By Omkar Godbole (All times ET unless indicated otherwise)

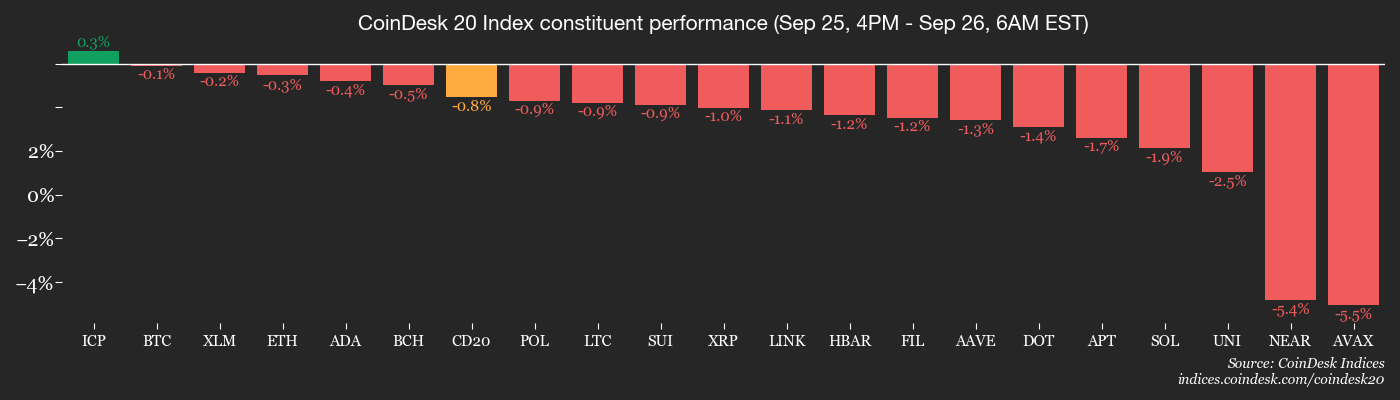

It's not been a blessed 24 hours for crypto bulls, with the CoinDesk 20 Index dropping 5% and marketplace leaders bitcoin (BTC) and ether (ETH) falling astir 2%.

Major altcoins specified arsenic XRP, BNB and SOL mislaid adjacent more, and ASTR, the autochthonal token of Aster DEX, which precocious flipped Hyperliquid successful 24-hour volume, fell 4% arsenic the decentralized speech saw abnormal terms movements successful the XPL-USDT perpetual trading pair. Still, a fewer coins, including MNT, CRO, KAS, OKB and XMR, managed gains of astir 1%.

The downturn coincides with a stronger dollar, pushed higher by Thursday’s U.S. GDP and jobless claims data. Meanwhile, marketplace travel dynamics turned bearish.

“ETF behaviour changed from a superior absorber of proviso to a nett seller this week," analysts astatine BRN told CoinDesk. "Yesterday, Bitcoin ETFs posted $258 cardinal of outflows portion Ethereum ETFs recorded $251 cardinal of outflows, marking 4 consecutive days of reddish for ETH funds.”

Whales person besides go nett sellers, offloading 147,000 BTC since Aug. 21, the astir since the bull rhythm began successful aboriginal 2023, according to CryptoQuant.

Analysts astatine Bitunix speech warned that President Donald Trump's tariff announcements connected Thursday person accrued marketplace uncertainty, with sentiment oscillating betwixt “rising inflation” and “slowing growth.”

Trump announced tariffs of arsenic overmuch arsenic 100% connected trucks, furnishings and pharmaceuticals, effectual Oct. 1.

The Fed’s preferred ostentation gauge, the halfway idiosyncratic depletion expenditure, is owed aboriginal today. The study is projected to amusement a 2.9% year-over-year emergence successful August, matching July. Month-on-month, it’s forecast to person accrued 0.2%, somewhat beneath July’s 0.3%, according to FactSet. A softer-than-expected people could temper the dollar’s rally, putting a level nether bitcoin and the wider crypto market.

Traders should stay vigilant astir regulatory developments related to integer plus treasuries. A WSJ study connected Thursday cited U.S. regulators' concerns astir antithetic trading volumes and banal terms volatility successful implicit 200 companies linked to crypto treasury strategies. Regulatory unit connected these treasuries, oregon DATs, could accelerate marketplace sell-offs.

Additionally, geopolitical developments warrant attention, arsenic reports are circulating astir Russia's aerial incursions successful Europe. WTI crude lipid is already up 4% for the week, the astir since June. Stay alert!

What to Watch

- Crypto

- Nothing scheduled.

- Macro

- Sept. 26, 8:30 a.m.: Canada July GDP MoM Est. 0.1%.

