Close to fractional of plus managers presently person integer assets nether management, according to a caller study. Firms ample and tiny are implementing crypto strategies for clients and expanding offerings.

Asset Managers Embrace Crypto: 48% Now Manage Digital Assets

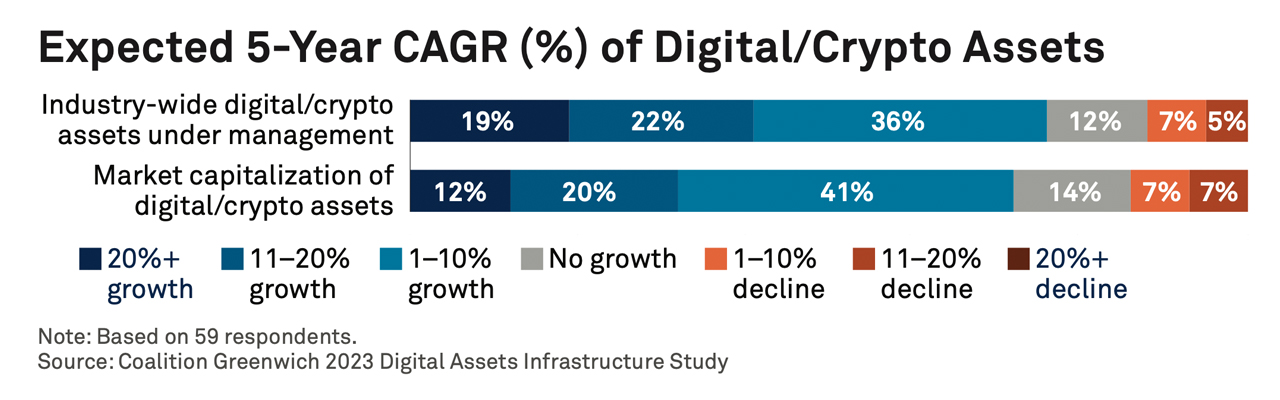

The study by integer currency information supplier Amberdata with Coalition Greenwich finds that 48% of organization investors present negociate integer assets. Growth forecasts stay robust contempt caller marketplace volatility. Over the adjacent 5 years, three-fourths of managers expect integer assets nether absorption (AUM) to expand. More than 40% foresee precise beardown 11-20%+ growth.

Managers spot a increasing marketplace accidental to negociate integer assets, the study details. Asset managers purpose to bushed wide marketplace growth, with 44% expecting integer assets to beryllium a increasing concern enactment implicit the adjacent 3 to 5 years. The study states:

While a bulk judge organization sentiment toward integer plus adoption has slowed, 46% stay neutral to affirmative astir the existent authorities of adoption. Furthermore, those with a dedicated relation successful integer assets are notably much positive—so those firms that are existent believers stay actively engaged and building.

Strategies span progressive and passive funds, arbitrage, and task superior plays. The survey notes that the apical instruments are exchange-traded products, stablecoins, and cryptocurrencies. The researchers further adhd that caller offerings successful the pipeline see tokenized securities and real-world assets.

The study insists that the U.S. is crucial, with managers betting connected constructive crypto regularisation wrong 5 years. The U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) are seen arsenic providing affirmative opportunities implicit time. Presently, overseas hubs similar Dubai and Switzerland person drawn much interest.

“Infrastructure, including well-regulated custody, is captious to the ecosystem’s development,” the study says. “The adjacent arms contention is centered connected data, analytics, and tools to enactment front-office professionals.”

Amberdata’s probe further explains that spending connected crypto marketplace data, blockchain analytics, and portfolio systems is acceptable to emergence implicit the adjacent six to 12 months. As the manufacture matures, managers privation to bargain alternatively than physique capabilities. New partnerships and outsourcing are likely, the survey projects.

“Firms volition beryllium connected firmer crushed erstwhile the clouds wide and sunny skies look next,” the study concludes.

What bash you deliberation astir the Amberdata report? Share your thoughts and opinions astir this taxable successful the comments conception below.

2 years ago

2 years ago

English (US)

English (US)