The crypto marketplace downturn explained

Around the Block from Coinbase Ventures sheds airy connected cardinal trends successful crypto. Written by Connor Dempsey. Data by Mike Cohen.

TLDR:

- Central Banks and governments responded to the March 2020 COVID marketplace daze with unprecedented involvement complaint cuts, wealth printing, and stimulus

- These casual wealth policies kicked disconnected a multi-year bull tally for equities and crypto, earlier yet causing ostentation that was further exacerbated by COVID supply shocks

- BTC, ETH, the NASDAQ, and S&P each peaked astatine the process extremity of 2021, erstwhile it became wide that ostentation was not nether power and that Central Banks would person to unwind the aforesaid policies that propelled stocks and crypto to caller heights successful the first place

- This rhythm crypto has been broadly correlated with tech stocks, and has traded similar risk assets

- While not immune to Central Bank argumentation successful the abbreviated run, the prospects of crypto and Web 3 successful the agelong tally stay stronger than they’ve ever been

Financial markets are, successful essence, 1 elephantine accusation processing machine. A instrumentality that responds to caller accusation not directly, but arsenic it affects the decisions of millions of idiosyncratic buyers and sellers. Or arsenic Benjamin Graham famously enactment it, “in the abbreviated run, the marketplace is simply a voting machine.”

With the S&P 500, NASDAQ, BTC, ETH, and astir crypto assets importantly disconnected of their all-time-highs, that begs the question: what accusation has marketplace participants predominantly voting to sell?

In this variation of Around The Block, we instrumentality a look astatine the wide macro downturn with an oculus towards the crypto markets.

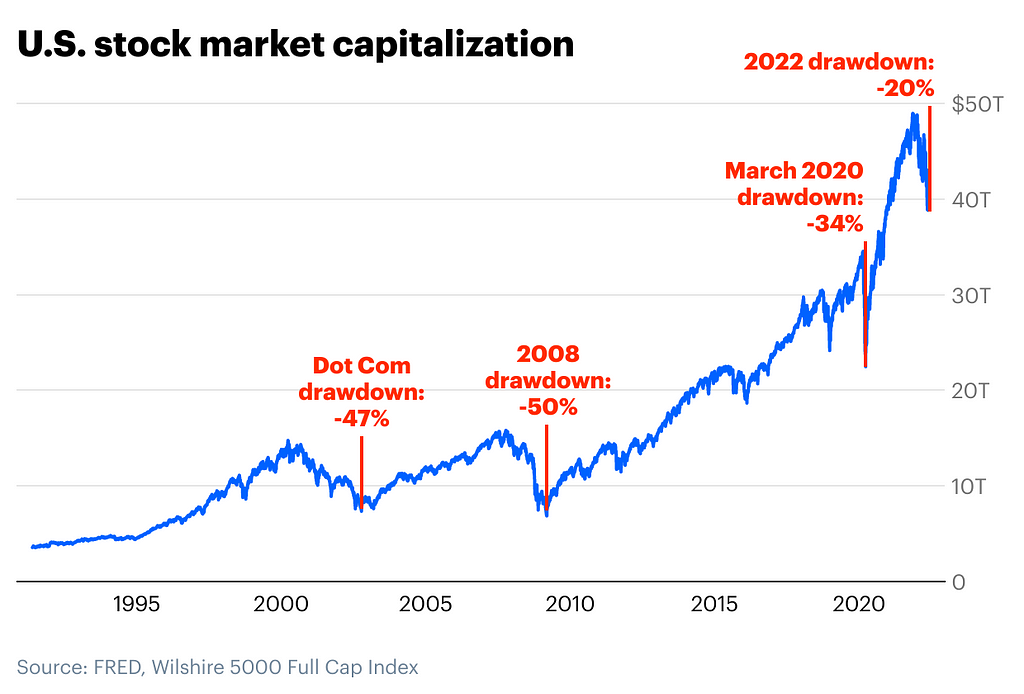

As of June 2022, US equities person shed astir 20%, oregon $10 Trillion successful value. For US stocks, the selloff has not yet approached the severity of different historically noteworthy downturns, but it’s surely successful the conversation.

