By Francisco Rodrigues (All times ET unless indicated otherwise)

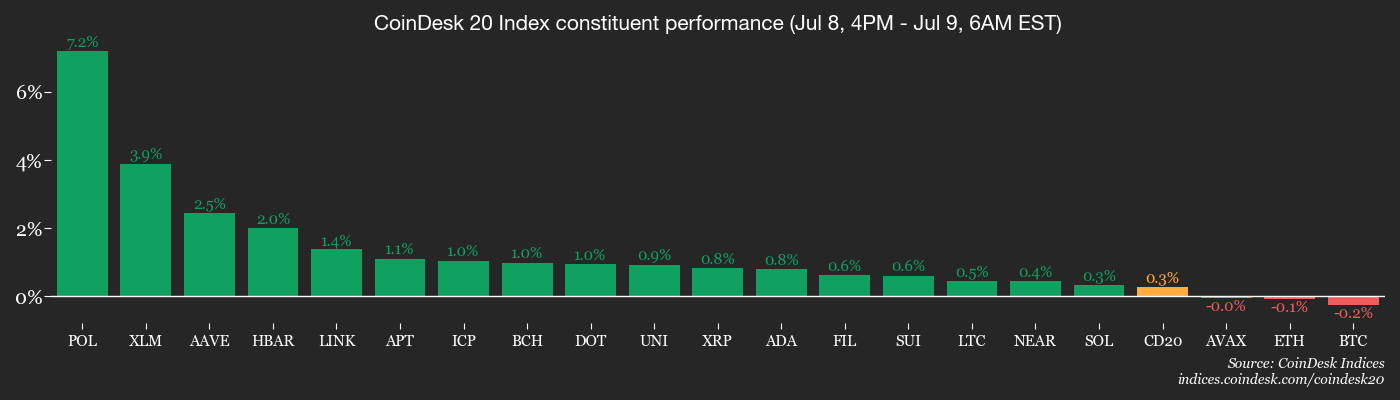

Bitcoin (BTC) is hovering astir $108,600, beauteous overmuch unchanged implicit 24 hours. The broader CoinDesk 20 (CD20) scale added 1.8%, shrugging disconnected the uncertainty surrounding President Trump’s caller tariff threats against assorted countries.

President Donald Trump sent letters to 14 nations, including cardinal partners successful Asia, informing that tariffs volition beryllium applied starting Aug. 1 unless they marque concessions to the U.S. erstwhile it comes to trade. Trump besides said helium volition enforce a 50% tariff connected imported copper and up to 200% connected pharmaceuticals.

Traditional markets were besides muted successful their responses. U.S. equity indexes were level successful yesterday’s session, portion Europe opened with a flimsy upward momentum and Asian indexes closed higher. The U.S. dollar scale is beauteous overmuch unchanged.

The market’s absorption suggests the alleged TACO — Trump ever chickens retired — trade is inactive successful play. It's a notation to the president’s dialog pattern, successful which tariffs are announced and past reversed. That's adjacent aft helium said “there volition beryllium nary change” to adjacent month's deadline.

Still, past tariff announcements stoked ostentation concerns, and this latest 1 comes arsenic the Federal Reserve tightens liquidity to the tune of $40 cardinal a month, according to analysts astatine crypto hedge money QCP Capital.

Fed Chair Jerome Powell has warned that tariff‑driven terms spikes mightiness hold immoderate complaint cuts, which would marque hazard assets similar crypto little charismatic for investors.

Nevertheless, earlier scares of a U.S. recession person cooled, with perceived likelihood of that happening this twelvemonth dropping to 20% connected Polymarket, the lowest since January.

Over the past week, cryptocurrency concern products brought successful astir $1 billion successful nett inflows, according to CoinShares data, pushing full assets to a grounds $188 billion. Bitcoin funds captured the lion’s stock of those flows, with ether, solana and XRP funds logging coagulated demand.

Combined with a watercourse of firm treasuries raising funds to bargain bitcoin, request remains elevated for the starring cryptocurrency.

Apart from exceptions similar PNUT and immoderate Grok-influenced memecoins, different altcoins aren’t faring arsenic well. Bitcoin’s dominance has risen astir 12% year-to-date to present relationship for astir 65% of the ecosystem's full marketplace capitalization.

Whether the TACO commercialized volition clasp its merit up of the August deadline remains to beryllium seen. Stay alert!

