USDT issuer Tether plans to motorboat a caller stablecoin pegged to the United Arab Emirates Dirham (AED) successful collaboration with the Phoenix Group and Green Acorn, according to an Aug. 21 connection shared with CryptoSlate.

This caller plus volition beryllium a integer practice of the UAE Dirham, pegged 1:1 and backed by reserves held wrong the UAE.

The instauration of this Dirham-pegged stablecoin aims to supply users with seamless entree to AED portion leveraging the transparency and ratio of blockchain technology. This inaugural is expected to boost planetary commercialized and remittances, little transaction fees, and connection a hedge against currency fluctuations.

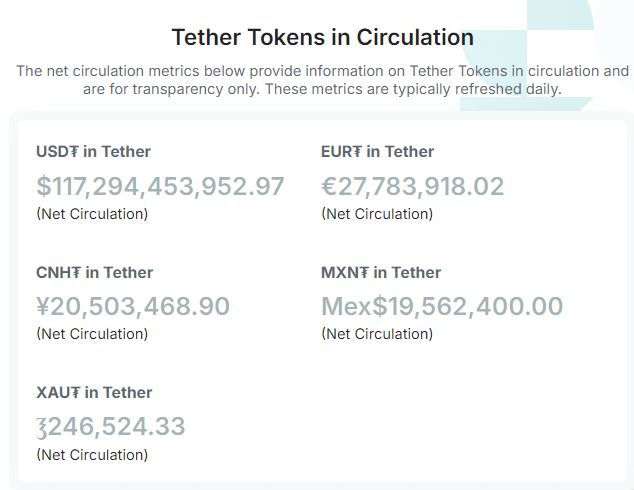

Once launched, the stablecoin volition articulation Tether’s existing portfolio of fiat-based tokens, including USDT, EURT, CNHT, MXNT, XAUT, and aUSDT.

Tether Tokens successful Circulation (Source: Tether)

Tether Tokens successful Circulation (Source: Tether)Why Tether is launching an AED stablecoin

Tether CEO Paolo Ardoino cited UAE’s presumption arsenic a planetary economical hub arsenic a cardinal origin down the launch. He emphasized the value of creating a Dirham-pegged token to facilitate determination transactions.

Ardoino stated:

“Tether’s Dirham-pegged stablecoin is acceptable to go an indispensable instrumentality for businesses and individuals looking for a unafraid and businesslike means of transacting successful the United Arab Emirates Dirham whether for cross-border payments, trading, oregon simply diversifying one’s integer assets.”

The stablecoin’s motorboat coincides with Abu Dhabi’s Financial Services Regulatory Authority (FSRA) proposing a regulatory model for fiat-referenced tokens (FRTs).

On Aug. 20, FSRA outlined that FRT issuers projected that the stablecoin issuers’ reserve assets should adjacent oregon transcend the par worth of each outstanding FRTs astatine the extremity of each concern day.

Additionally, the FSRA recommends that issuers of aggregate FRTs support abstracted pools of reserve assets for each token and negociate them independently.

Further, the regulator stated that the FRT indispensable not beryllium promoted arsenic nor considered to beryllium an concern oregon a savings product. However, it volition not prohibit an issuer from accruing and distributing income earned from Reserve Assets to the FRT holder.

This inaugural reflects the accelerated enlargement of the crypto marketplace successful the UAE, which has experienced important growth successful caller years.

The station Tether expands fiat portfolio with caller UAE Dirham stablecoin appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)