Crypto meanwhile, has shed astir 60%, oregon $1.7 Trillion. For comparison, it shed 87% of its full marketplace headdress aft the highest of the 2017 bull run.

BTC, ETH, and the NASDAQ each peaked successful November, with the S&P 500 peaking astatine the extremity of December. So what changed during the past 2 months of the year? To recognize this marketplace downturn, it’s adjuvant to commencement astatine the opening of a historical bull tally that some stocks and crypto experienced in 2020.

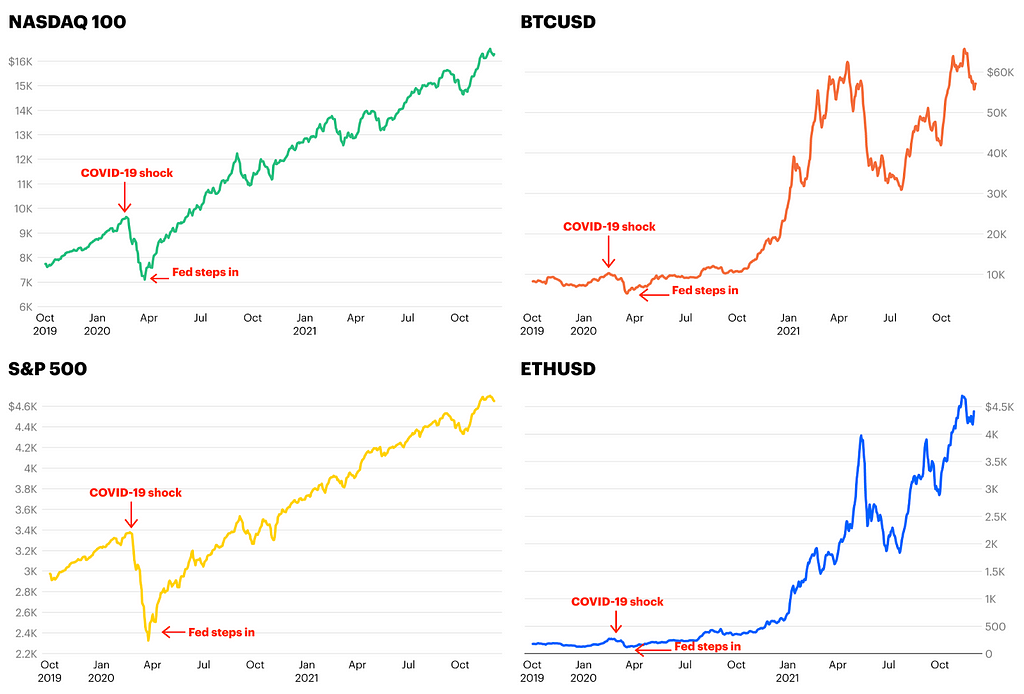

Entering 2020, Bitcoin was rallying from the depths of the 2018/19 crypto winter, from $7,500 to astir $10,000. Meanwhile the S&P and NASDAQ each stood astatine all-time highs. Then COVID hit.

COVID daze of March 2020

On March 12, 2020, the World Health Organization declared the Coronavirus a pandemic and governments astir the satellite placed full countries connected lockdown.

As the magnitude of COVID-19 acceptable in, it became wide that our planetary system was not adequately prepared to grip the shock, sending each markets into a panic. The S&P and NASDAQ each declined astir 30%, with crypto markets getting deed harder (in implicit terms). When the particulate settled, BTC concisely dropped beneath $4,000, shedding implicit 60% of its value.

In short, COVID sent panicked investors to unreserved for the information of cash, sending each liquid markets down sharply. Then the US Federal Reserve stepped in.

The Fed response

As the Central Bank down the world’s largest economy, the US Federal Reserve plays a unsocial relation successful fiscal markets. Mainly, it controls the proviso of the US dollar, which is the world’s reserve currency.