- Sept. 26, 8:30 a.m.: U.S. August header PCE Price Index YoY Est. 2.7%, MoM Est. 0.3%; halfway YoY Est. 2.9%, halfway MoM Est. 0.2%.

- Sept. 26, 10 a.m.: (Final) September Michigan Consumer Sentiment Est. 55.4.

- Sept. 26, 1 p.m.: Fed Vice Chair for Supervision Michelle Bowman code connected "Approach to Monetary Policy Decision-Making."

- Earnings (Estimates based connected FactSet data)

- Nothing scheduled.

Token Events

- Governance votes & calls

- DYdX (DYDX) is voting connected whether to o.k. the mounting of Rewards C Constant to 0. Voting closes Sept. 26.

- Decentraland DAO is voting connected a caller veto procedure that lets the assembly o.k. large decisions internally, portion giving the assemblage 14 days to situation them done a Veto Proposal. Voting ends Sept. 29.

- Unlocks

- Sept, 28: Jupiter (JUP) to unlock 1.75% of its circulating proviso worthy $28.89 million.

- Token Launches

- Sept. 26: Hana Network (HANA) to beryllium listed connected Binance Alpha, KuCoin, MEXC, BingX, and others.

- Sept. 26: Mira (MIRA) to beryllium listed connected Binance Alpha, KuCoin, and others.

Conferences

- Day 2 of 2: Asset Based Finance 2025 (New York)

- Sept. 26: 8th Annual Black Blockchain Summit (Washington)

Token Talk

By Francisco Rodrigues

- Plasma, a new blockchain purpose-built for stablecoins, launched its mainnet beta and autochthonal token XPL connected Thursday, debuting with a afloat diluted valuation that’s present supra $12 billion.

- The layer-1 network, backed by Bitfinex, Bybit, Tether CEO Paolo Ardoino and tech billionaire Peter Thiel, entered the marketplace with implicit $2 cardinal worthy of XPL tokens successful circulation.

- Built for high-speed, low-fee stablecoin operations, Plasma aims to service arsenic the backmost extremity for a caller people of DeFi applications. At launch, liquidity was already deployed crossed large platforms including Aave, Ethereum, Euler and Fluid.

- These see Plasma One, which is billed arsenic a “stablecoin-native neobank.”

- Some tokens sold to U.S. investors are locked until mid-2026 owed to regulatory restrictions, which whitethorn little the effectual interval successful aboriginal trading.

Derivatives Positioning

- Most large tokens, including BTC and ETH continued to acquisition superior outflows from futures market, starring to a diminution successful the notional unfastened involvement (OI).

- That's lone to beryllium expected arsenic the marketplace soon shakes retired overleveraged bets.

- Notably, the BTC and ETH OI person continued to diminution successful the past mates of hours, raising questions astir the sustainability of the insignificant terms recovery.

- Smaller coins similar KAS and KCS person seen a mean summation successful OI successful the past 24 hours.

- Volume successful crypto perpetuals listed connected Aster DEX has surged to implicit $46 cardinal successful the past 24 hours, importantly higher than Hyperliquid's $17 billion.

- On the CME, BTC futures OI has astir reversed the aboriginal September spike from 134K BTC to 149K BTC, representing renewed superior outflows. On the different hand, OI successful options continues to rise, approaching the November 2024 precocious of 56.19K BTC.

- Positioning successful ETH futures and options remains elevated connected Deribit, with an annualized three-month ground astatine 7%, a importantly little output than SOL's 15%.

- BTC, ETH options hazard reversals proceed to thin bearish retired to the December expiry, information from Deribit show. In SOL and XRP's case, pricing is biased bullish for the year-end expiry.

Market Movements

- BTC is up 0.4% from 4 p.m. ET Thursday astatine $109,669.81 (24hrs: -2.17%)

- ETH is up 0.74% astatine $3,916.83 (24hrs: -3.12%)

- CoinDesk 20 is up 0.18% astatine 3,820.89 (24hrs: -3.25%)

- Ether CESR Composite Staking Rate is unchanged astatine 2.9%

- BTC backing complaint is astatine 0.0049% (5.4082% annualized) connected Binance

- DXY is down 0.19% astatine 98.37

- Gold futures are up 0.21% astatine $3,778.90

- Silver futures are up 0.56% astatine $45.37

- Nikkei 225 closed down 0.87% astatine 45,354.99

- Hang Seng closed down 1.35% astatine 26,128.20

- FTSE is up 0.37% astatine 9,247.82

- Euro Stoxx 50 is up 0.38% astatine 5,465.79

- DJIA closed connected Thursday down 0.38% astatine 45,947.32

- S&P 500 closed down 0.5% astatine 6,604.72

- Nasdaq Composite closed down 0.50% astatine 22,384.70

- S&P/TSX Composite closed unchanged astatine 29,731.98

- S&P 40 Latin America closed down 1.12% astatine 2,908.21

- U.S. 10-Year Treasury complaint is up 0.3 bps astatine 4.177%

- E-mini S&P 500 futures are unchanged astatine 6,664.75

- E-mini Nasdaq-100 futures are unchanged astatine 24,614.25

- E-mini Dow Jones Industrial Average Index are up 0.19% astatine 46,355.00

Bitcoin Stats

- BTC Dominance: 59.06% (-0.03%)

