The U.S. Treasury yields person precocious been flashing informing signs. These yields, representing the instrumentality connected concern for U.S. authorities bonds, service arsenic a important barometer of marketplace sentiment and wide economical vitality.

An country of peculiar involvement successful this discourse is the dispersed betwixt the 10-year Treasury output and the 3-month Treasury yield. This spread, representing the quality betwixt the returns connected semipermanent and short-term investments, is simply a important indicator of aboriginal economical prospects.

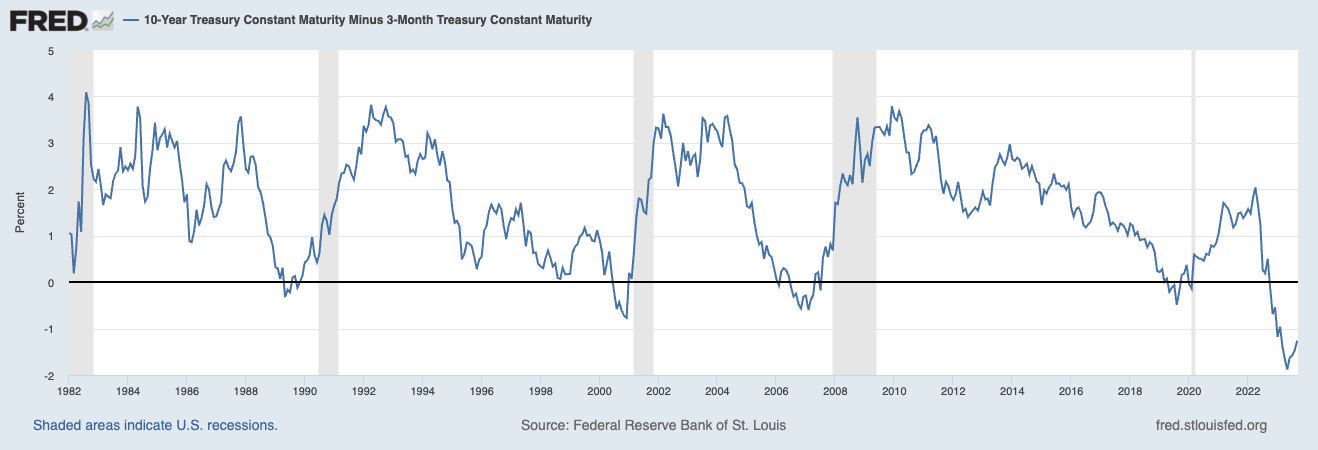

Graph showing the dispersed betwixt the U.S. 10-year Treasury output and the 3-month Treasury output from 1982 to 2023. Shaded areas bespeak periods of recession successful the U.S. (Source: Federal Reserve)

Graph showing the dispersed betwixt the U.S. 10-year Treasury output and the 3-month Treasury output from 1982 to 2023. Shaded areas bespeak periods of recession successful the U.S. (Source: Federal Reserve)Historically, the dispersed betwixt the 10-year and 3-month Treasury yields has been a reliable harbinger of economical downturns.

A affirmative dispersed typically indicates capitalist assurance successful the economy’s semipermanent prospects, portion a antagonistic spread, oregon an “inverted output curve,” often precedes recessions. This inversion suggests that investors are much assured successful the short-term outlook than the long-term, prompting them to question longer-term securities contempt the little yields.

Past instances of this inversion person consistently correlated with economical recessions. The improvement was evident earlier the recessions of the aboriginal 1980s, 1990s, the aboriginal 2000s dot-com boom, and, notably, the 2007-2008 fiscal crisis. The predictive powerfulness of this spread, rooted successful decades of fiscal data, underscores its value successful economical forecasting.