The wealth printer and involvement rates are the Fed’s main tools for supporting the system successful times of utmost turmoil. By digitally printing wealth and buying fiscal assets similar bonds from fiscal institutions, they tin present new money into the economy. By lowering involvement rates, they tin marque it cheaper for different banks to get wealth from the Fed, which besides introduces caller wealth (in the signifier of credit) into the economy.

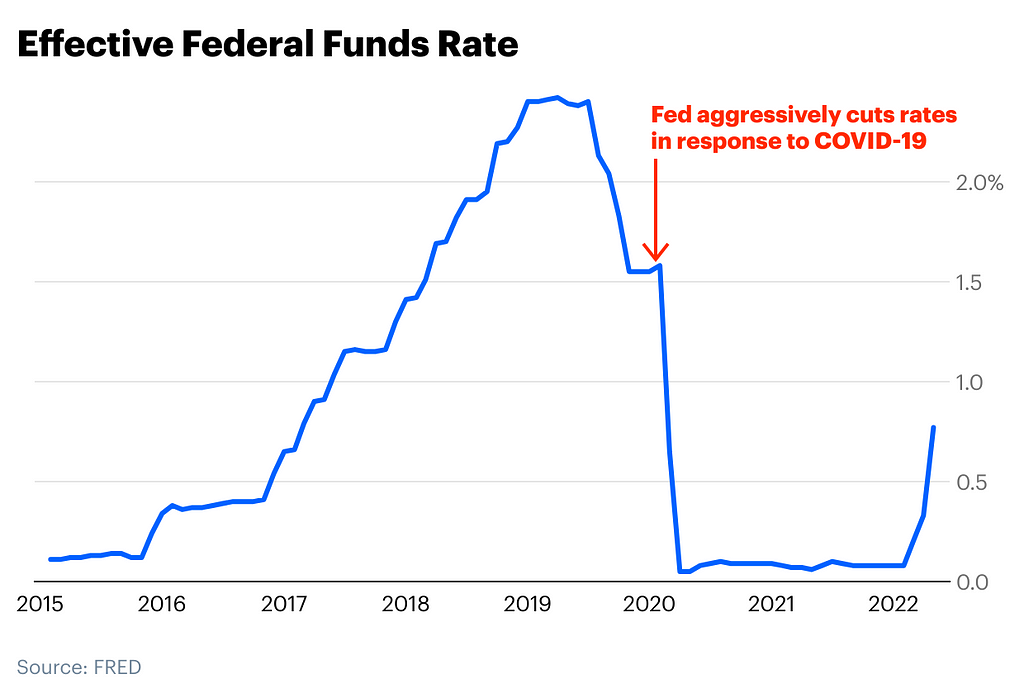

After COVID, the Fed dropped the outgo that banks wage to get wealth from the Central Bank, known arsenic the Federal Funds Rate, to fundamentally zero. This allowed banks to, successful turn, little the outgo astatine which their customers get money. These inexpensive loans could past beryllium utilized to concern homes, businesses, spending and different investments.

