As the crypto marketplace matures, Bitcoin’s spot terms is progressively influenced by planetary geopolitical events, regulatory changes, accepted fiscal marketplace movements, and different applicable macroeconomic events. However, the increasing Bitcoin derivatives marketplace besides shapes Bitcoin’s terms movements, albeit a smaller one.

Futures and options contracts are peculiarly insightful for predicting Bitcoin’s aboriginal movements arsenic they bespeak the sentiment of a blase marketplace segment. However, simply looking astatine the measurement of derivatives contracts oregon unfastened involvement doesn’t supply a broad presumption of marketplace sentiment. Instead, considering much nuanced metrics, specified arsenic the Bitcoin futures annualized three-month rolling basis, is besides essential.

The Bitcoin futures annualized three-month rolling ground measures the quality betwixt the existent (spot) terms of Bitcoin and the terms of a futures declaration for Bitcoin that expires successful 3 months. This quality is calculated connected a rolling ground and expressed arsenic an yearly percent rate.

Contango

A antagonistic rolling ground indicates that futures prices are little than the spot price, a concern known arsenic “backwardation.” Conversely, a affirmative rolling basis, wherever futures prices are higher than the spot price, is called a “contango.”

Contango is simply a captious conception successful accepted markets, particularly commodities, arsenic it reflects the outgo of transportation oregon retention until the contract’s expiration. In the discourse of Bitcoin, contango suggests that traders are consenting to wage a premium for Bitcoin futures arsenic they expect the terms to emergence successful the future.

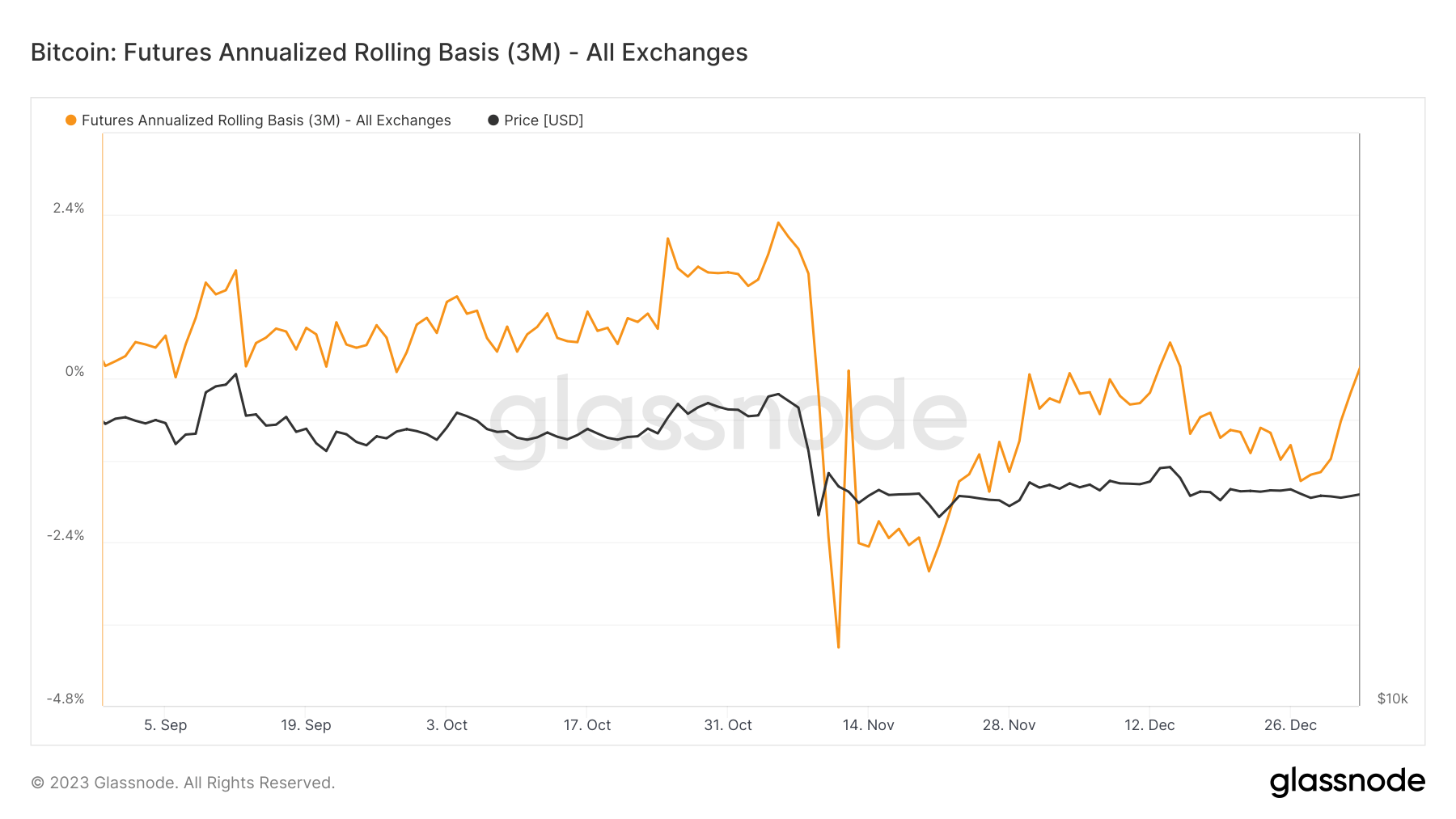

Between November 2022 and January 2023, the annualized three-month rolling ground was mostly negative, correlating with Bitcoin’s crisp plunge from $21,200 to $15,500. This antagonistic rolling ground reflected a bearish marketplace sentiment during this period, showing that traders expected Bitcoin’s terms to depreciate adjacent further.

