While astir of the marketplace focuses connected Bitcoin’s terms volatility, a overmuch bigger occupation seems to spell unnoticed.

The centralization of Ethereum has been 1 of the hottest topics successful the crypto manufacture since the network’s power to Proof-of-Stake, with galore critics informing astir the dangers of specified a precocious marketplace headdress cryptocurrency relying connected lone a fistful of centralized validators.

Since the coveted mining prohibition successful China, the centralization of the Bitcoin web mostly disappeared from mainstream discussions and became the absorption of a niche radical successful the mining sphere.

However, Bitcoin’s centralization is simply a occupation that concerns the full market, particularly present erstwhile lone 2 mining pools nutrient the bulk of its blocks.

CryptoSlate looked astatine Bitcoin’s planetary hash complaint organisation and recovered that much than fractional of it came from Foundry USA and Antpool.

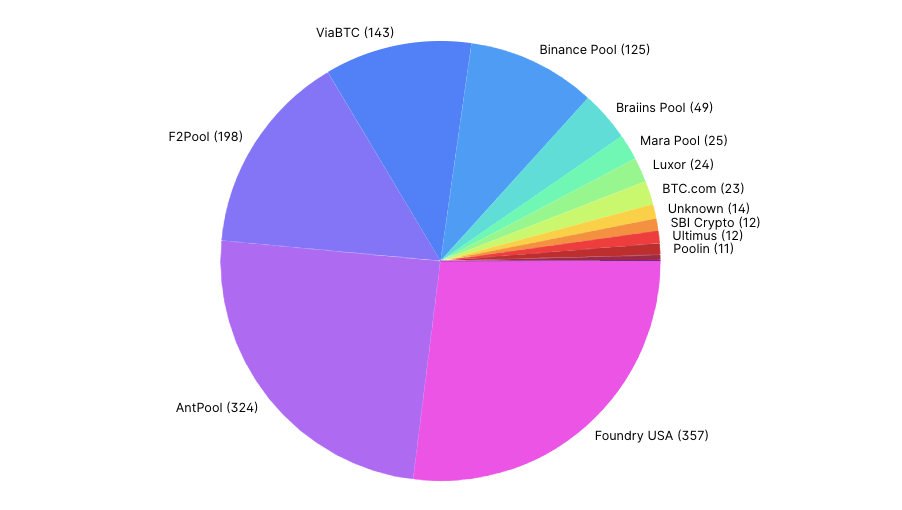

The 2 pools mined implicit a 4th of Bitcoin blocks successful the past 10 days each. Since mid-December, Foundry USA mined 357 blocks, portion Antpool mined 325. Foundry’s artifact accumulation accounted for 26.98% of the network, portion Antpool was liable for conscionable nether 24.5% of the full artifact production.

Chart showing the estimated hash complaint organisation among the largest Bitcoin mining pools (Source: Blockchain.com)

Chart showing the estimated hash complaint organisation among the largest Bitcoin mining pools (Source: Blockchain.com)Antpool has been astatine the forefront of Bitcoin mining for years and produced astir 14% of the blocks mined successful the past 3 years. On the different hand, Foundry is simply a comparatively caller sanction successful the mining space. However, it rapidly roseate to go 1 of the apical 10 pools by hash rate, accounting for 3.2% of the blocks mined successful the past year.

A deeper look astatine Antpool and Foundry USA shows an alarming level of centralization — and a web of interconnected companies that efficaciously ain fractional of the network.

Foundry — DCG’s mining behemoth

It took little than 2 years for Foundry USA to go a unit to beryllium reckoned with successful the Bitcoin mining space. The mining excavation is owned and operated by the eponymous Foundry, a institution Digital Currency Group (DCG) created successful 2019.

By precocious summertime 2020, Foundry was already among the largest Bitcoin miners successful North America. Aside from mining, the institution offered instrumentality financing and procurement. By the extremity of 2020, Foundry helped procure fractional of each the Bitcoin mining hardware delivered to North America.

Foundry’s monolithic occurrence arsenic an instrumentality procurer and miner straight results from DCG’s power successful the crypto industry.

The task superior steadfast is 1 of the space’s largest and astir progressive investors, backing much than 160 crypto companies successful implicit 30 countries. DCG’s portfolio is simply a registry of the industry’s biggest players — Blockchain.com, Blockstream, Chainalysis, Circle, Coinbase, CoinDesk, Genesis, Grayscale, Kraken, Ledger, Lightning Network, Ripple, Silvergate, and dozens more.

Foundry is its wholly-owned subsidiary that acts arsenic a one-stop store for each of these companies’ mining needs. The accelerated maturation successful Foundry USA’s hash complaint led immoderate to speculate that DCG’s companies were contractually obligated to bash each of their mining done Foundry’s pool. However, it’s important to enactment that neither DCG nor immoderate companies successful its portfolio confirmed this.

The mining ban instated successful China past twelvemonth helped arsenic well.

Forced to permission China’s abundant and inexpensive hydropower, miners were looking for alternate locations offering astatine slightest a fraction of their nett and a much welcoming regulatory environment.

The U.S. presented arsenic a cleanable relocation spot, offering miners a wide enactment of locations and powerfulness sources. And having a mining excavation arsenic ample arsenic Foundry USA astatine their doorstep surely didn’t hurt.

Antpool — Bitmain’s monopoly

Founded successful 2014, Antpool is 1 of the oldest operating mining pools connected the market. Frequently accounting for implicit a 4th of the planetary hash rate, Antpool has astir ne'er near the apical 10 largest mining pools.

The pool’s occurrence is its cleanable vertical integration — it is owned and operated by Bitmain, the world’s largest mining hardware manufacturer. The institution down the Antminer bid has supplied its excavation with the newest and astir businesslike Bitcoin hashers, helping it enactment profitable adjacent successful the coldest crypto winters.

Bitmain’s power implicit the planetary crypto marketplace has led galore to speculate that the institution was obligating its ample buyers to excavation with Antpool. With some Bitmain and Antpool having office successful China, galore besides interest astir the country’s power implicit specified a ample information of Bitcoin’s hash rate.

The corporatization of crypto mining

It’s important to enactment that a mining excavation differs from a backstage mining operation. Unlike a backstage miner, a excavation represents the associated hash complaint of galore machines owned by assorted entities.

Owners of mining machines, oregon hashers, divided the profits generated by the mining excavation according to the size of their contribution.

That Foundry USA accounts for a 4th of the Bitcoin hash complaint doesn’t mean that DCG owns each instrumentality that produced it.

However, Foundry provides the instauration and the extortion for its clients’ mining operations. The company’s weaknesses could shingle up a important information of the Bitcoin web and permission thousands of smaller miners and machines fending for themselves if it were to unopen down.

The aforesaid tin beryllium applied to Antpool.

The complaint of centralization these 2 entities imposed connected the manufacture becomes adjacent greater erstwhile looking beyond conscionable Bitcoin. Antpool has pools for different cryptocurrencies arsenic good — Litecoin (LTC), ZCash (ZEC), Bitcoin Cash (BCH), Ethereum Classic (ETC), and Dash (DASH), conscionable to sanction a few.

Foundry offers endeavor staking enactment for Ethereum (ETH), Solana (SOL), Polkadot (DOT), Avalanche (AVAX), and Cosmos (ATOM). The institution doesn’t disclose the fig of assets it manages.

The station The centralization of Bitcoin: Behind the 2 mining pools controlling 51% of the planetary hash rate appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)