Gold’s historical rally accelerated connected Monday, with spot prices punching done $3,800 per ounce to acceptable caller all-time record, extending a torrid twelvemonth successful which bullion is up astir astir 47% year-to-date.

That surge is echoing connected crossed crypto rails, with gold-backed tokens climbing to an all-time precocious marketplace capitalization of $2.88 billion, CoinGecko data shows. Tokenized versions of the metallic are backed by carnal reserves but settee connected blockchain rails, offering round-the-clock trading and near-instant transfers.

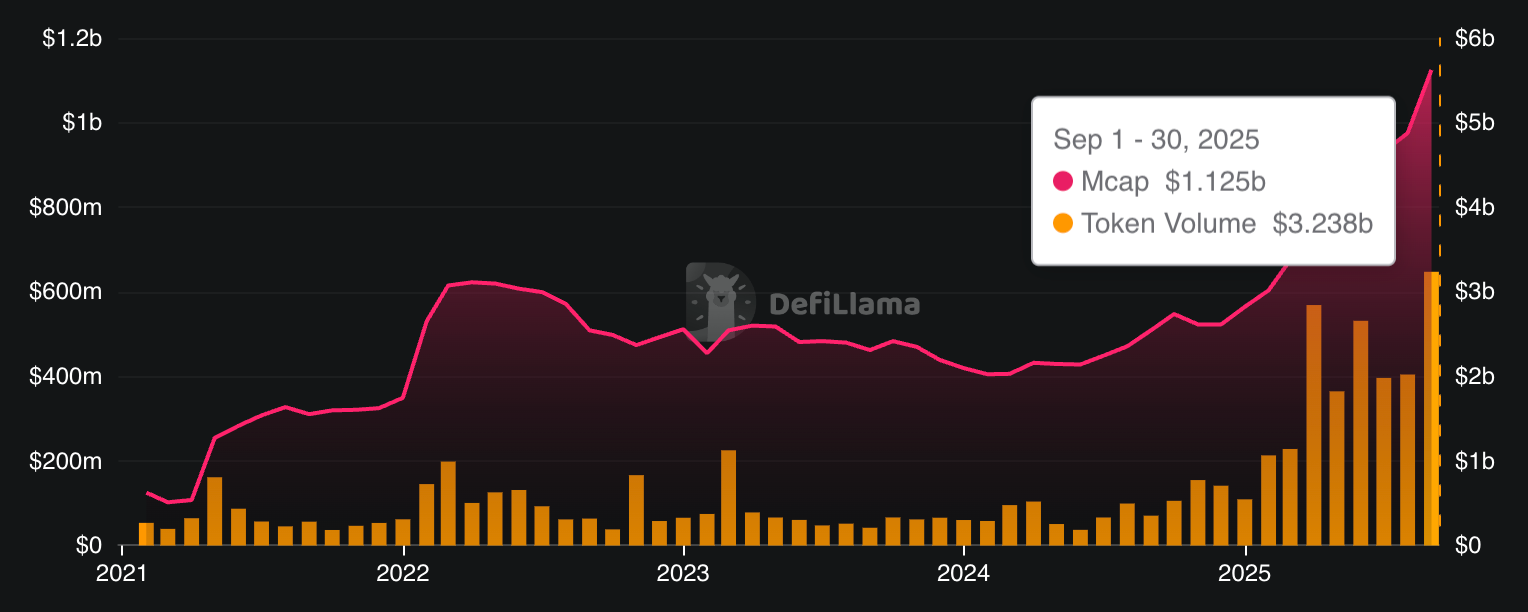

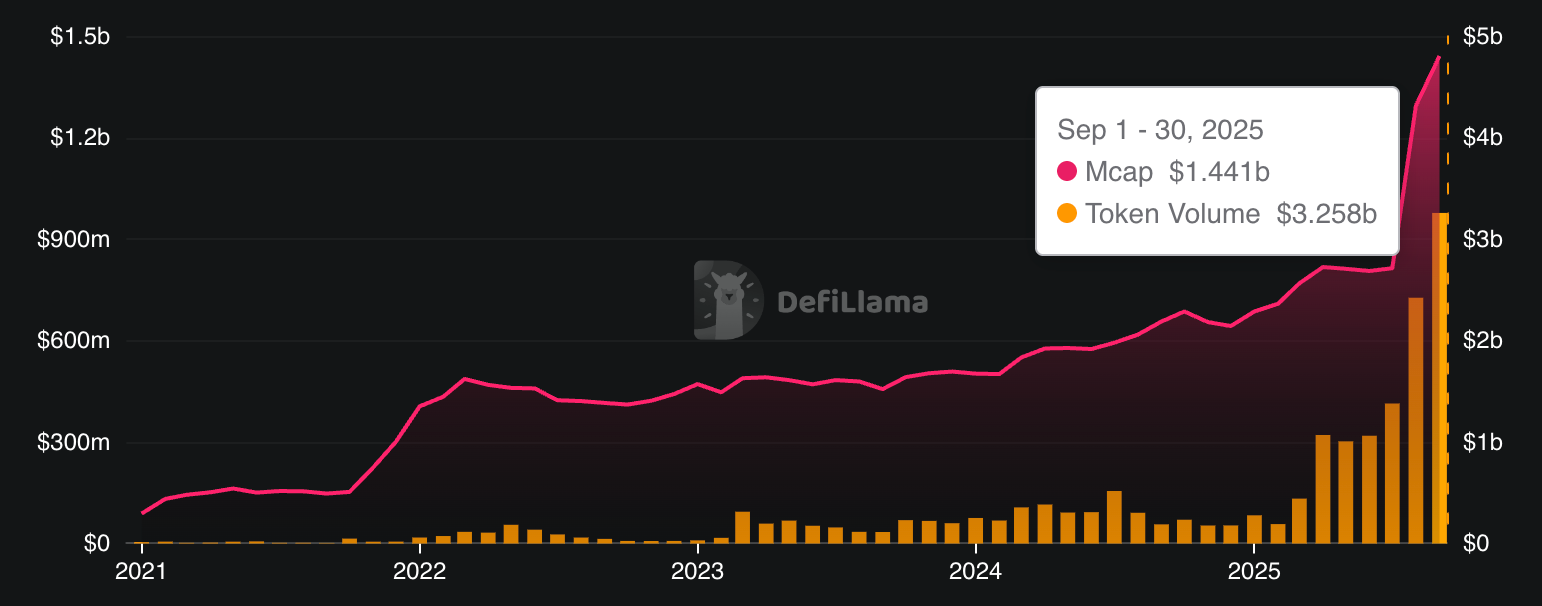

Tether Gold (XAUT) and Paxos' PAX Gold (PAXG), some tokens issued by firms predominantly known for their stablecoins, are dominating the category. XAUT’s capitalization stood adjacent $1.43 cardinal and PAXG’s astatine astir $1.12 billion, some astatine their respective all-time highs.

Liquidity has swelled alongside the rally, too. PAXG attracted much than $40 cardinal successful nett inflows during September and acceptable a caller trading measurement grounds surpassing $3.2 cardinal successful monthly turnover.

XAUT besides posted a grounds $3.25 cardinal successful monthly volume, per DeFiLlama. Meanwhile, the token's marketplace headdress maturation came solely from the underlying metal's appreciation, arsenic nary caller token minting happened this period aft August's $437 cardinal jump.

The tokenized golden marketplace could proceed gaining arsenic macro conditions stay supportive for the yellowish metal. Investors expectations equine for much Federal Reserve complaint cuts and a softer U.S. dollar, portion anxiousness builds implicit a imaginable authorities shutdown successful the U.S. Meanwhile, bitcoin (BTC), often dubbed arsenic "digital gold," is lagging down golden with a 22% year-to-date return.

Read more: Bitcoin to Join Gold connected Central Bank Reserve Balance Sheets by 2030: Deutsche Bank

1 month ago

1 month ago

English (US)

English (US)