Realized terms is simply a metric often utilized to find marketplace movements successful carnivore and bull markets. Defined arsenic the worth of each Bitcoins astatine the terms they were bought divided by the fig of circulating coins, realized terms efficaciously shows the cost-basis of the network.

Dividing the web into cohorts tin assistance america bespeak the aggregate outgo ground for each large radical owning Bitcoin. Long-term holders (LTHs) and short-term holders (STHs) are the 2 superior cohorts driving the marketplace — LTHs are each addresses that held BTC for longer than 155 days, portion STHs are addresses that held onto BTC for little than 155 days.

The LTH-STH outgo ground ratio is the ratio betwixt the realized terms for semipermanent and short-term holders. Given the historically antithetic behaviors LTHs and STHs exhibit, the ratio betwixt their realized prices tin exemplify however the marketplace dynamic is shifting.

For example, an uptrend successful the LTH-STH outgo ground ratio is seen erstwhile STHs recognize much losses than LTHs. This shows that short-term holders are selling their BTC to LTHs, indicating a carnivore marketplace accumulation signifier led by LTHs.

A downtrend successful the ratio shows that LTHs are spending their coins faster than STHs. This indicates a bull marketplace organisation phase, wherever LTHs merchantability their BTC for profit, which STHs bargain up.

An LTH-STH outgo ground ratio higher than 1 indicates that the outgo ground for LTHs is higher than the outgo ground for STHs. This has historically correlated with late-stage carnivore marketplace capitulations that turned into bull runs.

