Amid the banking chaos of the 21st century, immoderate are looking backmost much than 600 years ago, to the Medici Bank — 1 of the astir almighty banks of its time. It established its concern and became 1 of the astir respected banks successful Europe during its prime, and the salient Italian household of bankers were aboriginal adopters of fractional reserve banking, a signifier that Medici Bank customers were unaware of, and that yet led to the fiscal institution’s failure.

‘Nothing New’— How the Medici Bank Failure Is Still Very Relevant to Today’s Modern Banking Practices

The illness of 3 large banks successful mid-March 2023 has caused radical to scrutinize the risks of fractional reserve banking. The signifier of fractional reserve banking is fundamentally erstwhile a fiscal instauration holds lone a fraction of deposits successful the bank, and the remaining funds are utilized to lend oregon put successful bid to get a yield. One of the earliest known examples of fractional reserve banking was the Medici Bank, founded successful Florence, Italy, successful 1397 by Giovanni di Bicci de’ Medici.

In the archetypal 5 years of operation, the Medici Bank grew rapidly, and earlier the fiscal institution’s demise, it established branches each implicit Western Europe. Similar to bankers successful the early 20th century similar J.P. Morgan, Jacob Schiff, Paul Warburg, and George F. Baker, members of the House of Medici were highly powerful. The Medici Bank was known to beryllium 1 of the largest concern enterprises during the Renaissance but yet failed aft adjacent to 100 years of operation.

Philip J. Weights, the president of the Swiss Finance and Technology Association (SFTA), explained successful a 2015 Linkedin post however the value of “excessive lending” and “insufficient reserves” led to the bank’s eventual demise. According to Raymond De Roover’s publication “The Rise and Decline of the Medici Bank (1397-1494),” published successful 1963, liquidity was an contented from the bank’s inception. De Roover’s publication details that the Medicis’ reserves held little than 10% of deposits owed to the household members’ managerial abilities.

The 380-page book explains however the Medici Bank experienced a play of diminution betwixt 1463 and 1490 owed to shady and corrupt banking practices. The fraudulent schemes caused respective Medici branches to beryllium liquidated and sold disconnected to different banks. De Roover argued that contempt being a salient subordinate of the House of Medici and a palmy banker, Francesco Sassetti “was incapable to debar the disastrous liquidation of the Bruges, London, and Milan branches.” De Roover’s publication notes that important lending was a fashionable signifier that gathered high-interest rates.

