The tokenization of existent satellite assets (RWAs) is gaining designation from institutions seeking collateral mobility, issuers making private, alternate assets much accessible to retail investors and crypto enthusiasts engaging successful much superior conversations arsenic compared to the NFT and memecoin craze of past years.

As predicted earlier this year, tokenization is solidifying its presumption and moving into the "pragmatists" information of the adoption doorbell curve. 2024 ended with a $50 cardinal marketplace headdress and arsenic of May 2025 has surpassed $65 billion, excluding stablecoins.

A caller conference, TokenizeThis 2025, brought unneurotic manufacture leaders to dive heavy into circumstantial areas of the tokenization space, celebrating innovative accomplishments and evaluating however to tackle remaining challenges to scope mainstream adoption. While the league sheet topics delved into granular areas, a mates overarching themes to item see 1) collateral mobility and caller inferior enhancing existent satellite assets and 2) the effects tokenization volition person connected concern strategies and workflows.

Adding inferior and collateral mobility

“I deliberation that's really what makes this exertion truthful almighty is that you're talking astir the aforesaid token but it tin beryllium utilized successful precise antithetic ways for precise antithetic investors arsenic agelong arsenic of people the hazard model is right,” said Maredith Hannon, Head of Business Development, Digital Assets astatine WisdomTree.

While tokenizing assets is straightforward, the existent accidental lies successful enabling much streamlined usage of assets compared to their accepted counterparts and addressing the needs of antithetic participants. A panel dedicated to this taxable shared examples of tokenized treasury products that tin beryllium utilized successful some retail and organization settings. Because blockchain allows an plus to determination much freely, a wealth marketplace money could beryllium utilized arsenic collateral connected a premier brokerage, eliminating the request to exit from that presumption frankincense inactive earning its corresponding output for the investor. From a retail perspective, the aforesaid is imaginable with a antithetic exertion wherever the money units tin beryllium utilized for outgo utilizing a debit paper linked to them. Utility tin beryllium added to other, higher hazard concern products arsenic good done antithetic applications depending connected the usage case, with the communal denominator being the usage of blockchain technology.

Along the aforesaid lines, lending and borrowing is being disrupted acknowledgment to tokenization. Going to a accepted lender (usually an institution) for currency is simply a cumbersome process.

“The extremity end successful my sentiment would beryllium that my kids erstwhile doing their archetypal owe conscionable use anonymously connected a owe saying ‘this is my concern I privation to get this for that’ and past she conscionable borrows it [from] galore radical astatine the aforesaid clip and repaying stablecoins… it's already rather daunting to speech to 20 banks due to the fact that you privation to bargain 1 apartment, astatine slightest this is however it works successful France close now,” said Jerome de Tychey, CEO astatine Cometh.

