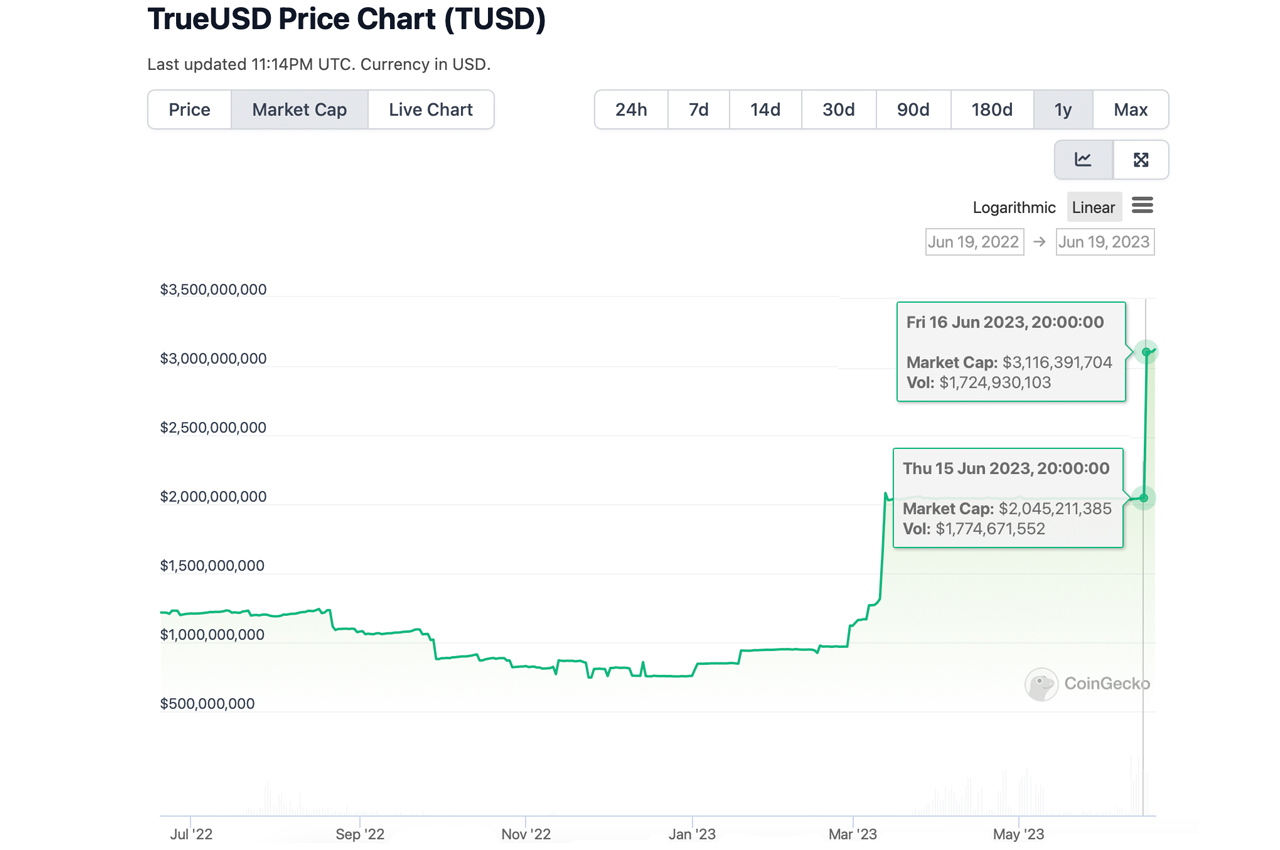

Despite the diminution successful stablecoins owed to important redemptions, peculiarly from projects similar USDC, DAI, and BUSD, the task TUSD has experienced a notable surge successful its supply. TUSD has added much than a cardinal dollars’ worthy of tokens to its existing supply. As of the contiguous moment, the marketplace capitalization of TUSD stands astatine astir $3.13 billion.

TUSD’s Supply Spiked 52% connected June 16, Rising by a Billion Tokens

In a caller stablecoin update, Bitcoin.com News shed light connected the challenging times faced by the dollar-pegged token economy, with important redemptions causing its marketplace valuation to plummet to its lowest constituent successful 20 months. As of June 19, 2023, the corporate marketplace capitalization of the starring stablecoins amounts to $129.99 billion, portion these tokens person witnessed planetary commercialized measurement of $20.84 cardinal successful the past 24 hours.

Notably, 3 of the apical 5 stablecoins successful presumption of marketplace capitalization, namely USDC, DAI, and BUSD, person experienced proviso reductions ranging from 3.8% to 22% implicit the past 30 days. TUSD, connected the different hand, has witnessed a proviso summation of astir 53.5% implicit the past month.

The stablecoin experienced a surge successful marketplace valuation connected July 16, 2023, reaching $3.11 billion, a important leap from the erstwhile day’s $2.04 billion. This means that portion TUSD grew by 53.5% wrong 30 days, a azygous time past Friday accounted for 52% of that increase. According to the smart declaration data connected Etherscan, the circulating proviso of TUSD tokens connected June 19 is astir 3,135,633,560.

Interestingly, contempt determination being 52,079 TUSD holders, the apical 10 wallets power 83.31% of the circulating supply. Among the apical 10 wallets, Binance emerges arsenic the largest holder with its starring code containing 389,561,743 TUSD tokens. Moreover, retired of the apical 10 addresses with the highest TUSD holdings, controls 5 of them.

The crypto exchange, known for its important commercialized volume, besides possesses different wallet with 45,233,811 TUSD, 1 with precisely 28,000,000, different with 10,601,602, and lastly, 1 holding 10,270,001 TUSD. Additionally, the decentralized concern (defi) protocol Aave has locked 4,780,182 TUSD for its aTUSD tokens.

According to statistics from Nansen.ai, Binance’s TUSD stash accounts for 5.26% of the exchange’s $52.45 cardinal portfolio. TUSD was introduced successful mid-2018 done the Trust Token level arsenic an ERC20-based stablecoin. It asserts to beryllium wholly backed by U.S. Dollars and overseen by a regulated operator.

The stablecoin institution besides collaborated with the custodian Prime Trust, the institution that Bitgo expressed intentions of acquiring. However, earlier this month, the team’s Twitter relationship disclosed that “TUSD mints via Prime Trust are paused” until further notice. On Monday, astatine 8:58 a.m. Eastern Time, the institution reiterated that mints via Prime Trust stay unavailable.

“In presumption of the uncertainty, minting done Prime Trust is inactive temporarily paused portion minting/redemption done our different banking partners are unaffected,” the institution tweeted. “We volition resume Prime Trust process erstwhile the circumstances improve. Thanks for your patience.”

What are your thoughts connected TUSD’s surge successful proviso amidst the diminution of different stablecoins? Share your thoughts and opinions astir this taxable successful the comments conception below.

2 years ago

2 years ago

English (US)

English (US)