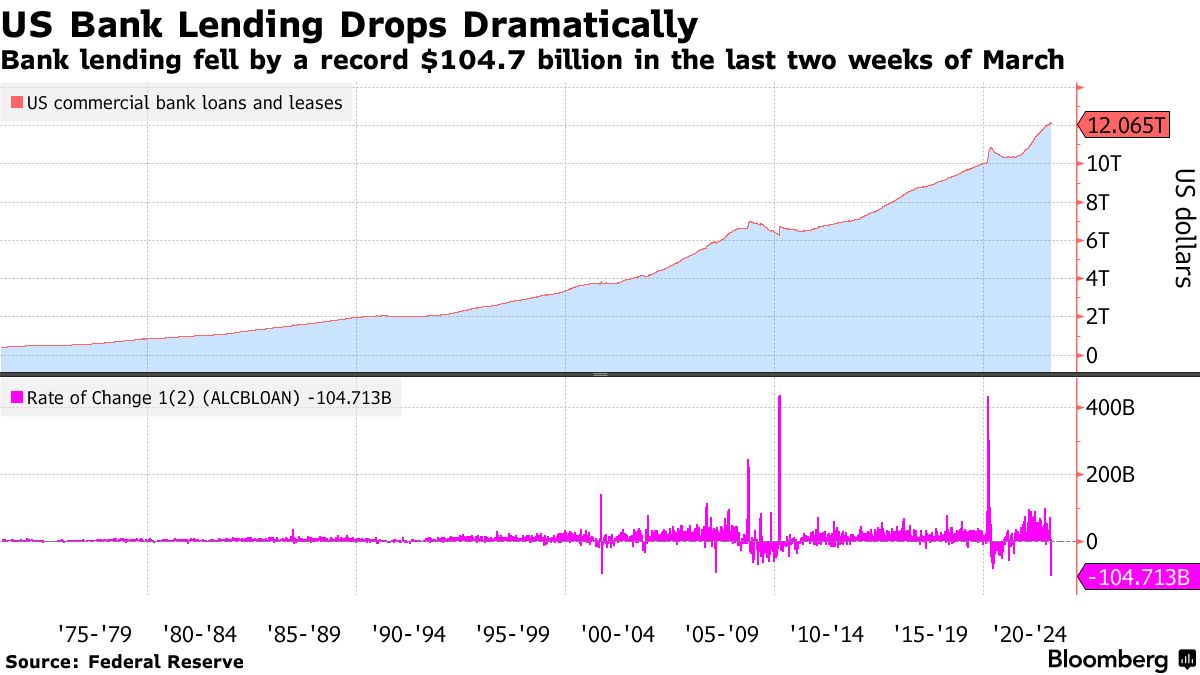

The banking manufacture successful the United States is inactive struggling aft the illness of 3 large banks. According to statistics, slope lending successful the U.S. has dropped by adjacent to $105 cardinal successful the past 2 weeks of March, which is the largest diminution connected record. Additionally, Elon Musk, a Tesla enforcement and proprietor of Twitter, precocious commented connected trillions of dollars being withdrawn from banks into wealth marketplace funds, and helium insists that the “trend volition accelerate.”

Statistics Still Show Glaring Signs of U.S. Bank Weaknesses; Musk Issues Warning

There are inactive plentifulness of signs showing that the U.S. banking strategy is feeling the aftermath of respective high-profile slope collapses. During the archetypal week of March, Silvergate Bank, Silicon Valley Bank (SVB), and Signature Bank (SBNY) closed down operations. Both SVB and SBNY were placed nether authorities control. The U.S. Federal Reserve, Treasury, and Federal Deposit Insurance Corporation (FDIC) bailed retired SBNY and SVB’s uninsured depositors and made each depositors whole.

Since then, the banking contagion has dispersed crossed the United States and internationally, with fiscal institutions similar SVB UK and Credit Suisse faltering. According to a caller report published by Bloomberg, the past 2 weeks of March saw the largest contraction successful lending connected grounds aft the collapses. The Federal Reserve’s information connected the taxable lone goes backmost to 1973, and successful the past 2 weeks of March 2023, astir $105 cardinal was erased.

Alexandre Tanzi from Bloomberg explains that loans consisted of industrial, commercial, and existent property loans. Furthermore, past week saw $64.7 cardinal successful commercialized slope deposits removed from fiscal institutions, which marked the 10th consecutive play diminution successful deposits. Another motion of occupation is the spike successful Federal Home Loan Bank (FHLB) enslaved issuance successful March. Jack Farley, a writer and macro researcher for Blockworks, shared a chart showing FHLB enslaved issuance surging past period “to conscionable nether a 4th trillion dollars.” Farley added:

This is implicit six times the post-GFC mean for the period of March and it indicates banks’ scramble for cash.

Moreover, the fashionable Twitter relationship Wall Street Silver (WSS) shared a video of economist Peter St. Onge explaining that a important magnitude of slope deposits are moving to wealth marketplace accounts. WSS tweeted, “Trillions of dollars are draining retired of the banks… into wealth marketplace funds. That weakens the banks. Fear that the banks are astatine hazard is driving this inclination and frankincense making the banks adjacent weaker.” The economist’s video connection and WSS’s tweet sparked a effect from Twitter’s owner, Elon Musk. The Tesla enforcement warned:

This inclination volition accelerate.

This is not the archetypal clip Musk has cautioned the nationalist astir the U.S. banking system, arsenic helium has criticized the U.S. Federal Reserve connected respective occasions. In November 2022, Musk warned that the U.S. would spot a terrible recession and urged the Fed to slash the national funds rate. In December 2022, the proprietor of Twitter said that a recession would amplify if the Fed raised the involvement complaint and the cardinal slope accrued the rate. Musk besides insisted successful December that the Fed’s accelerated complaint hikes would spell down successful past arsenic 1 of the “most damaging ever.” After the 3 large U.S. banks failed successful March, Musk lambasted the Fed’s information latency and called for an contiguous driblet successful involvement rates.

Tags successful this story

aftermath, Bailout, Banking Industry, Bloomberg, Cash, collapse, commercial slope deposits, credit suisse, decline, Economy, Elon Musk, Federal Deposit Insurance Corporation, Federal Home Loan Bank, Federal Reserve, FHLB enslaved issuance, Financial Institutions, government control, lending, major banks, money marketplace funds, Recession, record, Signature Bank, Silicon Valley Bank, Silvergate Bank, Statistics, Tesla, Treasury, trend, trillions, Twitter, United States

What bash you deliberation the semipermanent effects of the caller slope collapses and alteration successful lending volition beryllium connected the U.S. economy? What bash you deliberation astir Elon Musk’s warning? Share your thoughts astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Bloomberg Chart,

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)