Prime Trust, LLC, a salient subordinate successful integer plus custody, has filed voluntary petitions for Chapter 11 bankruptcy.

According to a study released by the institution connected Aug. 14, the proceedings are expected to supply a “transparent and value-maximizing process for the payment of its clients and stakeholders.”

The Nevada-based institution is known for its innovative services successful integer plus management. As reported connected July 18, Nevada courts ordered Prime Trust into impermanent receivership, signaling the superior fiscal difficulties it faced.

The company’s fiscal shortage successful July reportedly exceeded $82 million. As of the Chapter 11 filing, the consolidated database of the apical 50 unsecured creditors totals $144 million.

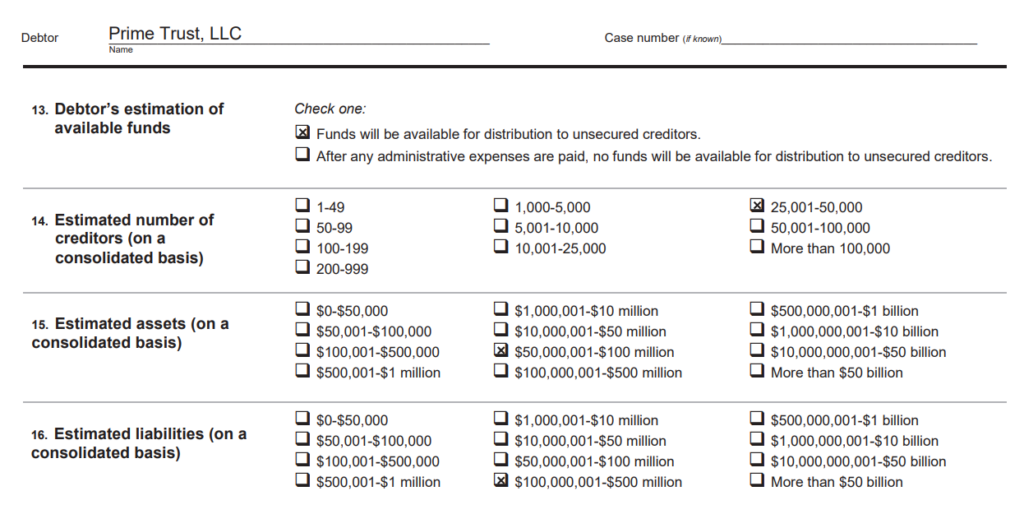

Further, across 4 filings for Prime Trust radical companies, Prime Core Technologies Inc., Prime Digital, LLC, Prime IRA LLC, and Prime Trust, LLC, determination are liabilities recorded to beryllium $100 cardinal and $500 million, and assets betwixt $50 cardinal and $100 million.

Source: Chapter 11 filing

Source: Chapter 11 filingThe imaginable interaction connected the manufacture could beryllium significant, fixed its pivotal relation successful providing custodial services to organization crypto investors.

Prime Trust is simply a ‘qualified custodian,’ meaning that each lawsuit custodied assets should beryllium protected from the bankruptcy of the custodian. CryptoSlate has reached retired to Prime Trust for confirmation but has yet to person a effect arsenic of property time.

Chapter 11 decision.

The determination to record for Chapter 11 bankruptcy follows the imperishable assignment of erstwhile banking enforcement John Guedry arsenic receiver for the company. Guedry, on with John Wilcox and Michael Wyse, signifier a peculiar restructuring committee with the authorization to oversee the company’s ongoing bankruptcy cases.

As the institution continues to run arsenic “debtors-in-possession,” it intends to record respective motions with the Bankruptcy Court to facilitate the “orderly valuation of each strategical alternatives.” These measures could perchance see selling the company’s assets and operations arsenic a going concern.

Prime Trust’s fiscal crisis, initiated astir a period earlier the receivership order, has ripple effects wrong the crypto industry.

It began with the Nevada Financial Institutions Division (NFID) issuing a cease and desist bid connected June 21 owed to the company’s inability to fulfill lawsuit withdrawal requests.

This was soon followed by the bankruptcy declaration of Prime Trust subsidiary Banq connected June 14 and the termination of BitGo’s planned acquisition of Prime Trust connected June 22.

Further details related to the court-supervised proceedings volition beryllium made disposable arsenic the proceedings unfold. They tin beryllium accessed connected the DDebtors’restructuring website.

The station Up to $500M successful liabilities arsenic crypto custodian Prime Trust files Chapter 11 bankruptcy appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)