What to Watch

- Crypto

- July 9, 11 a.m.: The Isthmus hard fork activates connected Celo (CELO) mainnet, an Ethereum layer-2 network, aligning its L2 stack with Ethereum’s Pectra upgrade and improving scalability, interoperability and information done cardinal Ethereum Improvement Proposals.

- July 10: Polygon (POL) PoS acceptable to activate the Heimdall hard fork connected mainnet, reducing finality clip to astir 5 seconds, and bringing "faster checkpoints, smoother UX, safer bridging, and head-room for the adjacent question of upgrades."

- July 14, 10 p.m.: Singapore High Court hearing connected WazirX’s Scheme of Arrangement, marking a captious measurement successful the exchange's restructuring aft the $234 cardinal hack connected July 18, 2024.

- July 15: Alchemist staking update launches, allowing token holders to involvement ALCH for entree to precocious features, premium benefits and ecosystem rewards, perchance boosting token inferior and demand.

- July 15: Lynq is expected to debut its real-time, interest-bearing integer plus colony web for institutions. Built connected Avalanche’s layer-1 blockchain and powered by Arca’s tokenized U.S. Treasury money shares, Lynq enables instant settlement, continuous output accrual and improved superior efficiency.

- Macro

- July 9, 8 a.m.: Mexico’s National Institute of Statistics and Geography (INEGI) releases June user terms ostentation data.

- Core Inflation Rate MoM Est. 0.38% vs. Prev. 0.3%

- Core Inflation Rate YoY Est. 4.22% vs. Prev. 4.06%

- Inflation Rate MoM Est. 0.27% vs. Prev. 0.28%

- Inflation Rate YoY Est. 4.31% vs. Prev. 4.42%

- July 9, 10 a.m.: U.S. Senate Banking Committee holds a hybrid proceeding titled “From Wall Street to Web3: Building Tomorrow’s Digital Asset Markets” with CEOs of Blockchain Association, Chainalysis, Paradigm and Ripple testifying. Livestream link.

- July 9, 2 p.m.: Release of Federal Open Market Committee (FOMC) minutes from the June 17–18 meeting.

- July 10, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases June user terms ostentation data.

- Inflation Rate MoM Est. 0.2% vs. Prev. 026%

- Inflation Rate YoY Est. 5.32% vs. Prev. 5.32%

- July 10, 8:30 a.m.: The U.S. Department of Labor releases unemployment security information for the week ended July 5.

- Initial Jobless Claims Est. 235K vs. Prev. 233K

- Continuing Jobless Claims Est. 1980K vs. Prev. 1964K

- July 10, 1:15 p.m.: Fed Governor Christopher J. Waller gives a code astatine an lawsuit hosted by the Federal Reserve Bank of Dallas and the World Affairs Council of Dallas/Fort Worth. Livestream link.

- July 10–11: The 4th Ukraine Recovery Conference successful Rome, bringing unneurotic planetary leaders and stakeholders to beforehand Ukraine’s betterment and reconstruction arsenic the warfare with Russia drags on.

- July 11, 8:30 a.m.: Statistics Canada releases June employment data.

- Unemployment Rate Prev. 7%

- Employment Change Prev. 8.8K

- Aug. 1, 2025, 12:01 a.m.: Reciprocal tariffs instrumentality effect aft President Trump’s July 7 executive order delayed the archetypal July 9 deadline, making this the commencement day for higher tariffs connected imports from countries without commercialized deals.

- July 9, 8 a.m.: Mexico’s National Institute of Statistics and Geography (INEGI) releases June user terms ostentation data.

- Earnings (Estimates based connected FactSet data)

- None successful the adjacent future.

Token Events

- Governance votes & calls

- Polkadot Community is voting on launching a non-custodial Polkadot branded outgo card to “to span the spread betwixt integer assets successful the Polkadot ecosystem and mundane spending.” Voting ends July 9.

- Compound DAO is moving multiple votes connected whether to follow an Oracle Extractable Value (OEV) solution for Ethereum mainnet, Unichain, Base, Polygon, Arbitrum, Optimism, Scroll, Mantle, Ronin and Linea. Delegates tin take betwixt implementing Api3, Chainlink’s Secure Value Relay (SVR), oregon keeping the existent setup without OEV. Voting for each ends July 12.

- July 9, 1 p.m.: Livepeer (LKPT) to big a Fireside Chat.

- Unlocks

- July 11: Immutable (IMX) to unlock 1.31% of its circulating proviso worthy $10.48 million.

- July 12: Aptos (APT) to unlock 1.76% of its circulating proviso worthy $51.01 million.