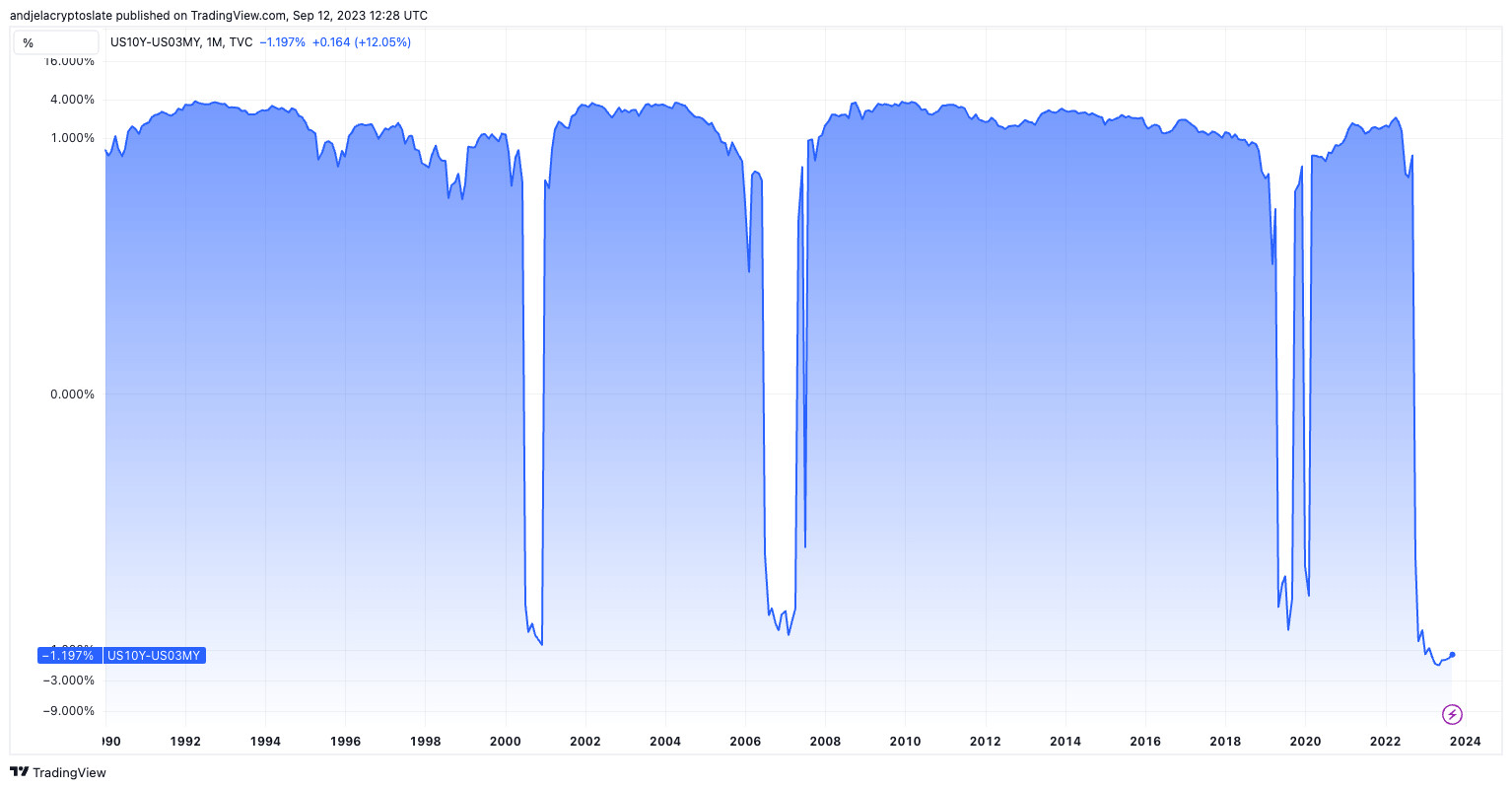

Graph showing the dispersed betwixt the U.S. 10-year Treasury output and the 3-month Treasury output from 1990 to 2023 connected a logarithmic standard (Source: TradingView)

Graph showing the dispersed betwixt the U.S. 10-year Treasury output and the 3-month Treasury output from 1990 to 2023 connected a logarithmic standard (Source: TradingView)In summation to its predictive power, the output dispersed has been employed to cipher the probability of impending recessions. According to a 1996 probe insubstantial from the Federal Reserve Bank of New York, the dispersed betwixt the 10-year and 3-month Treasury yields tin deduce a model-based probability of a recession successful the United States implicit the adjacent 12 months. This model, historically aligned intimately with existent recessions, offers a quantitative attack to gauging economical downturn risks.

By inputting the existent dispersed worth into the model, analysts tin get a percent likelihood of a recession occurring wrong the pursuing year.

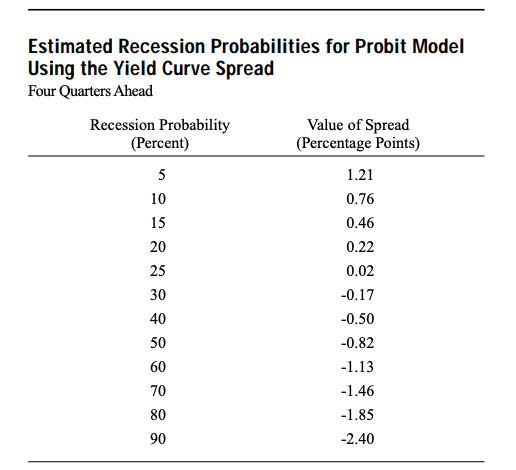

Table showing the estimated recession probabilities utilizing the output curve dispersed successful 1996 (Source: Federal Reserve Bank of New York)

Table showing the estimated recession probabilities utilizing the output curve dispersed successful 1996 (Source: Federal Reserve Bank of New York)October 2022 saw the dispersed turning negative, a improvement that raised eyebrows successful fiscal circles. By May 2023, this dispersed plummeted to an all-time debased of -1.88%. As of Sep. 10, it stands astatine a concerning -1.26%, with marketplace analysts and investors connected precocious alert. The Federal Reserve’s recession probability exemplary suggests a heightened recession probability, ranging from 60% to 70%.

