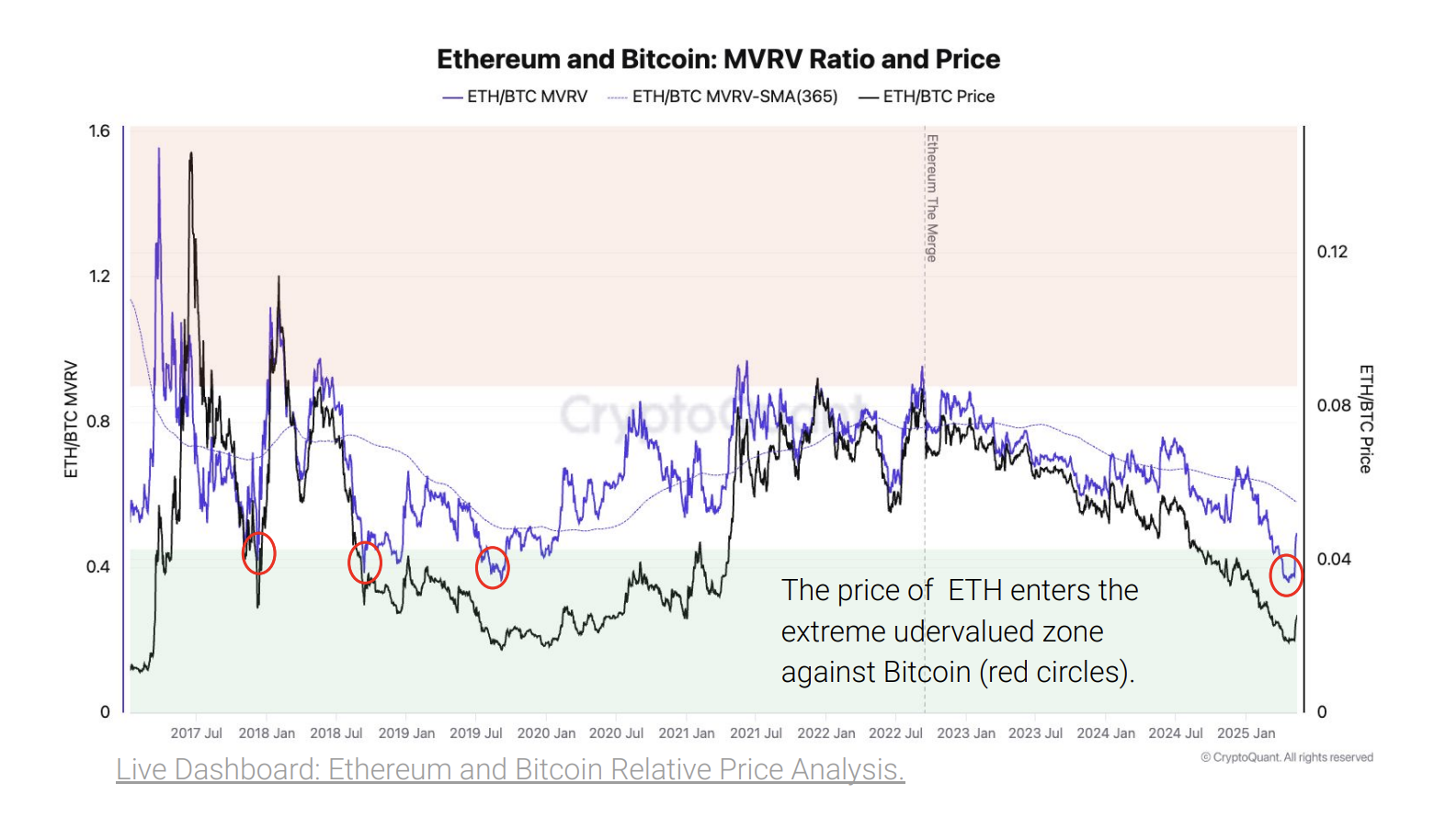

ETH has softly slipped into historically uncommon territory arsenic 1 marketplace awesome shows its profoundly undervalued compared to bitcoin (BTC), at a ratio not seen since 2019, a caller CryptoQuant study says.

The awesome comes from Ethereum’s ETH/BTC Market Value to Realized Value (MVRV) metric, a gauge of comparative valuation that measures marketplace sentiment and humanities trading patterns.

Historically, whenever this indicator has reached likewise debased levels, ETH has subsequently delivered important gains and substantially outperformed BTC.

