Most crypto trading measurement has historically travel from extracurricular the U.S., with Asia being the largest cryptocurrency market. However, determination has been a notable displacement successful this dynamic successful the past respective months, with the U.S. returning to its presumption arsenic the ascendant unit successful the Bitcoin market.

This displacement is evident erstwhile analyzing Bitcoin’s terms and proviso organisation changes crossed Asia and the U.S.

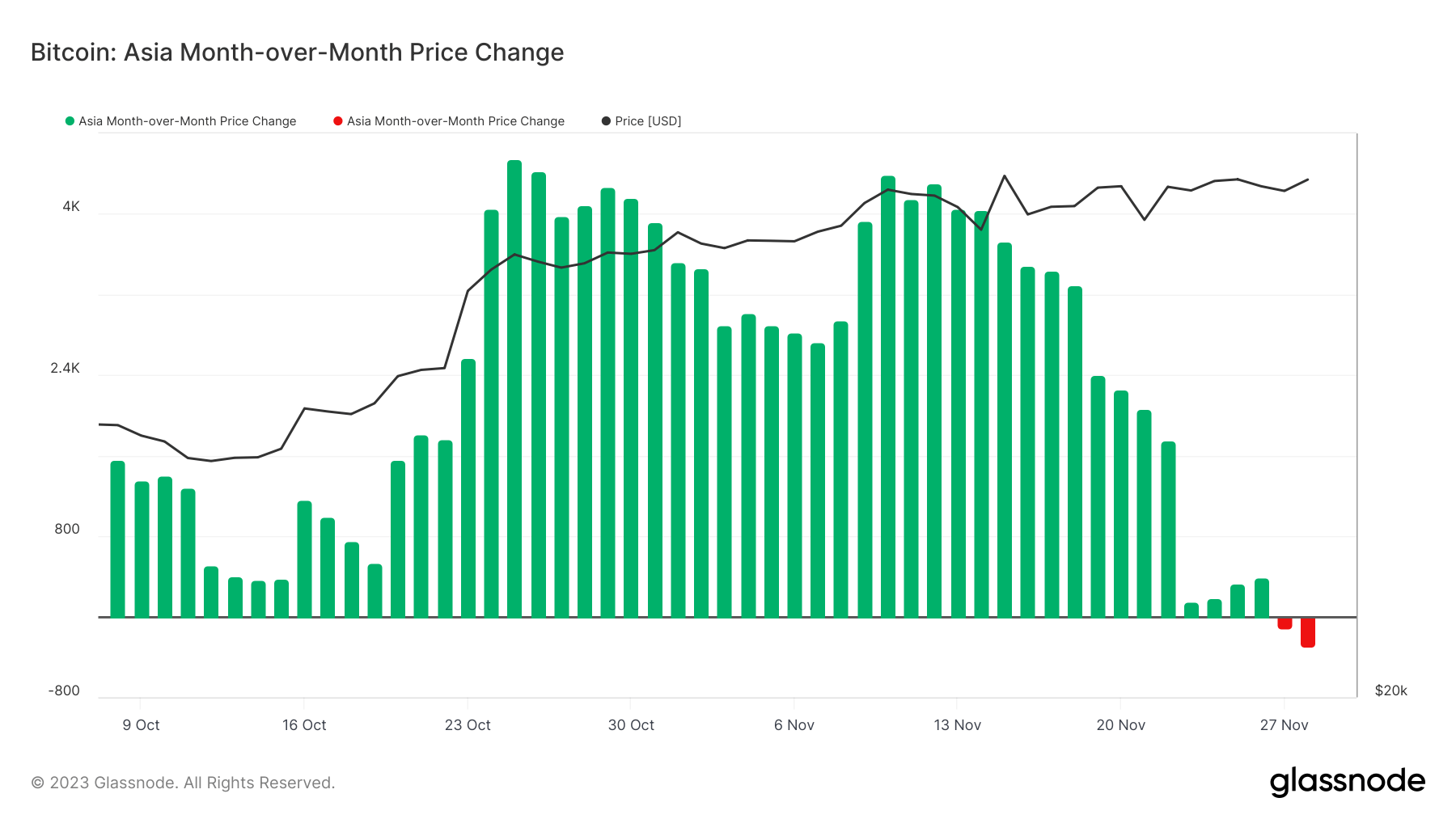

Looking astatine the month-over-month terms alteration of Bitcoin during Asian moving hours shows the determination fluctuations successful Bitcoin’s price, reflecting the market’s effect to assorted economical and governmental stimuli circumstantial to Asia. The trends observed present bespeak the level of marketplace enactment and capitalist sentiment wrong the region, offering a glimpse into the determination power connected Bitcoin’s planetary pricing.

Data from Glassnode has shown a crisp alteration successful the 30-day alteration successful Bitcoin’s terms acceptable during Asian moving hours successful November.

Graph showing the month-over-month terms alteration of Bitcoin during Asian moving hours from Oct. 1 to Nov. 28, 2023 (Source: Glassnode)

