2023 has been a rollercoaster thrust for the U.S. banking industry. The illness of 3 large banks has sent shockwaves done the fiscal world, with their combined assets surpassing the apical 25 banks that crumbled successful 2008. The pursuing is simply a person look astatine what has triggered a ‘great consolidation’ successful the banking sector, a recurring taxable successful the industry’s past implicit the past century.

A Listicle of Bank Consolidation, Failures, and Issues Facing the U.S. Banking Sector

The U.S. banking manufacture has taken a beating successful 2023, with the marketplace capitalizations of dozens of banks crossed the state dropping considerably successful caller months. The reasons for this conflict are varied, with immoderate blaming mediocre choices by fiscal institutions and others pointing fingers astatine the U.S. cardinal bank. While it’s important to see antithetic opinions, a broad listicle of accusation tin shed airy connected the country’s ‘great consolidation’ successful the banking assemblage and the largest slope failures successful the United States. So, let’s instrumentality a person look astatine these developments and what they mean for the country’s banking industry.

- In the twelvemonth 1920, historical data reveals that the United States boasted a expansive full of astir 31,000 banks. However, by the twelvemonth 1929, this fig had dwindled down to less than 26,000. Since that time, the fig of banks has experienced a precipitous decline, plummeting by a staggering 84%. As a result, less than 4,160 banks stay successful cognition today.

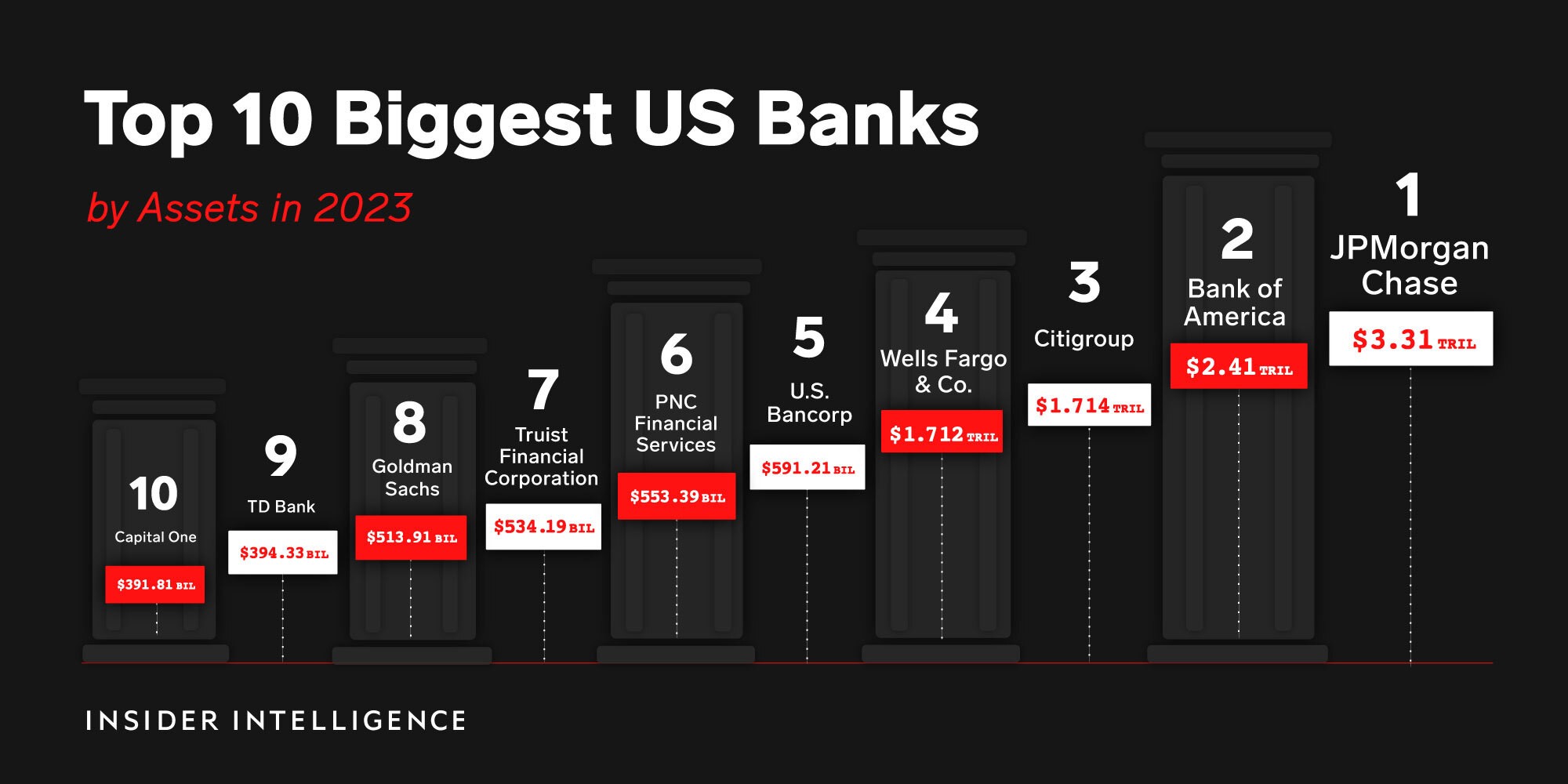

- Out of the 4,150 U.S. banks, the apical 10 clasp more than 54% of FDIC-insured deposits. The 4 largest banks successful the state person amassed a whopping $211.5 billion successful unrealized losses, with Bank of America bearing the brunt of a 3rd of that amount.

