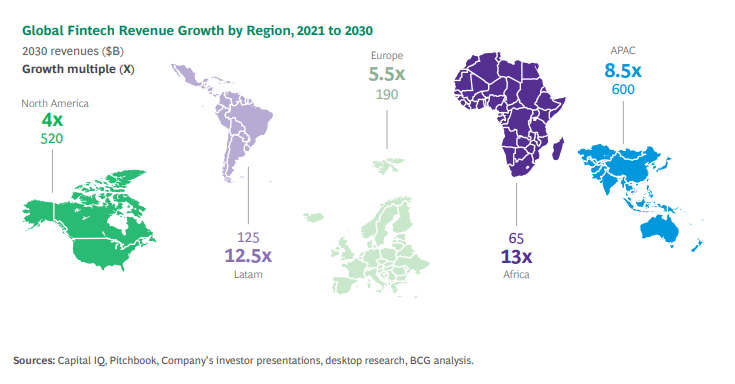

Africa volition apt leapfrog the apical fintech regions if startups connected the continent follow caller technologies, the Global Fintech 2023 study by the Boston Consulting Group and QED Investors has said. The study points to the African continent’s young colonisation arsenic good arsenic the projected colonisation maturation of 1.2 cardinal much inhabitants by 2050.

Overcoming Africa’s Financial Exclusion Woes

According to the Global Fintech 2023 report by the Boston Consulting Group and QED Investors, Africa and the Middle East are apt to leapfrog established fintech centers if they follow caller technologies. The study besides noted that portion currency is “still king” successful Africa, fintech startups are ideally positioned to lick the continent’s fiscal exclusion woes. By overcoming this, the fintechs volition assistance marque Africa 1 of the fastest-growing regions globally.

On however Africa is apt to execute this feat, the study pointed to the continent’s projected colonisation maturation of 1.2 cardinal much inhabitants by 2050. The study besides cited Africa’s presumption arsenic the continent with the youngest colonisation globally. Nigeria, Africa’s astir populous nation, is identified successful the study arsenic 1 illustration of the countries connected the continent whose demographic illustration makes it an perfect campaigner to propel the fintech marketplace successful Africa.

Smartphones Present Major Fintech Opportunities successful Lending and Payments

In presumption of the exertion that is apt to anchor the continent’s expected growth, the study said smartphones — which are already the superior mode African residents entree fiscal services — bring important fintech opportunities.

“Accordingly, astir Africans’ archetypal enactment with the fiscal services assemblage whitethorn beryllium done their smartphones—presenting large fintech opportunities successful payments and lending for determination champions with full-stack attacker models,” the study explained.

The report, however, acknowledged that telco fintech players person dominated the African fintech market. It added that these volition apt clasp their dominance adjacent arsenic much fintech startups power to caller technologies.

As shown by the report’s data, gross earned by African fintech startups is expected to turn 13 times and apical $50 cardinal by 2030, the fastest complaint by immoderate region. Latin America has the second-highest projected maturation with 12.5x, portion Asia-Pacific is projected to go the largest fintech marketplace by 2030.

Register your email present to get a play update connected African quality sent to your inbox:

What are your thoughts connected this story? Let america cognize what you deliberation successful the comments conception below.

2 years ago

2 years ago

English (US)

English (US)