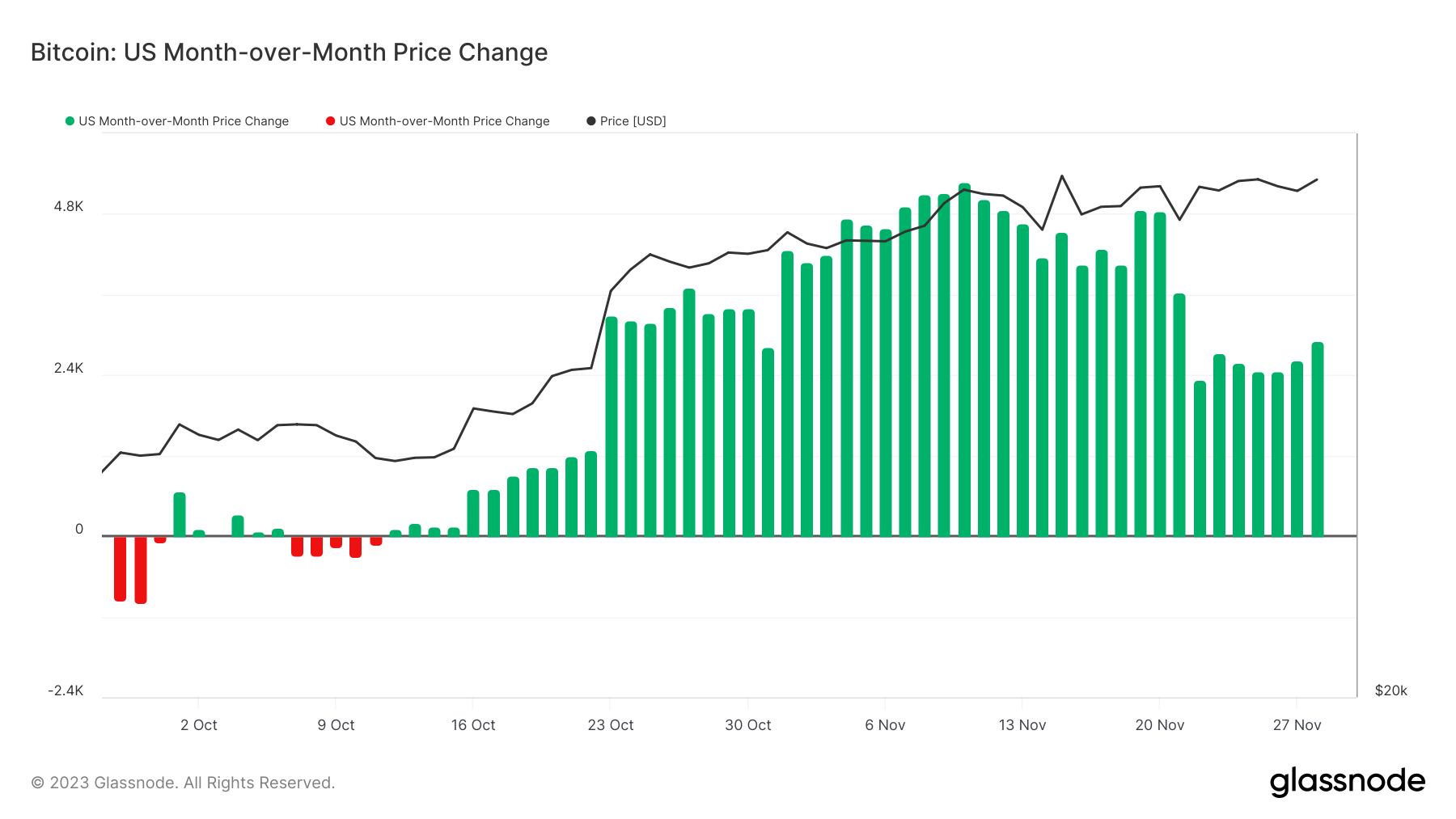

Graph showing the month-over-month terms alteration of Bitcoin during Asian moving hours from Oct. 1 to Nov. 28, 2023 (Source: Glassnode)The month-over-month terms alteration during U.S. moving hours contrasts with the Asian marketplace data, revealing a antithetic marketplace behaviour and capitalist attitude. The U.S. marketplace shows a important power implicit Bitcoin’s terms contempt variations successful trading volumes and marketplace information compared to its Asian counterpart.

Graph showing the month-over-month terms alteration of Bitcoin during U.S. moving hours from Oct. 1 to Nov. 28, 2023 (Source: Glassnode)