The apical 10 largest U.S banks by assets successful 2023 according to Insider Intelligence.

The apical 10 largest U.S banks by assets successful 2023 according to Insider Intelligence.- A caller Stanford survey shows U.S. banks collectively had $1.7 trillion successful unrealized losses astatine the extremity of 2022 which is awfully adjacent to their full equity of $2.1 trillion. American banks besides clasp astir $1.5 trillion successful debt, which is owed by the extremity of 2025. American fiscal institutions person besides amassed a important magnitude of commercial existent estate that’s been decreasing successful value.

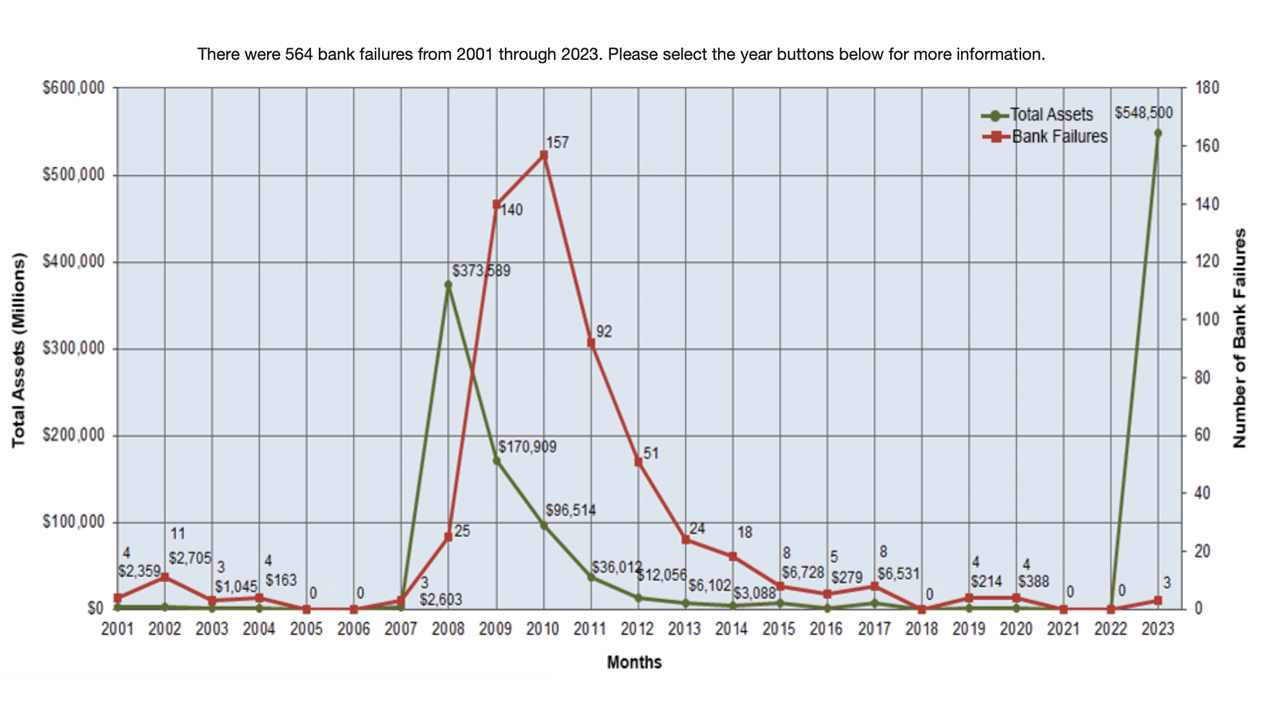

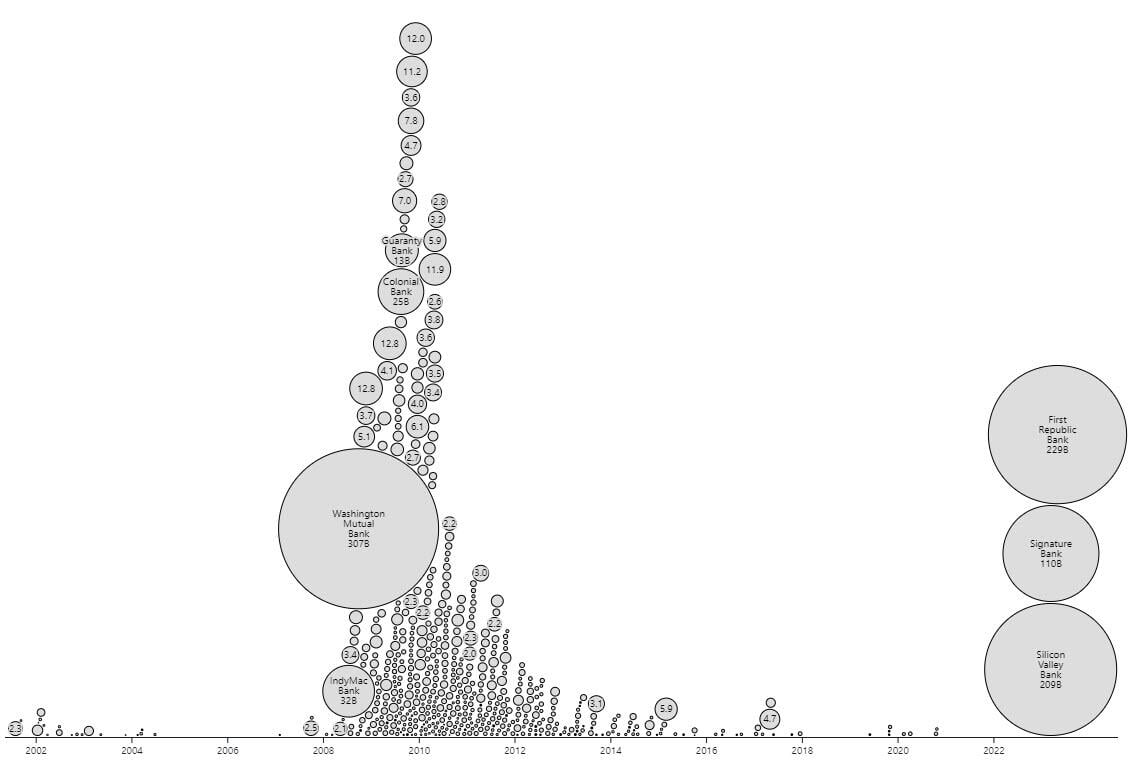

- The illness of First Republic Bank, Silicon Valley Bank, and Signature Bank were the third, fourth, and 5th largest slope failures successful the United States. Data shows the combined assets of each 3 banks outpaced the apical 25 slope failures of 2008.

The combined assets of First Republic Bank, Silicon Valley Bank, and Signature Bank outpaced the apical 25 slope failures successful 2008.

The combined assets of First Republic Bank, Silicon Valley Bank, and Signature Bank outpaced the apical 25 slope failures successful 2008.- The Federal Deposit Insurance Corporation (FDIC) provided JPMorgan Chase a $50 cardinal recognition enactment and noted it mislaid $13 cardinal from the First Republic Bank fallout. The FDIC estimated the outgo of Signature Bank’s nonaccomplishment to its Deposit Insurance Fund to beryllium astir $2.5 cardinal and the Silicon Valley Bank illness cost the FDIC $20 billion, bringing the full to $35.5 billion.

A look astatine the largest slope failures successful the United States since 2002.