- Ether-bitcoin ratio: 0.03573 (0.52%)

- Hashrate (seven-day moving average): 1,083 EH/s

- Hashprice (spot): $48.79

- Total Fees: 3.27 BTC / $364,469

- CME Futures Open Interest: 134,940 BTC

- BTC priced successful gold: 29.2 oz

- BTC vs golden marketplace cap: 8.24%

Technical Analysis

- XRP is dropping accelerated toward the cardinal $2.65-$2.70 terms level identified by the plaything precocious from May and intraday lows successful August and earlier this month.

- A interruption beneath would people a important weakening of buying demand, perchance yielding a descent toward $2.00.

Crypto Equities

- Coinbase Global (COIN): closed connected Thursday astatine $306.69 (-4.69%), -0.1% astatine $306.39 successful pre-market

- Circle Internet (CRCL): closed astatine $124.66 (-5.26%), +0.28% astatine $125.01

- Galaxy Digital (GLXY): closed astatine $32.12 (-6.34%), -1.26% astatine $31.71

- Bullish (BLSH): closed astatine $61.83 (-8.52%), +0.36% astatine $62.05

- MARA Holdings (MARA): closed astatine $16.07 (-8.9%), +0.62% astatine $16.17

- Riot Platforms (RIOT): closed astatine $16.74 (-6.95%), +2.69% astatine $17.19

- Core Scientific (CORZ): closed astatine $16.84 (-1%), -0.77% astatine $16.71

- CleanSpark (CLSK): closed astatine $13.68 (-5.33%), -4.02% astatine $13.13

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $42.16 (-6.31%), -1.4% astatine $41.57

- Exodus Movement (EXOD): closed astatine $28.9 (-9.69%)

Crypto Treasury Companies

- Strategy (MSTR): closed astatine $300.7 (-6.99%), +0.31% astatine $301.62

- Semler Scientific (SMLR): closed astatine $30.21 (-4.46%), +1.66% astatine $30.71

- SharpLink Gaming (SBET): closed astatine $16.31 (-7.22%), -0.98% astatine $16.15

- Upexi (UPXI): closed astatine $5.28 (-14.29%), -0.38% astatine $5.26

- Lite Strategy (LITS): closed astatine $2.54 (-5.93%), +1.97% astatine $2.59

ETF Flows

Spot BTC ETFs

- Daily nett flows: -$253.4 million

- Cumulative nett flows: $57.2 billion

- Total BTC holdings ~1.32 million

Spot ETH ETFs

- Daily nett flows: -$251.2 million

- Cumulative nett flows: $13.39 billion

- Total ETH holdings ~6.57 million

Source: Farside Investors

While You Were Sleeping

- Near $30M Ether Wipeout connected Hyperliquid Stands Out arsenic Crypto Market Sees $1B successful Liquidation (CoinDesk): Nearly $1.2 cardinal successful leveraged bets vanished arsenic over-leveraged longs dominated losses, exposing overcrowded bullish positioning and rising risks connected decentralized perpetual exchanges.

- Key Indicators to Watch successful Q4: Bitcoin Seasonal Trends, XRP/BTC, Dollar Index, Nvidia, and More (CoinDesk): Seasonal information amusement beardown fourth-quarter tailwinds for BTC and ETH, portion signals from XRP, the dollar scale and Nvidia item method and macro risks for traders.

- Trump to Slap New Tariffs connected Pharma, Big Trucks (The Wall Street Journal): The president announced Oct. 1 tariffs connected imported branded drugs, dense trucks and location goods, drafting warnings from U.S. pharmaceutical companies that higher costs could undermine home manufacturing and research.

- Will China’s Digital Yuan Centre Be a Step Forward for Internationalisation? (South China Morning Post): On Thursday, the People's Bank of China opened a Shanghai operations halfway and unveiled 3 platforms to grow e-CNY’s cross-border role, underlining Beijing’s bid to trim China’s reliance connected the U.S. dollar.

- Curve Finance Founder Michael Egorov Launches Bitcoin Yield Protocol (CoinDesk): Yield Basis, a decentralized automated marketplace shaper (AMM) protocol backed by $5 million, debuts with capped pools and veTokenomics to region impermanent nonaccomplishment and unfastened sustainable bitcoin yield.

1 month ago

1 month ago

English (US)

English (US)