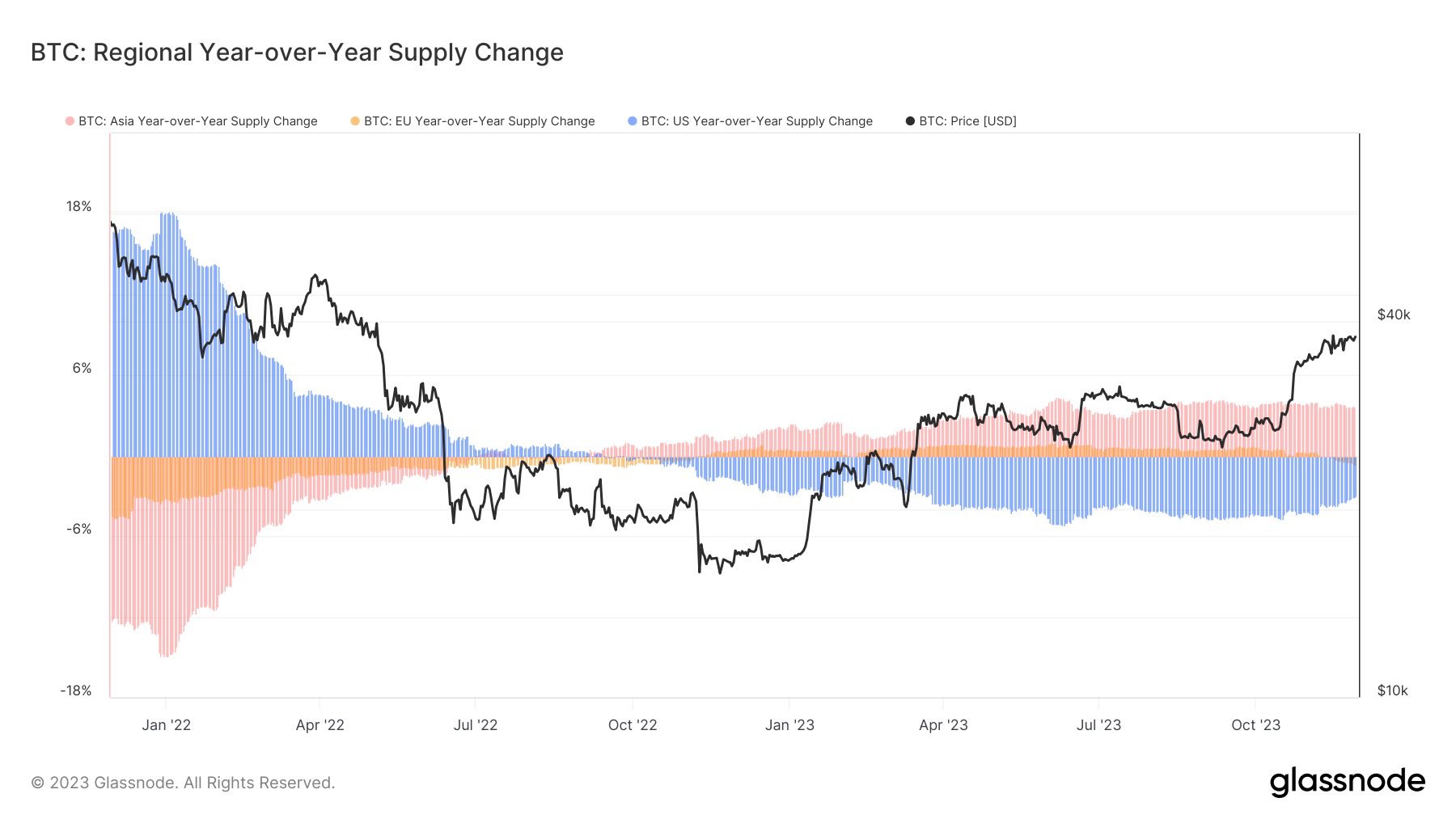

Graph showing the month-over-month terms alteration of Bitcoin during U.S. moving hours from Oct. 1 to Nov. 28, 2023 (Source: Glassnode)The year-over-year alteration successful Bitcoin’s proviso crossed antithetic regions is important successful knowing the shifts successful determination dominance oregon diminution concerning Bitcoin holdings. A cardinal reflection from this dataset is the inclination successful U.S. holdings, which person been decreasing since September 2022. In contrast, the proviso held by investors successful Asia has been increasing, signaling a 3.7% year-over-year maturation arsenic of Nov. 28.

Graph showing the year-over-year alteration successful the stock of the Bitcoin proviso held oregon traded successful Asia, the U.S., and the E.U. from November 2021 to November 2023 (Source: Glassnode)