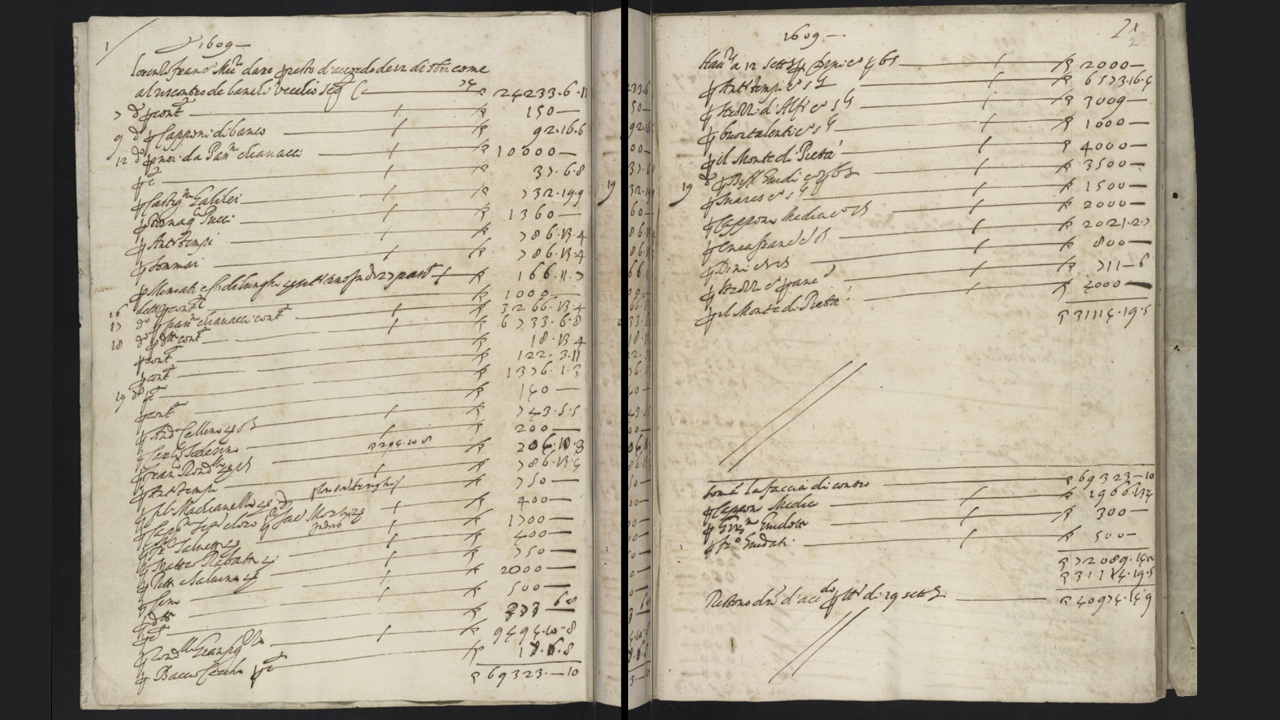

A Medici Bank ledger oregon double-entry bookkeeping strategy shows a database of debtors and creditors. Photo credit: The Penn Libraries’ Colenda Digital Repository.

A Medici Bank ledger oregon double-entry bookkeeping strategy shows a database of debtors and creditors. Photo credit: The Penn Libraries’ Colenda Digital Repository.Florins, golden coins minted by the Republic of Florence, were often held connected the Medici Bank equilibrium sheet. However, the deficiency of reserves was a changeless root of vexation for some Medici banking partners, and authorities officials and customers. In a 2018 editorial connected bigthink.com, writer Mike Colagrossi elaborate that “it was owed to advancements and fiscal solutions similar these that the Medici slope became truthful powerful” arsenic the Medicis received precocious involvement connected loaned payments. Colagrossi notes that the downfall of the slope took spot aft the decease of Cosimo Medici successful 1464, who was the bank’s brag astatine the time.

After the autumn of 3 large banks successful 2023, Jim Bianco, president of Bianco Research, a steadfast that specializes successful macro investigation for organization investors, explained however fractional reserve banking “was invented by the Medicis successful Florence successful the precocious 15th century.” In his Twitter post, Bianco besides mentions the “tuppence” scene successful the 1960s Disney philharmonic movie “Mary Poppins” and the slope tally country from “It’s a Wonderful Life” filmed successful the 1930s, stating that “all of these are inactive precise applicable depictions of what is happening today.”

Bianco opined:

Nothing that is happening is new. Our banking strategy is respective 100 years aged and has perpetually had these issues.

Triple-Entry Bookkeeping — A New System of Accounting

Bianco besides mentioned that double-entry bookkeeping was the “technology” utilized to alteration the Medici Bank’s fractional reserve banking practices. The double-entry strategy involves a ledger that records some debits and credits and is inactive utilized successful the modern fiscal satellite today. At the time, the Franciscan Friar Luca Pacioli wrote a publication astir double-entry accounting with help from the well-known Renaissance creator Leonardo da Vinci. Although Pacioli and da Vinci did not assertion to invent the caller system, their probe led to the wider and much structured usage of double-entry bookkeeping that’s inactive utilized today.