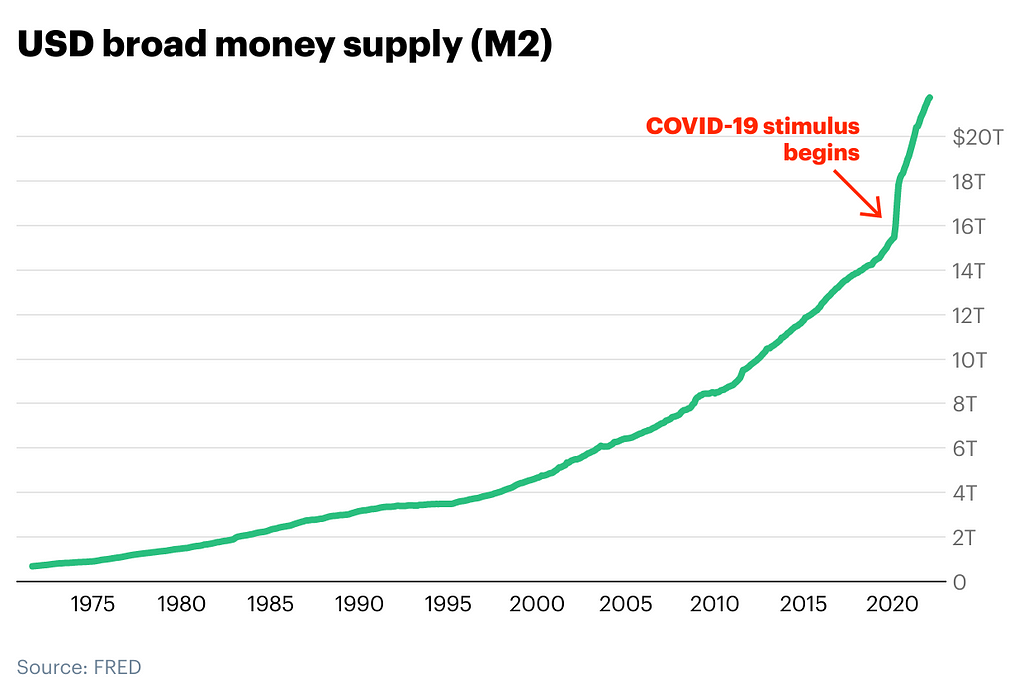

By digitally printing caller wealth and utilizing it to bargain treasury bills and different securities from fiscal institutions (this is known arsenic quantitative easing), an unprecedented magnitude of US dollars was introduced into the economy. Over the adjacent 2 years, astir 6 trillion successful caller wealth was printed, expanding the wide proviso of USD astir 40%. Awash with cash, fiscal institutions vie to lend this caller superior out, forcing them to little involvement rates to stay competitive. Again, availability of inexpensive recognition encourages borrowing, which yet supports the economy.

The US wasn’t alone, arsenic the European Central Bank, Bank of Japan, and Bank of England each lowered involvement rates to adjacent (or adjacent beneath zero) and printed wealth astatine historical levels. All told, the world’s 4 large cardinal banks printed $11.3 trillion, which is simply a 73% enlargement since the opening of 2020.

On apical of each that, the US Government injected implicit $5 trillion of “stimulus” into the system by taking connected indebtedness from public, private, and overseas entities. Similarly, China pumped different $5 trillion into its system done the aforesaid methods. Basically, the satellite became awash with fresh cash.

Don’t combat the Fed

“Don’t Fight the Fed” is an aged capitalist mantra which implies that fixed the Fed’s outsized influence, 1 should put successful lockstep with immoderate absorption the Fed is moving fiscal markets. This mantra rang existent aft COVID struck in 2020.

When caller wealth is being printed astatine grounds levels, and involvement rates are adjacent zero, each of this wealth and recognition needs a spot to go. On apical of that, erstwhile rates are low, blimpish instruments similar bonds are little profitable, pushing wealth into higher output assets. In the aftermath of COVID, these forces caused monolithic inflows into stocks, crypto, and adjacent NFTs, helping propulsion plus prices to new heights.

From their COVID panic induced bottoms, the S&P500, NASDAQ, BTC, and ETH would soar 107%, 133%, 1,600%, and 4,200% respectively.

Enter inflation

When the strategy is awash with money, and assets are going up, everyone feels richer. People tin walk much and companies tin wage their employees more. When spending and incomes summation faster than the accumulation of goods, you person “too overmuch wealth chasing excessively fewer goods,” and the terms of goods rise, or inflate.

