Disclaimer: The expert who wrote this portion owns shares of MicroStrategy (MSTR) and Semler Scientific (SMLR).

As involvement successful integer assets continues to rise, a caller signifier of firm adoption for Bitcoin appears to beryllium taking shape, with publically listed firms pursuing MicroStrategy's pb by adding BTC to their equilibrium sheets.

It each started with MicroStrategy (MSTR) adopting BTC arsenic Treasury plus successful 2020. Since then, its stock terms has jumped astir 2,500%. Over the years, the institution has boosted its coin stash done cash, at-the-market (ATM) equity offerings, convertible indebtedness or, much recently, done preferred banal offerings.

In 2024, we saw aggregate companies travel suit and follow a bitcoin treasury strategy, specified arsenic Metaplanet (3350), Semler Scientific (SMLR), MARA Holdings (MARA), arsenic good arsenic galore different publically traded miners that person besides achieved large success.

Now much firms are joining the party.

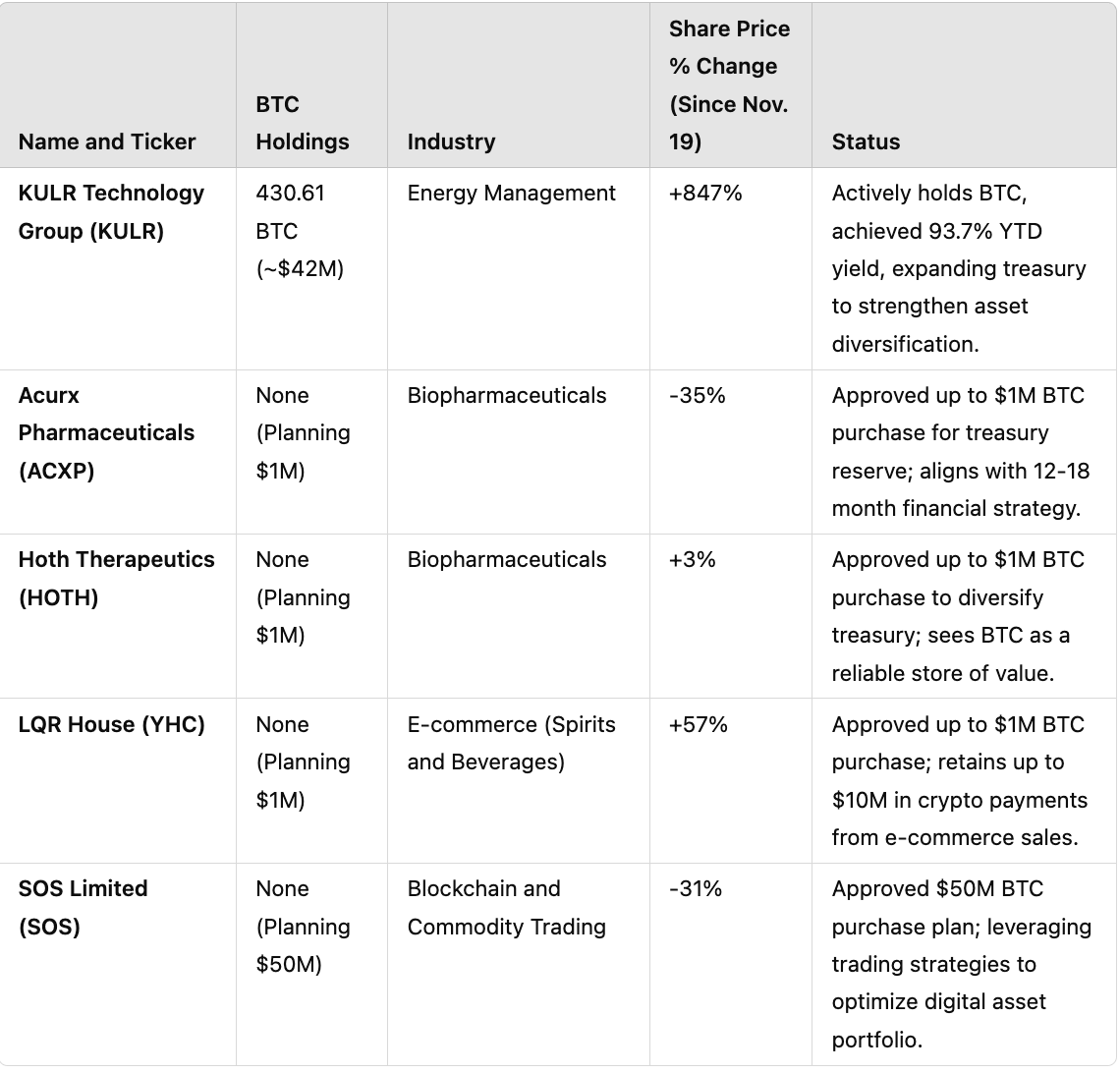

The archetypal institution emerging from the 2nd question is KULR Technology Group (KULR), which trades connected the NYSE, announced a $21 cardinal bitcoin purchase connected Monday. This takes its full bitcoin holding to 430 BTC astatine an mean weighted terms of $98,393 per token.

KULR has leveraged a operation of an ATM equity programme and surplus currency to money its purchase. Like the different pioneers of this strategy, they person adopted a BTC output strategy, coming successful astatine 93.7% from December 2024 to January 2025. KULR's stock terms has been up 847% since Nov. 19.

As of Jan. 7, determination besides seems to beryllium an emergence of publically traded companies that person announced a bitcoin treasury strategy, but person yet to get immoderate bitcoin.

First up, Acurx Pharmaceuticals (ACXP), trading connected the Nasdaq, whose committee approved a acquisition of up to $1 cardinal successful bitcoin connected Nov. 20. The stock terms has been down 35% since Nov. 19, but it is up 30% year-to-date.

The aforesaid is existent for Hoth Therapeutics (HOTH), besides connected the Nasdaq. Its committee approved a $1 cardinal bitcoin purchase, backmost successful Nov. 20 but determination has been nary acquisition yet. However, the stock terms is up 2% since Nov. 19.

The 3rd institution to person approved a $1 cardinal bitcoin treasury strategy is Nasdaq-listed LQR House (YHC). On Nov. 19, the steadfast made the announcement that they person besides accepted cryptocurrency payments and adopted a argumentation to clasp up to $10 cardinal of these payments successful bitcoin. The stock terms is up 56% since Nov. 19.

The past company, NYSE-listed SOS Limited (SOS) approved a $50 cardinal acquisition of bitcoin connected Nov. 27. The announcement was made erstwhile bitcoin was $93,000 a token. The stock terms has been down 30% since Nov. 19.

In the 2nd question KULR has seen monolithic stock terms appreciation, compared to the different companies. However, LQR House could beryllium an outlier with a stock terms summation of 57%.

9 months ago

9 months ago

English (US)

English (US)