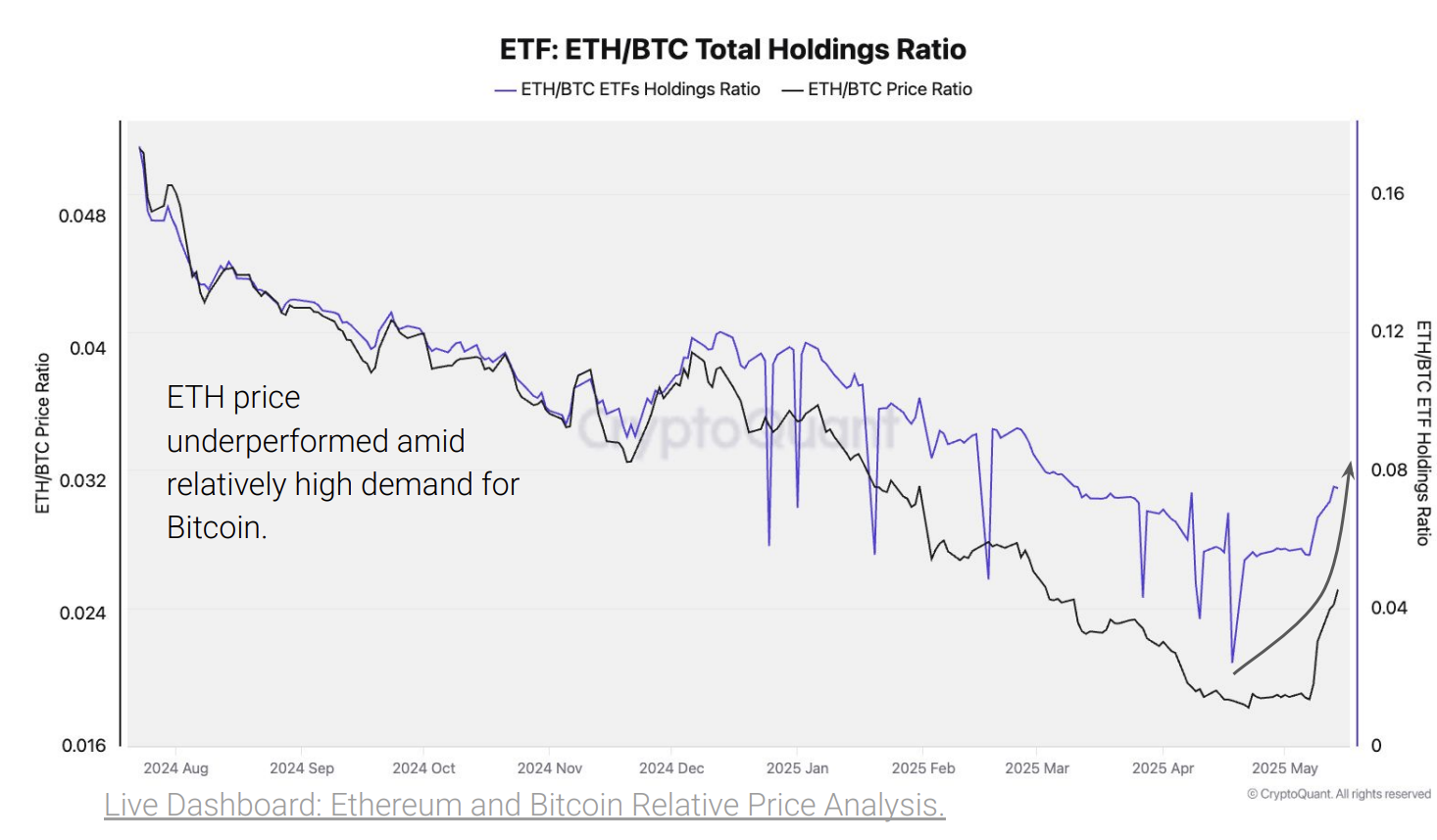

Investors look to beryllium taking notice. Demand for the ETH ETF has sharply picked up, with the ETH/BTC ETF holdings ratio rising steeply since precocious April, according to information from CryptoQuant.

This displacement successful allocation suggests organization investors expect ETH volition outperform BTC, perchance fueled by the recent Pectra upgrade oregon a much favorable macroeconomic environment.

Already, the ETH/BTC terms ratio has rebounded 38% from its weakest level since January 2020, suggesting investors and traders are betting the bottommost is successful and an "alt season" could soon follow.

This echoes what immoderate marketplace participants person been telling CoinDesk.

March Zheng, General Partner of Bizantine Capital, said successful a recent message that traders should retrieve that ETH has typically been the main on-chain altcoin indicator for risk-on, and its sizable upticks mostly pb to broader altcoin rallies.

