After the astir caller summation successful the national funds rate, the U.S. Federal Reserve is acceptable to rise the lending complaint by 25 ground points (bps) to 5.25% successful 3 days, according to expectations. A caller canvass of 105 economists revealed that 94 of them foretell a 25bps complaint hike volition hap during the May 2-3 Federal Open Market Committee (FOMC) meeting. While economists are anticipating a complaint hike successful May, they expect that it volition beryllium the last 1 successful 2023. The bulk of polled economists judge that the Fed volition support the complaint astatine 5.25% for the remainder of the year.

Report Says Next Phase of the Tightening Cycle Is Holding Benchmark Rate astatine Current Levels

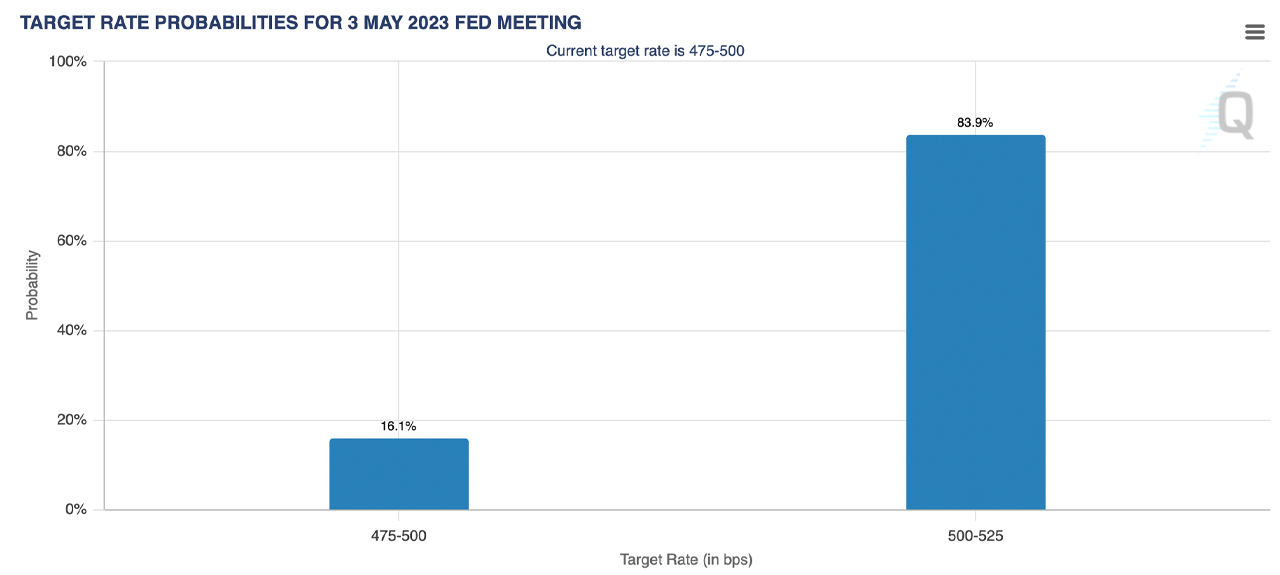

Several reports and surveys bespeak that marketplace observers judge the U.S. cardinal slope volition summation the benchmark involvement complaint by 25bps astatine the FOMC gathering this week. The FOMC gathering is scheduled to instrumentality spot connected May 2-3 and according to the CME Group Fedwatch tool, 83.9% fishy a 25bps complaint hike volition travel to fruition. On the different hand, the Fedwatch instrumentality shows 16.1% predicts nary complaint hike for the upcoming May meeting.

CME Group’s Fedwatch instrumentality connected Sunday, April 30, 2023.

CME Group’s Fedwatch instrumentality connected Sunday, April 30, 2023.The astir caller predictions up of the adjacent FOMC gathering are similar to the forecasts economists gave astatine the opening of April 2023. Additionally, Bloomberg reported connected April 29, that economists the work talked to besides judge a 25bps emergence is successful the cards.

Bloomberg’s economics study states:

Signs constituent to the FOMC raising rates by 25 ground points to 5.25% successful the May 3 determination — contempt ongoing turmoil successful the banking strategy — and signaling that this volition beryllium the past hike for a while. The adjacent signifier of the tightening rhythm volition beryllium to clasp rates astatine that elevated level, portion watching to spot if ostentation trends down.

Survey Shows 90% of Economists Suspect a 25bps Rise successful May, BOFA Analyst Says Additional Hikes Beyond May Uncertain

According to a survey from Reuters, a immense bulk (90%) of 105 economists polled fishy a 25bps hike. Additionally, 59 of those economists judge that the national funds complaint volition stay unchanged for the remainder of the twelvemonth pursuing the predicted May hike, portion 26 participants are forecasting a complaint cut. Furthermore, astir of the economists surveyed by Reuters bash not expect the ostentation complaint successful the U.S. to scope the Fed’s 2% people until 2025. The economists besides noted that there’s inactive a hazard of ostentation rates spiking again this year.

Michael Gapen, the main U.S. economist astatine Bank of America (BOFA) Securities, commented that a full batch remains to beryllium accomplished earlier the 2% extremity tin travel to a realization. Gapen besides added that it is uncertain whether oregon not the Fed volition hike the benchmark complaint aft May.

“On the information front, contempt the slowdown successful ostentation successful March, determination is inactive a batch much enactment to beryllium done to get backmost to the 2% target,” Gapen said. “We support the archetypal complaint chopped successful March 2024. Should the stresses successful the fiscal strategy beryllium reduced successful abbreviated order, we cannot regularisation retired that stronger macro information volition pb the Fed to enactment successful further hikes beyond May,” the BOFA enforcement added.

Tags successful this story

What bash you deliberation the interaction of the expected complaint hike by the U.S. Federal Reserve volition person connected the economy? Share your thoughts successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 7,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons, CryptoFX / Shutterstock.com

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)