“Fed Watch” is simply a macro podcast, existent to bitcoin’s rebel nature. In each episode, we question mainstream and Bitcoin narratives by examining existent events successful macro from crossed the globe, with an accent connected cardinal banks and currencies.

Watch This Episode On YouTube Or Rumble

Listen To The Episode Here:

In this episode, CK and I screen a ample chunk of the ongoing macro news. First, we update the concern successful the U.K. gilt market. Then plaything implicit to China to screen developments from the 20th Party Congress, the existent property marketplace and the wide concern climate. Lastly, we sermon the European vigor situation and existent retention situation.

Charts And Bitcoin Sentiment

Each week, CK and I pb disconnected with a fewer charts including bitcoin and different currencies to halfway our macro speech from that perspective.

In the week of October 17, 2022, the bitcoin illustration was showing continuing beardown enactment successful the scope of $17,500-$18,500 contempt each the geopolitical and planetary economical stresses happening. The stableness of bitcoin comparative to astir different assets indispensable beryllium getting noticed by radical managing ample superior pools successful the world.

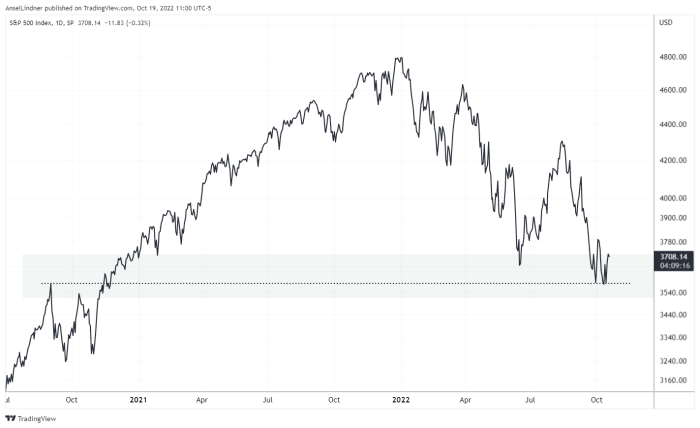

CK and I besides spoke concisely astir the U.S. banal marketplace and its likewise unchangeable performance. If you were lone to perceive and work the mainstream fiscal property and ne'er look astatine the charts, you mightiness beryllium fooled into reasoning stocks were overmuch lower, oregon astatine slightest falling connected a regular basis. However, arsenic it stands now, the S&P 500 is above the June low.

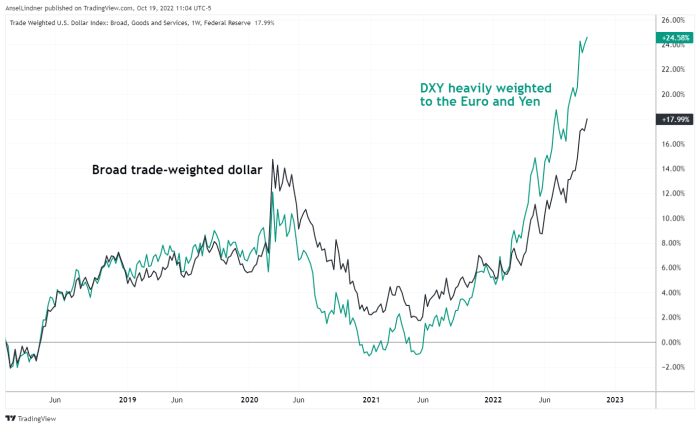

Below is my dueling dollar indices chart, showing the DXY which is heavy weighted toward the euro and yen, and the wide trade-weighted dollar scale that includes galore much currencies depending connected their stock of commercialized with the United States. Importantly, this includes the Chinese yuan and Mexican peso.

As you tin see, the trade-weighted dollar performed amended during the archetypal COVID-19 crash, but has lagged the euro-heavy DXY. What this means is dollar spot has go much broad-based successful the past mates of weeks.

The past currency illustration we analyse is the Japanese yen, which is crashing versus the dollar, reaching 150 yen to the dollar. In the broadcast, I notation that this is an illustration of the dollar’s existent effects passim East Asian currencies.

United Kingdom Gilt Recap And Credit Suisse

Admittedly, CK and I person not watched the situation successful the U.K. arsenic intimately arsenic different things, truthful we instrumentality an accidental to recap the timeline of what’s gone connected determination truthful far.

The Bank of England (BoE) announced involution connected September 28, aft the semipermanent gilt marketplace sold disconnected from astir 2% yields to 4.5% yields successful a substance of weeks. On earlier shows, I mentioned the value of the extremity of the Q3 for fiscal stress, which is good known, but for immoderate crushed the BoE decided to statesman quantitative tightening (QT) 1 week anterior to the extremity of the quarter.