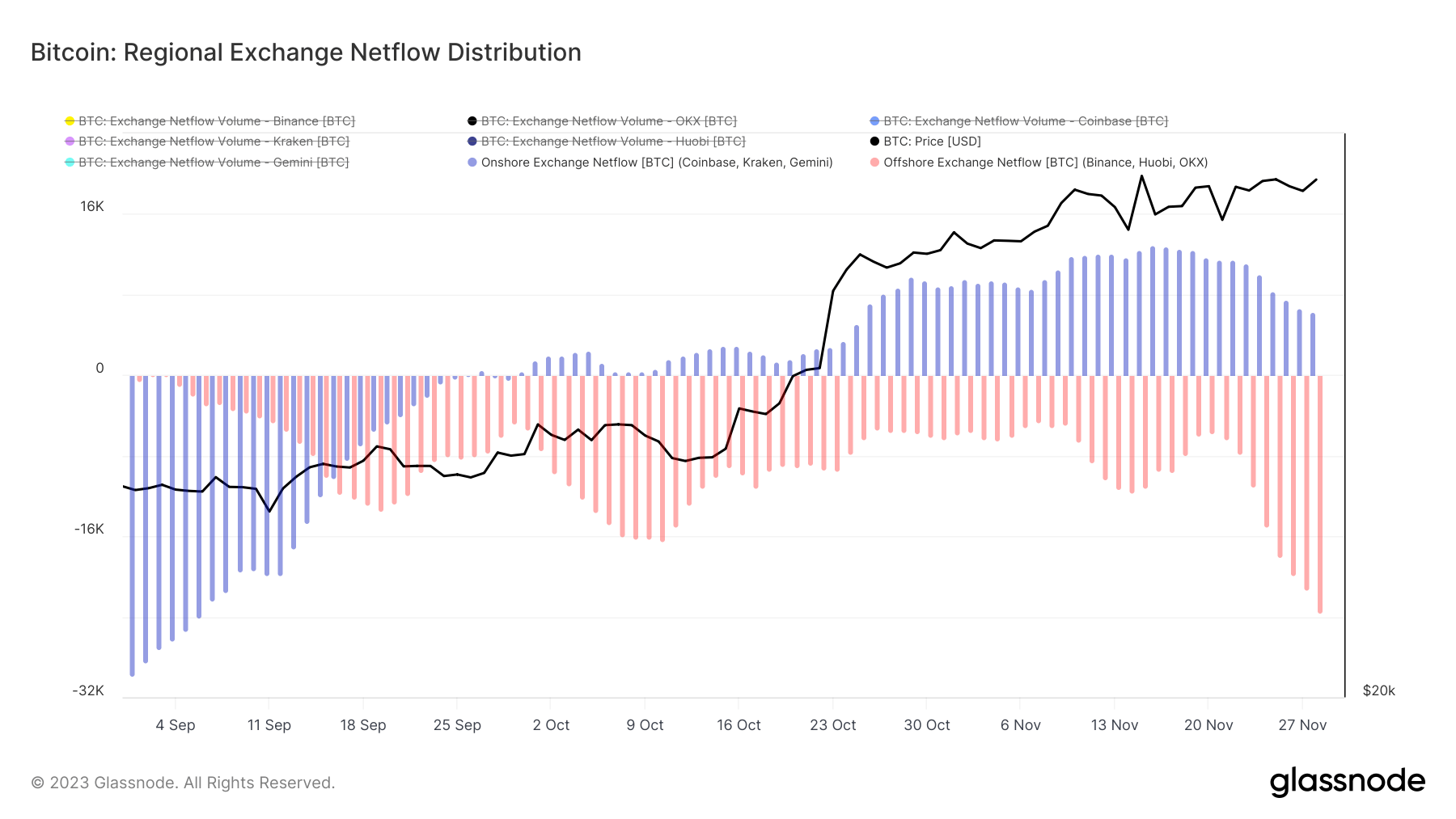

Graph showing the year-over-year alteration successful the stock of the Bitcoin proviso held oregon traded successful Asia, the U.S., and the E.U. from November 2021 to November 2023 (Source: Glassnode)Moreover, the nett travel of Bitcoin into and retired of exchanges, some successful the U.S. and offshore, is simply a beardown indicator of capitalist sentiment and marketplace activity. For instance, a nett inflow mightiness suggest a bullish marketplace sentiment, with investors buying oregon holding Bitcoin. In contrast, a nett outflow could bespeak bearish sentiment, with selling oregon a deficiency of assurance prevailing.

In the past 2 months, U.S. exchanges Coinbase, Kraken, and Gemini person seen their inflows summation drastically. Offshore exchanges Binance, Huobi, and OKX person each registered nett outflows since the opening of September.

Graph showing the nett travel of BTC successful and retired of exchanges domiciled on-shore and off-shore comparative to the U.S. from Sep. 1 to Nov. 28, 2023 (Source: Glassnode)

Graph showing the nett travel of BTC successful and retired of exchanges domiciled on-shore and off-shore comparative to the U.S. from Sep. 1 to Nov. 28, 2023 (Source: Glassnode)Despite a alteration successful the year-over-year proviso of Bitcoin successful the U.S., the country’s power implicit Bitcoin’s terms remains pronounced. This improvement suggests that the remaining Bitcoin proviso successful the U.S. is perchance controlled by influential marketplace players oregon institutions susceptible of importantly impacting marketplace prices. This paradoxical inclination underscores the U.S. market’s captious relation successful the Bitcoin ecosystem. The decreasing proviso could beryllium attributed to assorted factors, including regulatory environments and strategical concern decisions. Concurrently, the expanding terms power points to a marketplace wherever decision-making and marketplace powerfulness are concentrated among a constricted fig of U.S.-based investors oregon institutions.

The station U.S. reclaims dominance successful Bitcoin marketplace contempt proviso shift appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)