The crypto marketplace has experienced an antithetic lack of volatility passim astir of the summer. Seeing specified stableness successful what has historically been a precise tumultuous marketplace has prompted galore marketplace participants to halt their activity.

This deficiency of enactment has translated to a little sell-off risk, particularly among short-term holders.

Short-term holders, typically those who clasp their Bitcoin for little than 155 days, play a pivotal relation successful the crypto market. Short-term terms fluctuations thrust their trading behavior, often starring to terms volatility and pronounced liquidity shifts. Short-term holders tin amplify terms swings during marketplace uncertainty by rapidly moving successful and retired of positions.

Their propensity to respond rapidly to marketplace events makes them a important cohort to show to recognize potential marketplace shifts and sentiment.

The short-term holder (STH) sell-side hazard ratio is simply a method indicator that shows the imaginable for sell-side marketplace pressure. It’s derived by dividing the aggregate of each profits and losses realized on-chain by the realized cap. This fundamentally compares the full USD-denominated worth that investors transact regular against the wide STH realized cap.

When the hazard ratio is high, it suggests galore investors are selling their holdings, perchance to instrumentality profits. Prolonged periods of an elevated STH sell-side hazard ratio tin bespeak oversupply and marketplace sentiment that leans towards overvaluation.

In contrast, drops successful the sell-side hazard ratio amusement a alteration successful the worth realization by short-term holders. Periods of debased sell-side hazard ratio correlate with periods of debased volatility and are often seen during consolidations that precede ample marketplace movements.

Currently, the ratio for short-term Bitcoin holders is astatine 0.05%, a level not seen successful astir 13 years.

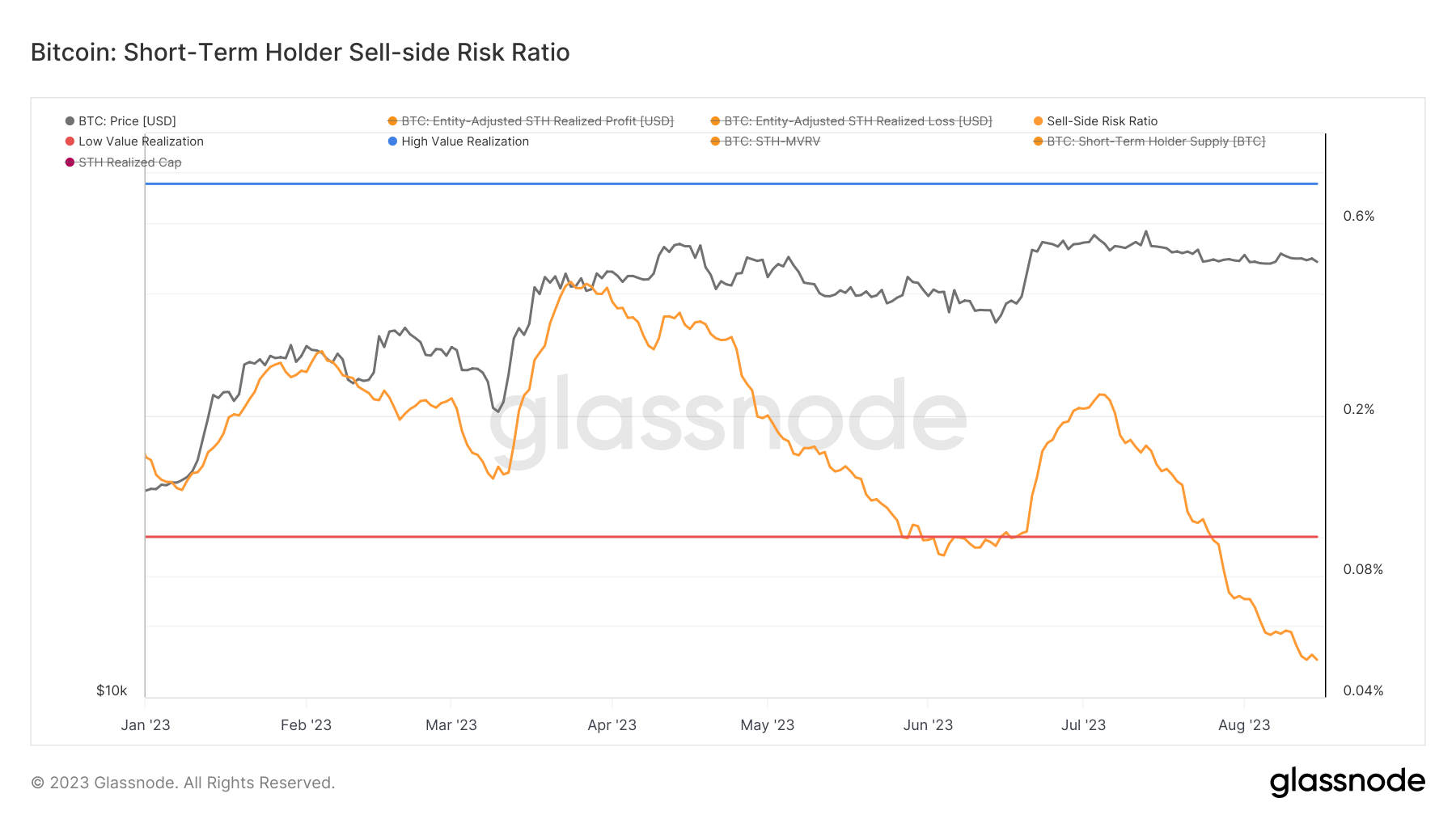

Graph showing the sell-side hazard ratio for short-term holders successful 2023 (Source: Glassnode)

Graph showing the sell-side hazard ratio for short-term holders successful 2023 (Source: Glassnode)To supply humanities context, the lone clip the ratio has been little was connected Oct. 3, 2010, erstwhile it dropped to 0.025%. At the time, Bitcoin’s terms hovered astir $0.06.

