After six months of Bitcoin speech withdrawals outpacing deposits, a reversal occurred this month, signaling a alteration successful holder behavior.

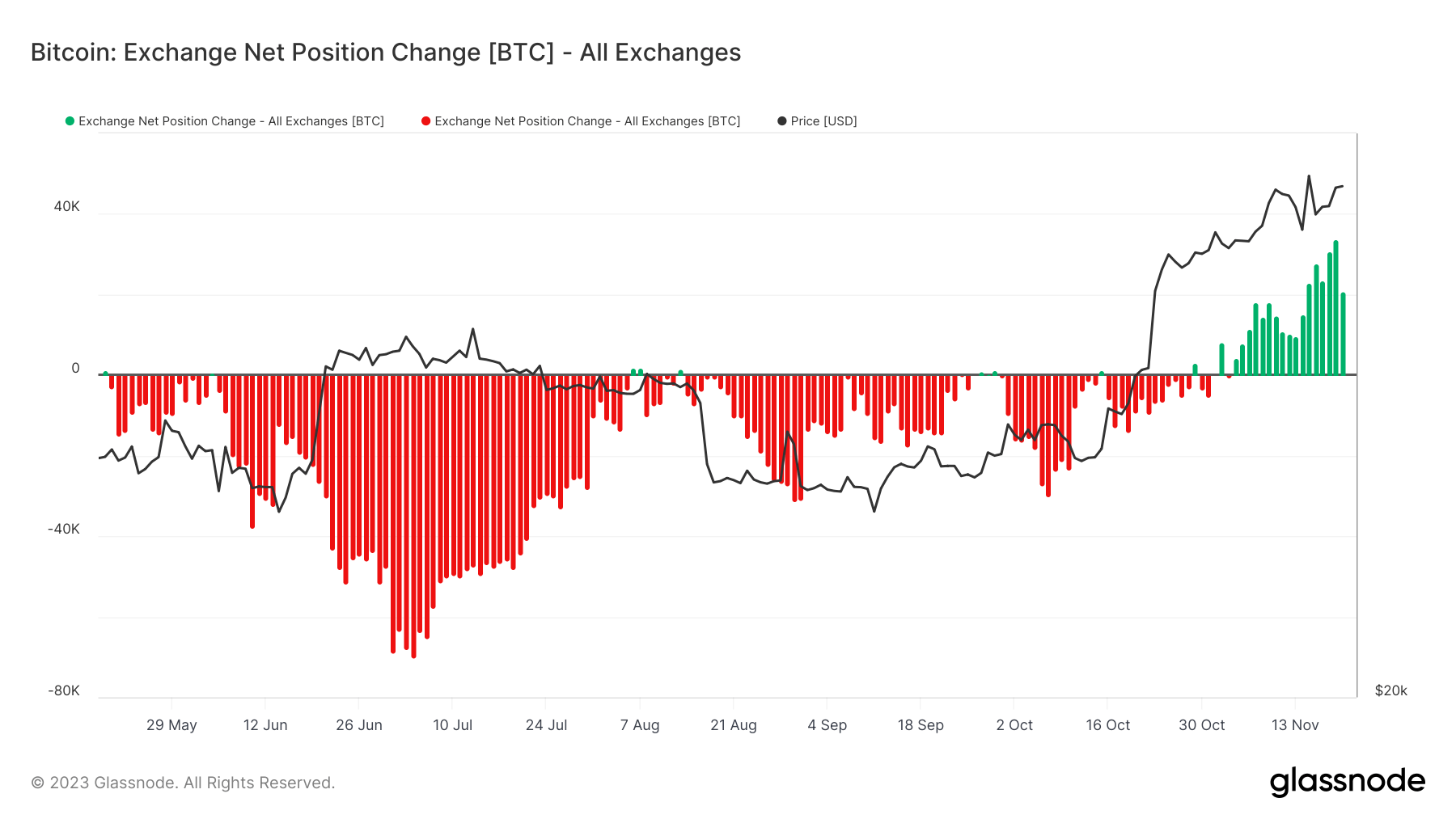

The speech nett flow, which measures the quality betwixt Bitcoin deposits and withdrawals connected exchanges, turned affirmative astatine the opening of November, indicating a renewed involvement successful speech activities among Bitcoin holders.