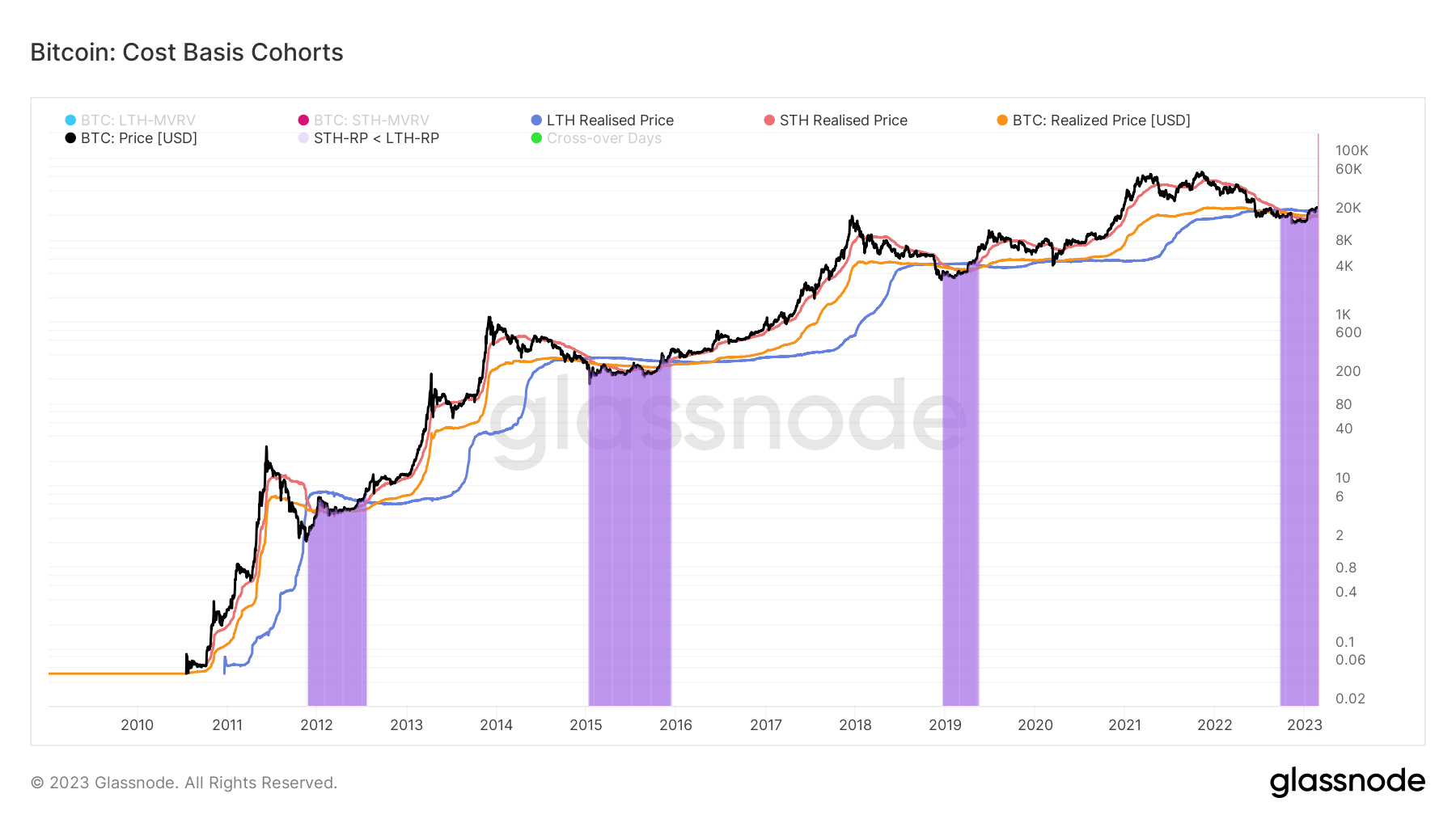

Graph showing the cost-basis for Bitcoin cohorts from 2010 to 2023 (Source: Glassnode)

Graph showing the cost-basis for Bitcoin cohorts from 2010 to 2023 (Source: Glassnode)2011

