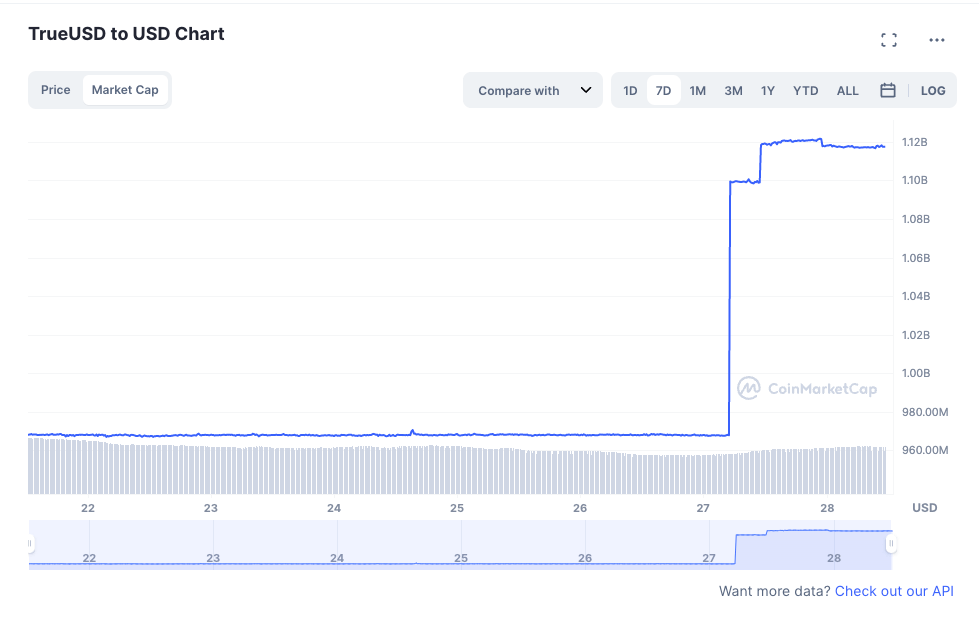

Over the past fewer weeks, the marketplace worth of True USD (TUSD) has surged and it is present ranked, according to Coin Market Cap, as the 5th largest stablecoin by marketplace capitalization.

In the past 24 hours, TUSD’s marketplace capitalization has risen by implicit 15%, presently astatine implicit $1.1 billion.

True USD Market Cap (Source: Coin Market Cap)

True USD Market Cap (Source: Coin Market Cap)TUSD nett outflow grows to conscionable demand

