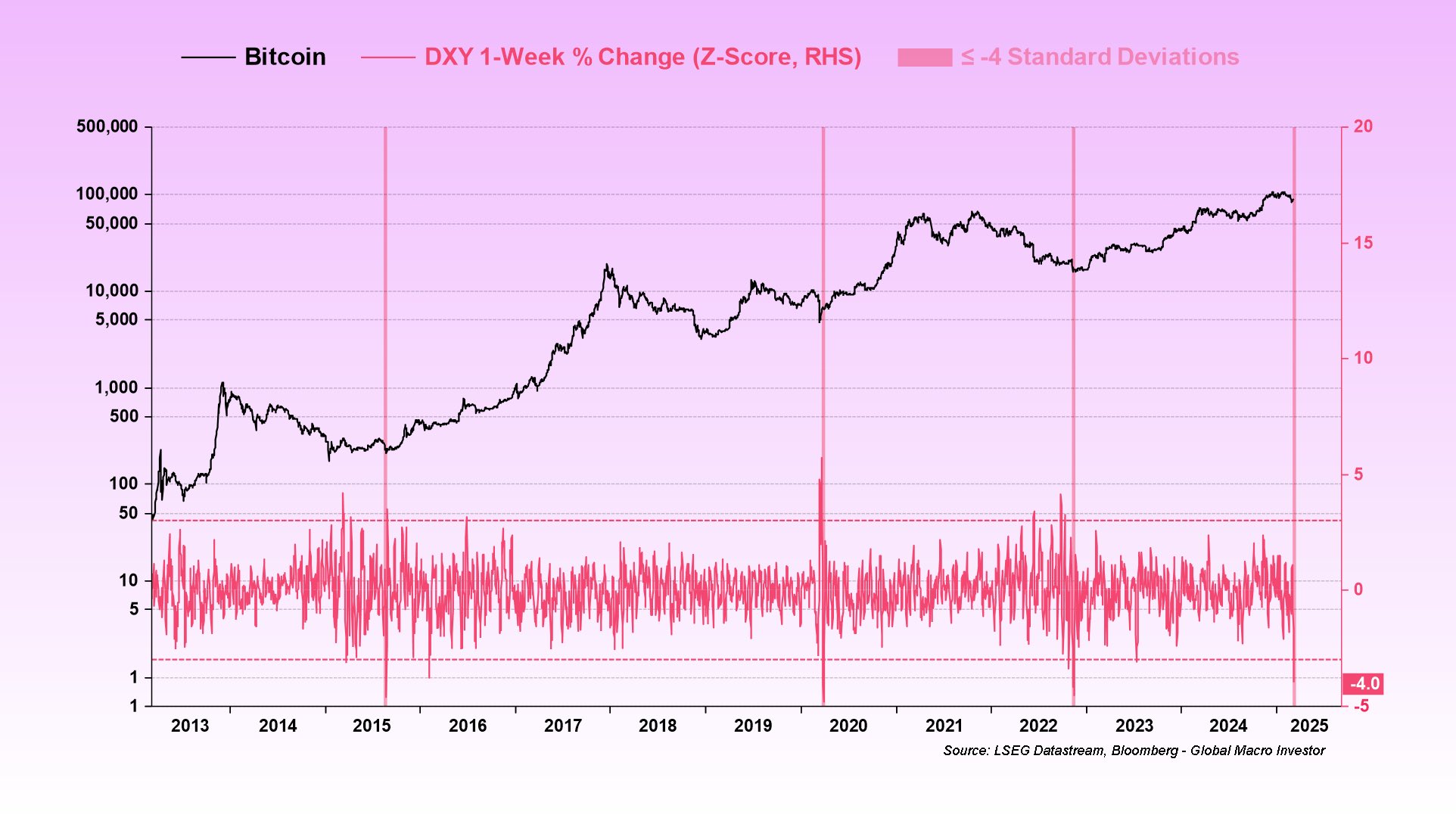

The DXY Index, has experienced 1 of its sharpest one-week declines since 2013. The scale measures the spot of the U.S. dollar against a handbasket of large currencies.

According to Bloomberg information from Global Macro Investor, the index’s one-week percent driblet has exceeded a antagonistic 4 modular deviation move—a uncommon lawsuit that has lone occurred 3 different times successful bitcoin's (BTC) history.

These erstwhile occurrences see November 2022, erstwhile bitcoin deed its rhythm debased of $15,500 during the FTX collapse; March 2020, amid the covid 19 pandemic, erstwhile bitcoin concisely fell beneath $5,000; and the 2015 carnivore market, erstwhile bitcoin traded astir $250. Each clip the DXY Index suffered a driblet larger than a -4 modular deviation, it coincided with a bitcoin bottom, followed by important terms gains.

Additionally, CoinDesk research highlights that the DXY Index is presently declining astatine a faster complaint than successful President Trump's archetypal term— a play that aligned with the 2017 bitcoin bull run. A diminution successful the DXY Index tends to beryllium favourable for risk-assets, nevertheless a DXY scale supra 100, is inactive considered strong, presently astatine 103.8.

6 months ago

6 months ago

English (US)

English (US)