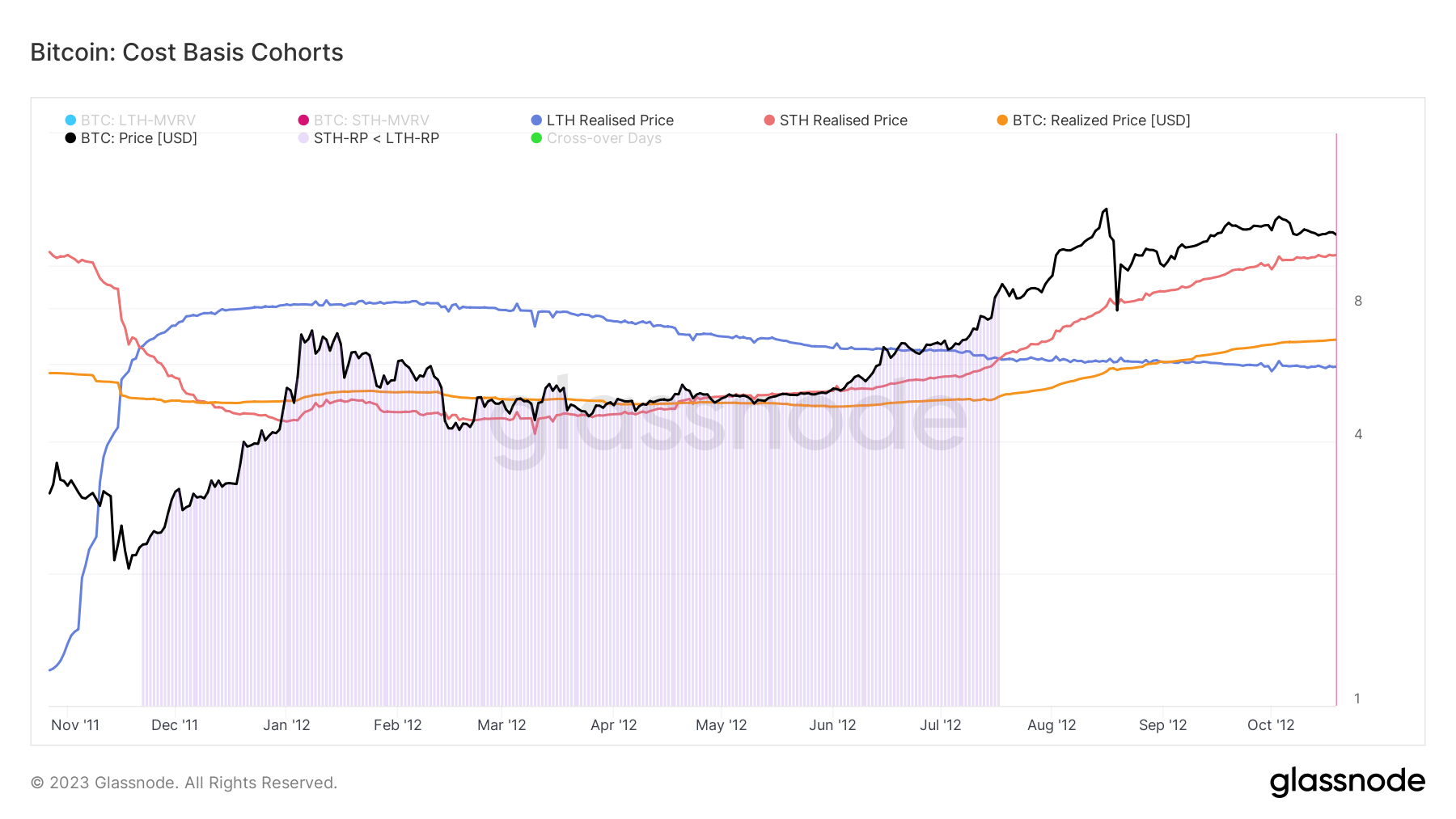

During Bitcoin’s archetypal carnivore marketplace successful 2011, the STH realized terms went beneath the LTH realized price. This inclination reversal marked the opening of a carnivore marketplace which started connected Nov. 22, 2011 and lasted until Jul. 17, 2012.

Long-term holders accumulated BTC passim the carnivore market, dollar-cost averaging (DCA) and bringing their cost-basis down. Buying during suppressed prices created a caller influx of short-term holders that pushed Bitcoin’s terms up. This summation successful STH accumulation caused the STH realized terms to rise, expanding the wide cost-basis of the web with it.

Graph showing the cost-basis for Bitcoin cohorts during the 2011/2012 carnivore marketplace (Source: Glassnode)

Graph showing the cost-basis for Bitcoin cohorts during the 2011/2012 carnivore marketplace (Source: Glassnode)2015

