The existent authorities of Bitcoin’s options and futures markets is witnessing a notable shift, reflecting a broader translation successful the crypto trading landscape.

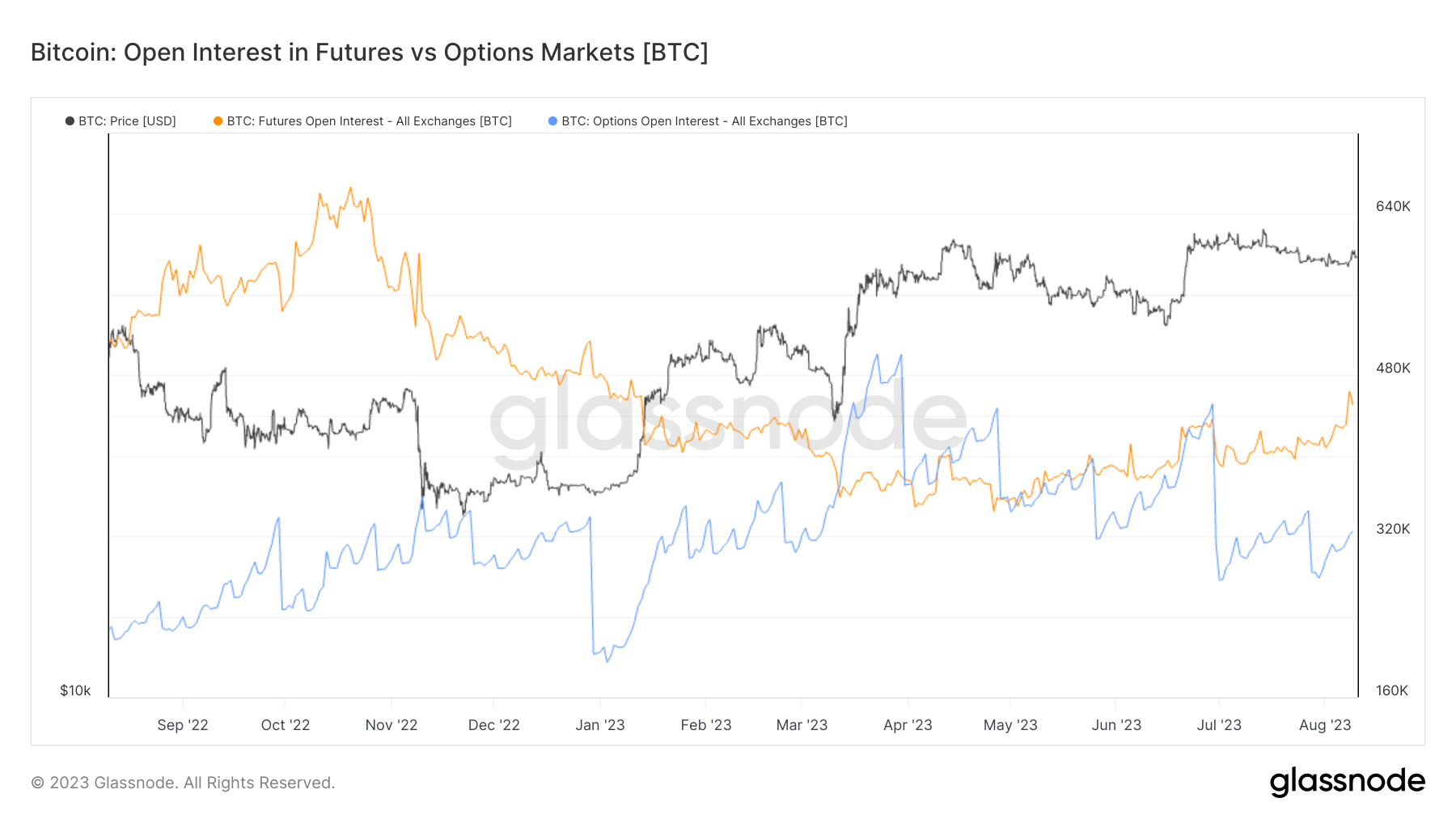

Over the past 12 months, Bitcoin options markets person seen a important uptick successful growth, with unfastened involvement much than doubling. This maturation successful options trading indicates an accrued involvement successful strategical fiscal products that connection flexibility and hazard absorption capabilities.

Options present rival futures markets successful presumption of unfastened involvement magnitude, signaling a displacement successful trading strategies and perchance a motion of marketplace maturity.

On the different hand, futures unfastened involvement has been successful dependable diminution since the illness of FTX successful November 2022.

This diminution whitethorn beryllium interpreted arsenic losing assurance successful the futures market, raising concerns astir stableness and hazard absorption practices. However, 2023 has seen a flimsy summation successful futures unfastened interest, indicating a cautious instrumentality of traders, but the wide inclination remains antagonistic compared to the options market.

The unfastened involvement connected Bitcoin futures is presently 420,000 BTC, portion the unfastened involvement connected Bitcoin options is 312,000 BTC.

Graph showing the unfastened involvement successful Bitcoin futures and options from August 2022 to August 2023 (Source: Glassnode)

Graph showing the unfastened involvement successful Bitcoin futures and options from August 2022 to August 2023 (Source: Glassnode)The maturation successful Bitcoin options trading reflects a much strategical and risk-averse attack to trading Bitcoin. Options, which supply the close but not the work to bargain oregon merchantability an plus astatine a circumstantial price, are favored implicit futures, which obligate the purchaser to acquisition oregon the seller to merchantability the plus astatine a predetermined aboriginal day and price.

This displacement has far-reaching implications for marketplace structure, regulation, and wide marketplace behavior. The emergence successful options trading could pb to antithetic terms dynamics, affecting the wide volatility of Bitcoin’s price.

Options supply leverage, which tin amplify some gains and losses, attracting much speculative trading. While this tin summation liquidity, it mightiness besides summation short-term volatility arsenic traders rapidly participate and exit positions.

However, it’s important to enactment that options tin besides enactment arsenic a stabilizing unit for the broader crypto market. As options are often utilized arsenic a hedging tool to support against adverse terms movements, they tin efficaciously acceptable a level connected imaginable losses, perchance mitigating crisp declines during marketplace downturns.

The displacement betwixt futures and options mightiness besides alteration the competitory scenery of exchanges offering these products. Those focusing connected options mightiness spot growth, portion futures-centric platforms mightiness look challenges.

The information mightiness besides bespeak changes successful capitalist behavior, with possibly much organization information successful options arsenic a hazard absorption instrumentality and perchance a alteration successful speculative trading successful futures.

The station The changing scenery of Bitcoin futures and options markets appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)