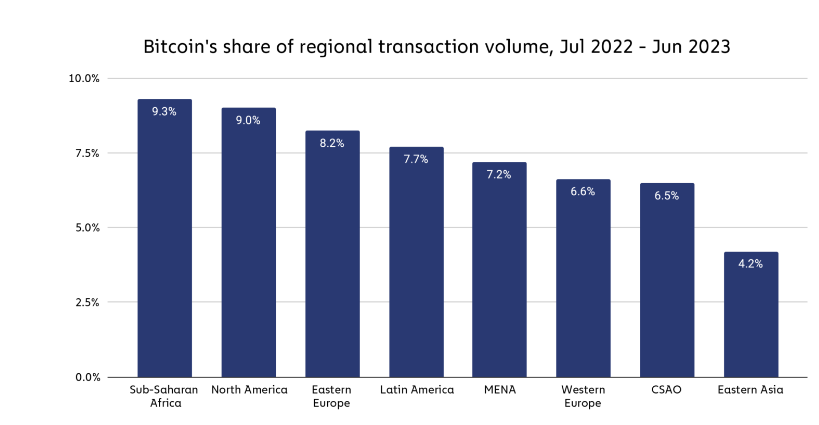

Despite accounting for conscionable 2.3% of planetary transaction volume, the latest information shows that crypto has penetrated cardinal markets successful Sub-Saharan Africa and “become an important portion of galore residents’ day-to-day lives.” With a determination measurement of 9.3%, Sub-Saharan Africa’s BTC stock outranks each regions including North America (9.0%) and Eastern Europe (8.2%).

Nigeria Epitomizes Sub-Saharan Africa’s Crypto Penetration

While the Sub-Saharan Africa portion is reported to person accounted for 2.3% of planetary transaction volume, a person look astatine the latest information shows that “crypto has penetrated cardinal markets and go an important portion of galore residents’ day-to-day lives.” As the excerpt from Chainalysis’ upcoming Geography Report shows, nary state from this portion champion exemplifies however crypto has go portion of mundane beingness than Nigeria.

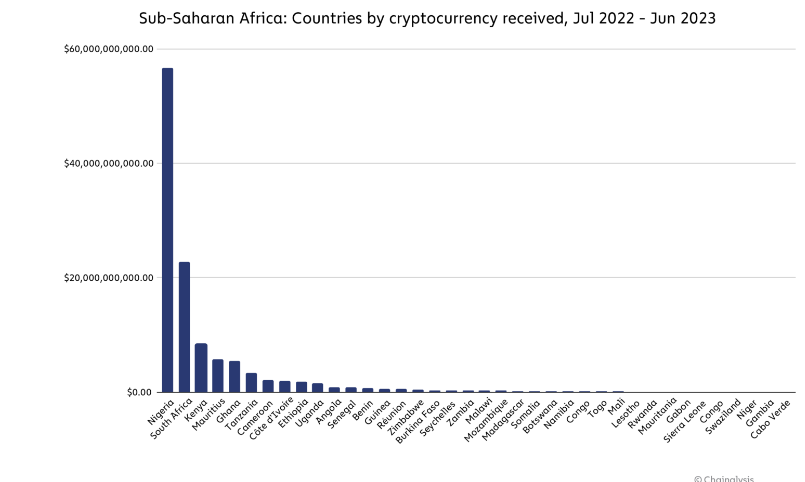

With transaction volumes of conscionable nether $60 cardinal betwixt July 2022 and June 2023, Nigeria is Sub-Saharan Africa’s largest crypto marketplace by a distance. For perspective, the region’s full volumes during the aforesaid play were $117.1 billion. The information shows that Nigeria accounted for astir fractional of the region’s full transaction measurement successful that period.

South Africa, whose traded volumes surpassed the $20 cardinal people during the aforesaid period, is location to the Sub-Saharan Africa region’s second-largest crypto market. Kenya, Mauritius and Ghana, which are ranked third, fourth, and fifth, respectively, implicit the region’s apical five.

Meanwhile, the Chainalysis information suggests that residents from the Sub-Saharan Africa portion progressively spot BTC arsenic an alternate store of value. With a determination measurement stock of 9.3%, Sub-Saharan Africa’s BTC stock outranks each regions including North America (9.0%) and Eastern Europe (8.2%). Explaining wherefore Sub-Saharan Africa is ranked first, Chainalysis said:

Many countries successful the portion person struggled with rising ostentation and debt, making cryptocurrency an charismatic means of storing value, preserving savings, and attaining greater fiscal freedom.

The blockchain quality steadfast singles retired inflation-hit Ghana wherever residents reportedly person turned to BTC.

While BTC is inactive the fig 1 crypto successful the region, the latest information appears to constituent to a displacement distant from the starring crypto plus towards stablecoins. Moyo Sodipo, the co-founder of Nigeria-based cryptocurrency speech Busha, said the driblet successful the terms of BTC whitethorn explicate wherefore users from the portion are gravitating towards stablecoins.

“Now that Bitcoin has mislaid a batch of its value, determination is simply a tendency for diversification betwixt Bitcoin and stablecoins. However, marketplace shifts aren’t dampening activity,” explained Sodipo.

Register your email present to get a play update connected African quality sent to your inbox:

What are your thoughts connected this story? Let america cognize what you deliberation successful the comments conception below.

2 years ago

2 years ago

English (US)

English (US)