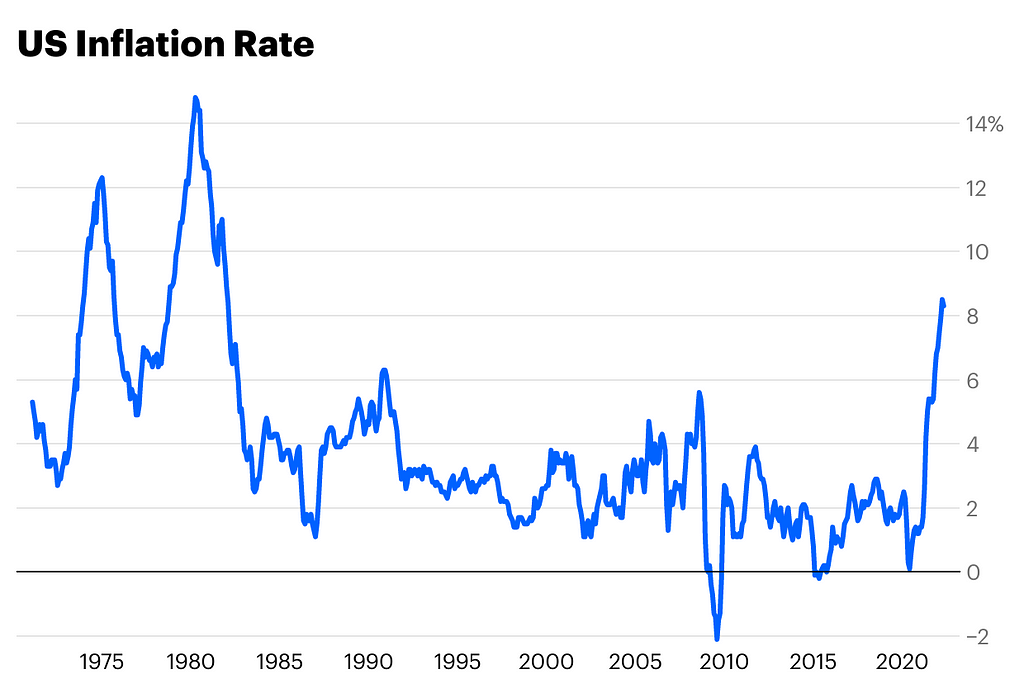

With proviso concatenation shocks stemming from COVID lockdowns, determination were adjacent less goods successful the economy. More wealth chasing adjacent less goods led to adjacent much inflation. This started to go evident successful May 2021.

The user terms scale (CPI) measures the alteration successful prices paid by consumers for goods similar gas, utilities, and food. From March to May 2021, it changeable up from a steadfast 2.6% to 5%. By March 2022 it deed 8% — levels of ostentation not seen successful implicit 40 years.

Inflation makes everyone poorer, due to the fact that people’s wealth nary longer buys arsenic overmuch arsenic it erstwhile did, truthful the Fed had to measurement successful erstwhile again. To combat rising inflation, they crook to the aforesaid tools they utilized to enactment fiscal assets successful the first place.

Reversing course

As we explained, debased involvement rates and recently printed wealth enactment some the system and plus prices. When overdone, they tin besides pb to inflation. When that happens, the Fed flips the switch, raises rates and removes wealth from the market, mounting the process in reverse.

Raising involvement rates ripples passim the economy. Since it makes it much costly for banks to get from the Central Bank, they successful crook complaint customers much to get money. On apical of it becoming much costly for everyone to get money, the terms to wage for wealth already borrowed besides goes up (think if your recognition paper complaint jumped from 5 to 10%).

Where quantitative easing involves injecting wealth into the system by buying securities from fiscal institutions, quantitative tightening is the opposite. First, the Fed stops buying securities portion letting existing securities expire, and eventually, begins selling them connected the unfastened market. This yet leads to little wealth successful the economy. Less wealth to lend retired causes involvement rates to emergence owed to elemental proviso and demand.

With the outgo of borrowing and paying existing debts much expensive, everyone slows down connected the spending that caused ostentation successful the archetypal place. With little wealth being pumped into the system via plus purchases, there’s little wealth chasing inflated goods, and prices successful mentation should normalize. There’s besides little wealth chasing investments, which brings the terms of assets down on with it — something blase marketplace participants cognize each too well.