On October 3, the BoE adjusted their involution size up to £10 cardinal per day, and an extremity day for the programme of October 14. Most economical commentators did not deliberation it would beryllium imaginable to extremity it truthful rapidly and successful specified a telegraphed manner. They were proven wrong, arsenic the “no quantitative easing” programme ended connected the projected date. The latest is that the BoE volition resume their QT attempts connected November 1.

We besides spoke astir the absorbing coincidence of the exigency swap lines betwixt the Federal Reserve and the Swiss National Bank (SNB) that took spot during the highest of the BoE’s troubles. I speculated that this swap enactment could person served arsenic an obscured bailout of these troubled fiscal institutions successful London, routed done the SNB.

The situation seems to beryllium nether power for the moment, but the harm whitethorn person been done. In these fiscal situation episodes, assurance is breached and contempt the acute panic being over, the marketplace is shifted to a much fragile authorities of caput going forward. This tin pb to the situation popping backmost up aft a fewer months.

China’s Economy And The 20th Party Congress

I did not propulsion immoderate quotes for the amusement from Xi Jinping’s two-hour opening speech. I provided a link to the afloat transcript and I promote radical to work it for themselves. It is eye-opening to spot the rhetoric, the devotion to Marxist-Leninist communism and the hubris of authoritarian cardinal planners.

What I did screen straight successful the occurrence was a blog station by BlackRock and a tweet thread by Michael Pettis, confirming immoderate of my views connected the authorities of China contiguous and their way successful the adjacent term.

BlackRock’s words are important arsenic they correspond what ample superior pools deliberation astir China. From their post, we larn that Chinese export volumes are apt to beryllium down 6% this twelvemonth and next, though successful nominal dollar presumption they volition beryllium up 3%. The authors besides enactment the horrific demographic concern successful China and accidental it precludes the needed home maturation to counteract the effect of shrinking exports. In a state with monolithic indebtedness and demographic issues, this is not a look for economical growth.

“Recession is looming present for the U.S., U.K. and Europe. But this time, China won’t beryllium coming to its own, oregon anyone else’s, rescue.”

Michael Pettis, Senior Fellow astatine the Carnegie Endowment and prof of concern astatine Peking University’s Guanghua School of Management, seems to hold with the absorption of the Chinese system successful the mean term. His tweet thread exposes the no-win concern faced by the Ministry of Finance successful China.

The Ministry of Finance said that state-backed entities are strictly prohibited from purchasing onshore by raising debt. Pettis agrees with this prohibition, due to the fact that “local governments [reversing] the diminution successful land-sale revenues by mounting up SPVs to bargain onshore from themselves [as] a mode for them to get wealth and unreal the proceeds were really land-sale revenues.”

Pettis, however, emphasizes the aforesaid no-win script facing the Ministry of Finance that the BlackRock comments did. Namely, that Beijing has nary country to stimulate. They are cracking down, but not offering immoderate help.

“The MoF stopped them from faking revenues without addressing the reasons they had to bash so.”

Pettis continues:

“Beijing indispensable cognize however hard the circumstances are that section governments face, and yet isn't doing overmuch to help. I deliberation we are astir apt seeing the opening of what implicit the adjacent fewer years volition beryllium a precise contentious narration betwixt section governments and Beijing.”

This does not bode good for Beijing and Xi, particularly arsenic the U.S. rhetoric, sanctions connected spot manufacturing and arming of Taiwan is picking up pace. There is simply a existent existential menace to the Chinese Communist Party appearing.

European Energy Non-Crisis?

We had Andreas Steno connected the show a fewer weeks ago, due to the fact that I wanted to perceive his sober investigation of the European vigor crisis. He was the 1 expert I saw pushing backmost against the panic narrative.

He is backmost successful the signifier of a tweet thread this week and connected the amusement I rapidly work done the highlights. They are:

- Natural state retention is astir afloat successful Europe mode up of schedule.

- Energy prices are rapidly coming down to normal.

- There is simply a immense backlog successful liquid earthy state ships disconnected Europe’s coasts waiting to unload.

What struck maine astir this investigation is however overmuch it reminded maine of the April 2020 lipid futures crash. At the time, lipid retention was afloat and tankers were loitering astir the satellite — besides full. There was simply nary spot to instrumentality transportation of the futures contracts, truthful holders had to merchantability astatine immoderate price, causing a flash clang to zero.

Could we spot the aforesaid happening successful Europe this month? Not rather yet, but it is astatine slightest a possibility. What a clown satellite crook of events. From monolithic grounds highs to a zero terms being a anticipation successful a substance of months.

This is simply a impermanent station by Ansel Lindner. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)