Graph showing the Bitcoin futures annualized three-month rolling ground from September 2022 to December 2022 (Source: Glassnode)

Graph showing the Bitcoin futures annualized three-month rolling ground from September 2022 to December 2022 (Source: Glassnode)However, the rolling ground turned affirmative successful 2023, increasing from 0.197% connected January 2 to a 17-month highest of 5.883% connected July 13. This displacement to contango suggests a bullish marketplace sentiment, with traders consenting to wage a premium for Bitcoin futures.

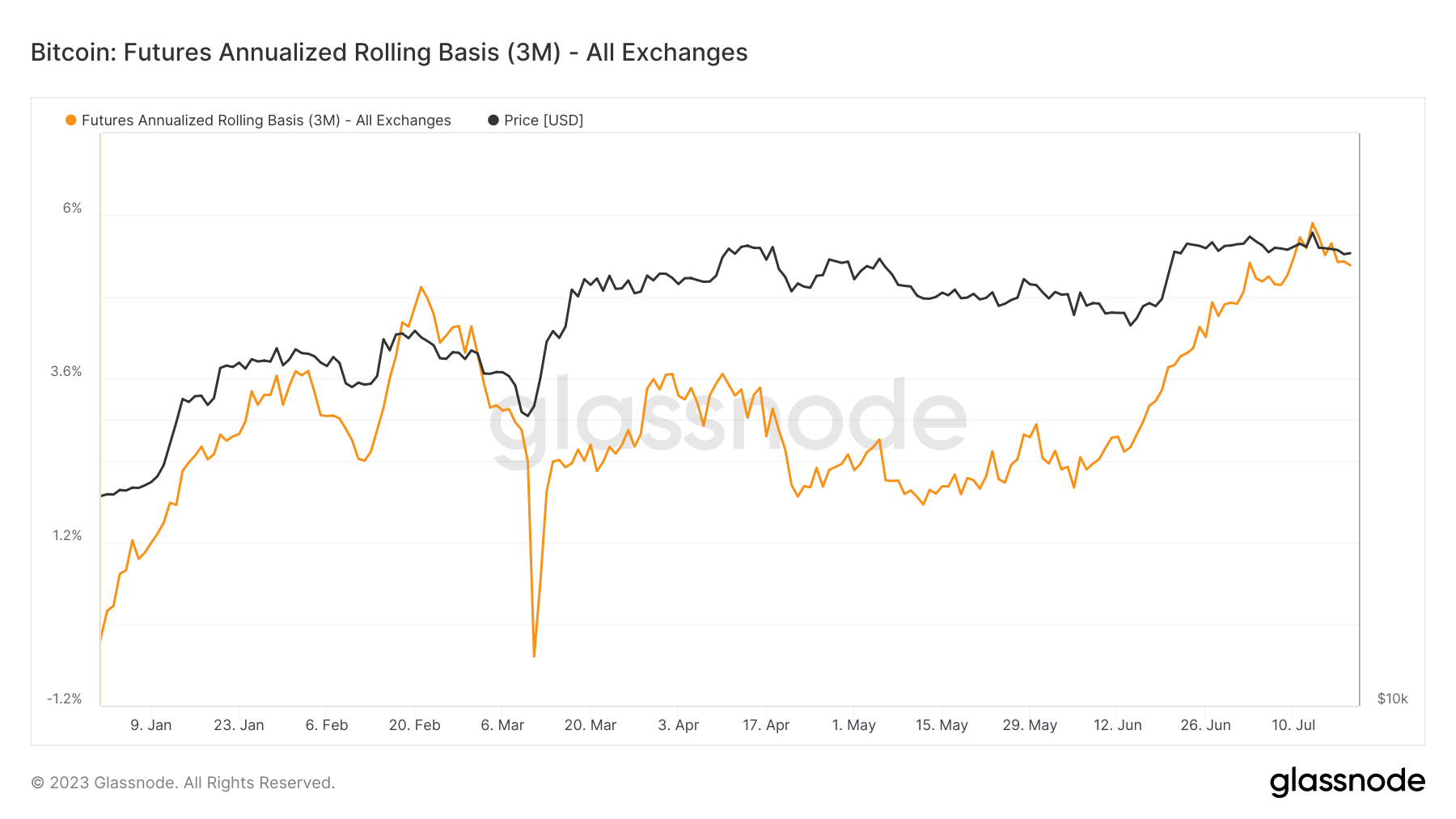

Graph showing the Bitcoin futures annualized three-month rolling ground from January 2023 to July 2023 (Source: Glassnode)

Graph showing the Bitcoin futures annualized three-month rolling ground from January 2023 to July 2023 (Source: Glassnode)The 3 Month Futures Annualized Rolling Basis dropped to 5.321% connected July 18 from 5.883% connected July 13, portion Bitcoin’s terms fell to $28,854 from $31,454. This alteration successful the rolling basis, coupled with the driblet successful Bitcoin’s price, suggests traders successful the futures marketplace are somewhat little optimistic astir the terms of Bitcoin expanding implicit the adjacent 3 months than connected July 13.

