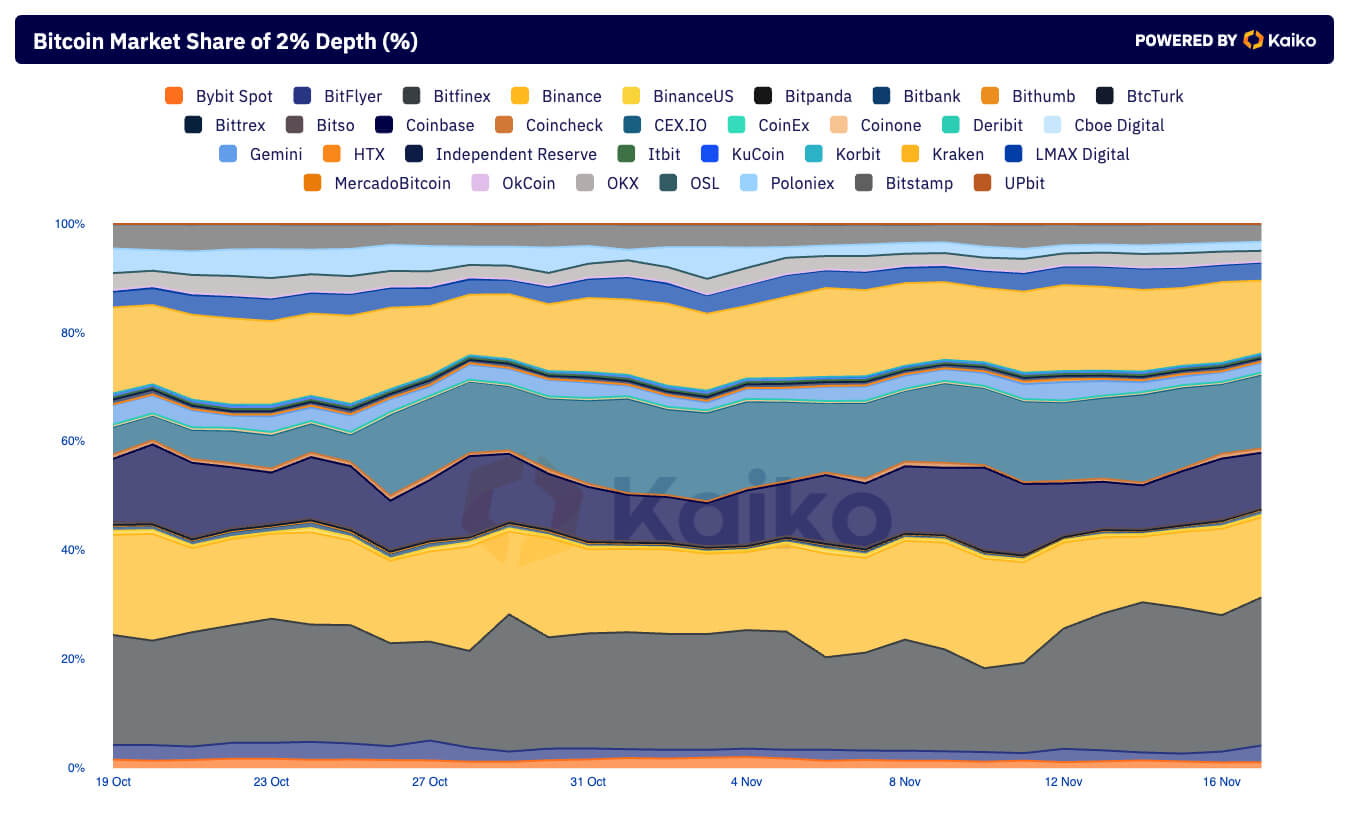

Graph showing the proportionality of marketplace extent attributed to the US marketplace compared to offshore markets from Aug. 20 to Nov. 18, 2024 (Source: Kaiko)On an exchange-specific level, the emergence of Bitfinex arsenic the person successful planetary marketplace extent whitethorn bespeak its quality to pull liquidity amid these governmental and marketplace shifts. The exchange’s 27% stock connected Nov. 16 coincides with Bitcoin’s post-election rally, suggesting that Bitfinex successfully captured a important information of the accrued trading activity.

In contrast, Binance’s declining share, hovering betwixt 10% and 15% successful November, could beryllium attributed to ongoing regulatory scrutiny, which whitethorn person deterred organization players from utilizing its level contempt the broader marketplace optimism.

Graph showing the marketplace stock of aggregated 2% marketplace extent held by a circumstantial speech from Oct. 19 to Nov. 18, 2024 (Source: Kaiko)

Graph showing the marketplace stock of aggregated 2% marketplace extent held by a circumstantial speech from Oct. 19 to Nov. 18, 2024 (Source: Kaiko)The station US elections boosted Bitcoin’s liquidity to caller highs appeared archetypal connected CryptoSlate.

10 months ago

10 months ago

English (US)

English (US)