This displacement is peculiarly important fixed the antagonistic inflows that persisted from May 20 to Oct. 31, suggesting a play wherever holders were much inclined to store their Bitcoin disconnected exchanges, perchance for semipermanent holding oregon successful anticipation of marketplace recovery. However, this inclination reversed successful November, with the speech nett presumption alteration showing a chiseled summation successful Bitcoin being moved to exchanges. This influx peaked connected Nov.19, erstwhile a staggering 33,854 BTC were deposited onto exchanges. Such a important spike tin often beryllium interpreted arsenic a motion of holders preparing to merchantability oregon commercialized their Bitcoin, perchance owed to changing marketplace conditions oregon to capitalize connected terms movements.

Graph showing the 30-day alteration of the Bitcoin proviso held successful speech wallets from May 20 to Nov. 20, 2023 (Source: Glassnode)

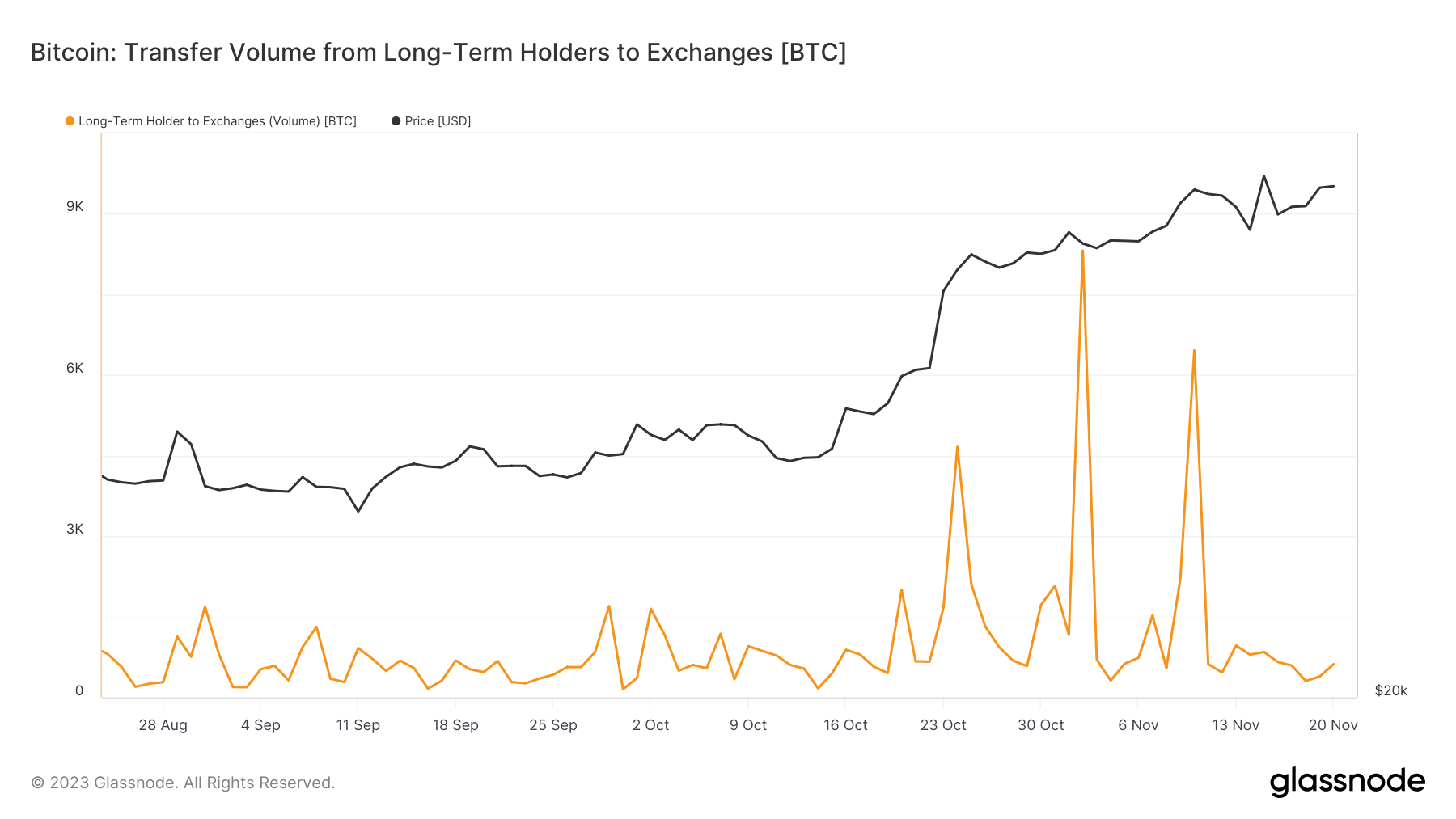

Graph showing the 30-day alteration of the Bitcoin proviso held successful speech wallets from May 20 to Nov. 20, 2023 (Source: Glassnode)Analyzing the transportation volumes by circumstantial cohorts of holders provides much profound insight. The transportation measurement from semipermanent holders (LTHs) to exchanges is peculiarly noteworthy, with 2 important spikes occurring successful November: 1,163 BTC connected Nov. 1 and a much important 8,318 BTC connected Nov. 2. These transfers suggest that immoderate LTHs, typically characterized by their inclination to clasp assets done assorted marketplace cycles, chose to determination their holdings to exchanges, perchance indicating a displacement successful their semipermanent concern strategies oregon reactions to existent marketplace dynamics.

Graph showing the Bitcoin transportation measurement from semipermanent holders (LTHs) to exchanges from Aug. 24 to Nov. 20, 2023 (Source: Glassnode)