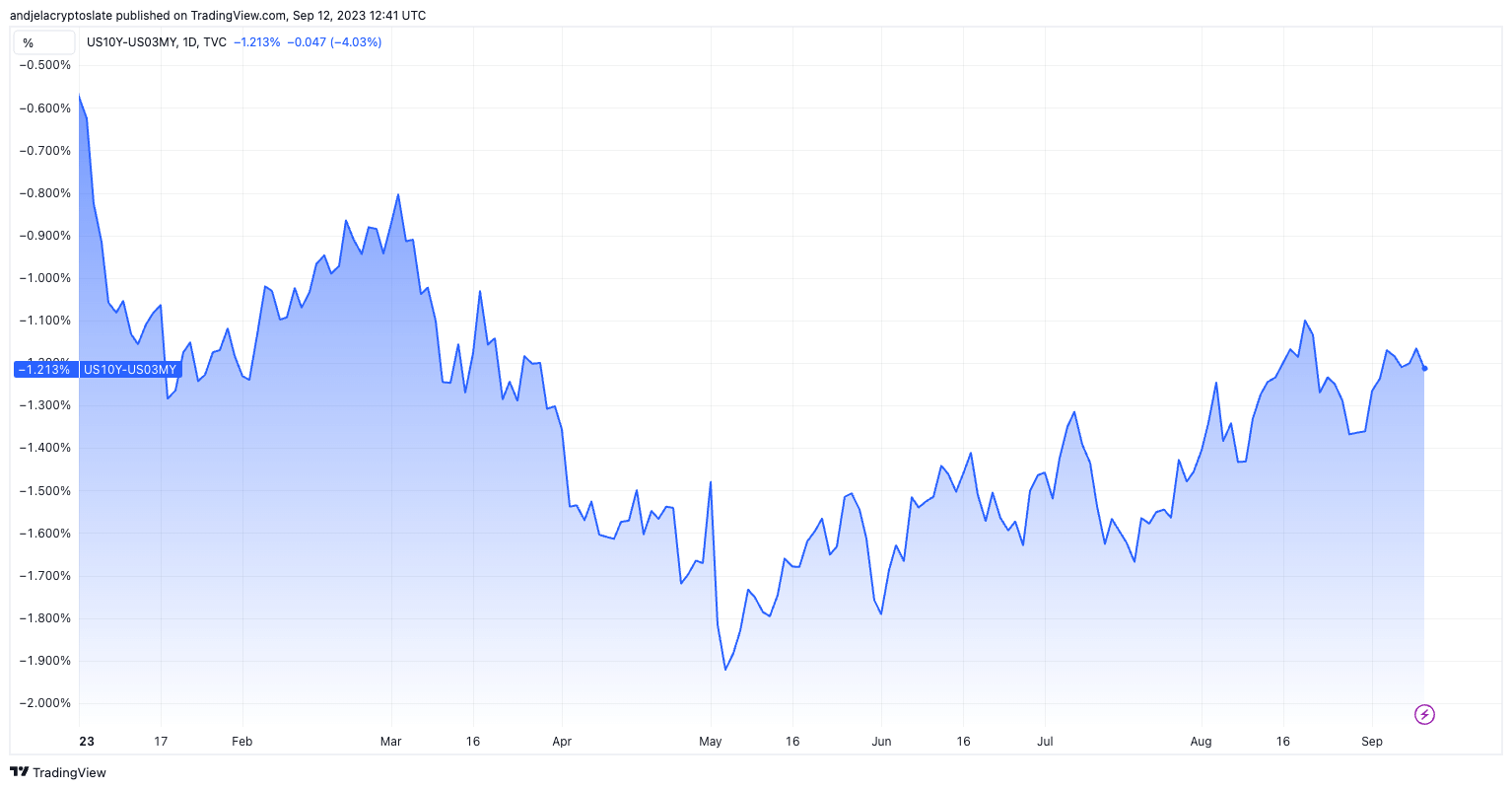

Graph showing the dispersed betwixt the U.S. 10-year Treasury output and the 3-month Treasury output YTD (Source: TradingView)

Graph showing the dispersed betwixt the U.S. 10-year Treasury output and the 3-month Treasury output YTD (Source: TradingView)A peculiarly ample antagonistic spread, specified arsenic the existent one, indicates a deficiency of assurance successful the semipermanent economical outlook. Investors, wary of aboriginal prospects, are flocking to longer-term securities, adjacent if it means settling for little returns. This behaviour suggests a corporate anticipation of economical headwinds successful the not-so-distant future.

The station U.S. Treasury output dispersed dips to historical lows signaling economical caution appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)