DigitalX Limited, an Australian integer Investment manager, has made headlines with a caller Bitcoin (BTC) acquisition, signaling renewed organization assurance successful the market. The ASX-listed crypto money manager has expanded its Bitcoin treasury by a whopping 74.7 BTC, marking a important summation to its already existing holdings.

DigitalX Buys 74.7 BTC

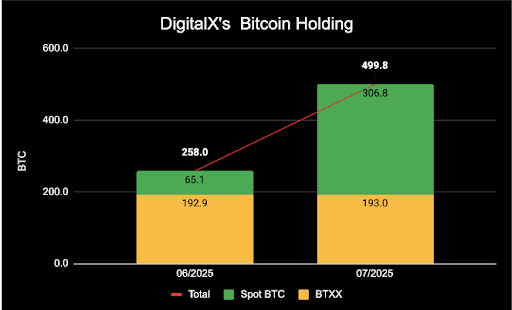

In a caller X societal media post connected July 23, DigitalX confirmed the summation of 74.7 BTC to its treasury. The acquisition, completed astatine an mean terms of $117,293 per BTC, reflects the company’s ongoing committedness to its Bitcoin-led strategy. This latest acquisition has raised the crypto money manager’s full Bitcoin holdings to 499.8 BTC, valued astatine astir $91.3 million.

Notably, the institution besides announced and expanded connected the details of this large-scale Bitcoin acquisition successful an authoritative connection connected Investorhub. Of its full 499.8 BTC holdings, 306.8 BTC are held straight by DigitalX, portion the remaining 193 coins are held indirectly done 881,000 units successful its ASX-listed Bitcoin ETF, BTXX.

Source: Investorhub connected X

Source: Investorhub connected XThe caller summation of 74.7 Bitcoin follows an earlier acquisition of 57.5 BTC disclosed by the institution connected July 18, 2025. These back-to-back purchases show a continued reallocation of DigitalX’s integer plus treasury toward Bitcoin. The firm’s full treasury, excluding cash, present exceeds $104.4 million.

As portion of its semipermanent crypto strategy, DigitalX’s targeted portfolio accommodation reinforces its relation arsenic a starring institutional-grade Bitcoin concern conveyance connected the Australian Securities Exchange. The crypto money manager highlights its latest acquisition arsenic a cardinal measurement successful its ongoing effort to found Bitcoin arsenic its halfway treasury reserve asset.

Shareholder Focus Sharpens As Bitcoin Treasury Value Rises

According to its authoritative statement, DigitalX’s strategy goes beyond simply increasing its BTC reserve. It besides aims to heighten shareholder worth done accordant and transparent reporting. The crypto money manager present tracks its Bitcoin holdings per stock successful Satoshis (Sats), the smallest portion of BTC.

As of the latest update, DigitalX’s BTC per stock stands astatine 33.88 Sats, marking a 58% summation successful its Bitcoin treasury worth since June 30, 2025. This fig reflects the interaction of caller acquisitions and provides a somewhat measurable benchmark for investors assessing vulnerability to the company’s sizeable portfolio.

By prioritizing Bitcoin accumulation and optimizing its treasury structure, DigitalX continues to presumption itself arsenic a salient crypto-centric firm—one that views shareholder worth arsenic straight tied to the spot and maturation of its BTC holdings. The institution is besides doubling down connected its semipermanent imaginativeness of leveraging the flagship cryptocurrency arsenic a strategical fiscal foundation.

Leigh Travers, erstwhile CEO and contiguous Non-Executive Chairman of DigitalX, reaffirmed the company’s committedness to its integer plus goals, stating that it aims to steadily turn its BTC portfolio passim the twelvemonth and good into the future.

Featured representation from Pixabay, illustration from Tradingview.com

3 months ago

3 months ago

English (US)

English (US)