Treasury yields are 1 of the astir important marketplace drivers and indicators. Representing the instrumentality an capitalist volition person by holding a authorities enslaved to maturity, these yields supply a snapshot of capitalist sentiment, aboriginal involvement complaint expectations, and the wide economical wellness of a nation.

When analyzing Treasury yields, distinguishing betwixt 2 cardinal output movements — inversion and flattening is essential.

A output curve plots the yields of bonds with identical recognition prime but varying maturities, offering a ocular practice of however short-term yields comparison to semipermanent yields. Under mean economical conditions, the curve slopes upward, signifying higher yields for bonds with longer maturities. However, the curve doesn’t stay static. Its signifier morphs successful effect to changing economical conditions and capitalist sentiment, starring to phenomena similar inversion and flattening.

Inversion occurs erstwhile short-term yields surpass semipermanent yields. This inversion signals marketplace participants’ pessimism astir near-term economical prospects.

Graph showing a normal, flat, and inverted output curve (Source: Britannica)

Graph showing a normal, flat, and inverted output curve (Source: Britannica)Conversely, a flattening output curve indicates a reducing quality betwixt short-term and semipermanent yields. Both these movements successful the curve person profound implications for the market, often acting arsenic harbingers of economical downturns.

There are assorted ways of assessing the wellness of the Treasury measure marketplace and, successful turn, the broader fiscal market, but the “10-2” dispersed stands retired for its humanities accuracy successful predicting economical downturns.

The 2-year and 10-year Treasury notes are among the astir liquid and actively traded U.S. authorities securities. The 2-year enactment reflects short-term economical expectations, portion the 10-year enactment indicates longer-term expectations. The dispersed betwixt these 2 yields provides a wide representation of the output curve’s slope implicit a tenable clip horizon.

The 10-2 dispersed has historically been a reliable predictor of upcoming recessions. When the output connected the 2-year enactment exceeds that of the 10-year enactment (resulting successful a antagonistic 10-2 spread), it indicates an inversion of this conception of the output curve. Such inversions person preceded each U.S. recession implicit the past 50 years, though the clip lag betwixt inversion and the onset of a recession varies.

A affirmative 10-2 dispersed (where the 10-year output is higher than the 2-year yield) usually means that investors expect steadfast economical maturation and request a premium for locking their wealth for extended periods. However, erstwhile a crisp emergence follows a humanities debased successful the spread, it suggests that investors foresee an economical slowdown oregon recession successful the adjacent term. They mightiness beryllium much consenting to judge little yields present for longer-term bonds if they judge they’ll get adjacent little returns successful the aboriginal oregon if they’re seeking safer, longer-term assets successful uncertain times.

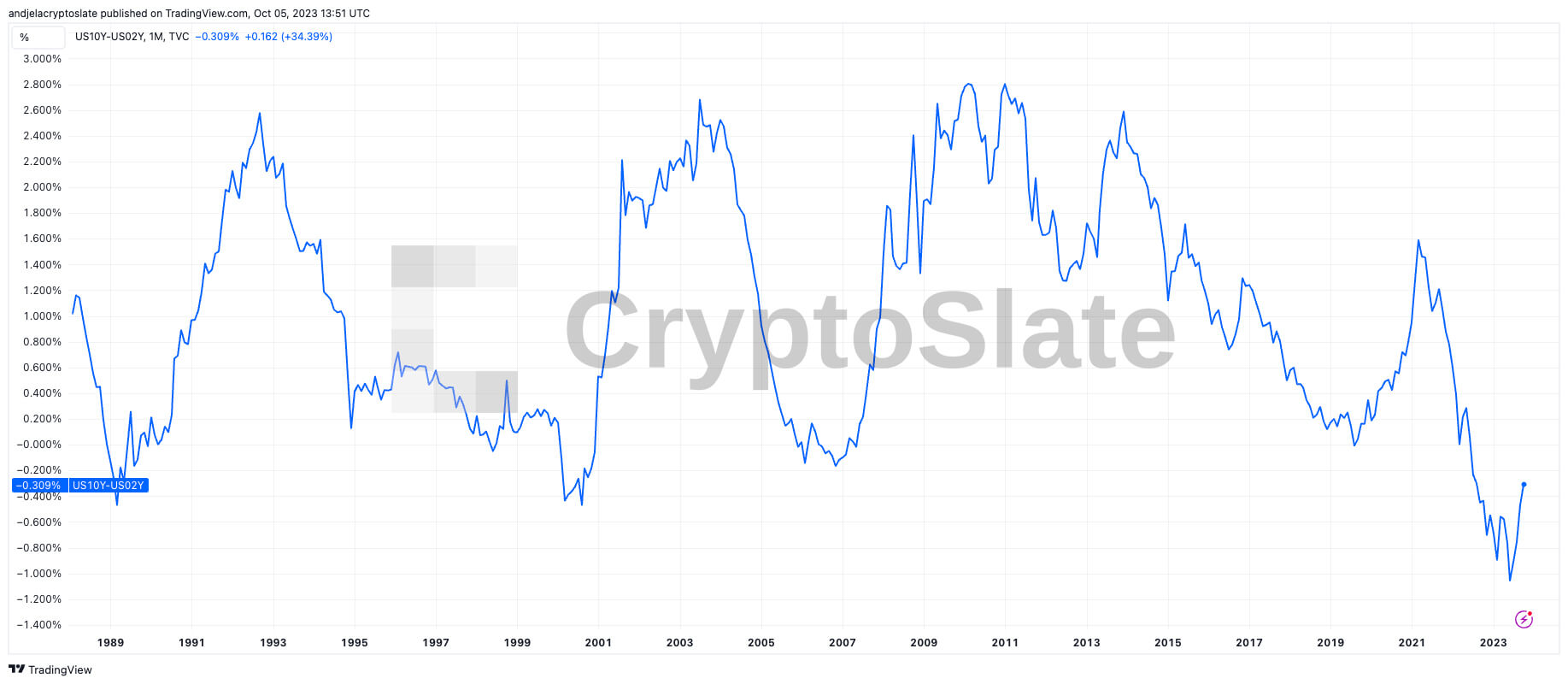

Recent movements successful the 10-2 dispersed bespeak a looming recession. As of Oct. 4, the quality betwixt the 10-year and 2-year Treasury output present stands astatine -0.29%. This marks a sizeable displacement from the -1.06% observed connected June 1, 2023, the lowest constituent the dispersed has touched since 1982.

Graph showing the dispersed betwixt the 10-year Treasury output and the 2-year Treasury output from 1988 to 2023 (Source: TradingView)

Graph showing the dispersed betwixt the 10-year Treasury output and the 2-year Treasury output from 1988 to 2023 (Source: TradingView)Such important dips successful the dispersed person historically preceded economical challenges.

For instance, successful November 2006, the dispersed contracted to a debased of -0.17%, preceding the onset of the 2007 recession. Similarly, a diminution to -0.47% successful August 2000 heralded the consequent dot com clang and the pursuing recession. These humanities precedents, among others, solidify the 10-2 spread’s estimation arsenic an economical crystal ball, providing aboriginal warnings of fiscal storms connected the horizon.

The existent flattening and the associated antagonistic dispersed person immense implications for the market. It suggests investors expect little returns, prompting a displacement towards longer-term bonds. Such behaviour typically reflects concerns astir aboriginal economical stableness and maturation prospects.

The station The 10-2 Treasury output spread: A harbinger of economical downturn? appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)