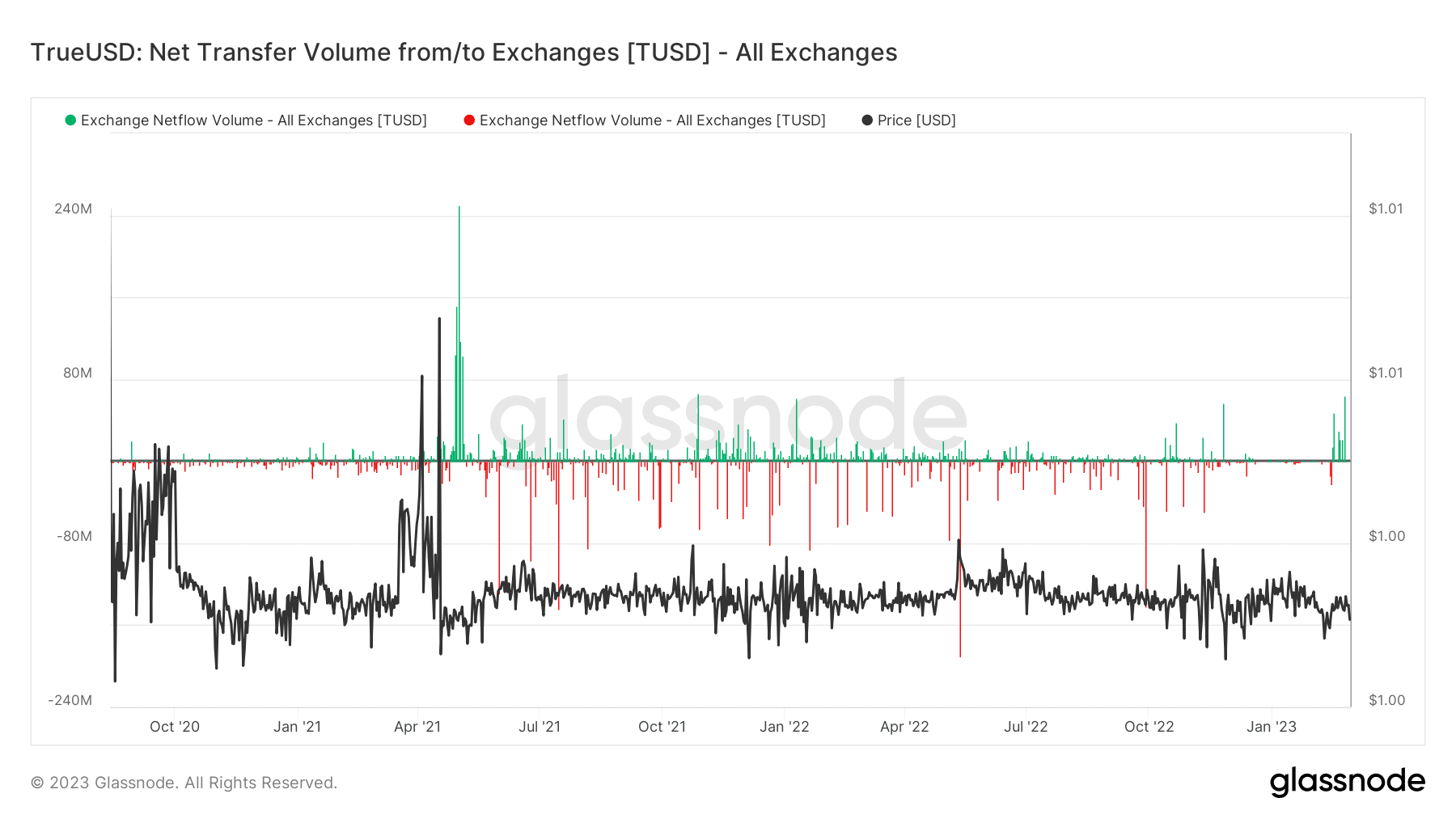

Glassnode’s Netflow measurement is simply a utile instrumentality for analyzing the enactment of a cryptocurrency similar True USD. Netflow refers to the quality betwixt the fig of coins flowing into and retired of a peculiar speech oregon mining pool. When the Netflow worth is supra 0, it indicates that much coins person flowed into the exchange/mining excavation than person flowed out.

Using this measure, Glassnode has observed that True USD’s enactment levels person precocious increased. This tin beryllium seen successful the important driblet successful enactment levels connected the illustration anterior to February, followed by a noticeable pick-up successful that month.

Additionally, the Netflow graph has shown a important affirmative increase, which has not been seen since October 2021. As of the clip of writing, the Netflow for True USD has surpassed 478,000 TUSD.

TrueUSD: Net Transfer Volume from/to Exchange (Source: Glassnode)

TrueUSD: Net Transfer Volume from/to Exchange (Source: Glassnode)Santiment shows bullish behaviour connected TUSD measurement YTD

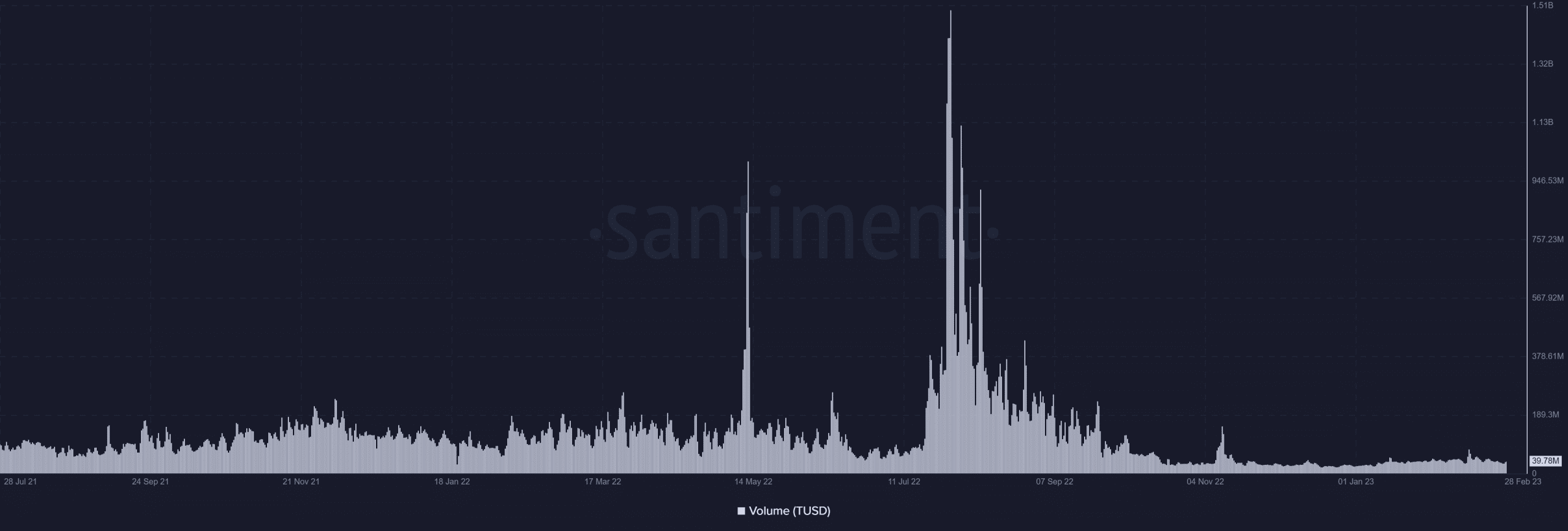

Examining Santiment’s measurement metric reveals that TUSD had displayed a alternatively unimpressive level of activity. However, determination are indications of a flimsy summation successful engagement.