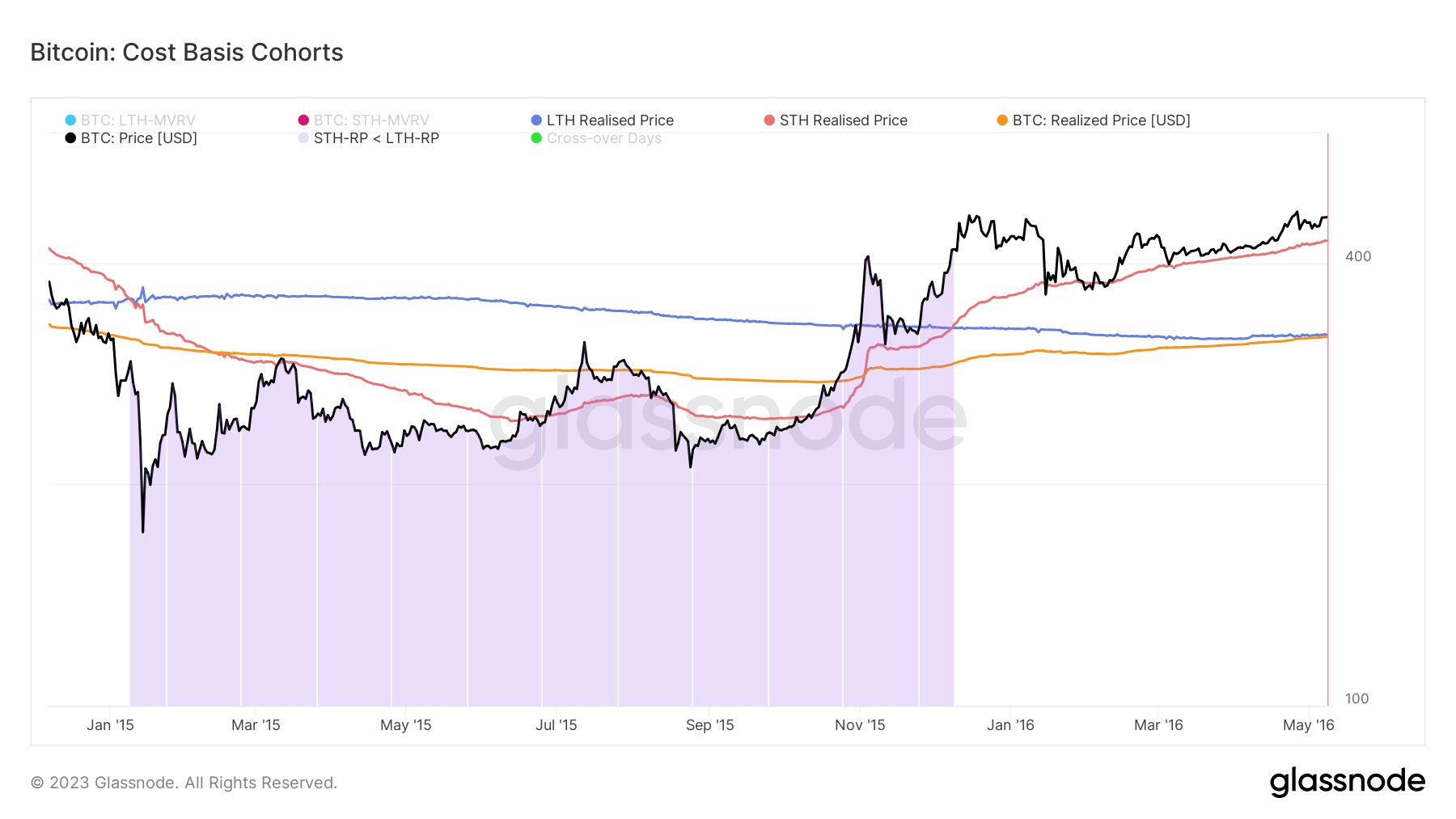

The 2015 carnivore marketplace followed a akin pattern. On Jan. 8, 2015, the STH realized terms dropped beneath the LTH realized price, triggering a carnivore marketplace that lasted until Dec. 08, 2015.

While Bitcoin’s terms began recovering successful aboriginal November 2015, it wasn’t until the opening of December that the STH realized terms broke supra the LTH realized price. At the time, the wide outgo ground of the web accrued slightly, triggering a carnivore marketplace reversal that saw Bitcoin’s terms spell past $400.

Graph showing the cost-basis for Bitcoin cohorts during the 2015 carnivore marketplace (Source: Glassnode)

Graph showing the cost-basis for Bitcoin cohorts during the 2015 carnivore marketplace (Source: Glassnode)2018