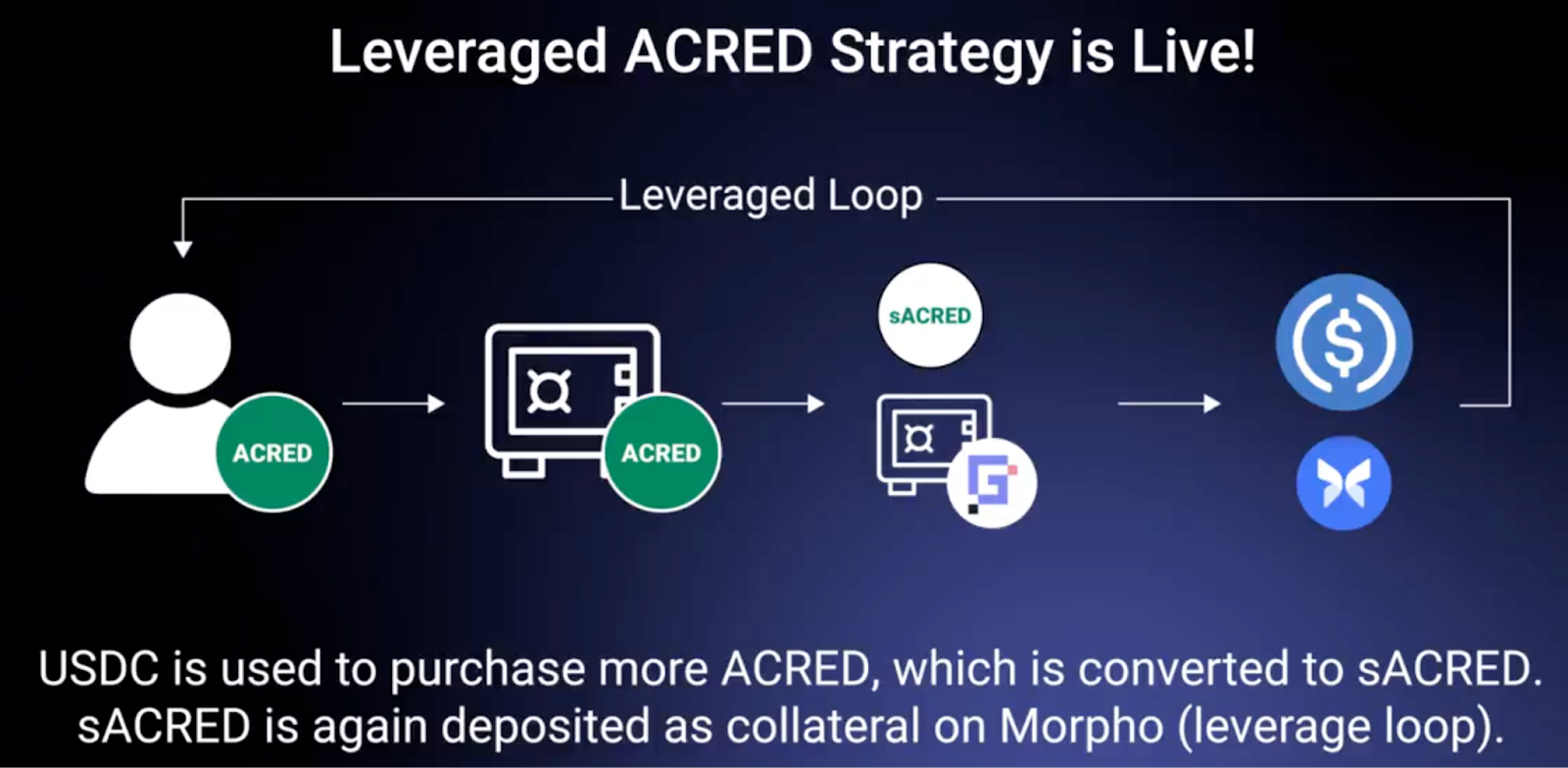

Jerome’s anecdote speaks to the powerfulness of decentralized concern for an idiosyncratic and however it tin fast-track a loan. Figure offers an internet-based solution for location equity lines of recognition (HELOCs) and adjacent they are utilizing the blockchain successful the backend. By issuing, warehousing and securitizing them, they’ve saved 150 bps retired of the process — an operational advantage. From an concern standpoint, the DeFi vaults sheet showcased however vaults streamline thing akin but for investors, with an illustration being Apollo’s tokenized backstage recognition money present utilizing this exertion to alteration leverage loops. This means borrowed stablecoin tin beryllium utilized to bargain much of the asset, expanding output portion being taxable to a built-in programmatic hazard framework.

Source: Securitize

However, challenges stay to beryllium solved earlier vaults tin instrumentality off, specified arsenic precocious custody and liquidity proviso costs, constricted RWA composability successful DeFi and minimal entreaty to crypto-native users seeking higher returns. Despite these obstacles, participants expressed enthusiasm for aboriginal possibilities.

How RWAs are impacting accepted strategies and workflows

“The crushed this exertion is truthful almighty is due to the fact that it's a computer. If you deliberation astir each the mediate and backmost bureau enactment from originating an plus to selling it, however galore intermediaries interaction it and instrumentality fees, however galore radical guarantee indebtedness tapes lucifer with received funds — bringing that workflow on-chain is acold much meaningful than conscionable focusing connected the plus itself,” said Kevin Miao, Head of Growth astatine Steakhouse Financial.

Traditional markets person had a challenging clip incorporating little liquid, higher yielding assets into concern strategies owed to analyzable backmost and mediate bureau needs for transfers, servicing, reporting and different factors. Automating transportation processes and providing on-chain transparency would marque it easier for these assets to beryllium allocated successful and retired of, successful summation to cryptocurrencies introducing caller concern opportunities.

Cameron Drinkwater from S&P Dow Jones Indices and Ambre Soubiran from Kaiko discussed however blockchain volition unlock antecedently inaccessible portfolio operation tools. They shared however this could effect successful blockchain-native concern strategies combining crypto and backstage plus allocations for greater diversification and caller sources of yield.

Achieving this, however, requires interoperability betwixt bequest and blockchain-based infrastructure and betwixt blockchains themselves. Some captious elements see aligning workflows, terms transparency, rebalancing, on-chain identity, hazard appraisal considerations and hazard absorption solutions. Providing maximum visibility into these assets and tools to navigate markets on-chain is 1 cardinal measurement in.

RWAs are shifting from theoretical blockchain to applicable tokenized plus implementation successful accepted and decentralized finance. The absorption is present connected enabling existent inferior done amended collateral mobility, caller fiscal products and much businesslike workflows. By improving interoperability and individuality frameworks, tokenization is expected to democratize illiquid assets and heighten fiscal efficiency. For further recordings of the informational sessions, delight sojourn STM TV connected YouTube.

3 months ago

3 months ago

English (US)

English (US)