TUSD monthly measurement (Source: Santiment)

TUSD monthly measurement (Source: Santiment)Market for stablecoins heating up

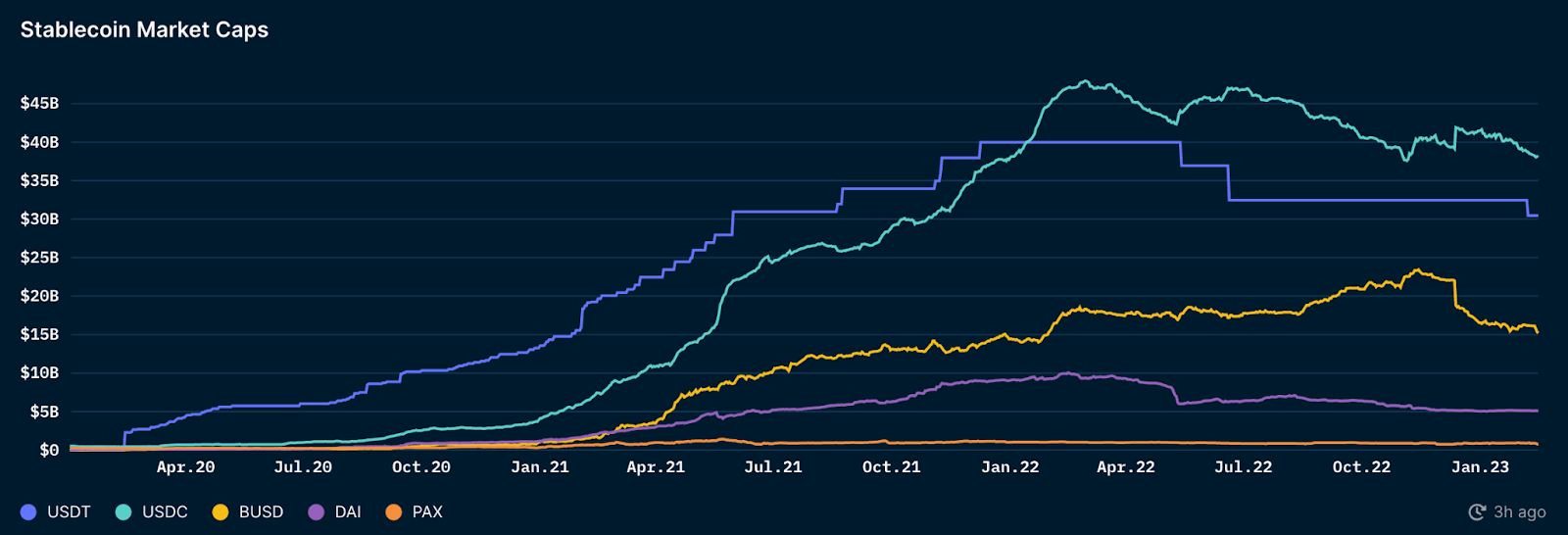

There are respective fashionable types of stablecoins successful the market, including decentralized under-collateralized algorithmic (UST), decentralized over-collateralized asset-backed (DAI), and centralized 1:1 backed versions specified arsenic USDC, USDT, and BUSD.

Nansen stablecoin measurement (Source: Nansen)

Nansen stablecoin measurement (Source: Nansen)During the erstwhile 24 months, BUSD and USDC person experienced singular growth, expanding by astir 1409% and 912%, respectively. Stablecoins are astir often disposable via centralized exchanges (CEXes) and bridges. An overview of the large four:

Overview of the large 4 stablecoins (Source: Nansen)

Overview of the large 4 stablecoins (Source: Nansen)BUSD formation apt fuelling maturation of different stablecoins

Recent blockchain probe by Nansen reveals that Binance USD (BUSD) has been facing a diminution successful demand, portion TUSD has been gaining popularity successful the market. This displacement successful request could beryllium owed to the caller quality that Coinbase intends to delist BUSD due to the fact that of regulatory issues.

As per the aforesaid Nansen report, Binance appears to beryllium attempting to retrieve its presumption by minting astir $130 cardinal worthy of TUSD successful the past week, suggesting a increasing reliance connected TUSD by the exchange. This determination could further lend to the summation successful TUSD’s marketplace cap, arsenic investors uncertainty the sustainability of BUSD successful the market.

However, contempt TUSD’s caller uptick, its marketplace valuation is inactive considerably smaller than that of Dai (DAI), which is presently the 4th largest stablecoin successful presumption of marketplace capitalization, worthy much than $5 billion. This suggests that portion TUSD whitethorn beryllium gaining ground, it inactive faces stiff contention from the apical players successful the stablecoin market.

The station True USD becomes 5th largest stablecoin aft marketplace headdress surges 15% appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)