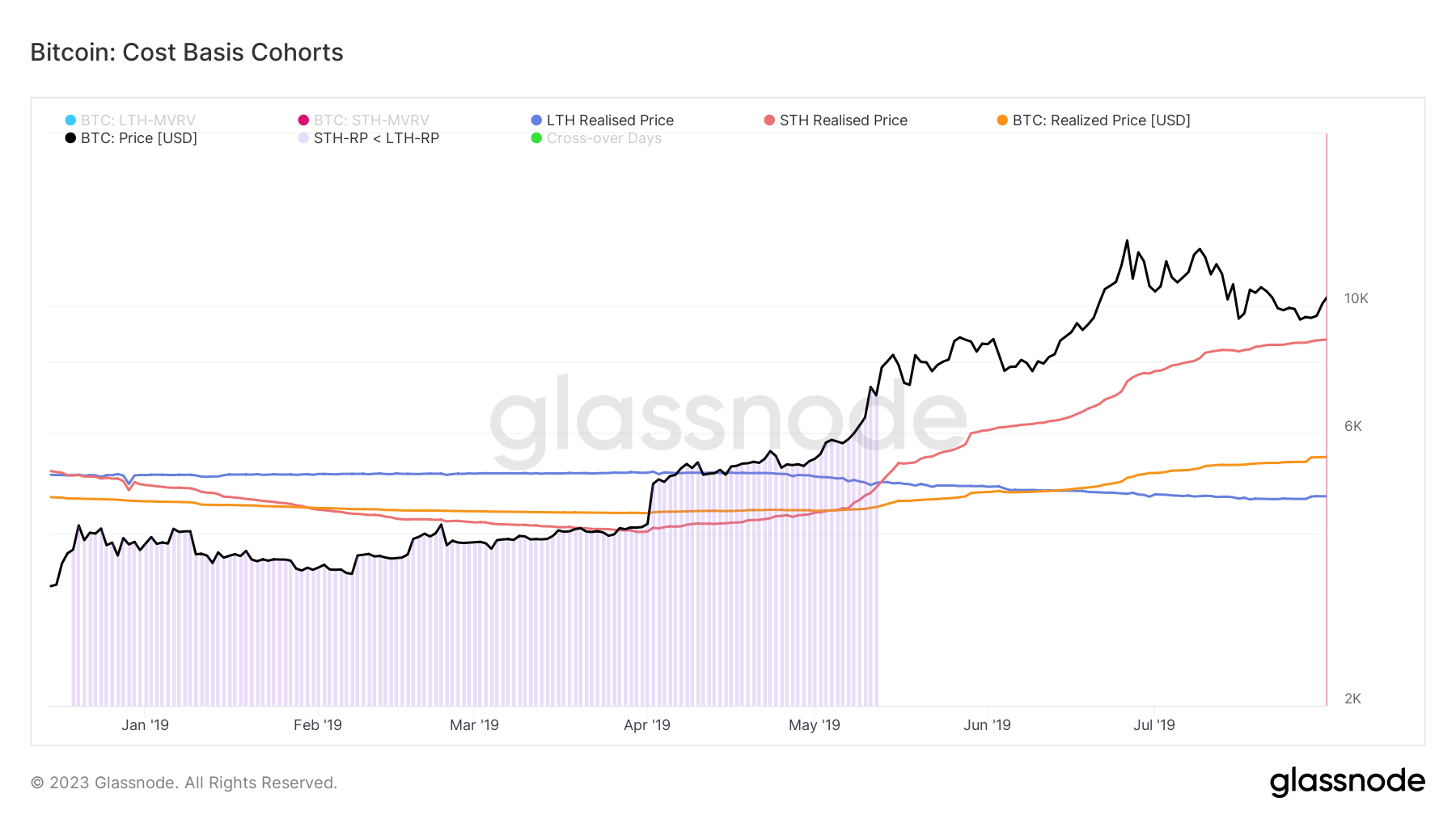

Bitcoin’s coveted rally to $20,000 successful precocious 2018 ended erstwhile the STH realized terms declined. It dropped beneath the LTH realized terms connected Dec. 20, 2018, pushing Bitcoin’s spot terms mode beneath its realized price.

The carnivore marketplace ended connected May 13, 2019, erstwhile the STH realized terms bounced backmost supra the LTH realized price.