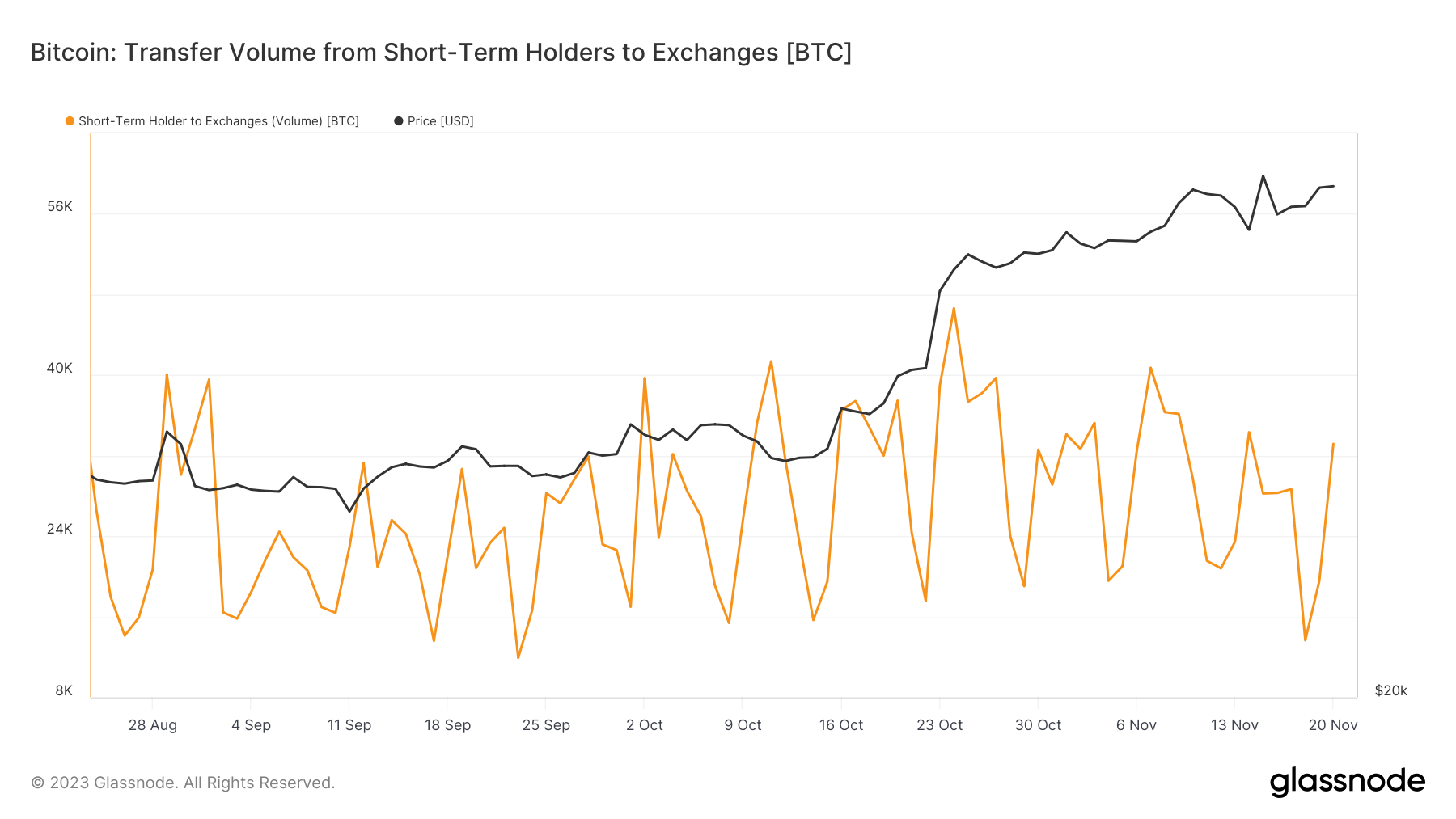

Graph showing the Bitcoin transportation measurement from semipermanent holders (LTHs) to exchanges from Aug. 24 to Nov. 20, 2023 (Source: Glassnode)In contrast, the transportation measurement from short-term holders (STHs) to exchanges was markedly higher, reflecting their much progressive and responsive trading behavior. Significant inflows were observed connected respective days, including 34,111 BTC connected Nov. 1 and 33,170 BTC connected Nov. 20. These figures align with the year’s mean but are indicative of the volatile quality of short-term holding, wherever investors are much apt to respond to contiguous marketplace changes.

Graph showing the Bitcoin transportation measurement from short-term holders (STHs) to exchanges from Aug. 24 to Nov. 20, 2023 (Source: Glassnode)