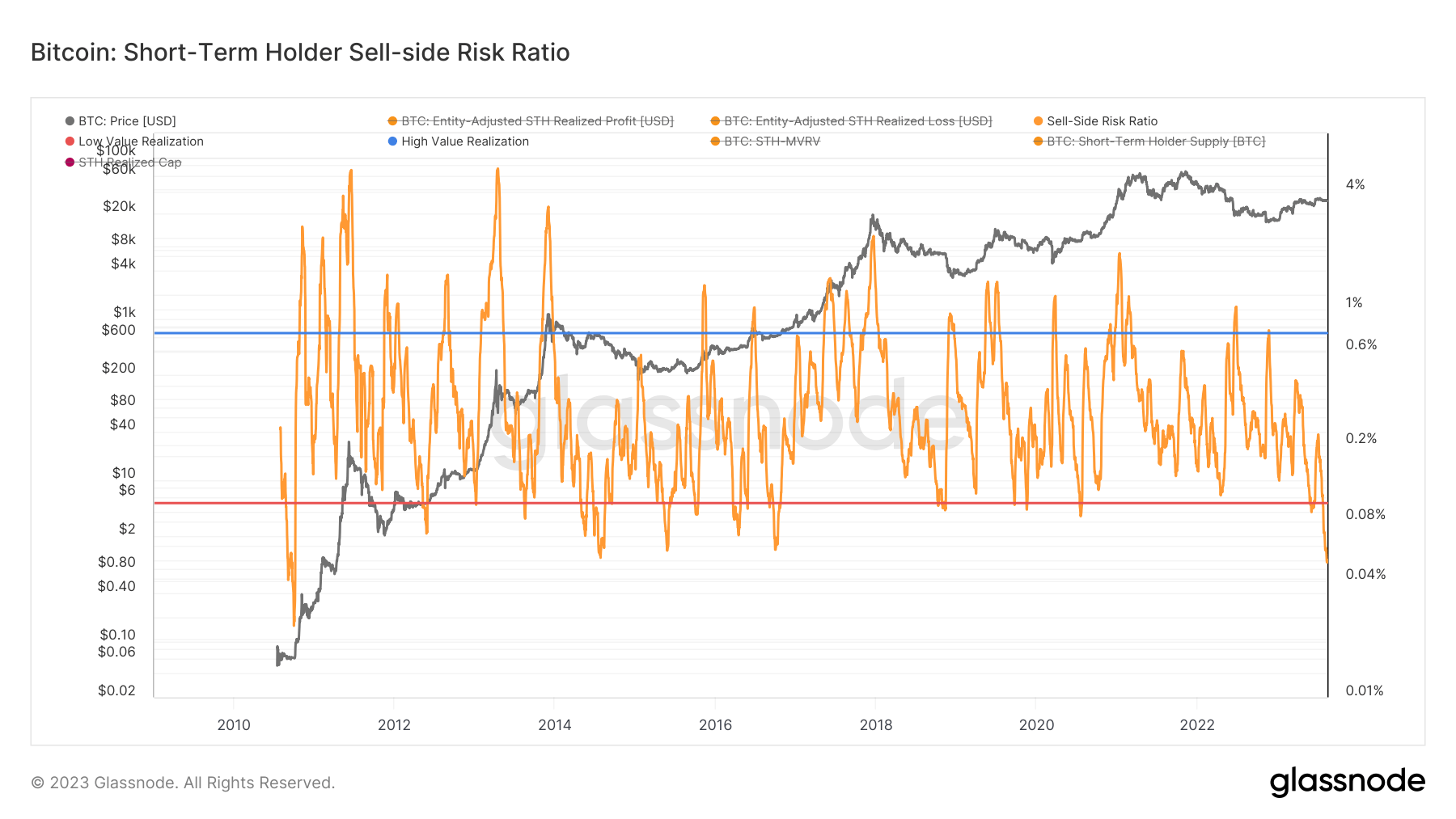

Graph showing the sell-side hazard ratio for short-term holders from 2010 to 2023 (Source: Glassnode)

Graph showing the sell-side hazard ratio for short-term holders from 2010 to 2023 (Source: Glassnode)Historical trends suggest that periods of highly debased sell-side hazard ratios, peculiarly among short-term holders, often travel earlier ample terms swings successful the market. This signifier indicates that the marketplace mightiness beryllium connected the cusp of a important shift, either bullish oregon bearish.

The station STH sell-side hazard ratio drops to grounds low: What does it mean for Bitcoin? appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)