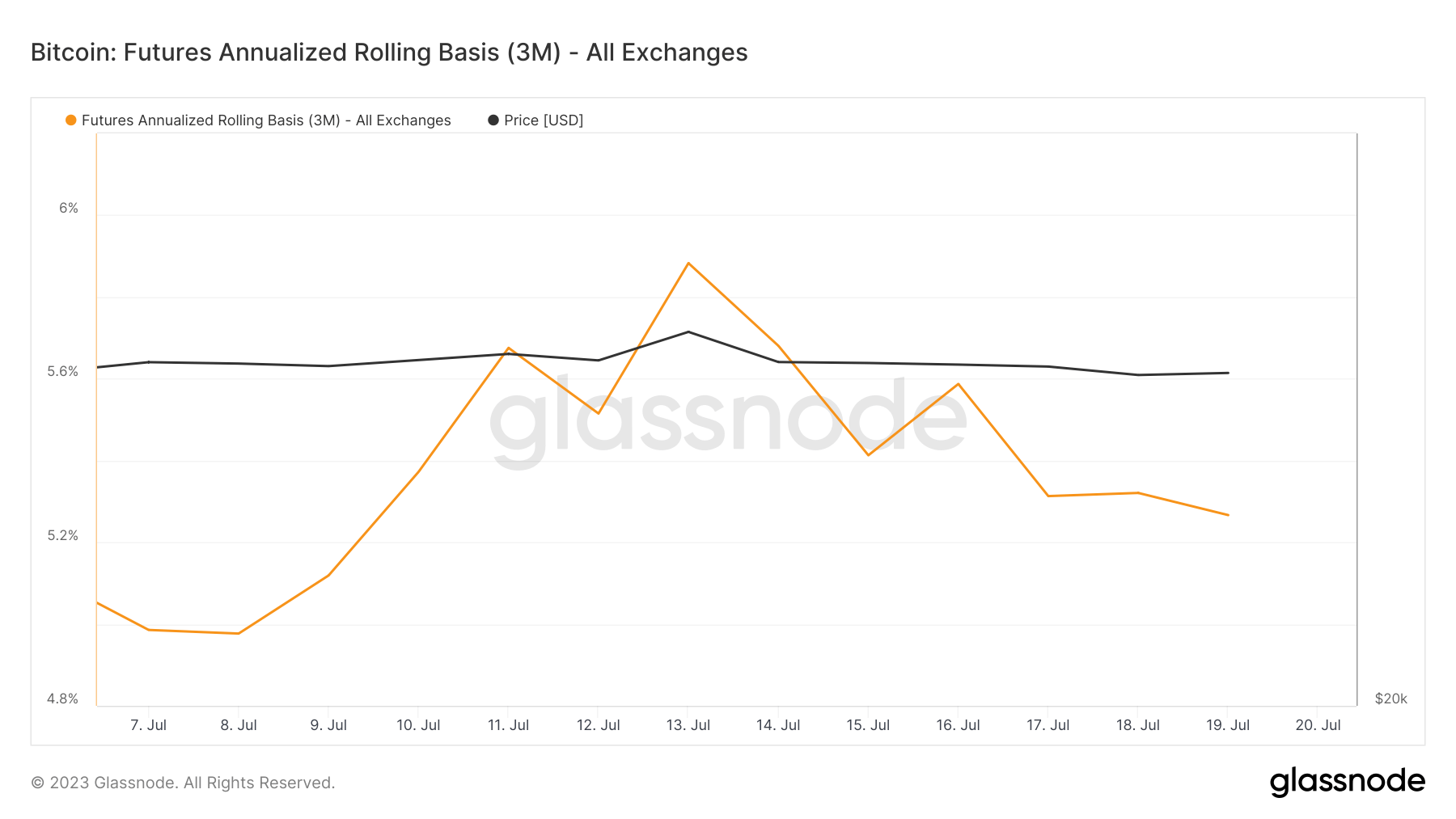

Graph showing the Bitcoin futures annualized three-month rolling ground from July 7 to July 19 (Source: Glassnode)

Graph showing the Bitcoin futures annualized three-month rolling ground from July 7 to July 19 (Source: Glassnode)However, the ground is inactive positive, which means the marketplace is inactive successful a authorities of contango wherever the futures terms is higher than the spot price. This indicates that the wide sentiment successful the futures marketplace remains bullish, but traders look to person recalibrated their expectations to origin successful a much blimpish terms range.

The station The Bitcoin futures contango appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)