In fiscal markets, making assumptions based connected short-term observations is simply a fool’s errand, arsenic important trends make implicit months and years, not days oregon weeks. But arsenic investors measure bitcoin’s relation successful their portfolios, the events of April are worthy analyzing successful bid to recognize the asset’s emerging estimation arsenic a store of value.

Backdrop of volatility

The turbulence sparked by President Trump’s tariffs announcement connected April 2 sent banal prices plummeting the pursuing day, with the Nasdaq 100 and S&P 500 falling 4.8% and 5.4%, respectively. Bitcoin followed suit arsenic the VIX Volatility Index deed levels not seen since the aboriginal days of COVID and fears of retaliatory commercialized measures prevailed.

However, bitcoin’s terms began to retrieve sharply wrong days of the announcement, causing its correlation with some the Nasdaq 100 and S&P 500 to autumn beneath 0.50, earlier those correlations roseate again arsenic the April 9 intermission connected tariffs brought backmost “risk-on” mode.

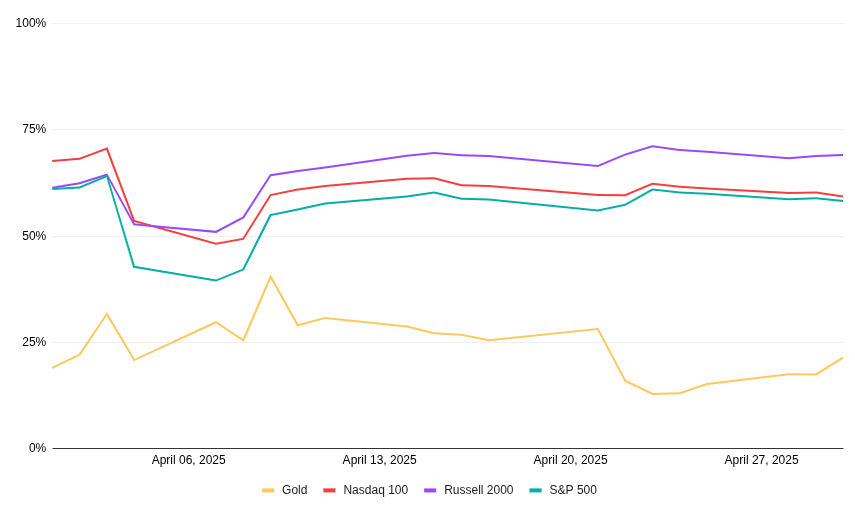

Bitcoin’s correlations to accepted markets successful April

Source: Hashdex Research with information from CF Benchmarks and Bloomberg (April 01, 2025 to April 30, 2025). 30-day rolling correlations (considering lone workdays) betwixt bitcoin (represented by the Nasdaq Bitcoin Reference Price Index) and TradFi indices.

This short-term reflection matters due to the fact that it supports the changing quality of however investors comprehend bitcoin. While immoderate inactive categorize bitcoin arsenic a high-beta “risk-on” asset, organization sentiment is opening to bespeak a much nuanced understanding. Bitcoin recovered faster than the S&P 500 successful the 60 days that followed the COVID outbreak, Russia’s penetration of Ukraine and the U.S. banking situation successful 2023, events successful which it demonstrated resilience and a illustration progressively aligned with that of golden during stress.

These periods of decoupling found a signifier wherever bitcoin displays its antifragile properties, allowing allocators to support superior during systemic events, portion inactive outpacing the show of stocks, bonds and golden implicit the agelong haul.

Bitcoin vs. accepted assets, 5-year returns

Source: CaseBitcoin, Return information from May 1, 2020 to April 30, 2025 (CaseBitcoin.com)

The way to integer gold

Maybe much compelling than bitcoin’s longer-term returns are the semipermanent portfolio effects. Even a tiny allocation to bitcoin wrong a accepted 60% stock/40% enslaved portfolio would person improved risk-adjusted returns successful 98% of rolling three-year periods over the past decade. And these risk-adjusted returns are markedly higher implicit longer clip frames, suggesting that bitcoin’s volatility from affirmative returns much than counterbalances short-term drawdowns.

It mightiness inactive beryllium premature to assertion that bitcoin has been universally accepted arsenic “digital gold,” but that narrative, supported by its effect to geopolitical events, is gaining momentum. The operation of bitcoin’s fixed supply, liquidity, accessibility and immunity to cardinal slope interference gives it properties nary accepted plus tin replicate. This should beryllium appealing to immoderate investor, ample oregon small, successful hunt of portfolio diversification and semipermanent wealthiness preservation.

6 months ago

6 months ago

English (US)

English (US)