The machine reacts

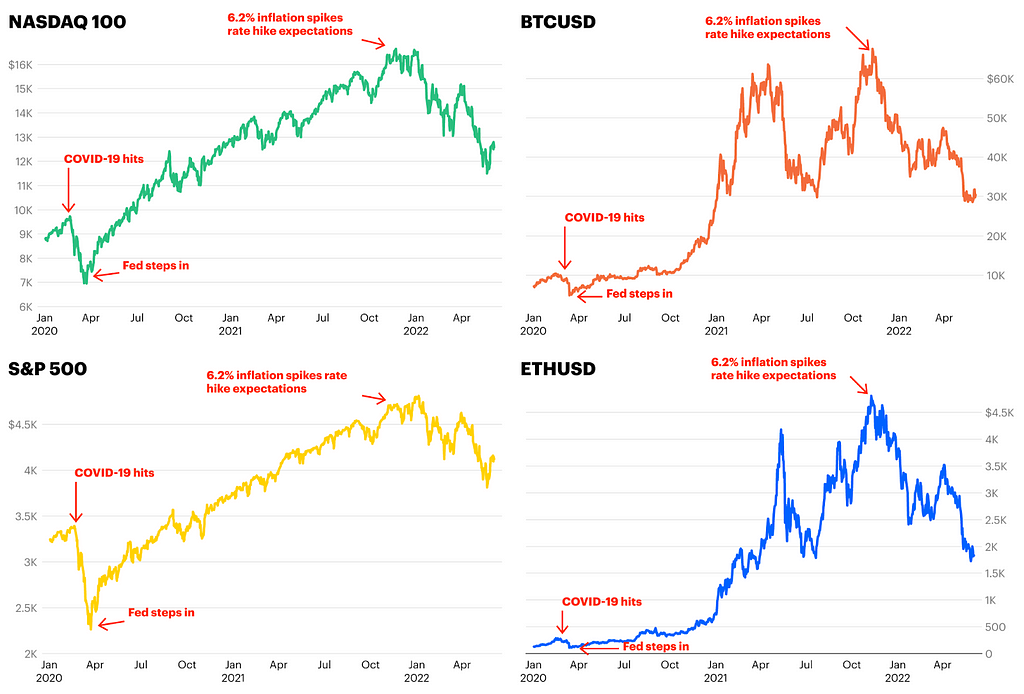

When ostentation was hanging astir 5% implicit the summer, the enactment retired of the Fed was that it was “transitory,” oregon non-permanent. On November 3rd, 2021, the Fed said that it would commencement to dilatory plus purchases, but would beryllium diligent with immoderate involvement complaint hikes arsenic it continued to show inflation.

When October’s CPI of 6.2% was announced connected November 10th, it became wide that ostentation was not nether power and that the Fed would person to intervene. While the archetypal involvement complaint hike wouldn’t travel until March, the large accusation processing instrumentality that is the market, seemed to respond astatine archetypal motion that they’d likely be coming.

Don’t combat the Fed rang existent erstwhile again, arsenic BTC and ETH each peaked connected November 8th, the NASDAQ connected November 19th, and the S&P astatine the extremity of December.

Even the CryptoPunks level price (a proxy for NFT sentiment) and DeFi TVL peaked during this same period.

In a nutshell

Basically, successful effect to COVID, Central Bank and authorities involution helped support markets afloat with grounds debased involvement rates, wealth printing and stimulus. These casual wealth policies yet helped propel stocks and crypto to all-time highs earlier starring to inflation — inflation that was exacerbated by proviso concatenation stocks stemming from COVID fastener downs successful China (and aboriginal connected successful 2022, Russia’s penetration of Ukraine).

When it became wide that ostentation was persistent and that Central Banks would person to reverse people and bring an extremity to the policies that propelled galore assets to caller heights, the macro downturn began.

The large re-rating

While we started our communicative astatine the opening of 2020, the epoch of casual Central Bank monetary policies started successful the aftermath of the 2008 Great Financial Crisis. An epoch that saw the commencement of crypto arsenic good arsenic a historical tally successful equities.

