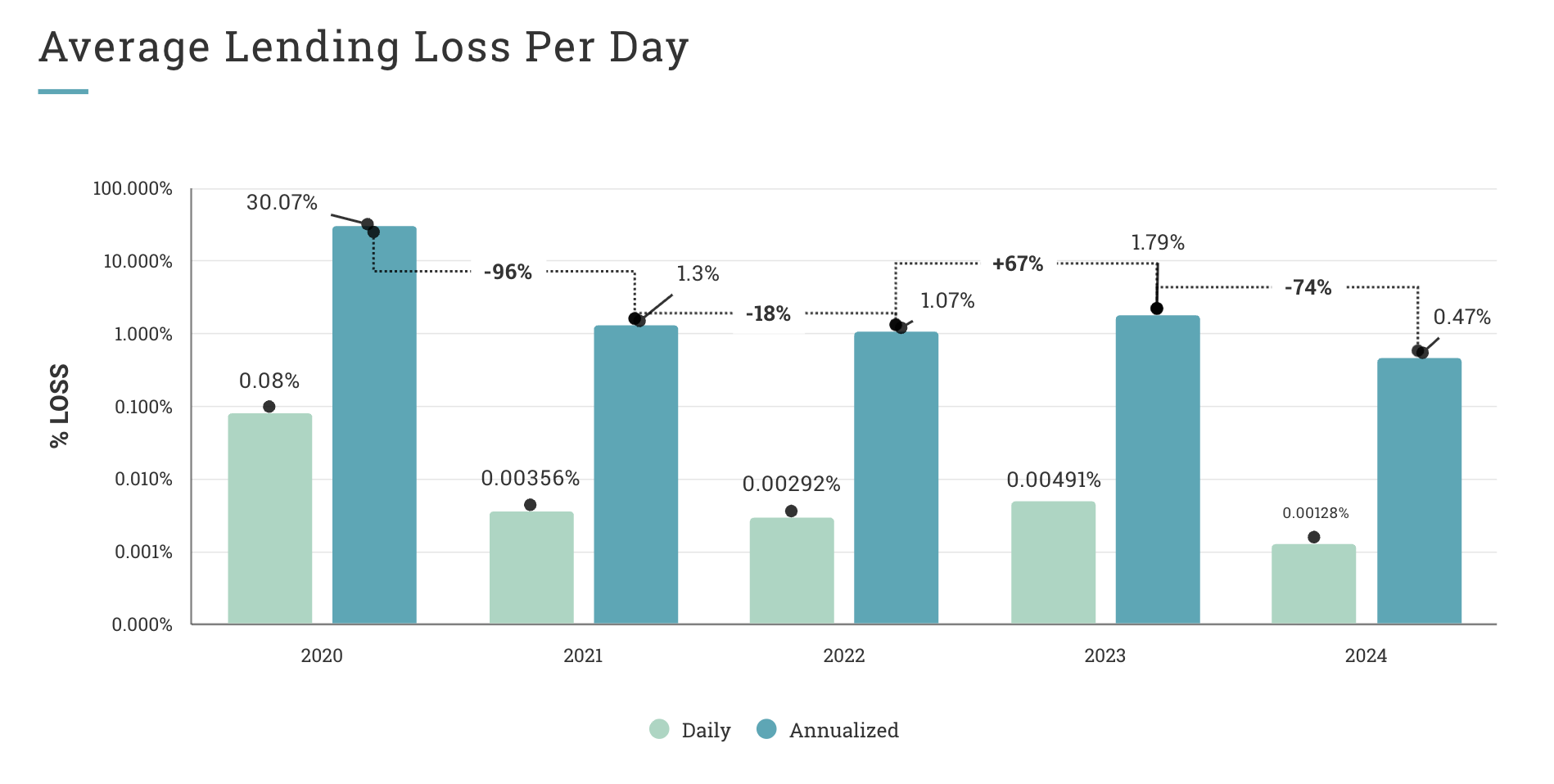

The decentralized concern (DeFi) assemblage has undergone a singular information transformation, achieving a 90% simplification successful exploit losses since 2020 and positioning itself arsenic mature fiscal infrastructure susceptible of organization adoption. Our investigation reveals that DeFi protocols person not lone survived the “experimental era” but person systematically evolved into immoderate of the astir unafraid fiscal systems successful existence, with regular nonaccomplishment rates plummeting to conscionable 0.0014% by 2024.

This improvement represents much than statistical improvement; it demonstrates that decentralized fiscal systems tin execute and support organization people information erstwhile broad hazard frameworks are implemented. The travel from 30.07% annualized losses successful 2020 to 0.47% successful 2024 marks the modulation from experimental protocols to mature fiscal infrastructure susceptible of serving organization standard superior deployment.

Five chiseled information phases person defined DeFi’s maturation: The "Experimental Era" of 2020 saw devastating 30.07% annualized losses owed to unaudited astute contracts and cardinal vulnerabilities. The "First Security Revolution" of 2021 delivered an unprecedented 96% betterment done wide adoption of nonrecreational auditing, bug bounty programs and ceremonial verification. After a little optimization plateau successful 2022 and concerning backslide successful 2023, the "Comprehensive Security Achievement" of 2024 established caller standards with 74% nonaccomplishment simplification contempt accrued protocol complexity.

