The laminitis of Tron, Justin Sun, has established a strategical concern with the decentralized concern protocol Curve Finance. This concern volition present a stUSDT excavation connected Curve, marking a important milestone for some parties.

This concern occurs amidst sizeable marketplace turbulence that Curve Finance is presently facing. In the past 24 hours, the full worth of assets locked connected Curve Finance saw a drastic drop, falling astir by half from $3.26 cardinal to $1.731 billion.

As Justin Sun stated successful his tweet,

“Our associated efforts volition present a stUSDT excavation connected Curve, amplifying idiosyncratic benefits. Together, we purpose to empower the assemblage and forge a decentralized finance!”

The stUSDT excavation is touted arsenic the archetypal real-world plus protocol connected the Tron Network, adding a important milestone to their ledger.

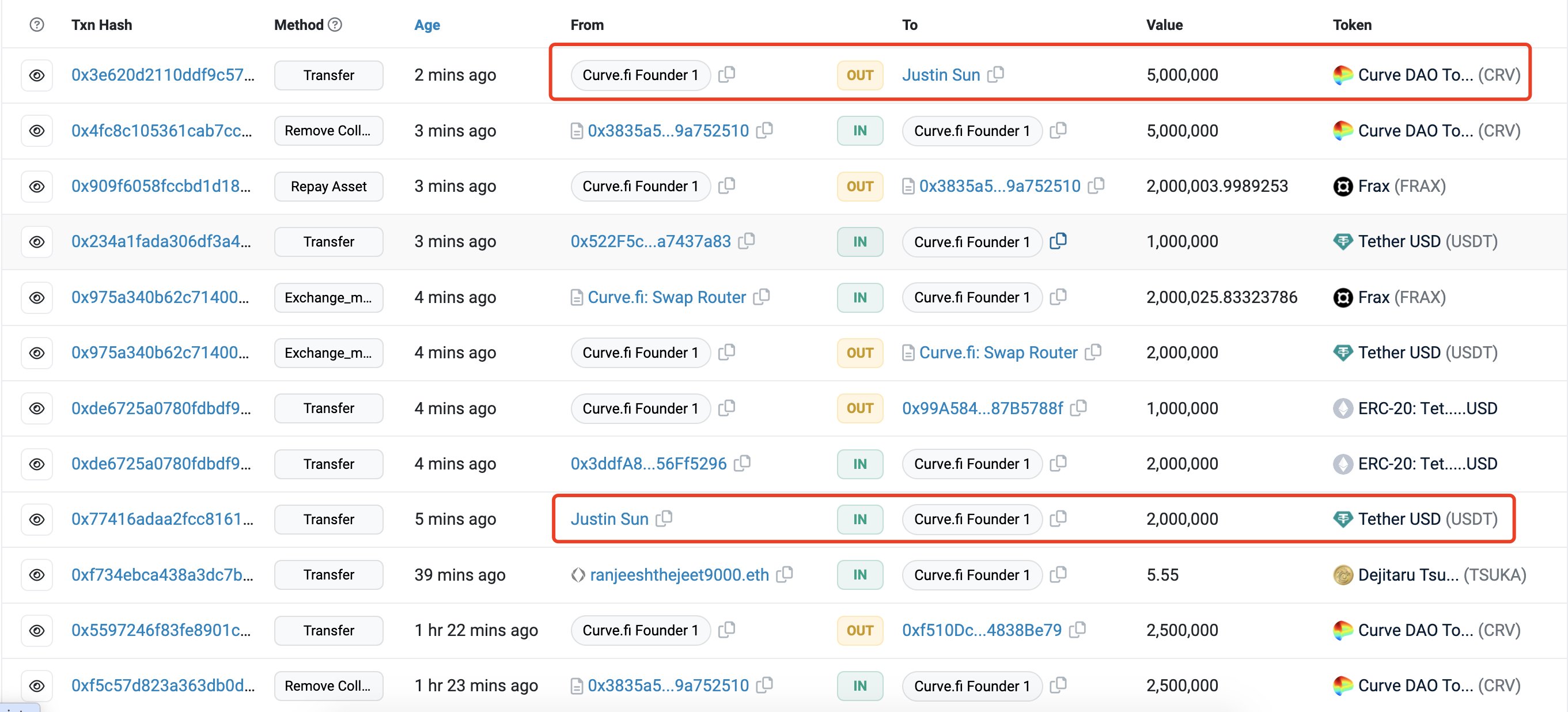

The concern announcement came soon aft an on-chain deal, arsenic revealed by PeckShield and Lookonchain. Sun procured 5 cardinal CRV tokens, valued astatine astir $2.9 million, from Curve laminitis Michael Egorov for $2 cardinal successful an OTC transaction.

Source: Lookonchain

Source: LookonchainCurve Finance exploit contagion.

The drastic driblet successful the plus worth connected Curve was attributed to an exploit of the protocol, starring to a fearfulness of liquidation and atrocious indebtedness among assemblage members. Delphi Digital had identified this precarious presumption of Curve Finance and its founder, Egorov, aboriginal connected Aug. 1.

Egorov holds a important indebtedness worthy astir $100M, backed by astir fractional of the full circulating proviso of CRV. With the CRV worth declining by 10% successful the past 24 hours, the wellness of Curve Finance is successful jeopardy.

In effect to the exploit, Egorov managed loans to debar liquidation portion making respective captious transfers, including repaying a 5.13 cardinal FRAX stablecoin indebtedness and reclaiming 12.5 cardinal CRV tokens arsenic collateral.

Market volatility remains a important concern, nonetheless. As reported by CryptoSlate, the terms of the CRV token experienced a 15% driblet to $0.64707. The contagion hazard whitethorn summation if hackers who clasp a important magnitude of CRV commencement selling.

However, it’s worthy noting that marketplace volatility besides remains a important concern. The CRV token’s terms dropped astir 15% to $0.64707, arsenic reported by CryptoSlate. The contagion hazard whitethorn further beryllium heightened if hackers holding a important magnitude of CRV commencement selling.

The concern betwixt Tron and Curve Finance could perchance unfastened caller opportunities for some parties, easing further liquidation fears.

The station Tron partners with turbulent Curve Finance to motorboat stUSDT excavation amid marketplace chaos appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)