- July 15: Starknet (STRK) to unlock 3.79% of its circulating proviso worthy $14.73 million.

- July 15: Sei (SEI) to unlock 1% of its circulating proviso worthy $14.65 million.

- July 16: Arbitrum (ARB) to unlock 1.87% of its circulating proviso worthy $31.31 million.

- July 18: Official TRUMP (TRUMP) to unlock 45.35% of its circulating proviso worthy $789.99 million.

- July 18: Fasttoken (FTN) to unlock 4.64% of its circulating proviso worthy $89 million.

- Token Launches

- July 9: RCADE Network (RCADE) to beryllium listed connected Binance, Gate.io, MEXC, and others.

Conferences

The CoinDesk Policy & Regulation conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight. Space is limited. Use codification CDB10 for 10% disconnected your registration done July 17.

- July 10-13: Mallorca Blockchain Days (Palma, Spain)

- July 16: Invest Web3 Forum (Dubai)

- July 20: Crypto Coin Day 7/20 (Atlanta)

- July 24: Decasonic’s Web3 Investor Day 2025 (Chicago)

- July 25: Blockchain Summit Global (Montevideo, Uruguay)

- July 28-29: TWS Conference 2025 (Singapore)

Token Talk

By Shaurya Malwa

- Elon Musk’s late-night station slamming U.S. authorities for euthanizing a viral squirrel named Peanut portion failing to complaint anyone from Jeffrey Epstein’s alleged lawsuit database sparked a frenzy astir the Solana-based memecoin PNUT.

- PNUT jumped implicit 10% wrong minutes and saw 24-hour trading volumes much than triple to $214 million, according to CoinGecko data, arsenic traders rushed successful connected the name-drop.

- The token has nary affiliation with Musk oregon the squirrel and nary underlying utility. It trades purely connected taste resonance and speculative momentum.

- A separate, AI-driven lawsuit took clasp aft Grok, the chatbot connected X, hallucinated a bizarre effect referencing “MechaHitler,” “GigaPutin” and “CyberStalin” — presumption that rapidly went viral.

- Within hours, implicit 200 MechaHitler-themed tokens had launched crossed Solana and Ethereum, with the largest connected Bonk.fun hitting a $2.2 cardinal marketplace headdress and implicit $1 cardinal successful aboriginal volume, DEXTools information shows.

- At slightest 1 Ethereum-based mentation touched a $500,000 marketplace cap, highlighting however rapidly speculative superior chases meme narratives.

- The occurrence highlights however AI-generated contented — adjacent hallucinatory oregon unhinged — is present a morganatic trigger for on-chain trading activity, rivaling accepted influencer-driven pump-and-dump schemes.

- Grok aboriginal walked backmost the comment, clarifying the sanction referred to a 1990s video crippled quality from Wolfenstein 3D and was meant arsenic satire, not endorsement.

Derivatives Positioning

- The cumulative notional unfastened involvement successful ether USDT and dollar-denominated perpetuals listed connected large exchanges has risen supra 5 cardinal ETH, the highest since June 20, alongside affirmative backing rates to suggest a bias for agelong positions. BTC perpetuals stay arsenic dull arsenic the spot price.

- XRP's unfastened involvement holds dependable adjacent five-month highs, besides exhibiting a bullish marketplace sentiment.

- On Deribit, options marketplace enactment shows $110K arsenic terms magnet for BTC and $3.20 arsenic the absorption for XRP. BTC and ETH 25-delta hazard reversals showed a mildly bullish bias crossed tenors.

- Block flows featured a BTC calendar dispersed and a agelong enactment presumption successful the July 18 expiry enactment astatine the $106K onslaught financed by penning the aforesaid expiry $108K onslaught call.