A look astatine the largest slope failures successful the United States since 2002.- In summation to the caller First Republic Bank collapse, Pacwest Bancorp’s shares person been sinking steeply. Over the past six months, Pacwest has mislaid 73% of its marketplace capitalization value. Presently, Pacwest is weighing strategical options and a possible sale, according to radical acquainted with the matter.

- Western Alliance Bancorp is besides struggling with shares down 57% little during the past six months. While respective of the failed banks saw important withdrawals similar First Republic’s $100 cardinal outflow successful March, Western Alliance claims it has not seen immoderate antithetic deposit outflows.

- Sources and statistics amusement that U.S. banks that supply mortgages mislaid an mean of $301 for each indebtedness that originated successful 2022, down 87.13% from the $2,339 nett per indebtedness successful 2021.

- In the 2nd 4th of 2021, banks acquired a grounds magnitude of authorities indebtedness by obtaining $150 billion worthy of 10-year Treasury notes. However, acknowledgment to the Fed’s 10 consecutive complaint hikes, 10-year and 2-year treasury bonds successful the U.S. are presently inverted. This means the banks with excessive reliance connected agelong word bonds are struggling due to the fact that the yields connected the 2-year Treasury enactment are really higher than the 10-year Treasury.

- On May 3, 2023, the U.S. Federal Reserve raised the benchmark slope complaint and it is present astatine a 16-year high.

- In March, the 4 biggest U.S. banks by assets held, JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo collectively mislaid $52 cardinal of marketplace value.

Tags successful this story

What bash you deliberation astir the issues U.S. banks look successful 2023? Share your thoughts astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 7,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)