In the look of ostentation not seen successful 40 years, Central Banks person signaled that the casual wealth epoch has travel to an end. Previous frameworks for valuing companies and assets are nary longer applicable successful lieu of this shift. The worth of everything has been “re-rated”, which is the downturn we’ve each experienced implicit the people of the past six months.

When involvement rates rise, bonds go much charismatic investments. Meanwhile, “growth” stocks, oregon companies that aren’t expected to nutrient dividends until galore years successful the aboriginal get deed the hardest. With wealth tighter, investors preferences displacement to investments that nutrient currency flows today, alternatively than acold retired successful the future. Thus the tech sell-off.

Crypto selloff

But wasn’t crypto expected to beryllium an ostentation hedge? It depends. If you bought Bitcoin successful May 2020 aft macro capitalist Paul Tudor Jones famously dubbed it “the fastest horse” successful a station COVID environment, you’re inactive up implicit 200% and good up of inflation. If you bought aft ostentation started to rear its head, overmuch less so.

Even with the correction, Bitcoin and ETH are each inactive up 500% and 1,000% respectively from their pandemic lows. Longer process assets person not fared arsenic well, however, and it’s hard to contradict that this clip astir crypto much broadly has been highly correlated with stocks — particularly tech.

Tech stocks are considered risk assets. Given the correlation, it’s just to accidental that astir individuals are inactive treating crypto similarly. Risk assets transportation precocious upside, arsenic good arsenic precocious downside risk. When wealth gets tight, which is what happens erstwhile Central Banks tighten up, hazard assets are often the archetypal to get sold. That, successful a nutshell, explains the caller crypto marketplace downturn.

The Fed giveth

Have you ever wondered wherefore marketplace participants bent connected each connection of the Fed Chair? It’s due to the fact that they cognize that the absorption successful which the Fed turns its dials tin importantly power markets and the economy. It tin marque businesses win oregon fail, and location values emergence or fall.

It’s not done with malice, but with the noble purpose of keeping prices unchangeable and radical employed. However, the Fed’s tools are somewhat crude, and successful the hands of good meaning, but inherently fallible groups of people. It isn’t unreasonable to deliberation it unusual that the unilateral decisions of a precise tiny radical of radical stay truthful consequential for the average person.

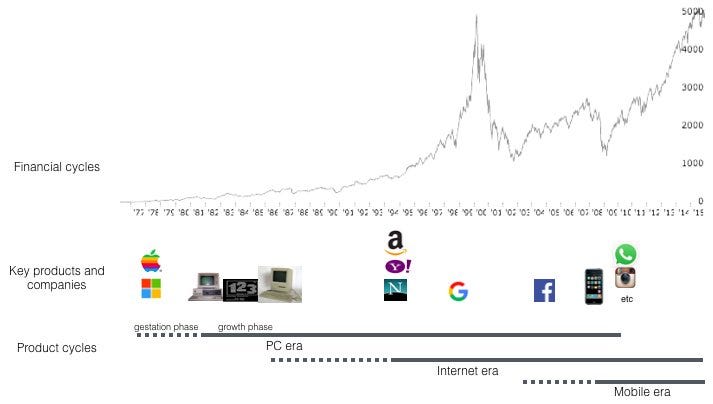

While crypto prices are intelligibly not immune to Fed policy, it should besides travel arsenic nary astonishment that it was among the champion performing plus classes implicit this past marketplace cycle. Easy wealth policies promote speculation, and speculation has ever accompanied paradigm shifting technologies: idiosyncratic computers, the internet, smartphones, and adjacent the railroads of the 1800’s.