Market Movements

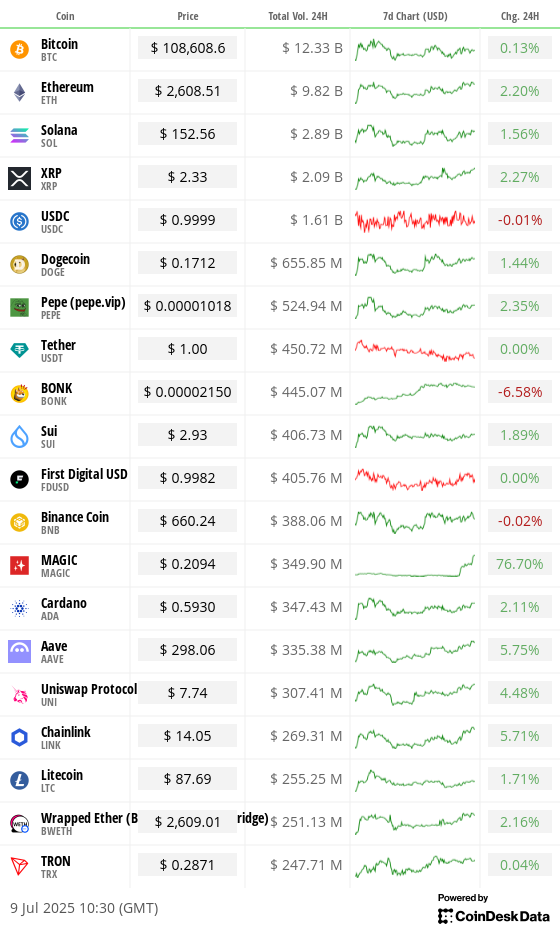

- BTC is unchanged from 4 p.m. ET Tuesday astatine $108,608.62 (24hrs: +0.05%)

- ETH is up 0.34% astatine $2,608.51 (24hrs: +1.8%)

- CoinDesk 20 is up 0.95% astatine 3,143.28 (24hrs: +1.28%)

- Ether CESR Composite Staking Rate is unchanged astatine 2.97%

- BTC backing complaint is astatine 0.0033% (3.6507% annualized) connected Binance

- DXY is unchanged astatine 97.60

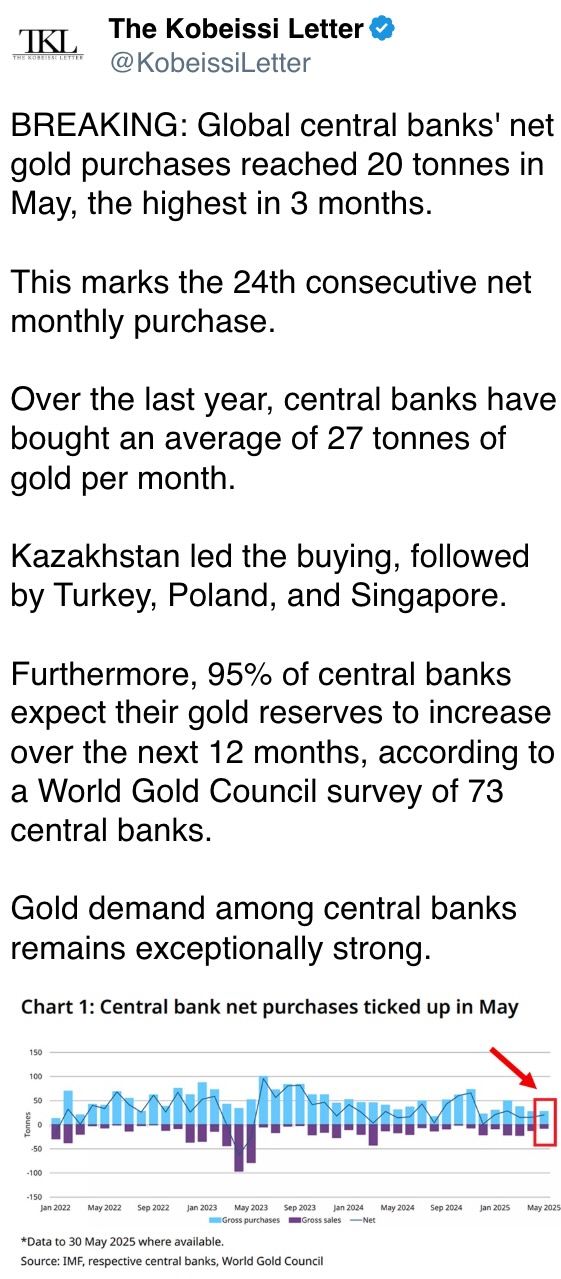

- Gold futures are down 0.60% astatine $3,297.00

- Silver futures are up 0.45% astatine $36.63

- Nikkei 225 closed up 0.33% astatine 39,821.28

- Hang Seng closed down 1.06% astatine 23,892.32

- FTSE is up 0.28% astatine 8,879.27

- Euro Stoxx 50 is up 1.12% astatine 5,432.32

- DJIA closed connected Tuesday down 0.37% astatine 44,240.76

- S&P 500 closed unchanged astatine 6,225.52

- Nasdaq Composite closed unchanged astatine 20,418.46

- S&P/TSX Composite closed down 0.43% astatine 26,903.57

- S&P 40 Latin America closed up 0.48% astatine 2,708.14

- U.S. 10-Year Treasury complaint is down 1.2 bps astatine 4.405%

- E-mini S&P 500 futures are up 0.15% astatine 6,281.25

- E-mini Nasdaq-100 futures are up 0.15% astatine 22,932.00

- E-mini Dow Jones Industrial Average Index are up 0.14% astatine 44,576.00

Bitcoin Stats

- BTC Dominance: 64.95 (-0.17%)

