Key takeaways:

Richard Byworth says Michael Saylor’s Strategy could ramp up its Bitcoin buys by acquiring cash-rich companies and converting their currency into Bitcoin.

He says that Strategy should see accelerating purchases arsenic the Bitcoin proviso connected exchanges continues to decline.

Byworth argues that aggressively expanding Bitcoin holdings would boost Strategy’s mNAV, benefiting shareholders.

Michael Saylor’s Strategy should instrumentality a much assertive attack to buying Bitcoin by acquiring companies to usage their currency holdings to money purchases and bash distant with over-the-counter buys, a crypto enforcement says.

“Saylor’s strategy truthful acold has been the close one,” Syz Capital spouse and Jan3 advisor Richard Byworth said connected an April 29 podcast.

Strategy should effort “super aggressive” buying

However, Byworth pondered what happens erstwhile Bitcoin (BTC) reaches an “illiquid supply” constituent wherever nary Bitcoin is near connected crypto exchanges oregon over-the-counter (OTC) desks.

“Should Saylor bargain Bitcoin truly carelessly? As in, not effort and bargain it done OTC desks…and really conscionable bargain it with the volition of massively ramping the price,” Byworth said.

“The constituent wherever things are getting little liquid, possibly you should effort for a play going ace aggressive, ace careless buying, marketplace interaction each across, and propulsion the terms higher.”Strategy presently holds 553,555 BTC, valued astatine astir $52.48 cardinal astatine the clip of publication, according to Saylor Tracker.

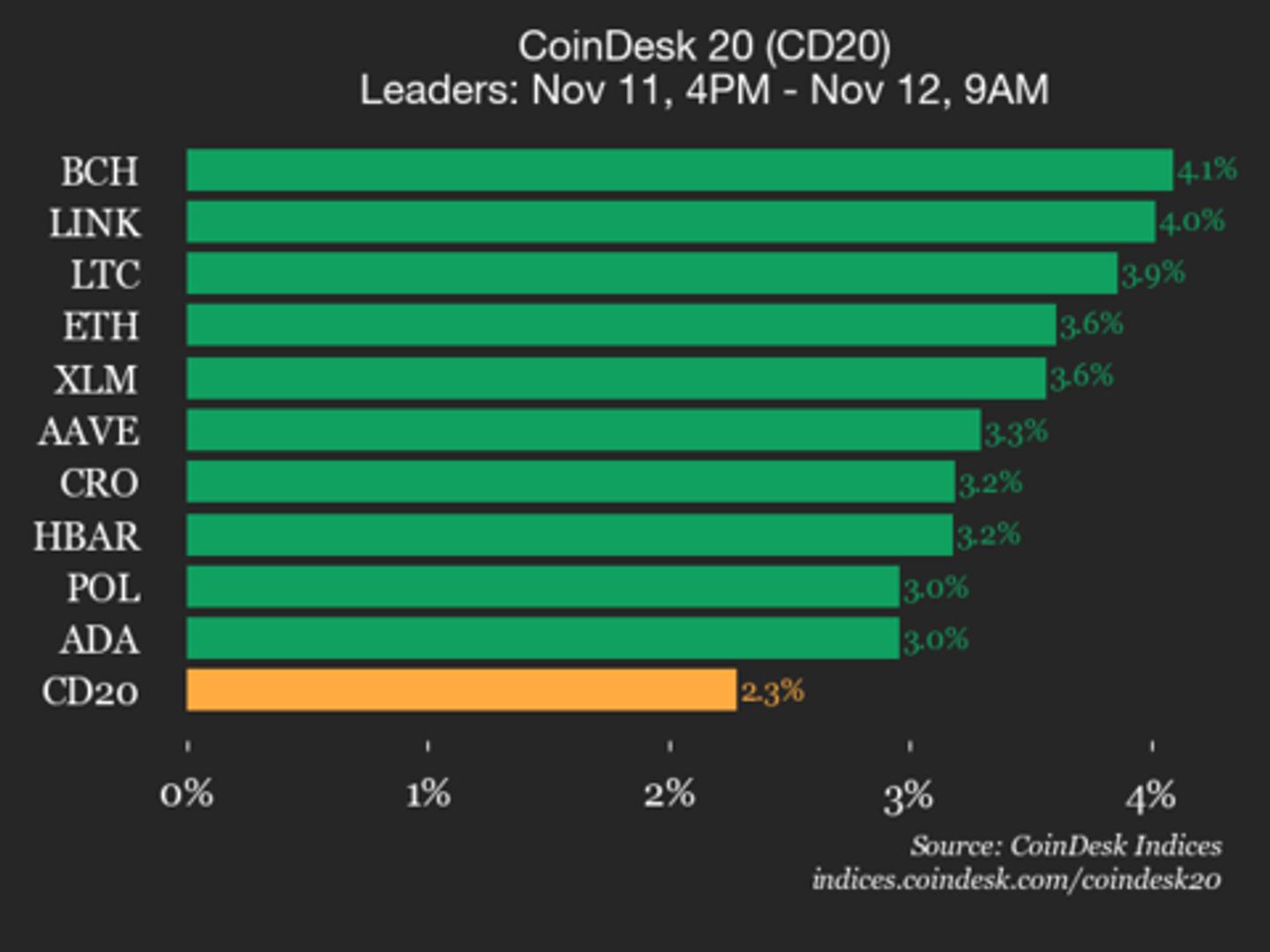

Fidelity Digital Assets said connected April 24 that it has seen Bitcoin proviso connected exchanges dropping owed to purchases by nationalist companies, which it anticipated would accelerate “in the adjacent future.”

Byworth said a steadfast similar Strategy wouldn’t beryllium acrophobic with the terms of Bitcoin erstwhile buying it arsenic its superior absorption would beryllium connected its mNAV (multiple of Net Asset Value), the value of the assets held, arsenic “it is overmuch much beneficial to [its] shareholders.”

He added that erstwhile determination is nary much Bitcoin, “you whitethorn arsenic good spell assertive buying, due to the fact that what happens is it volition conscionable ramp the price, it volition massively summation [Strategy’s] MNAV, which means [its] dilution volition go overmuch much accretive.”

Movements successful the NAV premium and discount tin springiness signals astir marketplace sentiment oregon imaginable aboriginal terms movements.

Related: New Bitcoin terms all-time highs could hap successful May — Here is why

Byworth said that Japan has a “large fig of zombie companies” holding important currency reserves. He projected that Strategy could follow an assertive attack by acquiring these companies and “immediately converting that currency into Bitcoin,” akin to the strategy taken by Japanese concern steadfast Metaplanet.

“There are plentifulness of companies retired determination successful Japan similar that, sitting connected these currency travel generative businesses that are beauteous boring and person precise debased price-to-cash ratios,” Byworth added.

On April 21, Metaplanet accrued its Bitcoin holdings to much than $400 cardinal after its latest $28 cardinal purchase.

Byworth’s comments travel arsenic Bitcoin trades beneath the intelligence $100,000 terms level, a threshold it fell beneath successful aboriginal February, which has wide been attributed to the tariffs imposed by US President Donald Trump.

Bitcoin is trading astatine $94,680, down 13.22% from its all-time precocious of $109,000 reached successful January, according to information from CoinMarketCap.

Magazine: TV deed Peaky Blinders to motorboat crypto game, FIFA Rivals connected Polkadot: Web3 Gamer

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

6 months ago

6 months ago

English (US)

English (US)