Graph showing the cost-basis for Bitcoin cohorts during the 2018/2019 carnivore marketplace (Source: Glassnode)

Graph showing the cost-basis for Bitcoin cohorts during the 2018/2019 carnivore marketplace (Source: Glassnode)2022

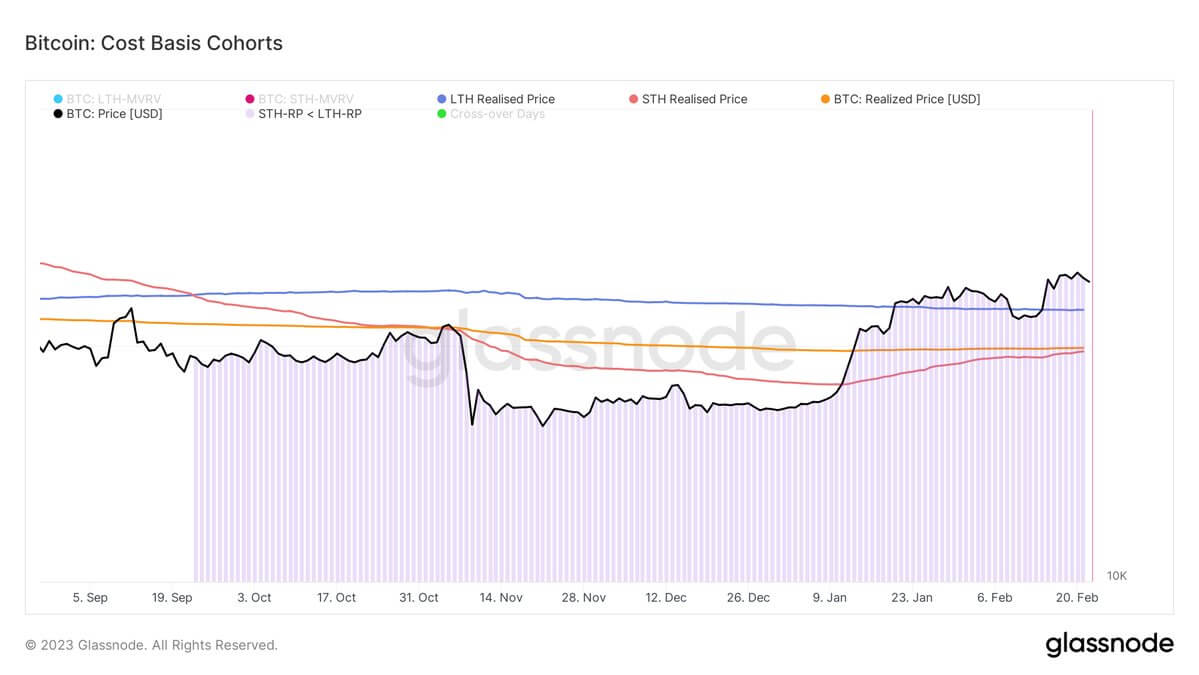

The STH realized terms began descending astatine the opening of September 2022, dripping beneath the LTH realized terms connected Sept. 22, 2022. It continued downward until Jan. 10, 2023, erstwhile it began a dilatory and dependable rebound that astir brought it connected par with Bitcoin’s realized price.

The STH realized terms presently stands astatine $19,671, portion the LTH realized terms is $22,228. Bitcoin’s realized terms is $19,876.

Graph showing the cost-basis for Bitcoin cohorts from Sept. 2022 to Feb. 2023 (Source: Glassnode)

Graph showing the cost-basis for Bitcoin cohorts from Sept. 2022 to Feb. 2023 (Source: Glassnode)Data analyzed by CryptoSlate showed that 4-year cycles successful the Bitcoin marketplace extremity erstwhile the STH realized terms flips some Bitcoin’s realized terms and the LTH realized price. This creates a measurable marketplace FOMO that triggers a parabolic run.

This flippening happened successful 2011 aft 9 months successful a carnivore market, successful 2015 aft 11 months, and successful 2019 aft 6 months. It’s been 5 months since the STH realized terms dropped beneath the LTH realized terms successful 2022.

The station The on-chain metric that could awesome a carnivore marketplace reversal appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)