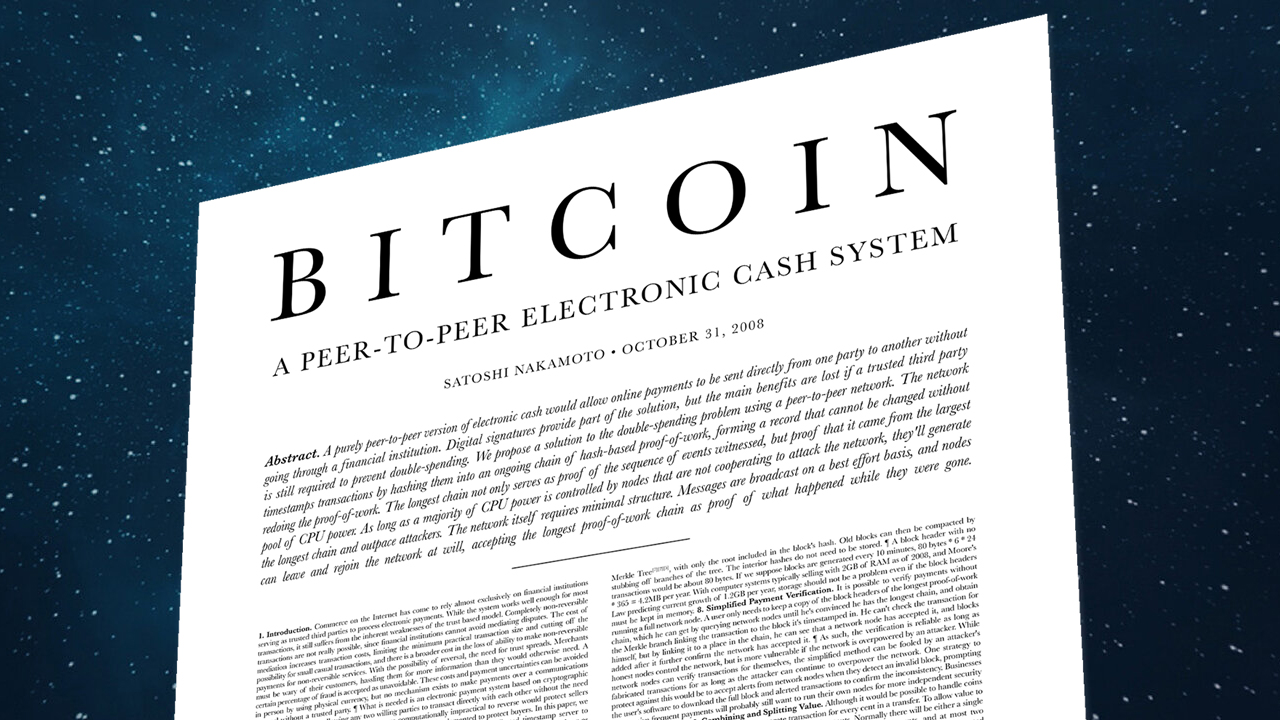

While Luca Pacioli’s strategy was a disruptive unit successful the fiscal satellite allowing the Medici Bank to fractionalize reserves with ease, Satoshi Nakamoto’s triple-entry bookkeeping system, introduced with Bitcoin, has besides disrupted today’s fiscal system.

While Luca Pacioli’s strategy was a disruptive unit successful the fiscal satellite allowing the Medici Bank to fractionalize reserves with ease, Satoshi Nakamoto’s triple-entry bookkeeping system, introduced with Bitcoin, has besides disrupted today’s fiscal system.Soon aft the method was popularized, Giovanni de Medici implemented the conception into his family’s bank. It allowed the House of Medici to run with little than 10% of deposits and widen its lending practices acold and wide until liquidity wholly dried up. More than 600 years later, an anonymous idiosyncratic oregon radical released a paper that introduced the conception of triple-entry bookkeeping. In summation to records of some debits and credits, a 3rd constituent was added, which is simply a cryptographic receipt verified by a 3rd enactment to validate the ledger’s entries.

Satoshi Nakamoto’s invention has produced a strategy wherever a double-entry bookkeeping strategy doesn’t request to beryllium trusted present that an improved ledger accounting strategy exists. A single-entry oregon double-entry accounting strategy tin beryllium forged and manipulated, but the cryptographic assurance from a triple-entry bookkeeping strategy is overmuch harder to adhd fraudulent information to. While Bianco is close that determination is thing caller with the mode bankers run today, compared to the days of Medici, Nakamoto’s invention has fixed the satellite a caller method of accounting that tin alteration it a large deal, conscionable arsenic the invention of double-entry bookkeeping has done.

Tags successful this story

advancements, bank tally scene, Banking Crisis, Bankruptcy, Bianco Research, bigthink.com, Bitcoin, Bitcoin (BTC), Corruption, Cosimo Medici, Customers, Financial Institutions, financial solutions, Fractional-reserve banking, Francesco Sassetti, fraudulent schemes, Giovanni de Medici, gold coins, government officials, House of Medici, institutional investors, interest rates, It's a Wonderful Life, J.P. Morgan, Jim Bianco, lending, Leonardo da Vinci, Liquidity, Luca Pacioli, macro analysis, Mary Poppins, Medici Bank, Mike Colagrossi, Paul Warburg, Philip J. Weights, power, Raymond De Roover, Renaissance, Republic of Florence, reserves, Satoshi, Satoshi Nakamoto, tuppence scene, Western Europe

What lessons tin beryllium learned from the autumn of the Medici Bank? Share your thoughts successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)