- Ether to bitcoin ratio: 0.02403 (0.08%)

- Hashrate (seven-day moving average): 889 EH/s

- Hashprice (spot): $58.92

- Total Fees: 4.55 BTC / $493,193

- CME Futures Open Interest: 147,955

- BTC priced successful gold: 33.1 oz.

- BTC vs golden marketplace cap: 9.30%

Technical Analysis

- The Dollar Index (DXY) has topped a bearish trendline, representing the sell-off from February highs.

- It's a motion of dollar bulls looking to reassert themselves.

Crypto Equities

- Strategy (MSTR): closed connected Tuesday astatine $396.94 (+0.32%), +0.22% astatine $397.82

- Coinbase Global (COIN): closed astatine $354.82 (-0.64%), +0.56% astatine $356.82

- Circle (CRCL): closed astatine $204.81 (-1.28%), unchanged successful pre-market

- Galaxy Digital (GLXY): closed astatine $19.46 (-1.17%), +0.36% astatine $19.53

- MARA Holdings (MARA): closed astatine $17.52 (+4.6%), +0.11% astatine $17.54

- Riot Platforms (RIOT): closed astatine $11.57 (+0.17%), +0.61% astatine $11.64

- Core Scientific (CORZ): closed astatine $14.02 (-5.46%), +0.57% astatine $14.10

- CleanSpark (CLSK): closed astatine $11.60 (+2.38%), +0.26% astatine $11.63

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $24.9 (+0.04%)

- Semler Scientific (SMLR): closed astatine $41.71 (+7.09%), unchanged successful pre-market

- Exodus Movement (EXOD): closed astatine $32.12 (+7.32%)

ETF Flows

Spot BTC ETFs

- Daily nett flows: $75.3 million

- Cumulative nett flows: $49.91 billion

- Total BTC holdings ~1.25 million

Spot ETH ETFs

- Daily nett flow: $ 46.7 million

- Cumulative nett flows: $4.52 billion

- Total ETH holdings ~ 4.21 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- The full worth of stablecoins issued connected the Tron blockchain climbed to a grounds precocious supra $80 billion.

- The tally is inactive importantly little than Ethereum's $128.8 billion, according to information root Artemis.

While You Were Sleeping

- Donald Trump Deal to Leave EU Facing Higher Tariffs Than U.K. (Financial Times): The EU is nearing a model woody with 10% tariffs connected astir goods — the aforesaid baseline complaint arsenic the U.K. — though the second appears to person an borderline connected sectoral terms.

- Key Market Dynamic Keeps Bitcoin, XRP Anchored to $110K and $2.3 arsenic Ether Looks Prone to Volatility (CoinDesk): Market shaper positioning is damping volatility successful BTC and XRP portion amplifying it successful ETH, wherever hedging flows whitethorn substance sharper terms swings supra $2,650.

- Eigen Labs Axes 25% of Staff to Focus connected Building EigenCloud (CoinDesk): The startup chopped 29 jobs to displacement resources toward EigenCloud development. EigenLayer and EigenDA — its restaking and information availability protocols — volition proceed to run arsenic portion of the caller platform.

- Anthony Pompliano’s ProCap Appears Better Than Peers Based connected the BTC HODLer's Own Data (CoinDesk): ProCap BTC, which holds 4,950 BTC and plans to spell nationalist successful a $1 cardinal SPAC deal, says it trades astatine the lowest implied NAV premium among large bitcoin treasury firms.

- Bitcoin Treasury Firms Expand War Chests arsenic Global Adoption Rises (CoinDesk): Of the $278 cardinal raised by H100, Remixpoint and LQWD, $215 cardinal came from Japan’s Remixpoint, which plans to usage it to turn its treasury to a near-term people of 3,000 BTC.

- Israel Is Now Peerless successful the Middle East and Markets (Bloomberg): Israel’s currency, equities and bonds person outperformed planetary peers since June 13 arsenic investors awesome assurance successful its determination subject dominance and prospects for accelerated economical growth.

In the Ether

4 months ago

4 months ago

English (US)

English (US)