Additionally, Bitcoin and its hard proviso of 21 cardinal that can’t beryllium debased by a cardinal authorization proceed to basal successful stark opposition to Central Bank wealth printers. History tells us that each centrally managed currencies neglect eventually, typically from wide ostentation via economical mismanagement. While this rhythm has besides shown that crypto is inactive acold from without its risks and shortcomings, it besides further validated the request for decentralized systems escaped from the risks of single-party power to co-exist with centralized counterparts. While crypto prices volition stay influenced by Fed argumentation successful the abbreviated run, successful the agelong run, crypto and Web3 stay much alluring than ever.

Looking ahead

If this is your archetypal crypto marketplace downturn, it tin surely beryllium scary. It is however, not without precedent. This marketplace has been pronounced dormant successful 2018, 2015, and 2013, lone to travel backmost stronger each time.

Like the net earlier it, crypto innovation marches connected careless of market cycles.

h/t Chris Dixon

h/t Chris DixonFrom our seat, crypto feels much inevitable than it’s ever been. Bitcoin has planetary adoption, present held by institutions, corporations, countries, and millions of individuals alike. DeFi has created the underpinnings of an net based fiscal strategy with nary azygous enactment successful control. The foundations for Web3 and a user-owned net person been laid. NFTs person birthed cardinal dollar industries crossed creation and gaming with a divers array of usage cases connected the way. DAO treasuries negociate nearly $10B+ and are conscionable getting started. Crypto’s existent satellite inferior has been showcased connected the satellite stage, raising millions successful aid for Ukraine pursuing a Russian invasion.

Even the biggest detractors person travel around. 9 retired of 10 Central Banks are exploring integer currencies and analysts astatine JP Morgan person dubbed crypto a “preferred alternate plus class.” Facebook rebranded to Meta, Twitter, Spotify, TikTok and Instagram are integrating NFTs, portion Google and Microsoft are each dipping their toes into Web3.

In the agelong run, it appears that the proliferation of the fiscal net is simply a relation of time, alternatively than Central Bank policy.

The weighing machine

As we mentioned, Benjamin Graham said that successful the abbreviated run, the marketplace is simply a voting machine. But helium besides said that successful the agelong tally it is simply a weighing machine. In the abbreviated tally it’s a elephantine accusation processing instrumentality taxable to affectional swings erstwhile presented with distressing information. In the agelong run, it has a knack for weighing assets based connected their true value.

Bitcoin and Ethereum person maintained their value implicit past downturns. Many different crypto assets volition beryllium weighed accordingly implicit the existent downturn. The occupation of the idiosyncratic is to ballot successful the abbreviated tally for immoderate they deliberation the marketplace volition measurement arsenic invaluable successful the long run.

At Coinbase, our votes are formed connected crypto, Web3, and the fiscal net yet being weighed arsenic 1 of the astir invaluable innovations of our time.

Special acknowledgment to Scott Meadows, David Duong, and Griffen McShane for the review!

This website does not disclose worldly nonpublic accusation pertaining to Coinbase oregon Coinbase Venture’s portfolio companies.

Disclaimer: The opinions expressed connected this website are those of the authors who whitethorn beryllium associated persons of Coinbase, Inc., oregon its affiliates (“Coinbase”) and who bash not correspond the views, opinions and positions of Coinbase. Information is provided for wide acquisition purposes lone and is not intended to represent concern oregon different proposal connected fiscal products. Coinbase makes nary representations arsenic to the accuracy, completeness, timeliness, suitability, oregon validity of immoderate accusation connected this website and volition not beryllium liable for immoderate errors, omissions, oregon delays successful this accusation oregon immoderate losses, injuries, oregon damages arising from its show oregon use. Unless different noted, each images provided herein are the spot of Coinbase. This website contains links to third-party websites oregon different contented for accusation purposes only. Third-party websites are not nether the power of Coinbase, and Coinbase is not liable for their contents. The inclusion of immoderate nexus does not connote endorsement, support oregon proposal by Coinbase of the tract oregon immoderate relation with its operators.

The crypto marketplace downturn explained: a macro outlook was primitively published successful The Coinbase Blog connected Medium, wherever radical are continuing the speech by highlighting and responding to this story.

3 years ago

3 years ago

English (US)

English (US)