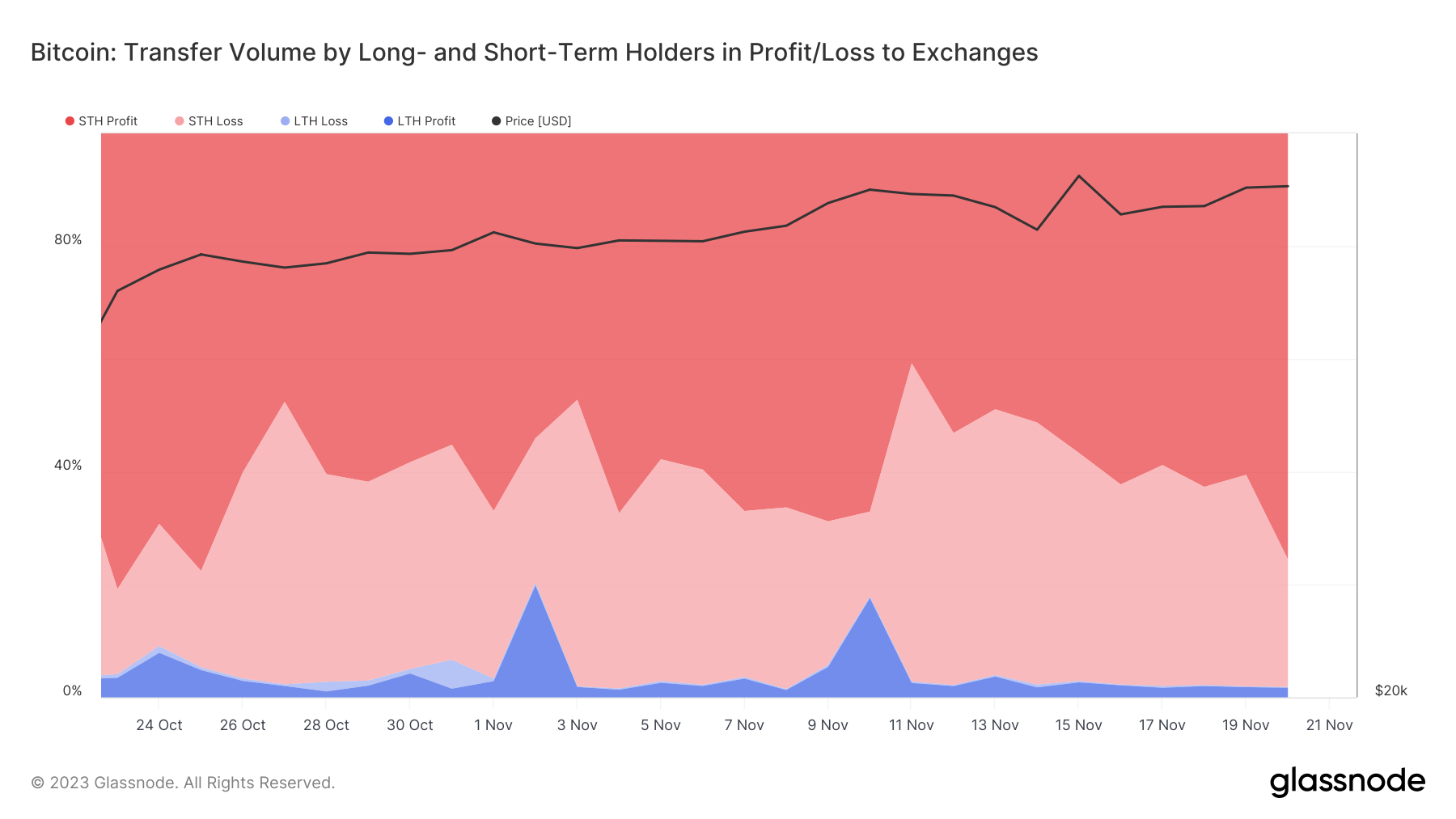

Graph showing the Bitcoin transportation measurement from short-term holders (STHs) to exchanges from Aug. 24 to Nov. 20, 2023 (Source: Glassnode)Another captious measurement to see is the magnitude of Bitcoin moved to exchanges by semipermanent and short-term holders and whether they are making a nett oregon loss. This metric reveals the percent of holders successful nett during their transfers. On Nov. 1, 66.9% of STHs and lone 2.8% of LTHs were profitable, reflecting these 2 groups’ antithetic concern horizons and strategies. By Nov. 20, the percent of profitable STHs accrued to 75.5%, portion that of LTHs decreased to 1.69%. This inclination indicates that much STHs, much attuned to short-term terms movements, were capitalizing connected their profits.

Graph showing the comparative magnitude of BTC moved by long- and short-term holders successful profit/loss to exchanges from Oct. 21 to Nov. 20, 2023 (Source: Glassnode)

Graph showing the comparative magnitude of BTC moved by long- and short-term holders successful profit/loss to exchanges from Oct. 21 to Nov. 20, 2023 (Source: Glassnode)The accrued speech inflows from STHs and LTHs, peculiarly with a important information of STHs successful profit, suggest a marketplace wherever short-term trading dynamics are progressively influential. STHs, buoyed by caller profits, are driving this trend, perchance looking to fastener successful gains amidst fluctuating prices. However, contempt these movements, Bitcoin’s terms remained comparatively stable, rising somewhat from $35,421 connected Nov. 1 to $37,485 connected Nov. 20.

This stability, contempt the accrued speech inflows and selling pressure, mightiness suggest a robust underlying request absorbing the sell-off, oregon a marketplace inactive successful equilibrium, waiting for a much decisive directional move.

The station Surge successful Bitcoin speech deposits breaks six-month withdrawal streak appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)