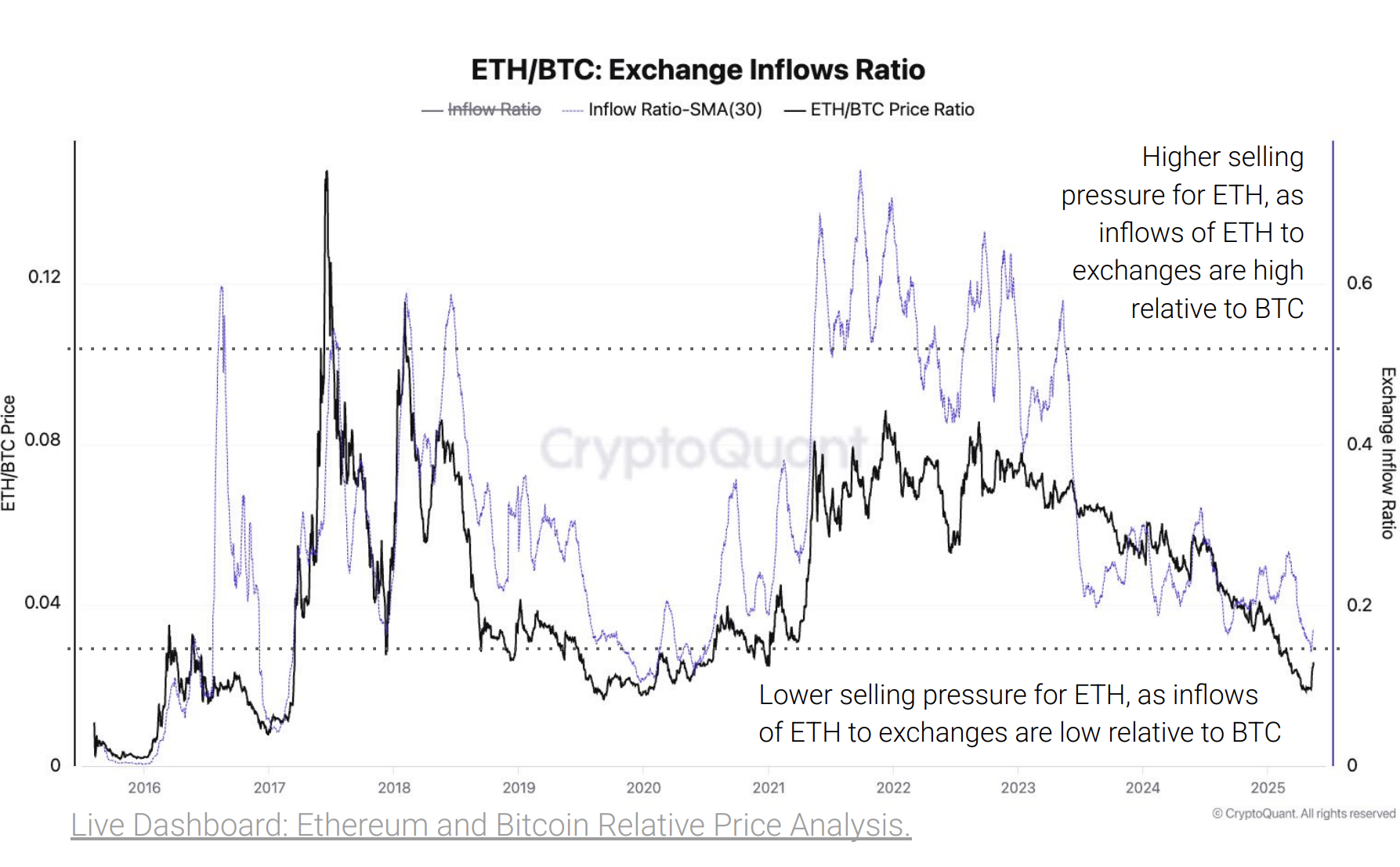

On-chain information further supports this optimism. ETH spot trading measurement comparative to BTC surged to 0.89 past week, its highest since August 2024, signaling renewed appetite from investors. A akin inclination occurred betwixt 2019 and 2021, erstwhile ETH went connected to outperform BTC by fourfold.

CryptoQuant besides notes that ETH speech deposits, often an indicator of selling pressure, person dropped to their lowest comparative level since 2020, implying investors expect higher prices ahead.

For now, confirmation hinges connected ETH decisively breaking supra its cardinal 365-day moving mean against BTC.

Still, with compelling undervaluation, rising organization interest, and diminishing selling pressure, ETH appears positioned for important upside successful the coming months.

But 1 happening ETH is inactive lagging connected is web activity, arsenic CryptoQuant flagged successful a anterior report. Without much radical utilizing Ethereum, it volition beryllium pugnacious for the token's terms to assistance disconnected and caput to the moon.

3 months ago

3 months ago

English (US)

English (US)