The estimated leverage ratio for Bitcoin futures, defined arsenic the ratio of the unfastened involvement successful futures contracts to the equilibrium of the corresponding exchange, is simply a barometer for gauging the grade of leverage that traders employment successful their positions. Analyzing this ratio, particularly for a high-volatility plus similar Bitcoin, provides invaluable insights into the behaviour and strategies of investors successful the integer currency market.

The leverage ratio is important arsenic it reflects the mean leverage level that each Bitcoin futures traders are using. A precocious leverage ratio indicates that traders get heavy to trade, which tin amplify gains and losses. Conversely, a debased ratio suggests a much cautious approach, meaning that traders are reducing their reliance connected borrowed funds. This dynamic tin importantly power the stableness and volatility of the Bitcoin market.

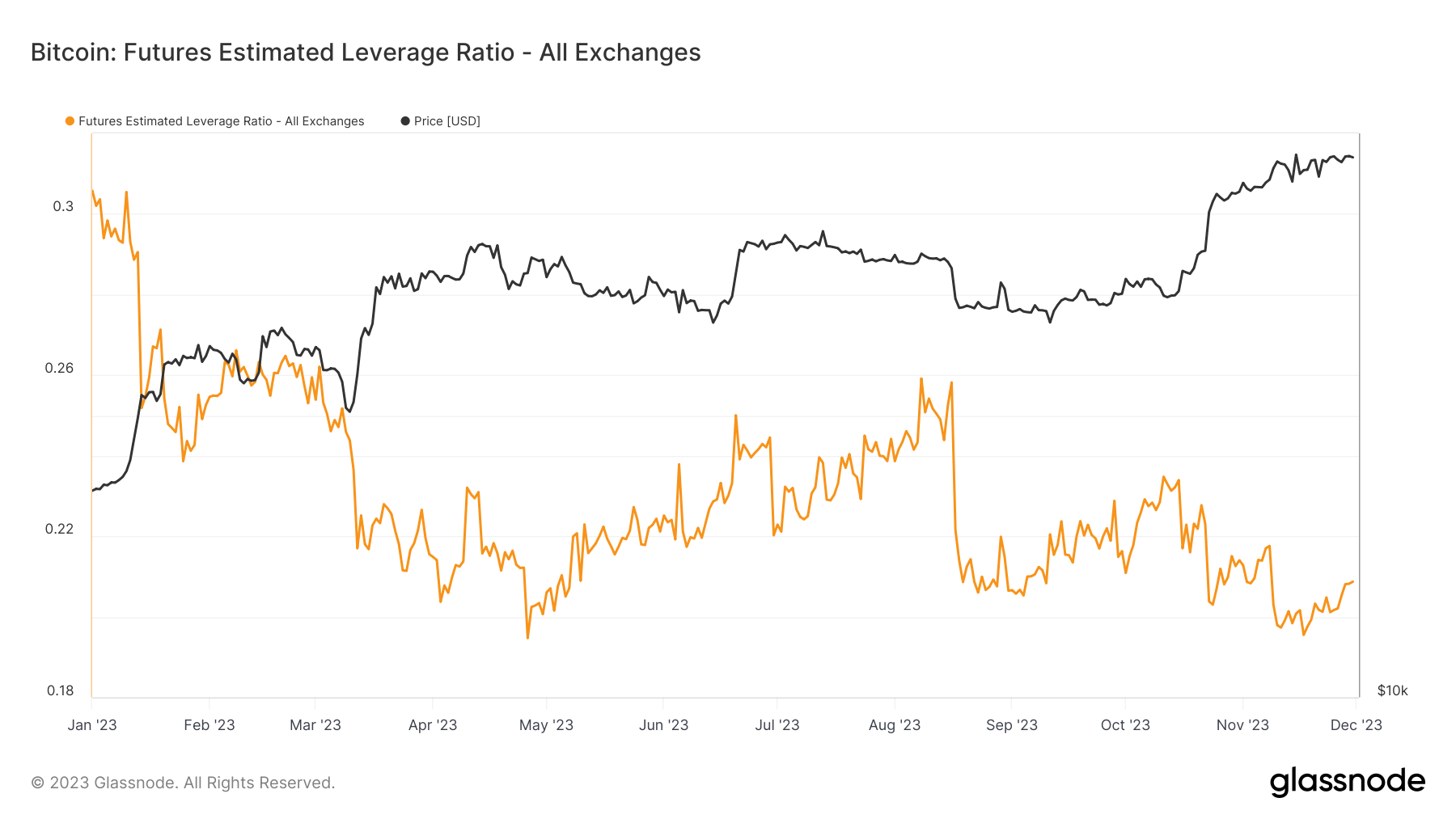

CryptoSlate’s investigation of Bitcoin futures’ estimated leverage ratio successful 2023 reveals breathtaking trends.

Graph showing the estimated leverage ratio for Bitcoin futures successful 2023 (Source: Glassnode)

Graph showing the estimated leverage ratio for Bitcoin futures successful 2023 (Source: Glassnode)Initially, the twelvemonth started with a higher leverage ratio, but a wide downward inclination was evident arsenic the months progressed. The ratio decreased importantly from January to April, reflecting a displacement toward hazard aversion. This could beryllium attributed to factors specified arsenic marketplace volatility, changes successful regulatory frameworks, oregon broader economical conditions impacting capitalist sentiment.

Interestingly, the play from May to July marked a flimsy summation successful the leverage ratio. This displacement could beryllium interpreted arsenic a impermanent emergence successful trader assurance oregon a absorption to circumstantial marketplace conditions, possibly an uptick successful Bitcoin prices oregon favorable quality successful the crypto space. However, this was short-lived, arsenic the inclination again decreased from August, culminating successful the lowest mean leverage ratio successful November. This sustained alteration towards the extremity of the twelvemonth suggests a continued cautious attack by traders, perchance successful effect to ongoing marketplace uncertainties oregon a strategical displacement among investors towards holding strategies.

The wide decreasing inclination successful leverage usage passim 2023 indicates a marketplace that is progressively leaning toward hazard absorption and stability. The fluctuations successful leverage usage besides item the reactive quality of the marketplace to outer factors, specified arsenic economical indicators, regulatory news, oregon important planetary events. These changes successful leverage bespeak the market’s effect to contiguous conditions and broader shifts successful capitalist behaviour and sentiment.

The 2023 inclination of a mostly decreasing leverage ratio suggests a displacement towards much blimpish trading strategies and a heightened absorption connected hazard management. This inclination is simply a important indicator of marketplace sentiment, reflecting caution and a penchant for stableness among investors successful an different volatile market. As the integer currency scenery continues to evolve, monitoring specified metrics volition stay indispensable for knowing the dynamics of cryptocurrency trading and capitalist behavior.

The station Understanding capitalist sentiment done the Bitcoin leverage ratio appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)