The caller collapse of the Silicon Valley Bank (SVB) and the USD Coin (USDC) de-peg halted the hype astir Non-Fungible Tokens (NFTs) portion benefitted the enactment connected Decentralized Finance (DeFi), arsenic the caller DappRadar study revealed.

During the play of Mar. 11-12, DeFi’s transaction measurement surpassed $58 cardinal crossed each platforms — portion Mar. 11 recorded the lowest fig of progressive NFT traders since November 2021, according to the DappRadar report.

DeFi surge

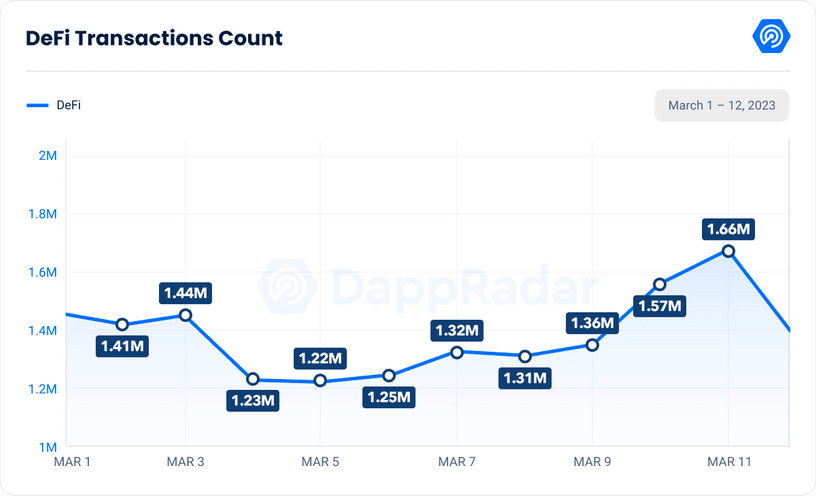

On Mar. 11, aft the SVB clang and the USDC de-peg, the Total Value Locked (TVL) successful DeFi fell to $71.61 cardinal from $79.28 cardinal — marking a 9.6% decrease. The transaction number besides accrued by 23%, to 1.6 cardinal from 1.3 million.

DeFi transactions number (Source: DappRadar)

DeFi transactions number (Source: DappRadar)After the SVB’s USDC reserves were made disposable to the nationalist connected Mar. 13, the DeFi marketplace besides stabilized and led the DeFi TVL to turn to $81.15 billion, marking a 13% spike.

The fig of unsocial progressive wallets (UAW) interacting betwixt DeFi protocols has besides recorded a 13% summation betwixt Mar. 8 to Mar. 11, increasing to 477,094 from 421,026.

DeFi winners

Among each DeFi protocols, Uniswap (UNI) became the 1 that recorded the astir important summation successful the UAW counts — portion 1inch Network (1INCH) won connected the trading measurement front.

Uniswap’s UAW accrued to 67,000 connected Mar. 11 from 54,000 connected Mar. 10, marking a 24% increase. Its trading measurement besides recorded a 96% increase, increasing to $14.4 cardinal connected Mar. 11 from $7.34 cardinal connected Mar. 10.

1inch Network, connected the different hand, recorded a 304% maturation successful its trading volume, expanding to $3.46 cardinal connected Mar. 11 from the $855 cardinal recorded connected Mar. 10. The UAW number of the speech besides grew to 24,100 from 21,600 successful 1 time — marking an 11% increase.

NFTs

The NFT marketplace has been increasing astatine an awesome complaint implicit the past fewer months. The NFT sphere maintained its resilience during the coldest wintertime successful crypto past and managed to afloat return to its pre-Luna clang levels successful February.

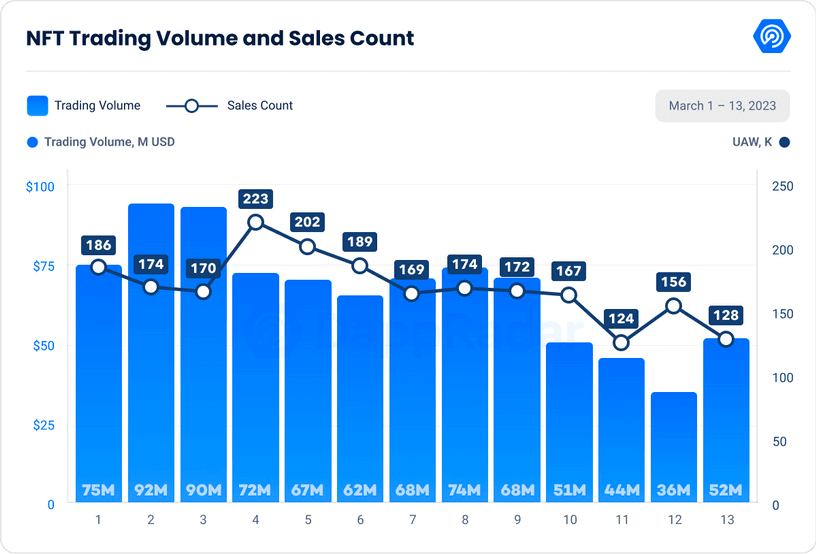

However, the NFT sphere took a deed from the US banking turmoil. The NFT trading measurement recorded a 51% alteration since the opening of March, falling to the existent 128,000 from February’s 156,000.

NFT trading measurement and income number (Source: DappRadar)

NFT trading measurement and income number (Source: DappRadar)The fig of progressive NFT traders was recorded arsenic 12,000, which marks the lowest since November 2021. It besides recorded the lowest commercialized number successful a azygous time of the year, with 33,112 transactions.

Interestingly, the banking turmoil didn’t impact the NFT trading measurement arsenic overmuch arsenic the trader activity. The study justified this contradiction by stating that Ethereum (ETH) NFT whales person been continuing to workplace connected Blur Season 2.

The station U.S. Banking turmoil halts NFT hype arsenic DeFi thrives appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)