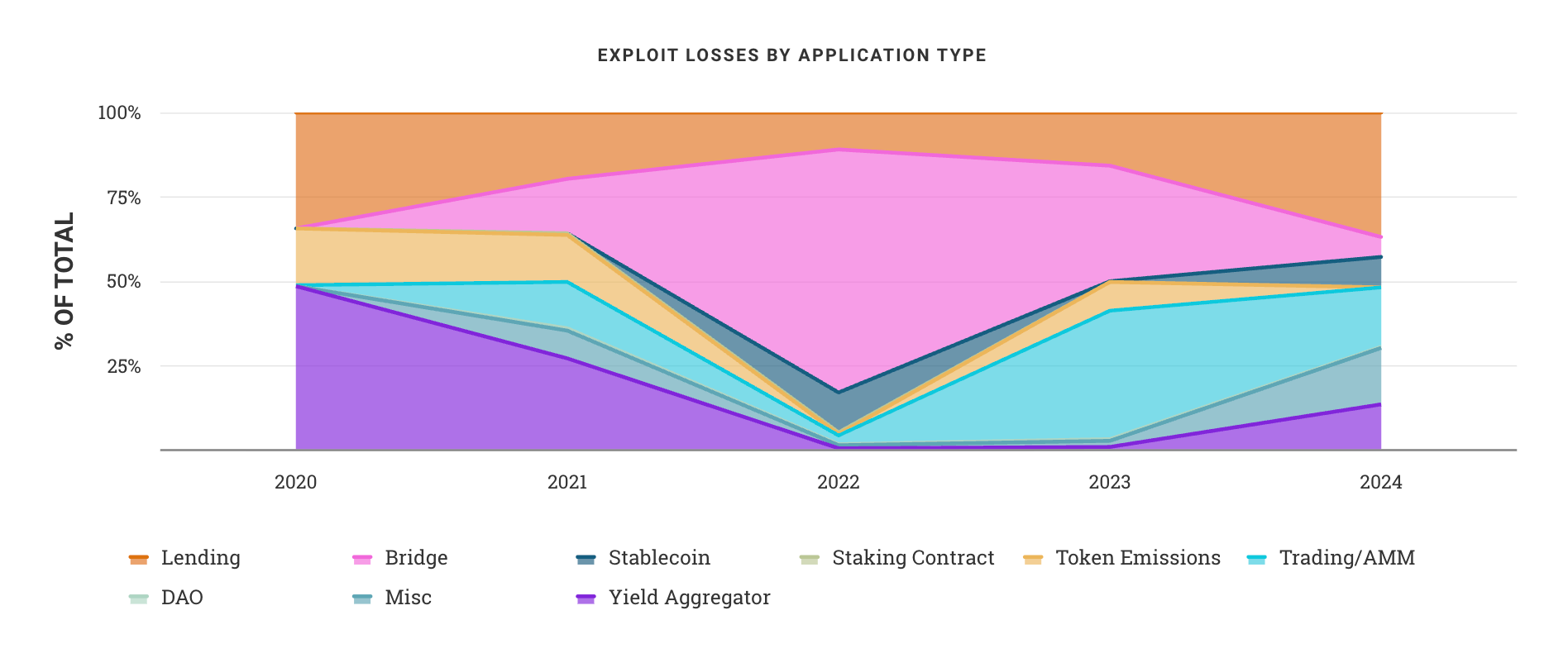

Attack patterns person fundamentally shifted, revealing some advancement and evolving challenges. Yield aggregators, which dominated aboriginal DeFi hacks astatine 49% successful 2020, person declined to conscionable 14% by 2024 arsenic protocols matured. Conversely, trading and automated marketplace shaper (AMM) platforms emerged arsenic superior targets, increasing from 0% to 18% of attacks arsenic attackers absorption connected high-value, high-liquidity protocols. Most significantly, backstage cardinal compromises person go the fastest-growing onslaught vector, jumping from 0% to 20% of incidents, highlighting that arsenic method information improves, attackers progressively people operational information weaknesses.

The lending assemblage exemplifies this translation astir dramatically, achieving an bonzer 98.4% betterment successful information from 2020 baseline levels. DeFi lending protocols present support regular nonaccomplishment rates of conscionable 0.00128%, making them 62.5 times much unafraid than during the experimental period. This betterment encompasses broad extortion against astute declaration vulnerabilities, flash indebtedness attacks, pricing manipulation, oracle failures and governance exploits.

Why this matters: The information achievements documented successful this investigation fundamentally situation prevailing narratives astir DeFi hazard and show that decentralized protocols tin lucifer oregon transcend accepted fiscal strategy information standards. The instauration of the Structural Risk Factor (SRF) model provides a methodology for accurately assessing protocol risks successful real-world plus (RWA) applications, enabling much informed superior allocation decisions. As organization adoption accelerates and regulatory frameworks crystallize, these information improvements presumption DeFi arsenic morganatic fiscal infrastructure alternatively than experimental technology, with profound implications for the aboriginal of stablecoins and planetary finance.

The information reveals that DeFi has successfully transitioned from high-risk experimental protocols to unafraid fiscal infrastructure, with broad defence systems present addressing aggregate onslaught vectors simultaneously alternatively than defending against idiosyncratic threats successful isolation. This translation establishes the instauration for analyzable decentralized fiscal products and institutional-scale superior deployment, proving that community-driven information innovation tin execute results that rival centralized alternatives.

3 hours ago

3 hours ago

English (US)

English (US)